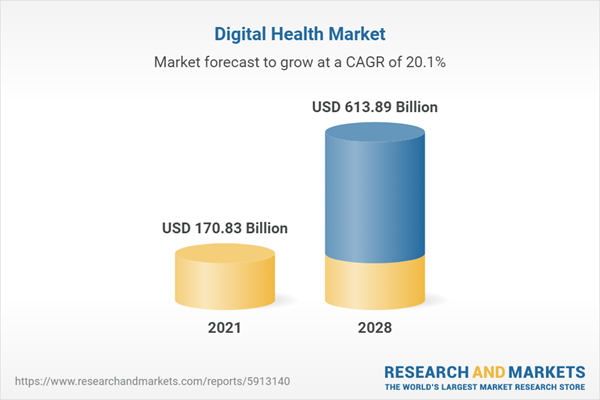

The digital health market is expected to grow at a CAGR of 20.05% from US$170.833 billion in 2021 to US$613.889 billion in 2028.

"Digital Health Technologies" refers to the use of digital tools, platforms, and devices in the healthcare industry to improve patient outcomes, increase efficiency, and enhance the provision of healthcare services. Wearable technology, healthcare analytics, telehealth services, mobile health (mHealth) apps, and other digital health devices are only a few examples of the extensive variety of items covered by these technologies. The goals of digital health technology are to increase patient involvement, simplify medical processes, and enhance patient-provider communication. They also make it possible to provide individualized treatment plans, monitor patient health, access real-time patient data, and conduct remote consultations.Growth Drivers

Some of the key factors driving the digital health market growth include rising smartphone adoption, better internet connectivity brought about by the rollout of 4G/5G, advancements in healthcare IT infrastructure, the growing need to control healthcare costs, an increase in the prevalence of chronic diseases, and increased accessibility to virtual care. Key players also concentrate on providing cutting-edge applications to enhance user experience. For instance, Teladoc Health and Microsoft worked together in July 2021 to connect their Solo platform with the Microsoft Teams environment, enhancing clinician and patient access throughout the virtual healthcare ecosystem.Shortage of trained medical professionals

There is a dearth of skilled medical personnel in several established and developing economies. By 2030, there will be a shortfall of roughly 15 million healthcare professionals, according to WHO projections. Due to an ageing population and the frequency of chronic illnesses, there is an increase in the demand for healthcare workers in many areas. Over 703 million people in the world were 65 or older in 2019, and the United Nations projects that figure will increase to 1.5 billion by the year 2050. It improves patient and doctor time management, expands access to healthcare, and lowers healthcare expenditures.Healthcare Policies and Regulatory Landscape

The Medical Council of India and NITI Aayog collaborated to develop telemedicine practice standards, which have helped to regulate the field in India and guarantee the high quality and security of telemedicine services. The National Medical Commission (NMC), the Central Drugs Standard Control Organisation (CDSCO), and the Ministry of Health and Family Welfare (MHFW) all implement laws that control the healthcare industry. This is a major growth factor for the digital health industry. Additionally, the government-funded health insurance program "Ayushman Bharat" intends to offer health coverage to more than 100 million families in India.Rising Prevalence Of Chronic Diseases

The rise in the prevalence of chronic diseases including diabetes, cardiovascular disease, and cancer is driving the demand for remote monitoring and management solutions, which may be delivered through telehealth services and digital health technologies. Wearables and remote monitoring technologies, for instance, may track vital signs and other health parameters in real-time and alert medical personnel to possible problems before they get worse. Therefore, digital health technologies can improve patient outcomes, save healthcare costs, and alleviate some of the issues brought on by chronic illnesses.The rapid adoption of the Internet and smart devices

Hacking and wiretapping of private information via linked and smart devices have increased significantly. Governments from different nations, healthcare organizations, and experts are reluctant to implement digital health solutions on a broad and national scale due to data security issues regarding healthcare information. For instance, the Data Protection Report, 2021 numbers show that in 2020, there was an increase of roughly 73% in healthcare cybercrimes and data breaches, which exposed 12 billion units of healthcare information. Furthermore, laws governing digital health are hazy and differ between nations and regions.Furthermore, the need for telehealth services is increasing as a result of the need to effectively track health and fitness, securely store medical data, and manage populations in real-time. The digital health market of services is being aided by the upgrading of telehealth hardware and software components. A second factor in the digital health market growth is the expanding trend of software upgrades that include several healthcare applications. One major driver of the market's growth is the creation of a variety of platforms for illness monitoring, diagnosis, wellness, and prevention.

North America is anticipated to witness a notable CAGR in thedigital health market

One of the first regions to adopt smart healthcare solutions is North America. This includes a range of technologies including smartphone applications, smart wearables, and telemedicine & eHealth services for remote access to information on critical & chronic medical illnesses. Throughout the projection period, the digital health market is anticipated to rise as a result of patient adoption of home care, growing demand for mobile technology, and a decline in hospital visits. With the rise of telemedicine apps that assist the populace in taking an active role in managing their health, particularly during the COVID-19 epidemic, healthcare in North America is witnessing favorable changes. Mobile technology and smartphones make it feasible to employ clinical and lifestyle applications to promote and encourage the adoption of healthy behaviors.Key manufacturers are focusing on product innovation

Product launches are further expected to aid the digital health industry. For instance, GoMeyra, a cutting-edge cloud software provider that enables medical laboratories to handle samples more quickly and precisely, released the free mobile app GoMeyra pass in May 2021 for sharing COVID-19 vaccine verification or PCR and rapid antigen test results. The GoMeyra lab information management system (LIMS), one of the quickest LIMS on the market, combines with GoMeyra Pass and enables its countrywide network of authorized laboratories to deliver COVID-19 test results within 24 hours.Market Developments

- In November 2022, Teva Pharmaceuticals and HealthSnap collaborated to assist the former firm in increasing consumer access to their respiratory digital health platform.

- In April 2022, in anticipation of a better digital user experience, the National Health Authority (NHA) revised the Ayushman Bharat Health Accounts smartphone application.

Segmentation:

By Technology

- Tele-healthcare

- mHealth

- Healthcare Analytics

- Digital Health Systems

By Component

- Software

- Hardware

- Services

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Cerner Corporation

- Veradigm LLC

- Apple Inc

- Telefonica S.A.

- McKesson Corporation

- Epic Systems Corporation

- AT&T

- Vodafone Group

- Airstrip Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | November 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 170.83 Billion |

| Forecasted Market Value ( USD | $ 613.89 Billion |

| Compound Annual Growth Rate | 20.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |