Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Another key factor fueling market expansion is the increasing prevalence of fungal diseases exacerbated by climate change. Unpredictable weather patterns, prolonged humidity, and rising temperatures are making crops more susceptible to fungal infestations globally. In this context, bio-fungicides offer a sustainable and effective line of defense. Their mode of action - such as competition, parasitism, and induced resistance - makes them highly adaptive to evolving pathogens. As climate-resilient agriculture becomes a necessity, bio-fungicides are emerging as a strategic input in mitigating crop losses and securing food supplies.

Key Market Drivers

Rapid Adoption of Bio-Fungicides for Seed Treatment

The bio-fungicides market is witnessing accelerated growth, with seed treatment emerging as a critical application area. As growers seek sustainable ways to protect early-stage crops, bio-fungicides have gained prominence due to their ability to suppress seed- and soil-borne pathogens. According to recent agricultural input trends, over 45% of seed treatment products launched globally in 2023 contained biological or microbial ingredients, indicating a growing shift away from synthetic chemicals. This shift is further reinforced by rising consumer demand for residue-free crops and stricter regulations on chemical pesticide usage in key agricultural economies.Farmers are increasingly recognizing the multiple benefits bio-fungicides offer - not just disease control, but also soil health improvement and seed vigor enhancement. These biological treatments often include strains of Trichoderma, Bacillus, and Pseudomonas, which colonize the seed and rhizosphere, creating a protective barrier against harmful fungi. In India, usage of microbial bio-fungicides for seed treatment grew by approximately 18% between 2021 and 2023, fueled by rising awareness campaigns and the expansion of organic farming. These products have also proven effective in drought-prone and marginal soils, where traditional fungicides often underperform.

Regulatory support is another strong enabler in this space. Governments across Asia-Pacific and Europe are rolling out subsidy programs and fast-track approvals for biopesticides, making it easier for farmers to adopt them. Bio-fungicides also enjoy favorable inclusion in Integrated Pest Management (IPM) systems, now mandatory or strongly recommended in many regions. Combined with the growing penetration of agricultural extension services, these policy-level drivers are rapidly increasing farmer access and trust in seed treatment bio-fungicides, especially among smallholder farmers.

Advancements in microbial fermentation, formulation technologies, and carrier systems are pushing the efficacy of bio-fungicides to levels comparable with synthetic counterparts. Modern formulations offer improved shelf life, compatibility with other inputs, and resilience in varying climatic conditions. As a result, seed companies and agrochemical manufacturers are collaborating to integrate bio-fungicides into commercial seed coatings. These partnerships are enabling broader dissemination of bio-fungicide technologies at the seed level, streamlining adoption. With increasing demonstration of field performance and continued innovation, the adoption of bio-fungicides for seed treatment is set to become a cornerstone of future-ready farming practices.

Key Market Challenges

Limited Shelf Life

Bio-fungicides have been praised for their potential in the agricultural sector, offering an eco-friendly alternative to traditional fungicides that are harmful to both the environment and the end consumers. However, a key challenge that has emerged is their limited shelf life, which could have significant implications for the global demand for bio-fungicides. The reduced shelf life of these organic fungicides often requires farmers to purchase and use them within a short time frame. This, in turn, not only increases storage and procurement costs but also brings logistical challenges.The need for frequent replenishment of stocks may not be practical or cost-effective for many farmers, particularly those in remote or less-developed regions where supply chains may be inadequate or unreliable. Thus, while the environmental and health benefits of bio-fungicides are acknowledged, the limited shelf life presents a significant deterrent. It is this factor that could potentially decrease the demand for bio-fungicides globally, as farmers look for solutions that are not only effective and sustainable but also economical and logistically feasible. Despite the ongoing research and development in the field, unless the issue of limited shelf life is effectively addressed, the global acceptance and uptake of bio-fungicides could be affected.

Key Market Trends

Rapid Growth of The Agricultural Sector in Developing Countries

The agricultural sector in developing nations is undergoing rapid growth, a phenomenon set to significantly elevate the global demand for bio-fungicides. These countries, historically reliant on traditional farming practices, are now transitioning towards more sustainable and efficient agricultural methods due to heightened awareness of the environmental impact of conventional farming. As part of this shift, the use of bio-fungicides - a biological, environmentally friendly alternative to chemical fungicides - is predicted to surge. Bio-fungicides are derived from natural organisms, offering a sustainable way to control fungal diseases without damaging the ecosystem or endangering human health.Their rising adoption is fueled, in part, by the expanding organic food market, with consumers increasingly seeking produce grown without synthetic chemicals. Adding to the demand is the supportive legislation from governments, encouraging eco-friendly farming practices to protect biodiversity and promote sustainable development. Furthermore, advancements in agricultural technology are making bio-fungicides more accessible and economical for farmers in developing regions, facilitating their widespread adoption. Thus, the rapid expansion of the agricultural sector in developing countries combined with a growing emphasis on sustainable farming practices is anticipated to significantly boost the global demand for bio-fungicides.

Key Market Players

- Andermatt Group AG

- Biolchim SPA

- Bioworks Inc.

- Certis USA LLC

- Corteva Agriscience

- Indogulf BioAg LLC

- Koppert Biological Systems Inc.

- Lallemand Inc.

- Marrone Bio Innovations Inc.

- Seipasa SA

Report Scope:

In this report, the Global Bio-fungicides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bio-fungicides Market, By Source:

- Microbial

- Biochemical

- Plant Incorporated Protectants

Bio-fungicides Market, By Formulation:

- Dry

- Liquid

Bio-fungicides Market, By Application:

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamental

- Others

Bio-fungicides Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bio-fungicides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Andermatt Group AG

- Biolchim SPA

- Bioworks Inc.

- Certis USA LLC

- Corteva Agriscience

- Indogulf BioAg LLC

- Koppert Biological Systems Inc.

- Lallemand Inc.

- Marrone Bio Innovations Inc.

- Seipasa SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | August 2025 |

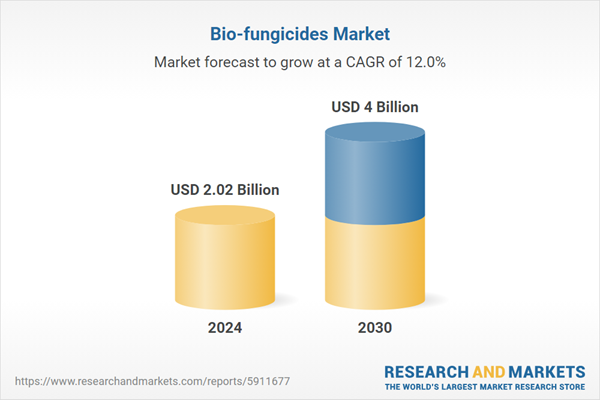

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.02 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |