1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Inclusions & Exclusions

1.4 Years Considered

1.5 Currency Considered

Table 1 USD Exchange Rates, 2019-2022

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 1 Biorational Pesticides Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

Figure 2 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

Figure 3 Biorational Pesticides Market Size Estimation (Demand Side)

Figure 4 Biorational Pesticides Market Size Estimation: Bottom-Up Approach

2.2.2 Top-Down Approach

Figure 5 Biorational Pesticides Market Size Estimation, by Type (Supply Side)

Figure 6 Biorational Pesticides Market Size Estimation: Top-Down Approach

2.3 Market Breakdown & Data Triangulation

Figure 7 Data Triangulation

2.4 Research Assumptions

Table 2 Research Assumptions

2.5 Limitations and Risk Assessment

3 Executive Summary

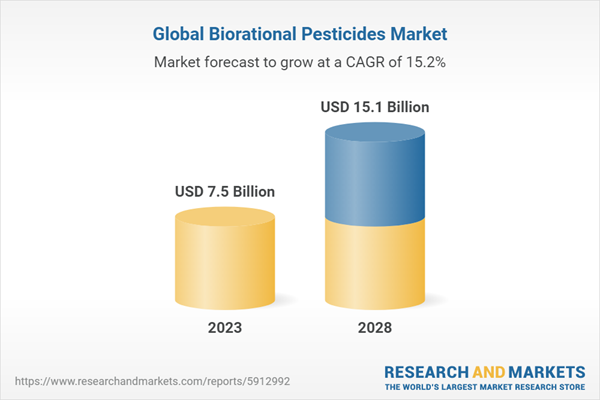

Table 3 Biorational Pesticides Market Snapshot, 2023 vs. 2028

Figure 8 Biorational Pesticides Market, by Type, 2023 vs. 2028 (USD Million)

Figure 9 Biorational Pesticides Market, by Mode of Application, 2023 vs. 2028 (USD Million)

Figure 10 Biorational Pesticides Market, by Source, 2023 vs. 2028 (USD Million)

Figure 11 Biorational Pesticides Market, by Formulation, 2023 vs. 2028 (USD Million)

Figure 12 Biorational Pesticides Market, by Crop Type, 2023 vs. 2028 (USD Million)

Figure 13 Biorational Pesticides Market: Regional Snapshot

4 Premium Insights

4.1 Opportunities for Players in Biorational Pesticides Market

Figure 14 Shift Toward Sustainable Agriculture and Government Policies to Drive Biorational Pesticides Market

4.2 North America: Biorational Pesticides Market, by Country and Key Type

Figure 15 Biorational Insecticides Segment and US Accounted for Significant Share in 2022

4.3 Biorational Pesticides Market, by Region

Figure 16 North America to Dominate Market During Forecast Period

4.4 Biorational Pesticides Market, by Formulation

Figure 17 Liquid Segment to Account for Larger Share by 2028

4.5 Biorational Pesticides Market, by Type

Figure 18 Biorational Insecticides Segment to Lead Market During Forecast Period

4.6 Biorational Pesticides Market, by Mode of Application

Figure 19 Foliar Spray Segment to Account for Largest Share During Forecast Period

4.7 Biorational Pesticides Market, by Crop Type

Figure 20 Fruits & Vegetables Segment to Lead Market During Forecast Period

Figure 21 India, Australia, and South America to Achieve Significant Growth During Forecast Period

5 Market Overview

5.1 Introduction

Table 4 List of Plant Products Registered as Biopesticides

5.2 Macroeconomic Indicators

5.2.1 Growth in Organic Agricultural Practices

Figure 22 Total Organic Land, by Region, 2021

Figure 23 Top 10 Countries with Large Area Under Organic Farming, 2021 (Million Hectares)

5.2.2 Increasing Pest Attacks on Fruit and Vegetable Crops

5.2.3 Reluctance in Adopting Harmful Chemical Pesticides in Developed Markets

5.3 Market Dynamics

Figure 24 Biorational Pesticides Market: Drivers, Restraints, Opportunities, and Challenges

5.3.1 Drivers

5.3.1.1 High Costs Associated with Development of New Synthetic Crop Protection Products

Figure 25 Trends of New Active Ingredient Launches, 1950-2019

Table 5 6Th Edition of Pan International Consolidated List of Banned Pesticides (May 2022)

5.3.1.2 Chemical Pesticide Bans and Awareness Programs by Government Agencies

5.3.1.3 Increase in Acceptance of Organic Food Products

Figure 26 Europe: Market Share of Organic Farming, by Key Country, 2021

Figure 27 Growth of Global Food & Drink Market (2000-2021)

5.3.2 Restraints

5.3.2.1 Technological Limitations for Use of Biological Products

5.3.2.2 Ineffectiveness of Biological Insecticides

5.3.3 Opportunities

5.3.3.1 Advancements in Microbial Research Undertaken by Key Players Across Regions

5.3.3.2 Resistance of Pests to Crop Protection Chemicals

5.3.3.3 Rising Consumption of Pesticides in Developing Countries

Figure 28 Top 10 Countries and Their Total Pesticide Usage in Agriculture, 2020 (‘000 Tonnes)

5.3.4 Challenges

5.3.4.1 Preference for Chemical Pesticides in Developing Countries

5.3.4.2 Delayed Effect of Biorational Pesticides on Pests

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

Figure 29 Value Chain Analysis

6.3 Supply Chain Analysis

Figure 30 Supply Chain Analysis

6.4 Ecosystem Analysis

Table 6 Role of Players in the Market Ecosystem

Figure 31 Ecosystem Map

6.5 Porter's Five Forces Analysis

Table 7 Impact of Porter's Five Forces on Biorational Pesticides Market

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Trends and Disruptions Impacting Customers

Figure 32 Trends and Disruptions Impacting Customers

6.7 Key Conferences & Events

Table 8 Key Conferences & Events, 2023-2025

6.8 Key Stakeholders & Buying Criteria

6.8.1 Key Stakeholders in the Buying Process

Figure 33 Influence of Stakeholders on the Buying Process for Top 3 Modes of Application

Table 9 Influence of Stakeholders on the Buying Process for Top 3 Modes of Application

6.8.2 Buying Criteria

Figure 34 Influence of Stakeholders on the Buying Process for Top 3 Types of Biorational Pesticides

Table 10 Key Buying Criteria for Top 3 Types of Biorational Pesticides

6.9 Tariff and Regulatory Landscape

6.9.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 11 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 RoW: List of Regulatory Bodies, Government Agencies, and Other Organizations

6.9.2 Regulatory Framework

6.9.2.1 North America

6.9.2.1.1 US

6.9.2.1.2 Canada

6.9.2.2 European Union

6.9.2.2.1 European Food Safety Authority (Efsa)

6.9.2.2.2 Confederation of European Pest Management Association (Cepa)

6.9.2.2.3 European Committee for Standardization (Cen)

6.9.2.3 Asia-Pacific

6.9.2.3.1 China

6.9.2.3.2 India

6.9.2.4 RoW

6.9.2.4.1 Brazil

6.9.2.4.2 Egypt

6.9.2.4.3 UAE

6.9.2.4.4 Saudi Arabia

6.10 Case Study Analysis

6.10.1 Koppert Biological Systems Acquired Geocom to Focus on Precision Agri-Farming

6.10.2 Upl Launched Flupyrimin to Protect Rice Yields and Boost Crop Health

7 Biorational Pesticides Market, by Formulation

7.1 Introduction

Figure 35 Biorational Pesticides Market, by Formulation, 2023 vs. 2028 (USD Million)

Table 15 Biorational Pesticides Market, by Formulation, 2018-2022 (USD Million)

Table 16 Biorational Pesticides Market, by Formulation, 2023-2028 (USD Million)

7.2 Liquid

7.2.1 Ease of Application to Drive Adoption of Liquid Biorational Pesticides

Table 17 Liquid: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 18 Liquid: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

7.3 Dry

7.3.1 Ease of Handling and Long Shelf to Boost Popularity of Dry Biorational Pesticides

Table 19 Dry: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 20 Dry: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

8 Biorational Pesticides Market, by Mode of Application

8.1 Introduction

Figure 36 Biorational Pesticides Market, by Mode of Application, 2023 vs. 2028 (USD Million)

Table 21 Biorational Pesticides Market, by Mode of Application, 2018-2022 (USD Million)

Table 22 Biorational Pesticides Market, by Mode of Application, 2023-2028 (USD Million)

