The global alopecia treatment market is experiencing significant growth, driven by the increasing prevalence of alopecia, particularly alopecia areata, an autoimmune disorder causing excessive hair loss. Factors such as unhealthy diets, sedentary lifestyles, hormonal changes, and rising stress levels among younger populations, including millennials, are contributing to the growing incidence of hair loss. The market is further propelled by heightened consumer awareness of physical well-being and aesthetic beauty, which is increasing demand for effective, minimally invasive treatments. Support from institutions like the National Alopecia Areata Foundation (NAAF) in the United States, which promotes research and public awareness, also bolsters market growth. However, challenges such as the high cost of treatments and limited accessibility in developing regions may pose constraints to market expansion.

Market Drivers

Rising Prevalence of Alopecia

The growing incidence of alopecia, particularly among younger demographics, is a primary driver of the market. Stress, hormonal imbalances, and lifestyle factors are exacerbating hair loss, prompting demand for well-designed treatments. The focus on early intervention to stimulate hair follicle growth is driving the development of innovative therapies, as early-stage treatment can significantly reduce symptoms and promote hair regrowth, fueling market growth.Improved Investment in Drug Development

Significant investments in research and development, coupled with regulatory approvals for new drugs, are providing a strong impetus for market growth. Pharmaceutical companies are prioritizing the development of novel treatments for alopecia, particularly for severe cases, to meet rising consumer demand. These efforts are supported by robust clinical trials and strategic acquisitions aimed at enhancing treatment portfolios, driving market expansion.Institutional Support

Non-profit organizations like the NAAF play a crucial role in advancing the alopecia treatment market by funding research, raising awareness, and supporting affected communities. These initiatives encourage the development and approval of modern medicines, while public education efforts increase demand for treatments with minimal side effects, further propelling market growth.Geographical Outlook

North America

North America, led by the United States, is expected to dominate the alopecia treatment market due to the high prevalence of hair loss and the presence of well-established pharmaceutical companies. The region benefits from significant healthcare spending on alopecia treatments and a growing demand for painless, effective solutions. Changing lifestyles, particularly among millennials and working-class women, coupled with rising stress levels, are driving hair loss rates, further increasing the need for innovative hair care products and treatments. The strong focus on research and development, supported by organizations like the NAAF, enhances market growth in the region.Key Developments

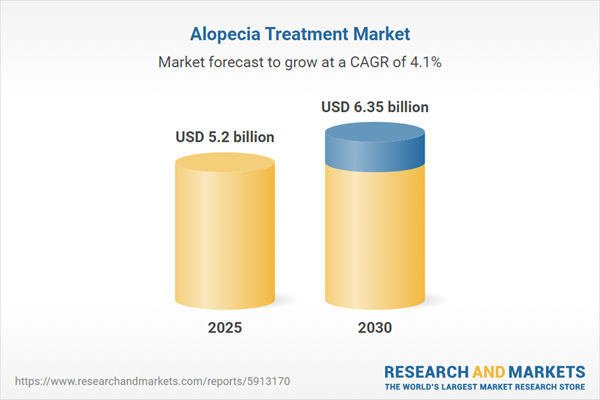

In March 2023, Sun Pharma acquired Concert Pharmaceuticals to advance the development of treatments for alopecia areata. This strategic acquisition aims to strengthen Sun Pharma’s portfolio by promoting drugs tailored to address the needs of individuals with this condition, reflecting the industry’s commitment to innovation and market expansion.The alopecia treatment market is poised for considerable growth, driven by the rising prevalence of alopecia, increased investments in drug development, and strong institutional support. North America, particularly the U.S., leads the market due to high hair loss rates, robust healthcare spending, and active research initiatives. Strategic moves like Sun Pharma’s 2023 acquisition of Concert Pharmaceuticals highlight the industry’s focus on innovation. Despite challenges such as treatment costs, the market’s alignment with consumer demand for aesthetic and health-focused solutions positions it for sustained expansion, offering opportunities for pharmaceutical companies to develop advanced therapies.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Segmentation:

By Condition Type

- Alopecia Areata

- Alopecia Totalis

- Alopecia Universalis

- Androgenetic Alopecia

- Ciactricial Alopecia

- Others

By Medication Type

- Oral

- Topical

- Injectable

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Eli Lilly and Company

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Cipla

- HCell Inc.

- Daiichi Sankyo Inc.

- Johnson & Johnson

- GlaxoSmithKline plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 5.2 billion |

| Forecasted Market Value ( USD | $ 6.35 billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |