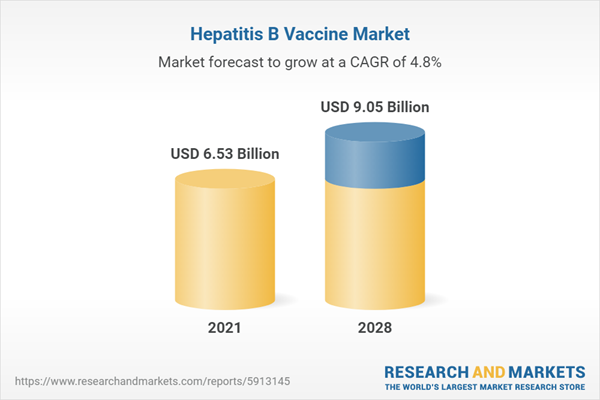

The Hepatitis B vaccine market is expected to grow at a CAGR of 4.77% from US$6.531 billion in 2021 to US$9.051 billion in 2028.

The Hepatitis B vaccine market is anticipated to rise at a steady pace during the projected period. The Hepatitis B vaccine is a preventative vaccination that offers immunity against the hepatitis B virus (HBV). It is intended to elicit the immune system's production of antibodies that are specific for the hepatitis B surface antigen (HBsAg), a protein that is present on the virus's surface. The vaccine can be given as a single antigen vaccination or as a component of combination vaccines that offer protection from several illnesses. It is commonly delivered intramuscularly. Infants, kids, teenagers, and adults who are susceptible to HBV infection should take it. In many nations, it is also a standard component of immunisation programmes.Growth drivers for the hepatitis B vaccine market

Growing government programmes, legislation, and awareness campaigns have contributed significantly to the promotion of the hepatitis B vaccine. The significance of avoiding hepatitis B infection and the related health consequences has been greatly underscored by the rise of hepatitis 8 infections and fatalities. Mandatory hepatitis B vaccination for newborns, children, and high-risk groups is one of the many initiatives that various governments have put into place to enhance vaccine coverage. The market share is anticipated to increase by including the vaccine in regular immunisation plans and funding immunisation campaigns. These drivers will upsurge the hepatitis B vaccine market.FDA-approved hepatitis B vaccines

Two HepA vaccines (both 2-dose vaccinations), three HepB vaccines (two 3-dose vaccines and a newer, 2-dose vaccine), and a HepA/HepB combination vaccine (3-dose) are among the hepatitis vaccines that have received FDA approval. Unfortunately, despite initiatives by several healthcare organisations to lower new hepatitis infections and raise vaccine coverage among people at high risk, adult hepatitis immunisation rates have persistently remained low in the US. All hepatitis vaccinations are multi-dose, therefore poor adherence to advised dosage regimens also reduces their efficacy, especially for underserved and difficult-to-reach groups. According to 2018 National Health Interview Survey (NHIS) statistics, just 11.9% and 30.0% of persons aged 19 had finished their HepA or HepB vaccination series, respectively.Rising government initiatives

Government initiatives to spread awareness about hepatitis and its treatment are extremely common and capable of deadly liver cirrhosis, hepatitis B is contagious. In addition, it is projected that government measures to increase public awareness of hepatitis and its treatment would promote hepatitis B vaccine market growth throughout the projection period. For instance, the "World Hepatitis Summit (WHS)" took held online in June 2022. The World Hepatitis Summit 2022 2021 is sponsored by the World Health Organisation (WHO) World Hepatitis Alliance. The summit provides a forum for the vast hepatitis community to analyse current progress and share ideas, personal experiences, and best practices for tackling the numerous challenges brought on by viral hepatitis.Increased in new drug permits

Rising new medicine approvals for hepatitis B and rising new drug releases. The worldwide hepatitis B vaccine market for hepatitis B is anticipated to increase as more regulatory bodies approve hepatitis B medications throughout the forecast period. For instance, the U.S. Food and Drug Administration (FDA) approved the supplemental new drug application (SNDA) for Vemlidy (tenofovir alafenamide) 25 mg tablets in November 2022 as a once-daily treatment for paediatric patients 12 years of age and older with compensated liver disease who have chronic hepatitis B virus (HBV) infection.Utilization of inactive medicines

During the forecast period, the inactivated hepatitis B vaccine market is anticipated to rule the market. Inactivated vaccines led the market globally, and a significant increase is anticipated soon. Vaccines that have been inactivated are very effective and safe. Traditionally, a two-dose regimen is advised, especially for travellers who are at high risk of getting hepatitis A and for people with impaired immune systems. However, stable individuals have had equal effectiveness with a single dose. It is anticipated that this will promote hepatitis B vaccine market growth.North America is anticipated to dominate the hepatitis B vaccine market

The North American hepatitis B vaccine market had a value of $2.6 billion, and during the following five years, it is anticipated to continue to be the largest hepatitis B vaccine market worldwide. National health agencies have taken action to prevent, screen for, and reduce the number of deaths brought on by hepatitis B as it becomes more prevalent. This has had the strongest impact on North America, which has the largest hepatitis B vaccine market share globally.For instance, in June 2021, Sanofi Pasteur and Merck & Co., Inc. plan to introduce Vaxelis in the US. It was the first hexavalent combination vaccination to safeguard kids and infants against illnesses including polio, hepatitis B, diphtheria, tetanus, and tetanus.

Asia Pacific is predicted to hold a significant market share

Hepatitis B is becoming increasingly common, and due to this, the Asia-Pacific hepatitis B vaccine market share is expanding. A new hepatitis B vaccine is being developed concurrently by the vaccine's manufacturers, and it is anticipated that it will enable the area to have the largest hepatitis B vaccine market growth over the ensuing years. To learn more about hepatitis B and develop a new vaccine, for instance, the Japanese pharmaceutical company Shionogi & Co., Ltd. collaborated with NEC Corporation in April 2022. Finding a treatment for hepatitis B and providing for all of its medical requirements are the objectives of the cooperation.Key manufacturers are focusing on product innovation

To spur hepatitis B vaccine market growth, major companies employ a range of tactics, such as alliances, mergers, and acquisitions. The HBV vaccine industry is currently testing a variety of strong antiviral medicines with high viral suppression and tolerance rates. Clinical trials for HBV medications have grown in number, and substantial research is being done on anti-HBV immune responses, which will affect how the pathways develop. The report on the HBV market looks more closely at how regulatory suggestions have affected current research orientations and the pace of vaccine development in emerging markets.Market Key Developments

- In November 2022, The supplemental new drug application (SNDA) for Vemlidy (tenofovir alafenamide) 25 mg tablets, a once-daily treatment for chronic hepatitis B virus (HBV) infection in paediatric patients 12 years of age and older with compensated liver disease, has been approved by the U.S. Food and Drug Administration (FDA).

- In April 2022, Veklury (remdesivir) for paediatric children treatment older than 28 days, weighing 3 kg, has reportedly gained FDA clearance for its new drug application (SNDA), according to Gilead Sciences, Inc.

- In April 2022, Modern treatments for the control of chronic hepatitis B virus have been developed by an international biopharmaceutical company called Antios Therapeutics, Inc.

Segmentation:

By Type

- Combination Vaccines

- Single Antigen Hepatitis B Vaccines

By End-User

- Hospitals

- Clinics

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Novartis AG

- CSL Ltd

- Dyanax Technologies

- Beijing Minhai Biotechnology

- Emergent Biosolutions

- GlaxoSmithKline Biologics

- Merck & Co. Inc.

- Pfizer Inc.

- Sanofi Pasteur

- Serum Institute of India

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | November 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 6.53 Billion |

| Forecasted Market Value ( USD | $ 9.05 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |