Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the major factors fueling the expansion of this market is the growing awareness among consumers about the importance of antioxidants in maintaining healthy and youthful-looking skin. Additionally, the rising trend of clean and natural beauty products has prompted manufacturers to incorporate natural antioxidants derived from botanical sources like green tea, vitamin C, and vitamin E into their formulations. Furthermore, the increasing disposable income in emerging markets has led to higher spending on premium cosmetic products, further propelling the demand for antioxidants in cosmetics.

However, the global cosmetic antioxidants market is not without its challenges. Regulatory complexities, especially in terms of the approval and labeling of cosmetic ingredients, can pose obstacles for manufacturers. Moreover, competition among cosmetic brands is fierce, and innovation in antioxidant formulations is crucial to stay ahead in the market. Overall, with the rising focus on holistic skincare and beauty, the cosmetic antioxidants market is poised for sustained growth in the coming years.

Key Market Drivers

Increasing Consumer Awareness and Demand for Anti-Aging Products

One of the primary drivers of the cosmetic antioxidants market is the growing awareness among consumers about the detrimental effects of oxidative stress on the skin and hair. Factors such as pollution, UV radiation, and a sedentary lifestyle contribute to the generation of free radicals, which can accelerate the aging process, cause wrinkles, and lead to skin disorders. As consumers become more conscious of these challenges, they seek out products that offer protection and anti-aging benefits.Antioxidants, such as vitamins C and E, coenzyme Q10, and green tea extract, are known for their ability to neutralize free radicals and mitigate the effects of oxidative stress. Consequently, cosmetic companies are incorporating these ingredients into their formulations to meet the rising demand for anti-aging and skin-rejuvenating products.

Rising Popularity of Natural and Clean Beauty Products

The global trend toward natural and clean beauty products is another significant driver of the cosmetic antioxidants market. Consumers are increasingly scrutinizing product labels and seeking formulations that are free from harsh chemicals, parabens, and synthetic additives. This shift in consumer preferences has pushed cosmetic manufacturers to embrace natural antioxidants derived from plant-based sources.Botanical antioxidants, such as extracts from aloe vera, grape seed, and chamomile, are gaining prominence for their perceived safety and effectiveness. These natural antioxidants not only offer protection against oxidative stress but also align with the clean beauty movement's ethos of sustainability and eco-friendliness. As a result, the market is witnessing a surge in demand for cosmetics that feature plant-based antioxidants.

Growing Disposable Income in Emerging Markets

The cosmetic antioxidants market is also benefitting from the rising disposable income in emerging economies. As middle-class populations expand in countries like India, China, Brazil, and Southeast Asian nations, consumer spending on premium cosmetic products has surged. Middle-class consumers in these regions are increasingly willing to invest in high-quality skincare and personal care products, including those with antioxidant properties.Cosmetic companies are capitalizing on this opportunity by launching targeted marketing campaigns and expanding their product portfolios to cater to the specific needs and preferences of consumers in emerging markets. The demand for cosmetic antioxidants in these regions is expected to continue to rise as economic conditions improve and consumer awareness grows.

Innovation in Antioxidant Formulations

Innovation is a driving force behind the cosmetic antioxidants market's growth. Cosmetic companies are continually investing in research and development to create advanced antioxidant formulations that offer superior benefits. This includes improving the stability and bioavailability of antioxidants in cosmetics, ensuring they remain effective throughout the product's shelf life and upon application to the skin.Novel antioxidant delivery systems, such as encapsulation technology, microencapsulation, and nanotechnology, are being employed to enhance the penetration of antioxidants into the skin and maximize their efficacy. Additionally, combination formulations that combine antioxidants with other beneficial ingredients, such as hyaluronic acid, peptides, and retinol, are gaining traction in the market, offering multifunctional skincare solutions.

Stringent Regulations and Consumer Safety Concerns

While regulations can sometimes be seen as a challenge, they are also a significant driver in the cosmetic antioxidants market. Stringent regulations related to cosmetic safety and labeling have led to increased consumer confidence in cosmetic products. Consumers are more likely to trust and purchase products that meet rigorous safety standards.This driver has pushed cosmetic manufacturers to invest in research and development to ensure the safety and efficacy of their antioxidant-rich formulations. Companies are conducting clinical trials, toxicity testing, and dermatological studies to substantiate their product claims and meet regulatory requirements. This commitment to safety and transparency has, in turn, bolstered consumer trust and contributed to the growth of the market.

In conclusion, the global cosmetic antioxidants market is witnessing robust growth, driven by factors such as increased consumer awareness of anti-aging benefits, the shift toward natural and clean beauty products, rising disposable incomes in emerging markets, ongoing innovation in antioxidant formulations, and stringent regulatory standards. As these drivers continue to shape the industry, the market is expected to expand further, offering consumers an array of antioxidant-rich skincare and personal care products to address their evolving needs.

Key Market Challenges

Regulatory Complexities and Compliance

One of the most substantial challenges in the cosmetic antioxidants market is navigating the complex web of regulations governing the cosmetic industry. Different countries and regions have their own sets of regulations and requirements for cosmetic products, making it challenging for manufacturers to ensure compliance across various markets.Cosmetic antioxidants, like all cosmetic ingredients, need to meet stringent safety and labeling standards. The regulatory landscape continues to evolve with changes in safety assessments, ingredient restrictions, and labeling requirements. Ensuring that antioxidant-containing products meet these diverse regulatory demands can be a time-consuming and costly endeavor. Failure to comply with regulations can result in product recalls, fines, and damage to a brand's reputation.

Additionally, the industry must contend with emerging regulations related to environmental impact and sustainability. These regulations may impact the sourcing of antioxidant ingredients and packaging choices, adding another layer of complexity for manufacturers.

Competition and Product Differentiation

The cosmetic antioxidants market is highly competitive, with numerous brands and products vying for consumer attention. As a result, product differentiation has become a significant challenge. Many products in the market claim to offer antioxidant benefits, making it difficult for consumers to distinguish between them.To stand out in this crowded landscape, cosmetic companies need to invest in research and development to create innovative antioxidant formulations that deliver real and noticeable benefits. Moreover, conveying these benefits to consumers through effective marketing and labeling is essential. Without clear product differentiation, brands risk being lost in the sea of antioxidant-infused products.

Furthermore, counterfeit and low-quality products have become a concern in the cosmetics industry. Consumers may unknowingly purchase products that lack the claimed antioxidant ingredients, potentially leading to disappointment and distrust in the market.

Ingredient Sourcing and Supply Chain Disruptions

The cosmetic antioxidants market relies heavily on sourcing high-quality antioxidant ingredients, many of which are derived from natural sources. This dependence on natural ingredients can pose challenges related to ingredient availability, sustainability, and supply chain disruptions.Climatic factors, crop yield variations, and geopolitical issues can all impact the availability and cost of antioxidant-rich botanicals. Sudden disruptions, such as adverse weather conditions or trade restrictions, can lead to supply shortages and price fluctuations. Manufacturers must develop strategies to secure a consistent supply of key antioxidant ingredients and mitigate risks associated with sourcing challenges.

Additionally, ethical and sustainable sourcing practices have become increasingly important to consumers. Brands are under pressure to ensure that their ingredient sourcing aligns with responsible and environmentally friendly practices, adding complexity to the supply chain.

Consumer Education and Misinformation

While growing consumer awareness of antioxidants and their benefits is a driver of the market, it also presents a challenge in terms of consumer education. Many consumers may not fully understand the science behind antioxidants or the specific benefits they offer for skin and hair health. This lack of understanding can lead to confusion and skepticism.Moreover, the abundance of information, including both reliable and unreliable sources, on the internet and social media can contribute to misinformation and misconceptions about antioxidants. Some consumers may be swayed by marketing claims that exaggerate the benefits of antioxidant products, leading to unrealistic expectations.

To address this challenge, cosmetic companies must invest in educational efforts to inform consumers about the science behind antioxidants, their role in skincare, and realistic outcomes. Transparency and honest communication about product efficacy are crucial to building trust and ensuring that consumers make informed choices.

Product Shelf Life and Formulation Stability

Cosmetic antioxidants must maintain their efficacy throughout the product's shelf life and upon application to the skin or hair. Ensuring the stability of antioxidants in formulations can be a significant challenge.Antioxidants are vulnerable to degradation when exposed to factors such as light, air, heat, and pH fluctuations. Formulating products that protect antioxidants from these environmental stressors while maintaining their effectiveness can be a complex task. Manufacturers need to invest in research and development to develop stable formulations that preserve the antioxidant's integrity.

Moreover, the use of innovative delivery systems, such as encapsulation technology, can help enhance the stability and penetration of antioxidants. However, these technologies come with their own set of challenges, including cost considerations and formulation compatibility.

In conclusion, the global cosmetic antioxidants market faces several challenges, including regulatory complexities, intense competition, ingredient sourcing and supply chain issues, consumer education, and formulation stability. Addressing these challenges requires a combination of regulatory compliance, innovation, transparent communication, and strategic planning. Despite these hurdles, the market continues to grow due to the increasing demand for antioxidant-infused skincare and personal care products. Successfully navigating these challenges can position companies for success in this dynamic and evolving industry.

Key Market Trends

Rise of Clean and Natural Beauty

One of the most prominent trends in the cosmetic antioxidants market is the growing preference for clean and natural beauty products. Consumers are increasingly conscious of the ingredients they put on their skin and are seeking products that are free from harmful chemicals, parabens, sulfates, and synthetic additives.As a response to this trend, cosmetic companies are incorporating natural antioxidants derived from botanical sources into their formulations. Ingredients such as green tea extract, aloe vera, chamomile, and grape seed extract are gaining popularity for their perceived safety and effectiveness. These natural antioxidants not only offer protection against oxidative stress but also align with the clean beauty movement's principles of sustainability and eco-friendliness.

Additionally, brands are transparently labeling their products with clean beauty certifications, organic seals, and cruelty-free logos to appeal to conscious consumers. This trend reflects a broader shift toward holistic and environmentally responsible skincare choices.

Advanced Antioxidant Delivery Systems

Innovations in delivery systems are revolutionizing how antioxidants are incorporated into cosmetic formulations. Recent trends include the use of advanced technologies such as microencapsulation, nanotechnology, and liposomal delivery to enhance the stability, penetration, and bioavailability of antioxidants in skincare and personal care products.Microencapsulation involves encapsulating antioxidant molecules in tiny particles, protecting them from degradation and ensuring a slow and controlled release upon application to the skin. This technology prolongs the antioxidant's efficacy and shelf life.

Nanotechnology allows for the creation of nanoparticles that can encapsulate antioxidants and improve their skin penetration. This enables antioxidants to reach deeper layers of the skin, where they can provide enhanced protection against oxidative stress.

Liposomal delivery systems use lipid-based vesicles to encapsulate antioxidants, improving their solubility and stability in cosmetic formulations. This technology enhances the delivery of antioxidants to the skin, resulting in improved antioxidant activity. These advanced delivery systems are enabling cosmetic companies to create more effective and efficient antioxidant products that deliver tangible benefits to consumers.

Personalized Antioxidant Solutions

Personalization is a growing trend in the cosmetic industry, and it has extended to the use of antioxidants in skincare and personal care products. Consumers are increasingly seeking personalized solutions tailored to their specific skin types, concerns, and lifestyles.Cosmetic brands are responding to this trend by offering customization options, such as personalized antioxidant serums and creams. Some companies provide online quizzes and consultation services to help consumers identify their unique skincare needs and select products that address those needs. Additionally, advancements in technology, such as AI-powered skincare analysis and 3D printing, are facilitating the creation of personalized antioxidant products. These innovations enable the formulation of products that precisely match an individual's skin profile and requirements.

By offering personalized antioxidant solutions, cosmetic companies are enhancing customer engagement and satisfaction while delivering more effective skincare results.

Multifunctional Antioxidant Formulations

Another notable trend in the cosmetic antioxidants market is the development of multifunctional formulations that combine antioxidants with other beneficial skincare ingredients. These combinations offer consumers a comprehensive approach to skincare, addressing multiple concerns simultaneously.For example, antioxidant-rich products may also contain hyaluronic acid for hydration, peptides for collagen stimulation, and vitamins for skin brightening. These combinations provide consumers with a single product that offers a wide range of benefits, simplifying their skincare routines. Additionally, some cosmetic brands are formulating makeup products, such as foundations and tinted moisturizers, with antioxidants. These products not only provide cosmetic coverage but also deliver antioxidant protection, further blurring the lines between skincare and makeup. The trend toward multifunctional antioxidant formulations reflects consumers' desire for efficiency and convenience in their skincare routines.

Sustainability and Eco-Friendly Practices

Sustainability and eco-friendly practices are becoming increasingly important in the cosmetic antioxidants market. Consumers are looking for products that are not only good for their skin but also good for the planet. This trend has led to a focus on sustainable sourcing of antioxidant ingredients, eco-friendly packaging, and reduced environmental impact.Cosmetic companies are making efforts to source antioxidant-rich botanicals responsibly, using practices that support biodiversity and protect natural habitats. Brands are also exploring circular economy initiatives, such as recycling and refilling programs, to reduce packaging waste.

Eco-friendly packaging materials, such as glass, recycled plastics, and compostable materials, are gaining popularity as consumers seek more sustainable options. Brands are embracing these materials and transparently communicating their commitment to environmental responsibility. Overall, the trend toward sustainability and eco-friendly practices reflects a broader shift in consumer values and a desire for ethical and environmentally conscious skincare choices.

In conclusion, the global cosmetic antioxidants market is experiencing several recent trends that are reshaping the industry. These trends include the rise of clean and natural beauty, advanced antioxidant delivery systems, personalized antioxidant solutions, multifunctional formulations, and a strong emphasis on sustainability and eco-friendly practices. As consumers continue to prioritize skincare and personal care products that align with these trends, the market is likely to see further innovation and growth in the coming years.

Segmental Insights

Type Insights

The global cosmetic antioxidants market is witnessing a significant surge in demand for natural products, driven by consumers' growing awareness of the importance of clean and sustainable beauty. Natural antioxidants, derived from plant-based sources like green tea, aloe vera, and grapeseed extract, have become the preferred choice for many consumers seeking skincare and personal care products. This increasing demand for natural ingredients is primarily rooted in the desire for safer, eco-friendly, and ethically sourced alternatives that promote overall skin health.Consumers are drawn to natural antioxidants due to their perceived safety and efficacy, as they are free from harsh chemicals and synthetic additives. The rising popularity of clean and natural beauty products is pushing cosmetic manufacturers to reformulate existing products or introduce new lines that feature these natural antioxidants. Additionally, as consumers become more conscious of the environmental impact of their choices, the use of sustainably sourced natural antioxidants aligns with their values, making it a key driver in the ever-expanding global cosmetic antioxidants market.

Distribution Channel Insights

The Global Cosmetic Antioxidants Market is experiencing a notable increase in demand from the online sales channel. This trend is largely attributed to the ever-growing popularity of e-commerce platforms and the convenience they offer to consumers. Online sales channels have become a preferred choice for purchasing cosmetic products, including those containing antioxidants, due to the ease of browsing, comparing products, and making purchases from the comfort of one's home.The COVID-19 pandemic has accelerated this shift towards online shopping as consumers sought safer alternatives to traditional brick-and-mortar stores. With the availability of detailed product information, customer reviews, and a wide range of options online, consumers can make informed decisions about antioxidant-infused skincare and personal care products. Cosmetic brands have also recognized the potential of online sales channels to reach a broader and more global audience. They have invested in digital marketing strategies, user-friendly websites, and seamless online shopping experiences to cater to this rising demand. As a result, the online sales channel is becoming increasingly pivotal in driving the growth of the global cosmetic antioxidants market, offering convenience and accessibility to consumers while opening up new avenues for cosmetic companies to expand their reach and market presence.

Regional Insights

The North America region is experiencing a significant surge in demand within the Global Cosmetic Antioxidants Market. This heightened demand can be attributed to several factors, including a strong consumer focus on skincare and personal well-being. North American consumers are increasingly recognizing the benefits of antioxidant-rich products in combating the effects of pollution, UV radiation, and aging on their skin, which has driven the growth of the market in the region.Furthermore, there is a growing trend in North America towards clean and natural beauty products. Consumers are actively seeking out cosmetics that contain natural antioxidants derived from botanical sources such as green tea, vitamin C, and aloe vera. The desire for cleaner and safer skincare options aligns with the preference for products that are free from harsh chemicals and synthetic additives. Cosmetic companies in the North American market have responded by incorporating these natural antioxidants into their formulations, further driving the demand for antioxidant-infused products.

In addition to consumer preferences, the North American market benefits from a robust and well-established cosmetics industry, a high level of disposable income, and a culture that values skincare and personal appearance. These factors, combined with the increasing awareness of the benefits of cosmetic antioxidants, make North America a key region driving the growth of the global cosmetic antioxidants market.

Report Scope:

In this report, the Global Cosmetic Antioxidants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Cosmetic Antioxidants Market, By Type:

- Synthetic

- Natural

Cosmetic Antioxidants Market, By Distribution Channel:

- Offline

- Online

Cosmetic Antioxidants Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- Egypt

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cosmetic Antioxidants Market.Available Customizations:

Global Cosmetic Antioxidants Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Wacker Chemie AG

- Evonik Industries AG

- Kemin Industries, Inc.

- Barentz International BV

- Eastman Chemical Company

- Ashland Global Holdings

- BTSA Biotecnologias Aplicadas S.L.,

- Koninklijke DSM N.V.

- SEPPIC

Table Information

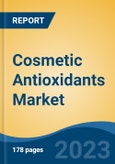

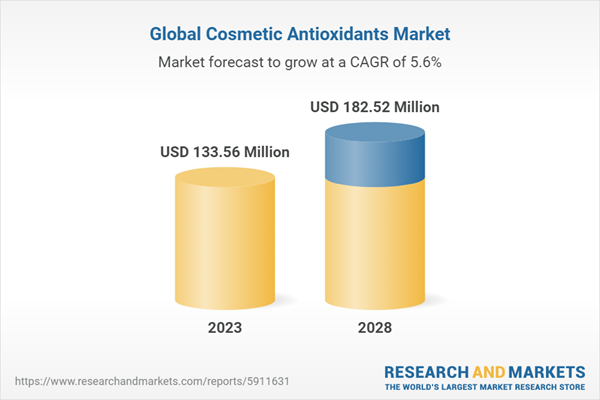

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 133.56 Million |

| Forecasted Market Value ( USD | $ 182.52 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |