Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These cans are widely adopted for preserving a variety of food and beverage products, offering robust protection against external contaminants, ensuring long shelf life, and maintaining product quality. One of the key advantages of metal packaging is its ability to form a hermetic seal, which safeguards contents during transportation and irregular handling. Due to the reactive nature of metal with food substances, protective internal lacquers are applied to prevent chemical interactions and block ion migration. This ensures product safety while preserving taste, aroma, and nutritional value.

Sustainability is another major factor fueling the demand for metal packaging. Metal is infinitely recyclable without loss of quality and requires less energy to recycle compared to producing virgin material. Its magnetic properties allow for easy separation during the recycling process, further enhancing its appeal as an environmentally friendly packaging solution. The low global warming potential of metal packaging also supports global sustainability goals.

The projected increase in global steel production to 2.75 billion tons by 2050 supports the long-term growth of the Food and Beverage Metal Cans Market by ensuring a stable and scalable supply of raw materials. As steel remains a primary component in the manufacturing of metal cans, this anticipated rise in production capacity enhances the industry's ability to meet the growing global demand for packaged food and beverages. It also strengthens the supply chain, reduces material shortages, and supports innovation in sustainable packaging solutions - ensuring that metal cans remain a reliable, durable, and recyclable option for manufacturers and consumers alike.

Key Market Drivers

Growth in Ready-to-Eat and Convenience Foods

As more individuals lead increasingly busy lives, finding time for cooking and meal preparation has become a challenge. This shift in lifestyle has given rise to a growing demand for ready-to-eat and convenience foods. These food options provide a quick, easy, and often healthier alternative to fast food, catering to the needs of time-constrained individuals.To meet this demand, ready-to-eat and convenience foods are commonly packaged in metal cans. The use of metal cans offers several advantages, including a longer shelf life and the ability to maintain food quality. These cans are not only durable and lightweight but also easily recyclable, making them an environmentally friendly packaging solution.

One of the key benefits of metal cans is their ability to effectively preserve the flavor and nutritional content of the food. This makes them a popular choice among both consumers and manufacturers. With consumers increasingly prioritizing convenience and quality, the demand for ready-to-eat and convenience foods, along with their metal can packaging, continues to grow.

The rise in ready-to-eat and convenience foods has emerged as a significant driver for the global food and beverage metal cans market. As consumers continue to seek convenient and high-quality food options, the demand for these products shows no sign of slowing down. The versatility and benefits of metal can packaging play a crucial role in meeting this demand, making it an integral part of the food industry's response to changing consumer needs and preferences.

Key Market Challenges

Volatility in Price of Raw Materials

Raw materials such as aluminum, iron ore, and steel play a crucial role in the production of metal cans used in the food and beverage industry. These materials offer several advantages, including durability, recyclability, and the ability to preserve the quality of the contents. However, fluctuations in the cost of these essential materials pose a considerable challenge to the industry.Several factors contribute to the price volatility of these raw materials. Global economic conditions, geopolitical tensions, trade policies, and market speculation can significantly impact the prices of metals like aluminum and steel. Environmental concerns related to the extraction and processing of these metals can influence their market prices.

Price volatility of raw materials directly affects the cost of production for metal cans. An increase in raw material costs can lead to a rise in product prices, potentially driving consumers towards cheaper alternatives such as plastic and paper packaging. This shift can adversely impact the demand for metal cans, thus hindering the growth of the market.

Key Market Trends

Growing Focus on Sustainability and Recycling

Metal cans, known for their high recyclability and durability, are increasingly recognized as a sustainable packaging solution that addresses the growing environmental concerns. With the mounting issue of packaging waste, metal cans offer an effective way to minimize environmental impact, making them appealing to both manufacturers and consumers who are becoming more eco-conscious.In response to the demand for sustainable packaging, manufacturers are constantly innovating to create lightweight metal cans that do not compromise on quality or functionality. By reducing the amount of material used, these lightweight cans not only contribute to overall sustainability but also help decrease transportation costs, making them an environmentally-friendly choice.

Among metal cans, aluminum cans are gaining popularity due to their high recycling rate and recycled content, surpassing other packaging materials. The increasing demand for canned foods and beverages driven by cost and convenience-related advantages is also contributing to the growth of the aluminum cans market.

The growing focus on sustainability and recycling is undeniably shaping the future of the global food and beverage metal cans market. As consumers continue to prioritize environmental considerations in their purchasing decisions, the demand for recyclable and sustainable packaging, such as metal cans, is expected to rise. This trend presents both a challenge and an opportunity for manufacturers to innovate and adapt, ensuring their products align with evolving consumer preferences and environmental standards while maintaining the highest quality standards.

Key Market Players

- Ball Corporation

- Silgan Holdings Inc.

- Tetra Laval International S.A.

- Kian Joo Can Factory Berhad

- Huber Packaging Group GmbH

- Crown Holdings, Inc.

- Ardagh Group SA

- CAN-PACK S.A.

- CPMC Holdings Ltd

- Kingcan Holdings Limited

Report Scope:

In this report, the Global Food & Beverage Metal Cans Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Food & Beverage Metal Cans Market, By Material:

- Aluminium Cans

- Steel Cans

Food & Beverage Metal Cans Market, By Application:

- Food

- Beverage

Food & Beverage Metal Cans Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Food & Beverage Metal Cans Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ball Corporation

- Silgan Holdings Inc.

- Tetra Laval International S.A.

- Kian Joo Can Factory Berhad

- Huber Packaging Group GmbH

- Crown Holdings, Inc.

- Ardagh Group SA

- CAN-PACK S.A.

- CPMC Holdings Ltd

- Kingcan Holdings Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

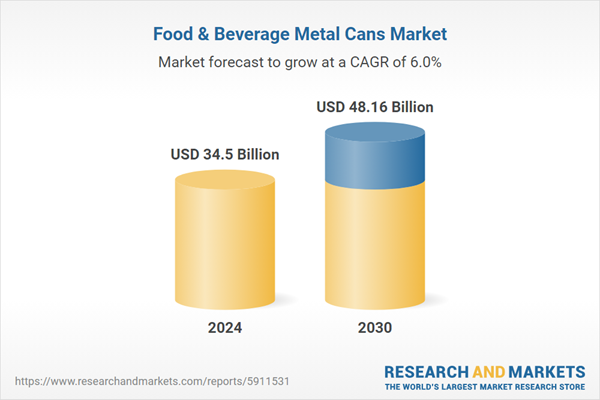

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.5 Billion |

| Forecasted Market Value ( USD | $ 48.16 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |