Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the key advantages of ECAs is their ability to replace soldering in heat-sensitive applications. Soldering processes often expose components to high temperatures, which can damage delicate electronics. ECAs offer a low-temperature alternative, making them ideal for printed circuit boards (PCBs) with dual-sided component placement. They prevent component displacement during assembly and eliminate the need for reflow soldering, streamlining manufacturing and reducing production costs.

The demand for electrically conductive adhesives is witnessing strong growth in tandem with the rapid advancement of consumer electronics, wearable devices, and miniaturized components. These adhesives are integral in ensuring robust electrical connections and long-term performance reliability. The rise of electric vehicles (EVs) is significantly contributing to market expansion. ECAs are widely used in EVs powered by batteries, solar panels, or electric generators. As global environmental regulations tighten and nations push toward greener mobility solutions, the shift from traditional combustion engines to electric vehicles is accelerating. Countries like China, Norway, and France are investing heavily in public charging infrastructure and offering incentives for EV adoption, fueling demand for advanced electronic materials like ECAs.

Despite these opportunities, fluctuating raw material prices remain a challenge for manufacturers. The high cost of silver and other conductive fillers can impact production expenses and pricing strategies. Nonetheless, the growing need for lightweight, flexible, and efficient bonding solutions in high-performance electronics continues to drive innovation and investment in the electrically conductive adhesives market. The outlook remains optimistic, with ECAs playing a pivotal role in enabling the next generation of smart and sustainable technologies.

Key Market Drivers

Growing Demand of Electrically Conductive Adhesives from Automotive Industry

Electrically conductive adhesives (ECAs) are highly specialized materials that serve dual functions, mechanically bonding components and enabling electrical conductivity. These adhesives, typically composed of epoxy resins embedded with conductive metallic particles such as silver or copper, provide strong adhesion and excellent electrical performance. In 2023, global automobile production reached approximately 94 million units, while the global automotive components market was valued at USD 2 trillion, with exports accounting for around USD 700 billion.India emerged as the fourth-largest vehicle producer globally, following China, the United States, and Japan, with an annual output of nearly 6 million vehicles. Their unique combination of properties makes them increasingly indispensable in various industrial applications, particularly in the automotive sector. The rapid adoption of electric and hybrid vehicles has significantly increased the integration of electronic components in modern automobiles. ECAs play a critical role in securing these components while maintaining stable and efficient electrical connections, which are vital for the proper functioning of systems such as battery management, sensors, infotainment, and advanced driver assistance systems (ADAS).

In addition to performance, the automotive industry is under continuous pressure to reduce vehicle weight to improve fuel efficiency and comply with stringent emission regulations. Electrically conductive adhesives offer a strategic advantage in this context by replacing traditional mechanical fasteners like screws and rivets. This not only reduces weight but also streamlines assembly processes and enhances design flexibility without compromising structural integrity or safety. Another key benefit of ECAs is their ability to dissipate heat effectively. With the increasing power density of automotive electronics, thermal management has become a critical consideration. ECAs facilitate heat transfer away from sensitive components, enhancing their longevity and operational stability.

The growing focus on electric vehicles (EVs) and the emergence of autonomous driving technologies are expected to further drive the demand for ECAs. These vehicles rely heavily on sophisticated electronic systems, increasing the need for reliable, lightweight, and conductive bonding solutions. Electrically conductive adhesives are becoming a core enabler of innovation and efficiency in the automotive industry. As automakers continue to adopt advanced electronics and move toward electrification and autonomy, the demand for ECAs is poised to grow substantially. The global market for electrically conductive adhesives is set for robust expansion, fueled by their essential role in supporting next-generation automotive technologies.

Key Market Challenges

Complexities Related with Long-Term Reliability and Pricing

Electrically conductive adhesives (ECAs) are materials that offer both adhesive bonding and electrical conductivity. These adhesives have become essential components in various industries, including electronics, automotive, and aerospace. They provide a reliable and efficient solution for joining electrical components, ensuring optimal performance and functionality.Despite their increasing demand, concerns over their long-term reliability and high cost may hinder their wider adoption. One of the main challenges faced by the ECAs market is the question of long-term reliability. Factors such as thermal aging, moisture exposure, and mechanical stress can affect the total electrical conductivity of adhesives, leading to potential performance degradation over time. Non-linear behavior under varying conditions can also impact the mechanical properties of adhesive joints, compromising the overall structural integrity. Certain applications like RFID tags often have a shorter lifetime than their etched counterparts, which can limit their use in long-term applications like passports. The need for long-term reliability and durability in industries such as aerospace and automotive further emphasizes the importance of addressing these challenges.

These reliability issues pose a significant challenge for the ECAs market. Ensuring the long-term reliability of these adhesives is crucial for their wider acceptance, especially in industries where durability and longevity are paramount. Extensive research and development efforts are underway to enhance the reliability and performance of ECAs, focusing on improving their resistance to environmental factors and optimizing their electrical and mechanical properties.

Another major challenge in the ECAs market is the high cost of these adhesives. While they offer numerous benefits, their price can be a barrier to adoption in some applications. The cost factor becomes even more critical when considering the competitive landscape of the adhesives market, where cheaper alternatives are readily available. To address this challenge, manufacturers are exploring cost-effective production methods, optimizing the formulation of ECAs, and seeking alternative raw materials without compromising their performance. The cost of ECAs can be influenced by various factors, including the price of raw materials and production costs. Any fluctuations in these factors can further increase the price of ECAs, making them less attractive to potential end-users. Collaborative efforts between manufacturers, suppliers, and end-users are necessary to streamline the supply chain, reduce costs, and make ECAs more accessible to a wider range of applications.

Key Market Trends

Growth in Flexible Electronics

Flexible electronics, also known as flex circuits, are revolutionizing the electronic industry with their unique characteristics. These electronic devices are built on flexible plastic substrates, allowing them to bend and conform to various shapes and surfaces. This flexibility opens up a world of possibilities, making them ideal for applications such as wearable devices, smartphones, and IoT devices.The increasing popularity of flexible electronics has fueled the demand for Electrically Conductive Adhesives (ECAs), which play a crucial role in their manufacture. ECAs, including film adhesives, are widely used in flexible electronics due to their exceptional bonding properties. These adhesives provide strong and reliable connections, ensuring the durability and performance of the devices, even under harsh operating conditions.

The growth of flexible electronics is driving significant changes in the global ECAs market. As the demand for flexible electronics continues to rise, the need for ECAs is expected to grow in parallel. Moreover, the trend towards miniaturization in electronics further fuels this demand. As electronic devices become smaller and more complex, the role of efficient and reliable adhesives like ECAs becomes increasingly critical. The growth of flexible electronics represents a pivotal trend in the global electrically conductive adhesives market. With continuous advancements in the electronics sector and the surging popularity of flexible and wearable electronics, this trend is poised to persist. As a result, the global electrically conductive adhesives market is projected to experience robust growth, driven by its indispensable role in the flourishing field of flexible electronics.

Key Market Players

- 3M Company

- Aremco LLC

- Creative Materials Inc.

- The Dow Chemical Company

- HB Fuller Company

- Henkel AG & Co. KGaA

- HITEK Electronic Materials Ltd

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parker Hannifin Corp.

Report Scope:

In this report, the Global Electrically Conductive Adhesives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Electrically Conductive Adhesives Market, By Chemistry:

- Epoxy

- Silicone

- Acrylic

- Polyurethane

- Others

Electrically Conductive Adhesives Market, By Application:

- Automotive

- Consumer Electronics

- Aerospace

- Biosciences

- Others

Electrically Conductive Adhesives Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electrically Conductive Adhesives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Company

- Aremco LLC

- Creative Materials Inc.

- The Dow Chemical Company

- HB Fuller Company

- Henkel AG & Co. KGaA

- HITEK Electronic Materials Ltd

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parker Hannifin Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

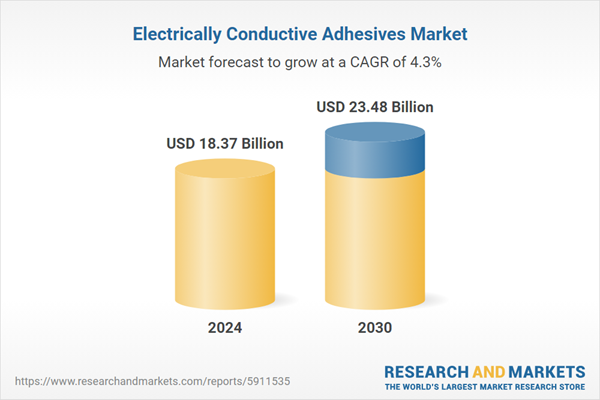

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.37 Billion |

| Forecasted Market Value ( USD | $ 23.48 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |