The U.S. government significantly contributed to the rise in demand for electric UTV and ATV powertrains, fostering a paradigm shift toward sustainable and environment-friendly transportation solutions. The government’s Advanced Technology Vehicles Manufacturing Loan Program grants loans to support the produce of a wide range of technologically advanced vehicles such as locomotives, light/medium/heavy-duty vehicles, aircraft, hyperloop, and maritime vessels, with offshore wind vessels. The manufacturing of electric and alternative fuel vehicle charging infrastructure, which also includes software and hardware for alternative fuel vehicles such as hydrogen, LNG, biofuel, and electricity, is also included under this program. Through this program, the government is expected to motivate manufacturers to develop effective technologically advanced and sustainable solutions within the transportation sector which is expected to foster the growth of the market.

Moreover, rising awareness of carbon emissions’ impact on the environment is motivating consumers to prefer electric ATVs and UTVs over conventional vehicles. Besides, the rapid adoption of utility carts and shuttle carts for local commutes, coupled with material battery handling vehicles for industrial applications in the U.S. is expected to propel the growth of the market. With the constantly evolving demand for electric vehicle technological advancements, key players are aiming to enhance their competitive edge. For instance, in July 2023, BorgWarner, Inc. collaborated with onsemi, a power & sensing technology provider, to integrate its 750 V and EliteSiC 1200 V power devices into its VIPER power modules. The collaboration is expected to help BorgWarner, Inc. improve the performance of its electric drivetrain and enrich its brand value.

U.S. Electric UTV and ATV Powertrain Market Report Highlights

- Based on vehicle type, the All-terrain Vehicle (ATV) segment is anticipated to register the highest CAGR over the forecast period. The growth is attributed to the growing emphasis on environmental sustainability and the need for cleaner transportation solutions

- Based on powertrain type, the more than 3 in 1 segment is anticipated to register the highest CAGR from 2023 to 2030. This can be attributed to the technology that enables enhanced performance, combining the functionalities of multiple power sources, such as electric motors and internal combustion engines, to provide increased power and torque for off-road use

- Key companies are engaging in several growth strategies, including mergers & acquisitions, partnerships, and geographical/product expansion, etc. to maintain their dominance in the market. In March 2023, DANA Limited launched a new drivetrain portfolio for vehicle electrification

Table of Contents

Companies Profiled

- American Axle & Manufacturing, Inc.

- BorgWarner Inc.

- Curtis Instruments, Inc.

- DANA Limited

- GKN Automotive Limited

- HyperCraft

- NIDEC CORPORATION

- Robert Bosch GmbH

- Tesla

- Yamaha Motor Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | November 2023 |

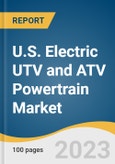

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.46 Billion |

| Forecasted Market Value ( USD | $ 5.18 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |