Construction chemicals are chemical additives used to bind the building material together with cement, concrete, or other building materials at the time of construction.

The Asia-Pacific and Middle East and Africa construction chemicals market growth is estimated to be driven by the rise in construction activities in emerging economies. The increasing investments in the public and private sectors further expand the trajectory of building chemical production. Industrialisation in this area is also expected to reinforce the growth of the Asia and Middle East construction chemicals sector. The market is highly diverse; thus, as a key strategy to improve their size, manufacturing performance, and market penetration, key players have embraced mergers and acquisitions.

The fast growth in end-use sectors such as residential, retail, and repair, among others, is important for economic growth in emerging economies. In the African market, the mining sector has grown rapidly, while many foreign countries are investing in the industrial sector in Asia. This increase in industrialisation fuels the demand for construction activities, which, in turn, stimulates the development of the market for construction chemicals.

Key Trends and Developments

Growing repair and refurbishment; green building initiatives; and focus on local production are the major trends impacting the Asia-Pacific and Middle East and Africa construction chemicals market expansion.February, 2024

MC-Bauchemie Tanzania Limited announced that it has set up a company in Tanzania to build a strong base of construction chemicals products in East African countries.October, 2023

MUTIARA ETNIK, a construction corporation, partnered with PETRONAS Chemicals Group Berhad (PCG) to build the largest chemical recycling plant in Asia.April, 2023

Indigo Paints announced that is set to acquire 51 per cent of stake in Apple Chemie India Private Ltd (ACIPL), a construction chemical company.March, 2023

Nippon Paint (India) Pvt Ltd announced that it aims to foray into the construction chemicals sector and expand its product portfolio.Growing repair and refurbishment activities

Due to the ageing infrastructure in many economies, chemicals that aid in fast repair such as concrete admixtures are in high demand.Green building initiatives

There is a rising demand for eco-friendly construction chemicals to improve the energy efficiency of buildings.Innovations in products

Technological innovations such as biotechnology and nanotechnology are leading to the development of construction chemicals with high-end properties such as advanced waterproofing.Focus on local production

Market players in the region are focused on scaling up the production of construction chemicals to reduce import costs.Asia-Pacific and Middle East and Africa Construction Chemicals Market Trends

Ageing infrastructure presents several challenges regarding the structural strength of infrastructure such as bridges, buildings, and roads, among others. Construction chemicals which offer superior performance such as epoxy-based compounds and high-performance concrete mixes are gaining popularity. These chemicals and materials offer fast settings and reduce the requirement for frequent maintenance, which is crucial, especially in infrastructure exposed to harsh environments.New players in Asia-Pacific and Middle East and Africa construction chemicals market are venturing into the construction chemical sector to strengthen their presence in the construction sector as well as expand their portfolio. For instance, Nippon Paint (India) Pvt Ltd announced in March 2023 that it aims to expand its operations into the construction chemicals sector. It aims to offer products such as dry mix, waterproofing and repair and maintenance, among others.

Market Segmentation

“Asia-Pacific and Middle East and Africa Construction Chemicals Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Concrete Admixture

- Waterproofing and Roofing

- Repair

- Flooring

- Adhesive and Sealant

- Others

Market Breakup by Application

- Residential

- Industrial

- Infrastructure

- Repair Structures

- Others

Market Breakup by Region

- China

- Japan

- India

- Africa

- UAE

- Saudi Arabia

Concrete admixture occupies a significant market share as it can enhance the durability of the concrete and improve the structural strength of the building. It also improves chemical and weather resistance and enhances the longevity of the building or other infrastructures. Moreover, rapid urbanisation in these regions has led to a surge in construction activities which fuels the demand for concrete admixture.

Waterproofing and roofing are expected to witness robust growth in the forecast period as many parts of APAC and MEA are subjected to high temperatures and extreme rainfall which necessitates the requirement of chemical solutions that offer complete protection.

The infrastructure sector maintains its dominance in the market due to rising government investments

The infrastructure sector holds the major share of the construction chemicals market in Asia-Pacific and Middle East and Africa due to rapid urbanisation and the rising investments in infrastructural projects by the government to ensure economic growth. For instance, the construction of the Gai Timber building in Nanyang Technological University (NTU) in Singapore is expected to sprawl across 43,500-metre squares and form a crucial part of the educational infrastructure of the country.The residential sector is anticipated to witness tremendous growth in the Asia-Pacific and Middle East and Africa construction chemicals market in the foreseeable future due to the growing population in countries like India and China. Moreover, the rising demand for good quality housing solutions among the growing middle class fuels the segment growth.

Asia-Pacific and Middle East and Africa Construction Chemicals Market Analysis by Region

China holds the largest share in the market due to the prominence of its infrastructure projects such as the Belt and Road initiative in the world which promotes the development of roads, airports, and other infrastructures. Furthermore, the rapid industrialisation in the country also necessitates the requirement of specific construction chemicals.India is also expected to emerge as a strong country in the Asia-Pacific and Middle East and Africa construction chemicals market due to its government initiatives such as Pradhan Mantri Awas Yojana which intends to offer affordable housing to the economically weaker sections of the country under eligibility criteria.

Competitive Landscape

The market players are increasing their collaboration activities to gain a competitive edge in the Asia-Pacific and Middle East and Africa construction chemicals market.Sika AG

Sika AG, founded in 1910 and based in Baar, Switzerland, is involved in the production and sales of bonding, sealing, and reinforcing products for infrastructure.Evonik Industries AG

Evonik Industries AG, founded in 2007, is known as a global leader in speciality chemicals and offers a wide array of chemicals for building materials, pharmaceuticals, and agriculture, among others.Pidilite Industries Ltd.

Pidilite Industries Ltd., founded in 1959, is involved in the sales of adhesives, sealants and construction chemicals, among others.

Mapei

Mapei, founded in 1937 and based in Milan, Italy, offers a broad range of products for waterproofing, and concrete admixtures, among others.Other market players such as Fosroc, Inc., among others are focused on the development of innovative and advanced chemical solutions to stand out among their competitors.

Table of Contents

Companies Mentioned

The key companies featured in this Asia-Pacific and Middle East and Africa Construction Chemicals market report include:- Sika AG

- Evonik Industries AG

- Pidilite Industries Ltd.

- Mapei

- Fosroc, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | August 2025 |

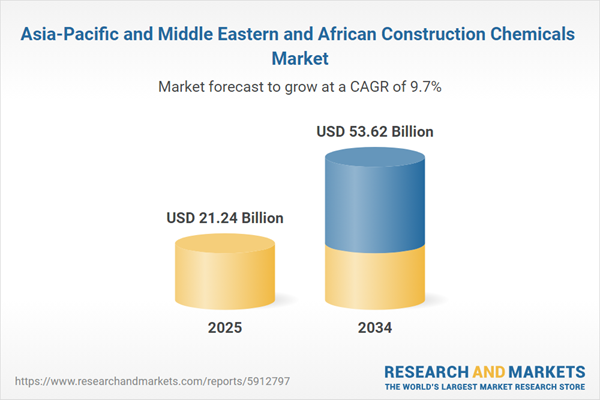

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 21.24 Billion |

| Forecasted Market Value ( USD | $ 53.62 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Africa, Asia Pacific, Middle East |

| No. of Companies Mentioned | 5 |