8.2 Foliar Spray

8.2.1 Effectiveness and Ease of Application of Foliar Spray to Spur Its Demand

Table 23 Foliar Spray: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 24 Foliar Spray: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

8.3 Soil Treatment

8.3.1 Need to Decrease Potential Impact of Pesticides on Neighbouring Non-Target Areas to Drive Use of Soil Treatment Practices

Table 25 Soil Treatment: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 26 Soil Treatment: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

8.4 Seed Treatment

8.4.1 Demand for Modern Pest Resistance Management Strategies to Boost Adoption of Seed Treatment Practices

Table 27 Seed Treatment: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 28 Seed Treatment: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

8.5 Other Modes of Application

Table 29 Other Modes of Application: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 30 Other Modes of Application: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

9 Biorational Pesticides Market, by Source

9.1 Introduction

Table 31 Popular Botanical Pesticides with Sources

Figure 37 Biorational Pesticides Market, by Source, 2023 vs. 2028 (USD Million)

Table 32 Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 33 Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

9.2 Botanical

Table 34 Botanical: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 35 Botanical: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

9.2.1 Pyrethrin

9.2.1.1 Ability of Pyrethrin-based Pesticides to Kill Insects to Boost Demand

9.2.2 Azadirachtin & Neem Oil

9.2.2.1 Azadirachtin Disrupts Insect Growth Cycles and Impacts Pests Like Aphids and Beetles

9.2.3 Rotenone

9.2.3.1 Effectivity of Rotenone Against Soilborne Pests to Boost Growth

9.2.4 Others

9.3 Microbials

Table 36 Microbials: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 37 Microbials: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

9.3.1 Bacillus Thuringiensis

9.3.1.1 Diverse Formulations and Cost-Efficiency of Bacillus Thuringiensis (Bt) in Pest Control to Drive Market

9.3.2 Beauveria Bassiana

9.3.2.1 Demand for Microbials That Control Soilborne Insects to Spur Market for Beauveria Bassiana

9.3.3 Others

9.4 Non-Organic

9.4.1 Rising Demand for Effective Alternative to Biological Crop Protection Solutions to Propel Market

Table 38 Non-Organic: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 39 Non-Organic: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

9.5 Other Sources

Table 40 Other Sources: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 41 Other Sources: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

10 Biorational Pesticides Market, by Type

10.1 Introduction

Figure 38 Biorational Pesticides Market, by Type, 2023 vs. 2028 (USD Million)

Table 42 Biorational Pesticides Market, by Type, 2018-2022 (USD Million)

Table 43 Biorational Pesticides Market, by Type, 2023-2028 (USD Million)

10.2 Biorational Insecticides

10.2.1 Need for Maximizing Crop Health and Sustainability to Encourage Adoption of Biorational Insecticides

Table 44 Biorational Insecticides Market, by Region, 2018-2022 (USD Million)

Table 45 Biorational Insecticides Market, by Region, 2023-2028 (USD Million)

10.3 Biorational Fungicides

10.3.1 Emphasis on Advancements in Fermentation Technology to Shift Focus to Biorational Fungicides

Table 46 Biorational Fungicides Market, by Region, 2018-2022 (USD Million)

Table 47 Biorational Fungicides Market, by Region, 2023-2028 (USD Million)

10.4 Biorational Nematicides

10.4.1 Increase in Nematode-Related Issues to Fuel Market for Biorational Nematicides

Table 48 Biorational Nematicides Market, by Region, 2018-2022 (USD Million)

Table 49 Biorational Nematicides Market, by Region, 2023-2028 (USD Million)

10.5 Biorational Herbicides

10.5.1 Preference for Eco-Friendly Alternatives to Synthetic Herbicides to Boost Growth

Table 50 Biorational Herbicides Market, by Region, 2018-2022 (USD Million)

Table 51 Biorational Herbicides Market, by Region, 2023-2028 (USD Million)

10.6 Other Biorational Pesticides

Table 52 Other Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 53 Other Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

11 Biorational Pesticides Market, by Crop Type

11.1 Introduction

Table 54 List of Biopesticides for Various Crops

Figure 39 Biorational Pesticides Market, by Crop Type, 2023 vs. 2028 (USD Million)

Table 55 Biorational Pesticides Market, by Crop Type, 2018-2022 (USD Million)

Table 56 Biorational Pesticides Market, by Crop Type, 2023-2028 (USD Million)

11.2 Fruits & Vegetables

11.2.1 High Export of Organic Fruits and Vegetables to Boost Market

Table 57 Fruits & Vegetables: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 58 Fruits & Vegetables: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

11.2.2 Citrus Fruits

11.2.3 Berries

11.2.4 Tomatoes

11.2.5 Potatoes

11.2.6 Other Fruits & Vegetables

11.3 Cereals & Grains

11.3.1 Rising Demand for Cereals and Grains from Health-Conscious People to Spur Market Growth

Figure 40 Total Organic Cereal Production Area, by Region, 2021

Table 59 Cereals & Grains: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 60 Cereals & Grains: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

11.3.2 Wheat

11.3.3 Rice

11.3.4 Corn

11.3.5 Other Cereals & Grains

11.4 Oilseeds & Pulses

11.4.1 Increasing Consumption of Oilseeds and Pulses to Propel Demand for Biorational Pesticides

Figure 41 Top 5 Countries and Their Area for Oilseed Production, 2021

Table 61 Oilseeds & Pulses: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 62 Oilseeds & Pulses: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

11.4.2 Soybean

11.4.3 Sunflower

11.4.4 Cotton Seed

11.4.5 Other Oilseeds & Pulses

11.5 Other Crop Types

Table 63 Other Crop Types: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 64 Other Crop Types: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

12 Biorational Pesticides Market, by Region

12.1 Introduction

Figure 42 Distribution of Organic Agricultural Land, by Region, 2021

Figure 43 India to Record Significant Growth in Biorational Pesticides Market During Forecast Period

Figure 44 Biorational Pesticides Market, by Region, 2023 vs. 2028 (USD Million)

Table 65 Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 66 Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

12.2 North America

Table 67 North America: Land Use in Organic Agriculture, 2021

Figure 45 North America: Biorational Pesticides Market Snapshot

Table 68 North America: Biorational Pesticides Market, by Country, 2018-2022 (USD Million)

Table 69 North America: Biorational Pesticides Market, by Country, 2023-2028 (USD Million)

Table 70 North America: Biorational Pesticides Market, by Type, 2018-2022 (USD Million)

Table 71 North America: Biorational Pesticides Market, by Type, 2023-2028 (USD Million)

Table 72 North America: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 73 North America: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

Table 74 North America: Biorational Pesticides Market, by Mode of Application, 2018-2022 (USD Million)

Table 75 North America: Biorational Pesticides Market, by Mode of Application, 2023-2028 (USD Million)

Table 76 North America: Biorational Pesticides Market, by Formulation, 2018-2022 (USD Million)

Table 77 North America: Biorational Pesticides Market, by Formulation, 2023-2028 (USD Million)

Table 78 North America: Biorational Pesticides Market, by Crop Type, 2018-2022 (USD Million)

Table 79 North America: Biorational Pesticides Market, by Crop Type, 2023-2028 (USD Million)

12.2.1 US

12.2.1.1 Government Initiatives and Organic Food Market to Boost Adoption of Biorational Pesticides

Table 80 US: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 81 US: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.2.2 Canada

12.2.2.1 Stringent Regulations on Chemical Pesticides to Make Way for Growth of Biorational Pesticides

Table 82 Canada: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 83 Canada: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.2.3 Mexico

12.2.3.1 Prohibition of Chemical Pesticides to Lead to Local Production of Biorational Pesticides

Table 84 Mexico: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 85 Mexico: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.3 Asia-Pacific

Figure 46 Asia-Pacific: Biorational Pesticides Market Snapshot

Table 86 Asia-Pacific: Biorational Pesticides Market, by Country, 2018-2022 (USD Million)

Table 87 Asia-Pacific: Biorational Pesticides Market, by Country, 2023-2028 (USD Million)

Table 88 Asia-Pacific: Biorational Pesticides Market, by Type, 2018-2022 (USD Million)

Table 89 Asia-Pacific: Biorational Pesticides Market, by Type, 2023-2028 (USD Million)

Table 90 Asia-Pacific: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 91 Asia-Pacific: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

Table 92 Asia-Pacific: Biorational Pesticides Market, by Mode of Application, 2018-2022 (USD Million)

Table 93 Asia-Pacific: Biorational Pesticides Market, by Mode of Application, 2023-2028 (USD Million)

Table 94 Asia-Pacific: Biorational Pesticides Market, by Formulation, 2018-2022 (USD Million)

Table 95 Asia-Pacific: Biorational Pesticides Market, by Formulation, 2023-2028 (USD Million)

Table 96 Asia-Pacific: Biorational Pesticides Market, by Crop Type, 2018-2022 (USD Million)

Table 97 Asia-Pacific: Biorational Pesticides Market, by Crop Type, 2023-2028 (USD Million)

12.3.1 China

12.3.1.1 Easy Registration Process and Advancements in Biomanufacturing to Lead to Market Expansion

Table 98 China: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 99 China: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.3.2 India

12.3.2.1 Large-Scale Production of Agricultural Commodities to Drive Market for Biorational Pesticides

Figure 47 Biopesticide Consumption in India (2018-2019 to 2021-2022)

Table 100 India: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 101 India: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.3.3 Japan

12.3.3.1 Initiatives by Maff to Encourage the Development and Adoption of Biopesticides and Associated Nature-based Technologies

Table 102 Japan: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 103 Japan: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.3.4 Australia

12.3.4.1 Organic Farming Expansion to Play Catalyst for Biorational Pesticides Market's Growth

Table 104 Australia: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 105 Australia: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.3.5 Rest of Asia-Pacific

Table 106 Rest of Asia-Pacific: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 107 Rest of Asia-Pacific: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.4 Europe

Table 108 Europe: Biorational Pesticides Market, by Country, 2018-2022 (USD Million)

Table 109 Europe: Biorational Pesticides Market, by Country, 2023-2028 (USD Million)

Table 110 Europe: Biorational Pesticides Market, by Type, 2018-2022 (USD Million)

Table 111 Europe: Biorational Pesticides Market, by Type, 2023-2028 (USD Million)

Table 112 Europe: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 113 Europe: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

Table 114 Europe: Biorational Pesticides Market, by Mode of Application, 2018-2022 (USD Million)

Table 115 Europe: Biorational Pesticides Market, by Mode of Application, 2023-2028 (USD Million)

Table 116 Europe: Biorational Pesticides Market, by Formulation, 2018-2022 (USD Million)

Table 117 Europe: Biorational Pesticides Market, by Formulation, 2023-2028 (USD Million)

Table 118 Europe: Biorational Pesticides Market, by Crop Type, 2018-2022 (USD Million)

Table 119 Europe: Biorational Pesticides Market, by Crop Type, 2023-2028 (USD Million)

12.4.1 France

12.4.1.1 Expansion of Organic Food Market to Spur Demand for Biorational Pesticides

Table 120 France: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 121 France: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.4.2 Italy

12.4.2.1 Government Regulations on Chemical Pesticides to Encourage Key Players to Introduce New Biorational Products

Table 122 Italy: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 123 Italy: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.4.3 Germany

12.4.3.1 Sustainable Organic Farming to Create Favorable Environment for Biorational Pesticides

Table 124 Germany: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 125 Germany: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.4.4 Spain

12.4.4.1 Growing Demand for Enhanced Agricultural Yield and Productivity to Propel Market

Table 126 Spain: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 127 Spain: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.4.5 UK

12.4.5.1 Ban on Chemical Pesticides and Continuous Growth in Organic Farming Practices to Boost Demand

Table 128 UK: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 129 UK: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.4.6 Rest of Europe

Table 130 Rest of Europe: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 131 Rest of Europe: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.5 Rest of the World

Table 132 Rest of the World: Biorational Pesticides Market, by Region, 2018-2022 (USD Million)

Table 133 Rest of the World: Biorational Pesticides Market, by Region, 2023-2028 (USD Million)

Table 134 Rest of the World: Biorational Pesticides Market, by Type, 2018-2022 (USD Million)

Table 135 Rest of the World: Biorational Pesticides Market, by Type, 2023-2028 (USD Million)

Table 136 Rest of the World: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 137 Rest of the World: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

Table 138 Rest of the World: Biorational Pesticides Market, by Mode of Application, 2018-2022 (USD Million)

Table 139 Rest of the World: Biorational Pesticides Market, by Mode of Application, 2023-2028 (USD Million)

Table 140 Rest of the World: Biorational Pesticides Market, by Formulation, 2018-2022 (USD Million)

Table 141 Rest of the World: Biorational Pesticides Market, by Formulation, 2023-2028 (USD Million)

Table 142 Rest of the World: Biorational Pesticides Market, by Crop Type, 2018-2022 (USD Million)

Table 143 Rest of the World: Biorational Pesticides Market, by Crop Type, 2023-2028 (USD Million)

12.5.1 South America

12.5.1.1 Increasing Arable Land and Sustainable Farming Methods to Encourage Market Expansion

Table 144 South America: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 145 South America: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

12.5.2 Middle East & Africa

12.5.2.1 Rapid Use of Innovative Agricultural Practices and Large-Scale Commercial Farming to Spur Growth

Table 146 Middle East & Africa: Biorational Pesticides Market, by Source, 2018-2022 (USD Million)

Table 147 Middle East & Africa: Biorational Pesticides Market, by Source, 2023-2028 (USD Million)

13 Competitive Landscape

13.1 Introduction

13.2 Market Share Analysis

Table 148 Biorational Pesticides Market: Intensity of Competitive Rivalry, 2022

13.3 Revenue Analysis

Figure 48 Revenue Analysis of Key Players, 2020-2022 (USD Billion)

13.4 Key Players’ Strategies/Right to Win

13.5 Company Evaluation Matrix

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

Figure 49 Company Evaluation Matrix, 2023

13.5.5 Company Footprint

Table 149 Company Product Type Footprint

Table 150 Company Crop Type Footprint

Table 151 Company Regional Footprint

Table 152 Overall Company Footprint

13.6 Start-Up/SME Evaluation Matrix

13.6.1 Progressive Companies

13.6.2 Responsive Companies

13.6.3 Dynamic Companies

13.6.4 Starting Blocks

Figure 50 Start-Up/SME Evaluation Matrix, 2023

13.6.5 Competitive Benchmarking

Table 153 Detailed List of Key Start-Ups/SMEs

Table 154 Competitive Benchmarking of Key Start-Ups/SMEs

13.7 Competitive Scenario & Trends

13.7.1 Product Launches

Table 155 Product Launches, 2019-2023

13.7.2 Deals

Table 156 Deals, 2019-2023

13.7.3 Others

Table 157 Others, 2019-2023

14 Company Profiles

Business Overview, Products Offered, Recent Developments, Analyst's View Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats

14.1 Key Players

14.1.1 Upl

Table 158 Upl: Business Overview

Figure 51 Upl Limited: Company Snapshot

Table 159 Upl: Products/Solutions/Services Offered

Table 160 Upl: Product Launches

Table 161 Upl: Deals

Table 162 Upl: Others

14.1.2 Fmc Corporation

Table 163 Fmc Corporation: Business Overview

Figure 52 Fmc Corporation: Company Snapshot

Table 164 Fmc Corporation: Products/Solutions/Services Offered

Table 165 Fmc Corporation: Product Launches

Table 166 Fmc Corporation: Deals

Table 167 Fmc Corporation: Others

14.1.3 BASF SE

Table 168 BASF SE: Business Overview

Figure 53 BASF SE: Company Snapshot

Table 169 BASF SE: Products/Solutions/Services Offered

Table 170 BASF SE: Product Launches

Table 171 BASF SE: Deals

Table 172 BASF SE: Others

14.1.4 Bayer AG

Table 173 Bayer AG: Business Overview

Figure 54 Bayer AG: Company Snapshot

Table 174 Bayer AG: Products/Solutions/Services Offered

Table 175 Bayer AG: Product Launches

Table 176 Bayer AG: Deals

Table 177 Bayer AG: Others

14.1.5 Syngenta AG

Table 178 Syngenta AG: Business Overview

Figure 55 Syngenta AG: Company Snapshot

Table 179 Syngenta AG: Products/Solutions/Services Offered

Table 180 Syngenta AG: Product Launches

Table 181 Syngenta AG: Deals

Table 182 Syngenta AG: Others

14.1.6 Novozymes A/S

Table 183 Novozymes A/S: Business Overview

Figure 56 Novozymes A/S: Company Snapshot

Table 184 Novozymes A/S: Products/Solutions/Services Offered

Table 185 Novozymes A/S: Product Launches

Table 186 Novozymes A/S: Deals

14.1.7 Sumitomo Chemical Co. Ltd.

Table 187 Sumitomo Chemical Co. Ltd.: Business Overview

Figure 57 Sumitomo Chemical Co. Ltd.: Company Snapshot

Table 188 Sumitomo Chemical Co. Ltd.: Products/Solutions/Services Offered

Table 189 Sumitomo Chemical Co. Ltd.: Deals

Table 190 Sumitomo Chemical Co. Ltd.: Others

14.1.8 Pro Farm Group Inc.

Table 191 Pro Farm Group Inc.: Business Overview

Table 192 Pro Farm Group Inc.: Products/Solutions/Services Offered

Table 193 Pro Farm Group Inc.: Product Launches

Table 194 Pro Farm Group Inc.: Deals

14.1.9 Koppert

Table 195 Koppert: Business Overview

Table 196 Koppert: Products/Solutions/Services Offered

Table 197 Koppert: Product Launches

Table 198 Koppert: Deals

14.1.10 Valent Biosciences LLC

Table 199 Valent Biosciences LLC: Business Overview

Table 200 Valent Biosciences LLC: Products/Solutions/Services Offered

Table 201 Valent Biosciences LLC: Deals

Table 202 Valent Biosciences LLC: Others

14.1.11 Gowan Company

Table 203 Gowan Company: Business Overview

Table 204 Gowan Company: Products/Solutions/Services Offered

Table 205 Gowan Company: Deals

14.1.12 Certis Biologicals

Table 206 Certis Biologicals: Business Overview

Table 207 Certis Biologicals: Products/Solutions/Services Offered

Table 208 Certis Biologicals: Product Launches

Table 209 Certis Biologicals: Others

14.1.13 Biobest Group

Table 210 Biobest Group: Business Overview

Table 211 Biobest Group: Products/Solutions/Services Offered

Table 212 Biobest Group: Product Launches

Table 213 Biobest Group: Deals

14.1.14 Bionema

Table 214 Bionema: Business Overview

Table 215 Bionema: Products/Solutions/Services Offered

Table 216 Bionema: Product Launches

Table 217 Bionema: Deals

14.1.15 Vestaron Corporation

Table 218 Vestaron Corporation: Business Overview

Table 219 Vestaron Corporation: Products/Solutions/Services Offered

Table 220 Vestaron Corporation: Product Launches

Table 221 Vestaron Corporation: Deals

14.2 Other Players

14.2.1 Stk Bio-AG Technologies

Table 222 Stk Bio-AG Technologies: Company Overview

Table 223 Stk Bio-AG Technologies: Products/Solutions/Services Offered

Table 224 Stk Bio-AG Technologies: Deals

14.2.2 Ipl Biologicals

Table 225 Ipl Biologicals: Business Overview

Table 226 Ipl Biologicals: Products/Solutions/Services Offered

14.2.3 Andermatt Group AG

Table 227 Andermatt Group AG: Business Overview

Table 228 Andermatt Group AG: Products/Solutions/Services Offered

14.2.4 Vegalab SA

Table 229 Vegalab SA: Business Overview

Table 230 Vegalab SA: Products/Solutions/Services Offered

14.2.5 Fytofend

Table 231 Fytofend: Business Overview

Table 232 Fytofend: Products/Solutions/Services Offered

14.2.6 Biotalys Nv

14.2.7 Innovate Agriculture

14.2.8 Agrilife (India) Private Limited

14.2.9 Kay Bee Bio-Organics

14.2.10 Lallemand Inc.

Details on Business Overview, Products Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices Made, Weaknesses, and Competitive Threats Might Not be Captured in the Case of Unlisted Companies.

15 Adjacent & Related Markets

15.1 Introduction

Table 233 Markets Adjacent to Biorational Pesticides Market

15.2 Limitations

15.3 Biopesticides Market

15.3.1 Market Definition

15.3.2 Market Overview

15.3.3 Biopesticides Market, by Source

Table 234 Biopesticides Market, by Source, 2019-2022 (USD Million)

Table 235 Biopesticides Market, by Source, 2023-2028 (USD Million)

15.4 Bioinsecticides Market

15.4.1 Market Definition

15.4.2 Market Overview

15.4.3 Bioinsecticides Market, by Crop Type

Table 236 Bioinsecticides Market, by Crop Type, 2018-2025 (USD Million)

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options