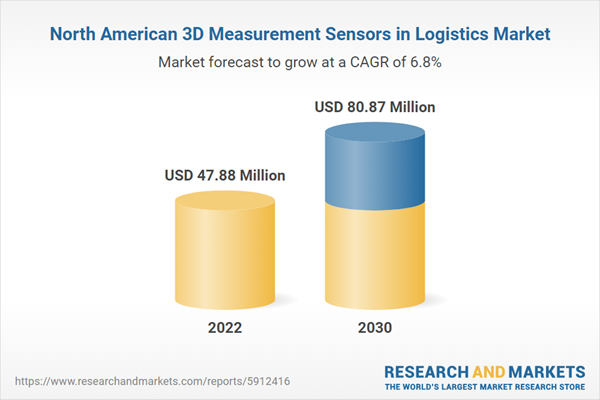

The North America 3D measurement sensors in logistics market is expected to grow from US$ 47.88 million in 2022 to US$ 80.87 million by 2030. It is estimated to grow at a CAGR of 6.8% from 2022 to 2030.

Increasing Deployment of 3D Measurement Sensors in Autonomous Mobile Robot’s Fuel North America 3D Measurement Sensors in Logistics Market.

Mobile robots are integrated with 3D sensors, lighting units, and depth processing units to calculate depth. The technology makes it easy to evaluate distance in a full scene. The rising need for real-time depth and visual information has surged the adoption of 3D measurement sensors in the logistics industry. Further, 3D sensing cameras can offer depth-sensing intelligence to automated guided vehicles and autonomous mobile robots in warehouse operations. The 3D sensing camera helps perceive the surroundings and capture depth imaging data, which further helps to accelerate business-critical functions with more accuracy, convenience, and speed. The camera provides various functions such as localization, mapping, navigation, obstacle avoidance, object detection, and odometry. Thus, due to all the above factors, the demand for 3D measurement sensors is increasing in the logistics industry. Further, various market players are offering 3D measurement sensors due to their rising deployment in robotics, particularly for palletization and depalletization, as they help in dimension measurement. LMI Technologies INC. offers Gocator 2490 sensors, particularly for packing and logistics operations. The Gocator 2490 sensor can be mounted on the robotic arm to scan the loaded pallet. It also provides precise positional coordinates to lift the box and place it on the outbound conveyor accurately. Thus, the rising need for 3D measurement sensors in autonomous mobile robots for accurate logistic operation is expected to fuel the growth of the North America 3D Measurement Sensors in Logistics Market during the forecast period.

North America 3D Measurement Sensors in Logistics Market Overview

The 3D measurement sensors in logistics market in North America is segmented into the US, Canada, and Mexico. North America is a technologically advanced region owing to factors such as a high inclination toward technical innovation, developed infrastructure, and favorable economic policies. All these factors are fueling the growth of automation in every industry, including logistics, in the region. Various logistics companies in the region are working on automating their warehouses to increase productivity. For instance, in September 2021, Bergen Logistics, a global third-party logistics (3PL) company, announced that it had automated one of its New Jersey warehouses to increase productivity, ensure same-day delivery, and remain competitive in a tight labor market. For this, the company selected CAJA Robotics to provide software, robots, and workstations to optimize order fulfillment processes and warehouse operations. Thus, growing automation and increasing use of robots in warehouse operations are raising the demand for 3D measurement sensors, as these sensors help calculate the length, width, and depth of an object, which further helps the robots in handling, picking, and sorting objects.

Increased e-commerce activity in the region is one of the major factors boosting automation in the logistics industry. As per the Digital Commerce 360 analysis of U.S. Department of Commerce figures, the US e-commerce sales reached US$ 1.03 trillion in 2022, which increased by 7.7% from US$ 960.44 billion in 2021. According to the International Trade Administration (ITA), in 2022, approximately 75% of the Canadian population (~27 million people) was using e-commerce, which is expected to reach 77.6% by 2025. In March 2022, e-commerce sales in Canada were ~US$ 2.34 billion and are estimated to reach US$ 40.3 billion by 2025. Such growth in e-commerce is driving the logistics industry in North America, further raising the need for automation in the logistics industry. Hence, this growing need for automation will fuel the growth of the North America 3D Measurement Sensors in Logistics Market.

North America 3D Measurement Sensors in Logistics Market Revenue and Forecast to 2030 (US$ Million)

North America 3D Measurement Sensors in Logistics Market Segmentation

The North America 3D measurement sensors in logistics market is segmented into type, application, and country.

Based on type, the North America 3D measurement sensors in logistics market is segmented into image sensors, position sensos, acoustic sensors, and others. The image sensors segment held a largest share of the North America 3D measurement sensors in logistics market in 2022.

Based on application, the North America 3D measurement sensors in logistics market is segmented into technology, stereo vision, structured light, laser light, and others. The structured light segment held the largest share of the North America 3D measurement sensors in logistics market in 2022.

Based on country, the North America 3D measurement sensors in logistics market is segmented into the US, Canada, and Mexico. The US dominated the North America 3D measurement sensors in logistics market in 2022.

Micro-Epsilon Messtechnik GmbH & Co KG, Infineon Technologies AG, Cognex Corp, ifm Electronic GmbH, Intel Corp, Keyence Corp, LMI Technologies Inc, OMRON Corp, and Sick AG are some of the leading companies operating in the North America 3D measurement sensors in logistics market

Table of Contents

Companies Mentioned

- Cognex Corp

- Ifm Electronic GmbH

- Infineon Technologies AG

- Intel Corp

- Keyence Corp

- LMI Technologies

- Micro-Epsilon Messtechnik GmbH & Co KG

- OMRON Corp

- Sick AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | October 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 47.88 Million |

| Forecasted Market Value ( USD | $ 80.87 Million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |