Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With the aging population increasing in virtually every country, experts anticipate this number to surge to 78 million by 2030 and a staggering 139 million by 2050. Consequently, the expanding prevalence of dementia on a global scale is anticipated to propel growth within the market. For instance, according to the NCBI, approximately 6.7 million individuals aged 65 and older in the U.S. were living with Alzheimer’s disease dementia in 2023. This number is projected to nearly double, reaching around 13.8 million by 2060.

Also, the rising government support through funding, policy initiatives, and public awareness campaigns aimed at educating people about Alzheimer’s are expected to further drive market growth. These efforts focus on early diagnosis, improved treatment options, and enhanced caregiving support, contributing to increased demand for innovative therapies and healthcare solutions. The growing emphasis on research and public health strategies underscores the urgency of addressing Alzheimer’s disease.

Key Market Drivers

Increasing Dementia Prevalence

One of the most prominent factors contributing to the rise in dementia prevalence is the aging global population. As people live longer, the risk of developing dementia increases significantly. The baby boomer generation, which constitutes a substantial portion of the world's population, is now reaching retirement age. This demographic shift results in a larger pool of individuals susceptible to dementia, creating a substantial market for dementia drugs.According to WHO data published in March 2023, over 55 million people worldwide suffer from dementia, with cases expected to rise to 78 million by 2030 and 139 million by 2050. Each year, approximately 10 million new cases are reported, with higher prevalence in developing countries like China, India, and Brazil. The development of novel dementia treatments is expected to drive market growth. For example, in November 2023, Eisai Co., Ltd. launched Leqembi in the U.S., aiming to have 10,000 prescriptions by March 2024. The drug received FDA approval in July 2023, marking a significant step in dementia treatment.

Advances in healthcare, nutrition, and medical technology have contributed to increased lifespans. While this is a remarkable achievement, it also means that individuals are more likely to live long enough to develop age-related conditions such as dementia. The extended lifespan of the elderly population further fuels the demand for effective dementia treatments.

Key Market Challenges

Complex Pathology and Lack of Cure

Dementia, particularly Alzheimer's disease, is characterized by complex and multifaceted pathology. The exact causes of dementia are not fully understood, making it difficult to develop targeted therapies. Currently, there is no cure for dementia, and many drugs in development have focused on symptom management rather than addressing the root causes of the disease.Key Market Trends

Disease-Modifying Therapies

One of the most anticipated trends in the dementia drugs market is the development of disease-modifying therapies. Researchers are increasingly focusing on treatments that target the underlying causes of dementia, such as the accumulation of amyloid-beta plaques and tau protein tangles in Alzheimer's disease. Promising drug candidates and clinical trials are offering hope for treatments that can slow down or even halt disease progression.Key Market Players

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Eli Lilly & Co

- Johnson & Johnson

- Pfizer Inc

- Teva Pharmaceutical Industries Ltd

- Zydus Lifesciences Ltd

- Biogen Inc

- GSK PLC

- Merck & Co Inc

Report Scope:

In this report, the Global Dementia Drugs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Dementia Drugs Market, By Indications:

- Alzheimer's Disease

- Lewy Body Dementia

- Parkinsons Disease Dementia

- Vascular Dementia

Dementia Drugs Market, By Drug Class:

- Cholinesterase Inhibitors

- Glutamate Inhibitors

- MAO Inhibitors

Dementia Drugs Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Dementia Drugs Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Eli Lilly & Co

- Johnson & Johnson

- Pfizer Inc

- Teva Pharmaceutical Industries Ltd

- Zydus Lifesciences Ltd

- Biogen Inc

- GSK PLC

- Merck & Co Inc

Table Information

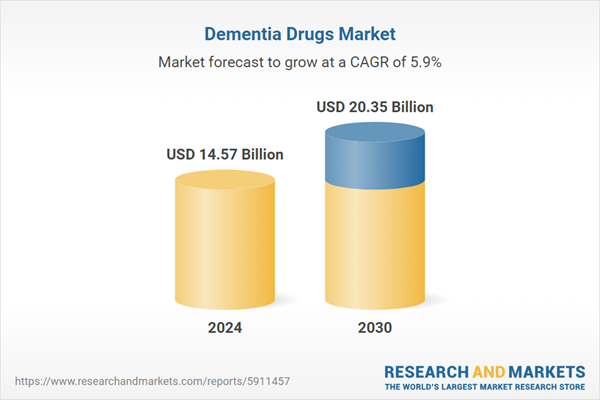

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.57 Billion |

| Forecasted Market Value ( USD | $ 20.35 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |