Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Global Population and Food Security Concerns

The steadily rising global population expected to exceed 9.7 billion by 2050 is placing immense pressure on the world’s food systems. According to the UN, global food production must increase by nearly 70% to meet future demand. This has intensified the need for high-efficiency fertilizers like ammonium sulfate that can support higher crop productivity. With over 30% of global arable land experiencing declining fertility, farmers are increasingly turning to nutrient-rich fertilizers to maintain yields. Ammonium sulfate, providing both nitrogen and sulfur, has become a crucial tool in tackling this productivity challenge.Ammonium sulfate’s dual nutrient benefit directly supports food security goals. It delivers a fast-acting nitrogen source essential for chlorophyll and protein synthesis, while also supplying sulfur, which improves amino acid formation and nutrient absorption. Recent data shows that sulfur deficiency in crops has risen by nearly 20% globally over the last decade due to declining atmospheric sulfur levels. As a result, more growers are incorporating ammonium sulfate into their nutrient management plans to maintain crop quality and soil balance.

In regions with alkaline or calcareous soils - such as parts of Asia, the Middle East, and North Africa - ammonium sulfate is particularly effective. It helps acidify the soil slightly, improving nutrient availability and uptake efficiency. In 2023, studies showed a 15-25% increase in nutrient absorption rates in wheat and maize fields treated with ammonium sulfate versus urea alone in alkaline soils. This adaptability enhances its appeal across geographies where maintaining soil health is critical for long-term food security.

Additionally, as precision farming and sustainable agriculture gain momentum, ammonium sulfate fits well within integrated nutrient management practices. Its consistent formulation, ease of blending, and compatibility with other inputs make it suitable for targeted application, reducing environmental waste. A 2022 field survey across South Asia found that farms using ammonium sulfate reduced nitrogen loss by up to 18% compared to traditional fertilizers. This efficiency supports both environmental conservation and the global mission to sustainably feed a growing population.

Key Market Challenges

Environmental Concerns and Regulations

industry, is facing substantial challenges, and among the most pressing is the impact of environmental concerns and increasingly stringent regulations. Environmental sustainability has become a focal point in recent years, prompting governments and industry stakeholders to scrutinize the production and usage of ammonium sulfate due to its environmental implications.One of the primary environmental concerns associated with ammonium sulfate is its contribution to greenhouse gas emissions. The production of ammonium sulfate typically involves the synthesis of caprolactam, a precursor chemical that emits nitrous oxide (N2O), a potent greenhouse gas. N2O has a significantly higher global warming potential than carbon dioxide (CO2), making it a major concern for climate change mitigation efforts. As a result, ammonium sulfate manufacturers are under mounting pressure to reduce N2O emissions, which often necessitates costly alterations to production processes.

Another critical concern is the potential for nitrogen runoff from ammonium sulfate-treated fields. When excess nitrogen-based fertilizers, including ammonium sulfate, are applied to crops, there is a risk of nitrogen leaching into groundwater or running off into nearby water bodies. This runoff can lead to water pollution and contribute to the eutrophication of aquatic ecosystems, causing harm to aquatic life.

Key Market Trends

Advanced Fertilizer Blends

Advanced fertilizer blends are playing a pivotal role in boosting the global ammonium sulfate market. These blends represent a growing trend in modern agriculture, driven by the need for precise and efficient nutrient management. Ammonium sulfate, with its unique nutrient profile containing nitrogen and sulfur, has become a preferred choice for formulating customized fertilizers that cater to the specific needs of various crops, soil types, and growth stages.Farmers and agronomists are increasingly adopting precision agriculture techniques to optimize crop yields while minimizing fertilizer wastage. This approach involves soil testing and data-driven decision-making to determine the precise nutrient requirements of a given field. Ammonium sulfate's versatility makes it an excellent component for these advanced fertilizer blends because it provides both nitrogen and sulfur, two essential nutrients for plant growth.

These customized fertilizer formulations offer several advantages. First, they allow farmers to fine-tune nutrient application, ensuring that crops receive the right amount of nitrogen and sulfur at the right time. This precision leads to improved crop health, increased yields, and resource efficiency, as excess nutrients are minimized, reducing the risk of nutrient runoff and environmental pollution.

advanced fertilizer blends address the growing demand for specialty crops and organic farming. As consumers increasingly seek healthier and more sustainable food options, specialty crops like fruits, vegetables, and herbs have gained popularity. These crops often have unique nutrient requirements that can be met effectively with ammonium sulfate-based fertilizer blends. Moreover, for organic farming practices, which prohibit the use of synthetic chemicals, ammonium sulfate's natural origin and compliance with organic standards make it a favored choice among organic growers.

Key Market Players

- BASF SE

- Evonik Industries

- Lanxess Corporation

- Novus International

- Sumitomo Chemical

- Honeywell International

- Royal DSM.

- Merck KGa

- LANXESS

- Domo Chemicals

Report Scope:

In this report, the Global Ammonium Sulfate Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Ammonium Sulfate Market, By Product:

- Solid

- Liquid

Ammonium Sulfate Market, By Application:

- Fertilizers

- Pharmaceuticals

- Food & Feed Additives

- Water Treatment

- Others

Ammonium Sulfate Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ammonium Sulfate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- BASF SE

- Evonik Industries

- Lanxess Corporation

- Novus International

- Sumitomo Chemical

- Honeywell International

- Royal DSM.

- Merck KGa

- LANXESS

- Domo Chemicals

Table Information

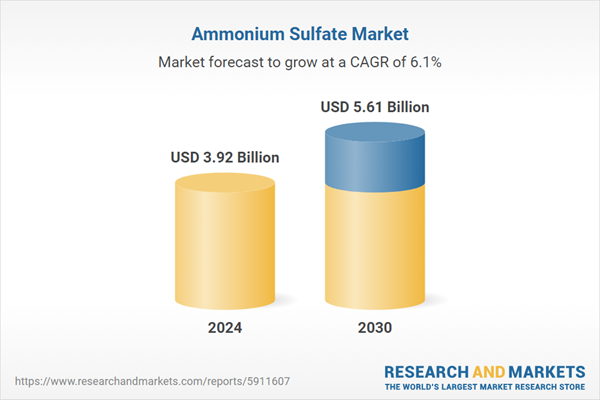

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.92 Billion |

| Forecasted Market Value ( USD | $ 5.61 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |