Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A primary driver of the nitrogenous fertilizer market is the increasing global population. With a growing number of people to feed, the agricultural sector faces immense pressure to produce larger crop yields. Nitrogenous fertilizers are indispensable in this context, as they significantly enhance plant growth, boost agricultural productivity, and help meet global food demands. The adoption of modern farming practices such as precision agriculture and controlled-release fertilizers has further fueled the market's expansion. These innovative technologies enable farmers to optimize fertilizer application, minimize waste, and maximize crop productivity, resulting in more efficient agricultural output.

Key Market Drivers:

Rising Global Population

The expanding global population is a major factor driving the growth of the nitrogenous fertilizer market. As the population increases, so does the demand for food production. Nitrogenous fertilizers play a critical role in improving agricultural productivity, as they provide essential nitrogen compounds that promote plant growth, stimulate chlorophyll formation, enhance photosynthesis, and support healthy vegetative development. These benefits ultimately lead to higher crop yields.Key Market Challenges:

Environmental Concerns

Environmental challenges have emerged as significant barriers to the growth of the global nitrogenous fertilizer market. Although these fertilizers are crucial for boosting crop yields and global food security, their environmental impact has prompted increased scrutiny and regulation. One of the most pressing concerns is nitrogen runoff, which occurs when excess nitrogen from fertilizers contaminates water sources. This runoff can lead to water pollution, harmful algal blooms, and damage to aquatic ecosystems, posing risks to human health and wildlife. Consequently, stricter regulations in various regions are discouraging excessive fertilizer use, impacting the market’s growth.Key Market Trends:

Technological Advancements in Fertilizer Manufacturing

Technological innovations in fertilizer production have significantly enhanced the efficiency and environmental sustainability of the nitrogenous fertilizer market. New manufacturing techniques are helping to reduce energy consumption, lower greenhouse gas emissions, and improve cost-effectiveness. Notably, the development of controlled-release nitrogen fertilizers, which gradually release nutrients over time, helps minimize nitrogen runoff and improve nutrient utilization by crops. As a result, farmers can achieve higher crop yields while mitigating the environmental impact of fertilizer application.Additionally, technological advancements in fertilizer manufacturing have facilitated precision agriculture. Fertilizers are now tailored to meet the specific needs of different crops and soil conditions. Combined with GPS-guided machinery and soil sensors, these advancements enable precise fertilizer application, reducing waste, optimizing nutrient uptake, and ultimately enhancing crop yields.

In March 2022, EuroChem Group acquired a controlling stake (51.48%) in Brazilian distributor Fertilizantes Heringer SA, strengthening its production and distribution capacity in Brazil.

Key Market Players:

- Nutrien Ltd.

- Yara International ASA

- Omnia Group Limited

- Eurochem Group AG

- Rolfes Agri (Pty) Ltd.

- CF Industries Holdings, Inc.

- Koch Fertilizer, LLC

- Hellagrolip SA

- Coromandel International Limited

- Notore Chemical Industries Plc

Report Scope: This report segments the Global Nitrogenous Fertilizer Market into the following categories, along with detailed insights into industry trends:

By Product:

- Urea

- Methylene Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Ammonia

- Calcium Ammonium Nitrate

- Others

By Application:

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region:

North America:

United States, Canada, MexicoEurope:

France, United Kingdom, Italy, Germany, SpainAsia-Pacific:

China, India, Japan, Australia, South KoreaSouth America:

Brazil, Argentina, ColombiaMiddle East & Africa:

South Africa, Saudi Arabia, UAECompetitive Landscape

The report provides an in-depth analysis of the major companies in the global nitrogenous fertilizer market.Available Customizations: TechSci Research offers customization options for the report to meet specific company needs. Customization options include:

- Detailed profiling and analysis of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nutrien Ltd.

- Yara International ASA

- Omnia Group Limited

- Eurochem Group AG

- Rolfes Agri (Pty) Ltd.

- CF Industries Holdings, Inc.

- Koch Fertilizer, LLC

- Hellagrolip SA

- Coromandel International Limited

- Notore Chemical Industries Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2025 |

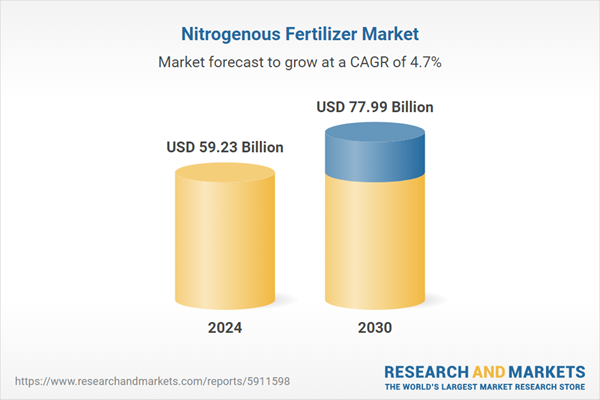

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 59.23 Billion |

| Forecasted Market Value ( USD | $ 77.99 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |