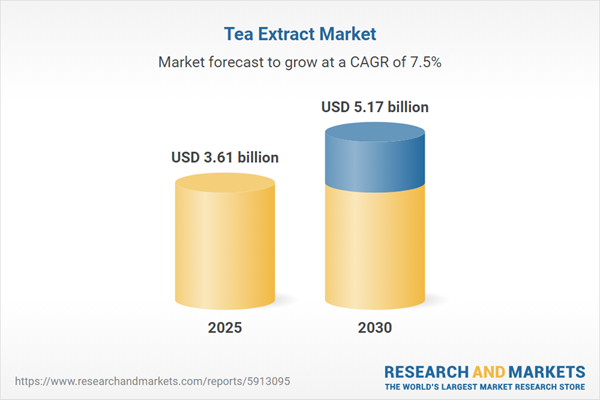

The tea extract market is poised for significant growth, driven by increasing demand for health-focused products, a rising working population, and expanding retail marketplaces. Lifestyle shifts and growing interest from the personal care sector further fuel this expansion. The market is propelled by the use of tea extracts in dietary supplements, personal care products, and functional ingredients, with key regions like the United States showing robust growth potential.

Growth Drivers

Tea extracts are widely utilized in dietary supplements due to their health benefits, including blood sugar and pressure regulation, weight management, and exercise recovery. The global rise in healthcare costs and a focus on preventative medicine have boosted the popularity of nutritional supplements. Consumers increasing health awareness drives demand for tea extracts, particularly green tea, which contains caffeine (approximately 45 mg per cup) and catechins (240-320 mg per cup), notably epigallocatechin gallate (EGCG). These compounds are linked to weight loss, antioxidant protection, and anti-aging benefits, making tea extracts a preferred choice for health-conscious consumers.Key Players and Innovations

Major manufacturers are innovating within the dietary supplement space to meet growing consumer demand. For example, INLIFE's 500 mg green tea extract, rich in EGCG, supports immune health and prevents cell damage. Similarly, Zenwise's Green Tea Extract (725 mg) combined with Vitamin C (60 mg) promotes weight loss, cholesterol balance, and cardiovascular and cognitive health. These products highlight the industry's focus on leveraging tea extracts antioxidant properties to enhance immune function and overall wellness, catering to both men and women seeking healthier lifestyles.Geographical Outlook

The United States is expected to lead growth in the North American tea extract market, driven by the increasing use of tea as a natural, functional ingredient rich in polyphenols and antioxidants. Rising consumer focus on health and wellness further accelerates market expansion. According to the Tea Association USA, over 159 million Americans consume tea daily, with annual consumption reaching approximately 3.9 billion gallons. This high consumption rate underscores the market's potential for tea extract products, particularly in health and wellness applications.Personal Care and Other Applications

Tea extracts are gaining traction in the personal care industry due to their ability to absorb ultraviolet radiation, offering skin protection. This property has increased demand for tea extracts in cosmetics and skincare products. Additionally, the water-soluble extract percentages for green tea (32%), black tea (32%), and Kangra tea (23%) highlight their versatility for various applications, further driving market growth.Government Initiatives

Regulatory developments are supporting market expansion. For instance, Health Canada's Food Directorate has evaluated the safety of green tea extract (EGCG/catechins) for use in supplementary foods, indicating potential regulatory approval to expand its application. Such initiatives enhance consumer confidence and market opportunities for tea extract products.In summary, the tea extract market is experiencing robust growth driven by health-conscious consumer trends, innovative dietary supplements, and expanding applications in personal care. The United States stands out as a key growth region, supported by high tea consumption and a focus on wellness.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Segmentation:

By Tea Type

- Green Tea

- White Tea

- Oolong Tea

- Black Tea

- Pu erh Tea

By Water Solubility

- Hot Water-Soluble Extract

- Cold Water-Soluble Extract

By Form

- Liquid

- Powder

By Application

- Food

- Beverage

- Cosmetics

- Pharmaceuticals

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Kemin Industries, Inc.

- Givaudan

- Synthite Industries Ltd.

- Martin Bauer Group (Martin Bauer GmbH & Co. KG)

- Synergy Flavors (Carbery Group)

- Cymbio Pharma Private Limited (Karle Group)

- Phyto Life Sciences P. Ltd.

- AVT Natural Products Ltd (AV Thomas Group)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.61 billion |

| Forecasted Market Value ( USD | $ 5.17 billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |