Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

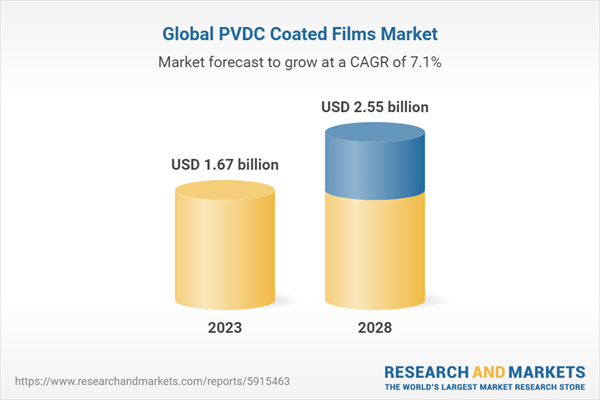

The global PVDC Coated Films market has witnessed substantial growth in recent years, fueled by its widespread adoption across various industries. Critical sectors such as food, pharmaceuticals, consumer goods and agriculture have come to recognize PVDC coated films as vital tools for protecting products from moisture, oxygen, grease and other contaminants.

Stricter food safety and quality regulations have compelled packaging manufacturers to make significant investments in advanced barrier film technologies. Leading PVDC coated films suppliers have launched innovative offerings boasting capabilities like high barrier properties, printability, flexibility and compatibility with automated packaging lines. These improvements have significantly enhanced product protection and shelf-life.

Furthermore, the integration of nanotechnology and biopolymer coatings is transforming PVDC coated film capabilities. Advanced solutions now provide ultra-high moisture and gas barriers, biodegradability, and generate insights into supply chain and logistics optimization. This allows businesses to better monitor product freshness, extract more value from inventories and accelerate new product development cycles.

Companies are actively partnering with PVDC coated film specialists to develop customized solutions catering to their specific packaging needs. Additionally, growing emphasis on sustainability and consumer health is opening new opportunities across food, pharma and consumer goods industries.s

The PVDC Coated Films market is poised for sustained growth as investments in digital agriculture, global food trade, pharmaceutical manufacturing and consumer packaging continue. Investments in new capabilities are expected to persist globally. The market's ability to support high-quality, safe and sustainable product protection will be instrumental to its long-term prospects.Key Market Drivers

Increasing Demand for High-Barrier Packaging Solutions

One of the key drivers for the PVDC Coated Films market is the increasing demand for high-barrier packaging solutions. As industries such as food and beverage, pharmaceuticals, and personal care continue to grow, there is a growing need to protect products from moisture, oxygen, and other contaminants. PVDC coated films offer excellent barrier properties, providing an effective solution for extending the shelf life and maintaining the quality of packaged goods. The rise in consumer awareness regarding product safety and quality has further fueled the demand for PVDC coated films, as they provide enhanced protection against external factors that can compromise the integrity of the packaged products.Growing Emphasis on Sustainability and Environmental Concerns

Another driver for the PVDC Coated Films market is the growing emphasis on sustainability and environmental concerns. With increasing awareness about the impact of plastic waste on the environment, there is a shift towards more sustainable packaging solutions. PVDC coated films offer advantages in terms of recyclability and reduced material usage compared to traditional packaging materials. They can be easily incorporated into recycling streams, reducing the environmental footprint. Additionally, PVDC coated films help in reducing food waste by extending the shelf life of perishable products, contributing to a more sustainable supply chain. The demand for PVDC coated films is expected to be driven by the growing preference for eco-friendly packaging solutions and the implementation of stringent regulations promoting sustainable practices.Technological Advancements and Product Innovations

Technological advancements and product innovations are also significant drivers for the PVDC Coated Films market. Manufacturers are continuously investing in research and development to enhance the performance and functionality of PVDC coated films. This includes improvements in barrier properties, adhesion, printability, and compatibility with various packaging formats and production processes. The development of advanced coating techniques and formulations has led to the production of PVDC coated films with superior barrier properties, enabling them to meet the evolving needs of different industries. Furthermore, the integration of PVDC coated films with smart packaging technologies, such as temperature indicators and freshness sensors, is opening up new opportunities for applications in the food and pharmaceutical sectors. These technological advancements and product innovations are driving the adoption of PVDC coated films and expanding their market potential.In conclusion, the PVDC Coated Films market is driven by the increasing demand for high-barrier packaging solutions, growing emphasis on sustainability and environmental concerns, and technological advancements and product innovations. These drivers are expected to continue shaping the market, driving further growth and adoption of PVDC coated films across various industries....

Key Market Challenges

Cost and Availability of Raw Materials

One of the significant challenges faced by the PVDC Coated Films market is the cost and availability of raw materials. PVDC, as a key component in the coating process, is derived from petroleum-based sources. Fluctuations in crude oil prices can significantly impact the cost of PVDC, making it a volatile input cost for manufacturers. Additionally, the availability of PVDC can be affected by supply chain disruptions, geopolitical factors, and changes in trade policies. Limited availability and increased costs of raw materials can pose challenges for manufacturers in terms of maintaining competitive pricing and ensuring a stable supply of PVDC coated films. To mitigate these challenges, manufacturers are exploring alternative raw materials and investing in research and development to develop cost-effective and sustainable coating solutions.Environmental Concerns and Regulatory Compliance

Another significant challenge for the PVDC Coated Films market is environmental concerns and regulatory compliance. While PVDC coated films offer excellent barrier properties and product protection, there are growing concerns about their environmental impact. PVDC is not readily biodegradable, and improper disposal of PVDC coated films can contribute to plastic waste and environmental pollution. As a result, there is increasing pressure from consumers, regulatory bodies, and environmental organizations to adopt more sustainable packaging solutions. Manufacturers in the PVDC Coated Films market are facing the challenge of balancing the need for high-performance packaging with environmental sustainability. They are investing in research and development to develop recyclable or biodegradable alternatives to PVDC coated films. Additionally, compliance with evolving regulations and standards related to packaging materials and waste management poses challenges for manufacturers, requiring them to stay updated with the latest requirements and invest in sustainable practices throughout the product lifecycle.In conclusion, the PVDC Coated Films market faces challenges related to the cost and availability of raw materials, as well as environmental concerns and regulatory compliance. Overcoming these challenges will require innovation, collaboration, and a proactive approach from manufacturers to develop cost-effective and sustainable coating solutions, while also ensuring compliance with evolving environmental regulations. By addressing these challenges, the PVDC Coated Films market can continue to grow and meet the increasing demand for high-barrier packaging solutions in a sustainable and responsible manner...

Key Market Trends

Growing Demand for Sustainable Packaging Solutions

One of the prominent trends in the PVDC Coated Films market is the growing demand for sustainable packaging solutions. With increasing environmental awareness and concerns about plastic waste, consumers and regulatory bodies are pushing for more sustainable packaging options. This trend is driving the adoption of PVDC coated films that offer recyclability, biodegradability, and reduced environmental impact. Manufacturers are investing in research and development to develop eco-friendly alternatives to traditional PVDC coatings, such as water-based or bio-based coatings. Additionally, there is a focus on optimizing packaging designs to reduce material usage and improve recyclability. The trend towards sustainable packaging aligns with the broader sustainability goals of businesses and the increasing preference of consumers for environmentally friendly products.Technological Advancements in Barrier Coating Technologies

Another significant trend in the PVDC Coated Films market is the continuous technological advancements in barrier coating technologies. Manufacturers are investing in research and development to enhance the barrier properties of PVDC coated films, making them more effective in protecting products from moisture, oxygen, and other contaminants. Advanced coating techniques, such as plasma-enhanced chemical vapor deposition (PECVD) and atomic layer deposition (ALD), are being employed to create ultra-thin and uniform barrier layers on films. These advancements result in improved barrier performance, reduced material usage, and enhanced product shelf life. Furthermore, the integration of nanotechnology in PVDC coatings is enabling the development of films with superior barrier properties, such as enhanced gas barrier performance and resistance to oil and grease. Technological advancements in barrier coating technologies are driving the adoption of PVDC coated films in various industries, including food and beverage, pharmaceuticals, and electronics.Increasing Application Scope in Diverse Industries

The PVDC Coated Films market is experiencing an increasing application scope in diverse industries. Traditionally, PVDC coated films have been widely used in the food and beverage industry for packaging perishable products, as they provide excellent moisture and oxygen barrier properties. However, the market is witnessing a growing adoption of PVDC coated films in other sectors as well. In the healthcare industry, PVDC coated films are used for packaging pharmaceutical products, medical devices, and diagnostic kits, ensuring their integrity and extending their shelf life. The electronics industry is also utilizing PVDC coated films for packaging sensitive electronic components, protecting them from moisture and static discharge. Additionally, PVDC coated films find applications in the agriculture sector for packaging seeds, fertilizers, and pesticides, safeguarding their quality and efficacy. The increasing application scope of PVDC coated films across diverse industries is driven by the need for high-performance packaging solutions that ensure product integrity, extend shelf life, and meet regulatory requirements.In conclusion, the PVDC Coated Films market is witnessing trends such as the growing demand for sustainable packaging solutions, technological advancements in barrier coating technologies, and an increasing application scope in diverse industries. These trends are shaping the market and driving the adoption of PVDC coated films as a preferred choice for high-barrier packaging. Manufacturers in the PVDC Coated Films market need to stay abreast of these trends and invest in research and development to meet the evolving needs of customers and capitalize on the opportunities presented by these trends.

Segmental Insights

By Film Type Insights

In 2022, the Bi-axially Oriented Polypropylene (BOPP) segment dominated the PVDC Coated Films Market and is expected to maintain its dominance during the forecast period. BOPP films are widely used in various industries due to their excellent mechanical properties, high clarity, and good barrier properties. These films are known for their versatility and are extensively used in packaging applications such as food and beverages, personal care products, and pharmaceuticals. The dominance of the BOPP segment can be attributed to its wide availability, cost-effectiveness, and compatibility with PVDC coatings. BOPP films provide a strong base for PVDC coatings, enhancing the barrier properties of the films and ensuring the preservation of product freshness and quality. Additionally, BOPP films offer excellent printability and heat-sealing properties, making them suitable for various packaging formats such as pouches, bags, and labels. The BOPP segment's dominance is further supported by the growing demand for flexible packaging solutions, driven by changing consumer preferences, convenience, and sustainability considerations. As the demand for high-quality, visually appealing, and sustainable packaging solutions continues to rise, the BOPP segment is expected to maintain its dominance in the PVDC Coated Films Market during the forecast period. Manufacturers in the PVDC Coated Films Market should focus on innovation, product development, and strategic partnerships to capitalize on the opportunities presented by the dominant BOPP segment and meet the evolving needs of customers in the packaging industry.By Coating Side Insights

In 2022, the double-side coated segment dominated the PVDC Coated Films Market and is expected to maintain its dominance during the forecast period. Double-side coated PVDC films offer enhanced barrier properties on both sides, providing superior protection against moisture, oxygen, and other contaminants. This makes them highly suitable for applications where maximum product protection is required, such as in the food and beverage, pharmaceutical, medical device, and industrial sectors. The double-side coating ensures that the packaged products remain fresh, extend their shelf life, and maintain their quality throughout the supply chain. Additionally, double-side coated PVDC films offer excellent printability and heat-sealing properties on both sides, allowing for attractive packaging designs and secure sealing of the packages. The dominance of the double-side coated segment is driven by the increasing demand for high-performance packaging solutions in various industries, where product integrity and consumer safety are of utmost importance.In terms of industry vertical, the food and beverage segment dominated the PVDC Coated Films Market in 2022 and is expected to maintain its dominance during the forecast period. The food and beverage industry is a major consumer of PVDC coated films due to the need for effective barrier protection against moisture, oxygen, and other external factors that can degrade the quality of food and beverage products. PVDC coated films provide an excellent barrier to preserve the freshness, flavor, and nutritional value of packaged food and beverages. They also help in extending the shelf life of perishable products, reducing food waste, and ensuring food safety. The growing demand for convenience foods, ready-to-eat meals, and packaged beverages is driving the adoption of PVDC coated films in the food and beverage industry. Additionally, stringent regulations regarding food safety and quality further contribute to the dominance of the food and beverage segment in the PVDC Coated Films Market. Manufacturers in this segment should focus on product innovation, customization, and sustainable packaging solutions to cater to the evolving needs of the food and beverage industry and maintain their dominance in the market..

Regional Insights

In 2022, North America dominated the PVDC Coated Films Market and is expected to maintain its dominance during the forecast period. North America has a well-established packaging industry and is known for its technological advancements and innovation in various sectors. The region's dominance in the PVDC Coated Films Market can be attributed to several factors. Firstly, the food and beverage industry in North America is one of the largest consumers of PVDC coated films, driven by the demand for high-quality packaging solutions that provide excellent barrier properties to protect perishable products. Additionally, the pharmaceutical and medical device industries in North America also contribute significantly to the demand for PVDC coated films, as these films are widely used for packaging drugs, medical equipment, and diagnostic kits, ensuring their integrity and extending their shelf life. Moreover, the region's emphasis on sustainability and environmental regulations has led to the adoption of PVDC coated films as a preferred choice for eco-friendly packaging solutions. The stringent regulations regarding food safety, quality, and sustainability have further propelled the demand for PVDC coated films in North America. The presence of major players in the packaging industry, along with their focus on research and development activities, has also contributed to the region's dominance. These companies are continuously investing in product innovation, customization, and strategic partnerships to meet the evolving needs of customers and maintain their market leadership. Overall, North America's strong industrial base, technological advancements, and focus on sustainability are expected to drive its continued dominance in the PVDC Coated Films Market during the forecast period.Report Scope:

In this report, the Global PVDC Coated Films Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:PVDC Coated Films Market, By Film Type:

- Bi-axially oriented polypropylene (BOPP)

- Polyethylene terephthalate (PET)

- Polyvinyl chloride (PVC)

- Others

PVDC Coated Films Market, By Coating Side:

- Single-side coated

- Double-side coated

PVDC Coated Films Market, By Industry Vertical:

- Food and beverage

- Pharmaceutical

- Medical device

- Industrial

- Others

PVDC Coated Films Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global PVDC Coated Films Market.Available Customizations:

Global PVDC Coated Films Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cosmo Films Ltd

- Innovia Films Ltd

- Treofan Group

- Jindal Poly Films Limited

- Perlen Packaging

- SRF Limited

- Klockner Pentaplast

- CCL Industries Inc

- Polinas.

- Vibac Group S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.67 billion |

| Forecasted Market Value ( USD | $ 2.55 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |