Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Expanding Applications in Diverse Industries

The Global Drone Data Services Market is witnessing remarkable expansion due to the integration of drones across diverse industries. Sectors such as agriculture, construction, environmental monitoring, and disaster management are leveraging drone technology for data collection and analysis. Drones equipped with advanced sensors provide real-time information crucial for decision-making. In agriculture, drones aid in precision farming, optimizing crop yield. In construction, they enable accurate surveying and mapping. Environmental monitoring benefits from drones' ability to access remote or hazardous areas, ensuring efficient data collection. Additionally, in disaster management, drones facilitate rapid aerial assessments, aiding in disaster response planning. This widespread adoption across industries signifies the transformative impact of drones on operational efficiency, cost-effectiveness, and data accuracy.Technological Advancements and Data Processing Capabilities

Technological innovations in drones and data processing techniques are driving the market's growth. Drones are now equipped with high-resolution cameras, LiDAR systems, and multispectral sensors, capturing detailed images and data. Moreover, advancements in artificial intelligence and machine learning enable sophisticated data analysis. Algorithms process vast datasets, extracting valuable insights. These capabilities empower businesses and organizations to make informed decisions, enhancing operational efficiency and resource allocation. The integration of AI-driven analytics amplifies the utility of drone data, making it a pivotal tool for industries requiring precise geospatial information and 3D mapping.Regulatory Support and Compliance

The global drone data services market is being driven by regulatory support and compliance requirements. As the use of drones continues to expand across various industries, governments and regulatory bodies have implemented guidelines and regulations to ensure safe and responsible drone operations. These regulations often require drone operators to collect and manage data in a compliant manner, which has created a demand for specialized drone data services. These services provide solutions for data acquisition, processing, analysis, and storage, ensuring that drone operators can meet regulatory requirements and maintain data integrity. Additionally, regulatory support in the form of licensing and certification programs for drone operators has further boosted the market growth. By obtaining the necessary licenses and certifications, drone operators can demonstrate their compliance with regulations and gain the trust of clients and stakeholders. Moreover, regulatory support also includes the establishment of no-fly zones and airspace restrictions, which necessitate the use of drone data services to ensure compliance with these restrictions. The increasing focus on data privacy and security regulations has also contributed to the growth of the drone data services market. Drone operators are required to handle sensitive data, such as aerial imagery and geospatial information, which must be protected from unauthorized access and misuse. Drone data services offer secure data storage, encryption, and data management solutions to ensure compliance with data protection regulations. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning in drone data services enables efficient data processing, analysis, and actionable insights, further driving market growth. Overall, regulatory support and compliance requirements are playing a crucial role in shaping the global drone data services market, as they drive the demand for specialized services that enable drone operators to operate safely, responsibly, and in accordance with regulatory guidelines.Environmental and Sustainability Concerns

The global drone data services market is being driven by increasing environmental and sustainability concerns. Drones offer a more environmentally friendly alternative to traditional data collection methods, reducing the carbon footprint associated with manned aircraft or ground-based surveys. By utilizing drones for data collection, businesses can minimize the need for physical infrastructure and reduce the impact on natural habitats. This is particularly relevant in industries such as environmental monitoring, forestry, and agriculture, where the preservation of ecosystems and sustainable practices are of utmost importance. Drones enable precise and targeted data collection, allowing for better resource management, early detection of environmental changes, and more efficient decision-making processes. Additionally, the use of drones in industries such as renewable energy and infrastructure inspection supports sustainability efforts by facilitating the monitoring and maintenance of clean energy installations and reducing the need for manual inspections that may require disruptive and environmentally harmful methods.The adoption of drone data services aligns with the growing global focus on sustainability and environmental responsibility, as businesses strive to minimize their ecological impact and contribute to a greener future. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning in drone data services enables more accurate data analysis and predictive modeling, aiding in the identification of potential environmental risks and the development of proactive mitigation strategies. As environmental and sustainability concerns continue to gain prominence, the demand for drone data services is expected to grow, driven by the need for efficient and eco-friendly data collection and analysis solutions. Companies operating in the drone data services market are investing in research and development to enhance the capabilities of drones, including longer flight times, improved sensors, and advanced data processing algorithms, to meet the evolving needs of environmentally conscious industries. Overall, the environmental and sustainability benefits offered by drone data services are propelling the market's growth, enabling businesses to make informed decisions, monitor and protect ecosystems, and contribute to a more sustainable future.

Key Market Challenges

Compatibility and Interoperability Issues

The Global Drone Data Services Market faces substantial challenges arising from compatibility and interoperability issues. Drones come in various models and configurations, each utilizing different data formats and communication protocols. This diversity results in complications when integrating data from different drones or utilizing various software applications. Incompatibility issues hinder seamless data sharing and analysis, requiring stakeholders to invest additional resources in developing solutions to bridge these technological gaps. This fragmentation within the drone data services industry often leads to confusion and inefficiencies, impacting the smooth flow of data-driven insights across sectors.Counterfeit and Substandard Solutions

The market is inundated with counterfeit and substandard drone data services, posing significant risks to users and data integrity. Inferior data processing software, inaccurate sensors, or compromised communication systems in counterfeit solutions can lead to erroneous data analysis. Moreover, compromised cybersecurity features in substandard services pose threats to sensitive data, risking data breaches and unauthorized access. Addressing this challenge necessitates stringent quality control measures and public awareness campaigns, empowering users to identify genuine and secure drone data services to safeguard their operations and data integrity.Environmental Concerns and Sustainability

The widespread adoption of drones in various industries raises concerns about environmental impact and sustainability. Drones, particularly those powered by traditional fuels, contribute to carbon emissions and environmental pollution. Additionally, the disposal of drones and related electronic components after their operational life poses challenges. The accumulation of electronic waste from obsolete drones poses environmental hazards. To mitigate these issues, the industry must focus on developing eco-friendly drone technologies, including electric and solar-powered drones. Additionally, implementing efficient recycling and disposal programs can minimize the environmental footprint, ensuring responsible end-of-life management for drones and related equipment.Standardization and Regulatory Compliance

The absence of standardized protocols and regulations within the drone data services industry presents substantial challenges. Drones operate in airspace shared with other manned and unmanned vehicles, necessitating standardized communication protocols and airspace regulations to ensure safe operations. The lack of global standards hampers industry growth and innovation, leading to fragmented efforts in different regions. Adhering to evolving regulations related to data privacy, security, and airspace usage requires continuous adaptation. Failure to comply with these regulations can result in legal consequences and reputational damage, necessitating rigorous testing, adherence to international standards, and ongoing regulatory awareness.Key Market Trends

Rapid Integration of Drone Technology

The global drone data services market is experiencing a rapid surge driven by the seamless integration of drones in various sectors. Drones have transcended their traditional roles and are now vital tools for industries such as agriculture, construction, environmental monitoring, and emergency response. Their ability to capture high-resolution images, perform aerial surveys, and collect real-time data has revolutionized data analytics and decision-making processes. The increasing reliance on drone technology reflects a paradigm shift, where businesses and organizations leverage drone data services to enhance operational efficiency, reduce costs, and gain competitive advantages.Advancements in Data Analytics and AI Integration

One of the pivotal trends shaping the global drone data services market is the integration of advanced data analytics and artificial intelligence (AI) algorithms. Drones generate vast amounts of data, including images, videos, and sensor readings. The application of sophisticated data analytics tools and AI algorithms enables businesses to derive actionable insights from this data. Machine learning algorithms process data in real-time, identifying patterns, trends, and anomalies. This analytical prowess empowers industries to make informed decisions promptly. From precision agriculture optimizing crop yields to infrastructure monitoring ensuring structural integrity, the amalgamation of drone technology and advanced analytics has ushered in a new era of data-driven decision-making.Surge in Demand for Real-Time Data

Real-time data acquisition has become a critical trend in the global drone data services market. Businesses and industries require instant access to actionable information to respond promptly to changing conditions. Drones equipped with high-resolution cameras, LiDAR sensors, and thermal imaging devices capture real-time data, facilitating swift decision-making. Applications range from disaster response, where drones assess disaster-stricken areas rapidly, to logistics and delivery services, optimizing routes based on real-time traffic data. The ability to gather, process, and transmit data instantaneously has positioned drone data services as invaluable assets, driving their widespread adoption across diverse sectors.Focus on Data Security and Privacy

The growing utilization of drones for data collection has accentuated concerns regarding data security and privacy. As drones capture sensitive information, ensuring the confidentiality and integrity of data has become a paramount consideration. Encryption techniques, secure data transmission protocols, and compliance with data protection regulations are at the forefront of industry developments. Companies offering drone data services are investing substantially in cybersecurity measures, assuring clients that their data is safeguarded against unauthorized access and breaches. Moreover, regulatory frameworks are evolving to address privacy concerns, outlining guidelines for responsible drone operations. This trend highlights the industry's commitment to upholding data security and privacy standards, fostering trust among businesses and consumers alike.Collaborative Ecosystems and Partnerships

The global drone data services market is witnessing a trend toward collaborative ecosystems and strategic partnerships. Drone service providers, data analytics firms, and industry-specific businesses are joining forces to create comprehensive solutions. These partnerships leverage the expertise of multiple stakeholders, offering end-to-end services to clients. For example, agriculture-focused drone data service providers collaborate with agritech companies to deliver integrated solutions that not only capture agricultural data but also provide actionable insights for farmers. Such collaborations enhance service offerings, expand market reach, and cater to the specific needs of diverse industries. This trend underlines the industry's evolution toward holistic, collaborative approaches, ensuring that clients receive tailored solutions tailored to their unique requirements.Segmental Insights

Service Type Insights

The Global Drone Data Services Market was overwhelmingly dominated by the Mapping & Surveying segment, a trend anticipated to persist throughout the forecast period. Mapping & Surveying services emerged as the cornerstone of the drone data services market, driven by their widespread applicability across various industries such as construction, agriculture, infrastructure, and environmental monitoring. Organizations leveraged drones equipped with advanced sensors and imaging technologies to capture high-resolution aerial imagery and terrain data, facilitating precise mapping, land surveying, and spatial analysis. The ability of drones to access remote or inaccessible areas quickly and cost-effectively made them indispensable tools for large-scale mapping projects and infrastructure development initiatives. Moreover, the demand for mapping and surveying services was further fueled by the growing emphasis on digital transformation and data-driven decision-making processes across industries. Additionally, the integration of drones with advanced geospatial software and analytics platforms enabled organizations to extract actionable insights, optimize resource allocation, and streamline project planning and execution. As industries continue to recognize the value of drone-based mapping and surveying solutions in enhancing operational efficiency, reducing costs, and minimizing risks, the dominance of the Mapping & Surveying segment in the Global Drone Data Services Market is poised to endure, underpinned by its pivotal role in driving innovation and driving transformative change across diverse sectors.Platform Insights

The Cloud-Based platform segment emerged as the dominant in the Global Drone Data Services Market, a trend projected to persist steadfastly throughout the forecast period. Cloud-based platforms revolutionized the landscape of drone data services by offering scalable, accessible, and efficient solutions for data storage, processing, and analysis. Leveraging cloud infrastructure, organizations could seamlessly upload, manage, and share vast volumes of drone-captured data with stakeholders across geographically dispersed locations in real-time. Furthermore, cloud-based platforms provided advanced analytics tools and machine learning algorithms, enabling users to derive actionable insights and generate value from drone data more effectively. The scalability and flexibility offered by cloud-based solutions empowered businesses to adapt to evolving data requirements and scale operations as needed, making them indispensable assets across various industries, including agriculture, construction, mining, and environmental monitoring. Additionally, the cloud-based approach facilitated collaboration and integration with third-party applications and services, fostering ecosystem development and innovation within the drone data services market. As organizations increasingly prioritize digital transformation initiatives and harness the power of drone technology for data-driven decision-making, the dominance of the Cloud-Based platform segment is poised to endure, underpinned by its ability to drive efficiency, agility, and innovation in the delivery of drone data services on a global scale.Regional Insights

North America emerged as the dominant region in the Global Drone Data Services Market, a trend projected to persist throughout the forecast period. Several factors contribute to North America's dominance, including its robust technological infrastructure, well-established regulatory framework, and a mature ecosystem of drone technology providers and service users. The United States, in particular, has been at the forefront of drone adoption across diverse sectors such as agriculture, construction, oil and gas, and public safety. Moreover, North America's expansive geographical landscape and diverse industrial sectors present abundant opportunities for drone data services, including aerial surveys, mapping, infrastructure inspection, and environmental monitoring. Additionally, the region's strong investment in research and development, coupled with strategic partnerships between government agencies, academia, and industry stakeholders, fosters continuous innovation and drives the adoption of drone technology for data-driven decision-making. With sustained advancements in drone technology, increased affordability, and growing awareness of the benefits of drone data services, North America is poised to maintain its dominant position in the Global Drone Data Services Market, serving as a key driver of growth and innovation in the years ahead.Key Market Players

- Azur Drones Sas

- Sz Dji Technology Co., Ltd

- Dronecloud Tm

- Dronedeploy, Inc

- Pix4d Sa

- Precisionhawk Inc.

- Sentera Inc.

- Skycatch, Inc.

- Ageagle Aerial Systems Inc.

- Airware Solutions Limited

Report Scope:

In this report, the Global Drone Data Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Drone Data Services Market, By Service Type:

- Mapping & Surveying

- Photogrammetry

- 3D Modeling

- Others

Drone Data Services Market, By Platform:

- Cloud-Based

- Operator Software

Drone Data Services Market, By End-use:

- Real Estate & Construction

- Agriculture

- Mining

- Oil & Gas

- Renewables

- Others

Drone Data Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Drone Data Services Market.Available Customizations:

Global Drone Data Services market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Azur Drones Sas

- Sz Dji Technology Co., Ltd

- Dronecloud Tm

- Dronedeploy, Inc

- Pix4d Sa

- Precisionhawk Inc.

- Sentera Inc.

- Skycatch, Inc.

- Ageagle Aerial Systems Inc.

- Airware Solutions Limited

Table Information

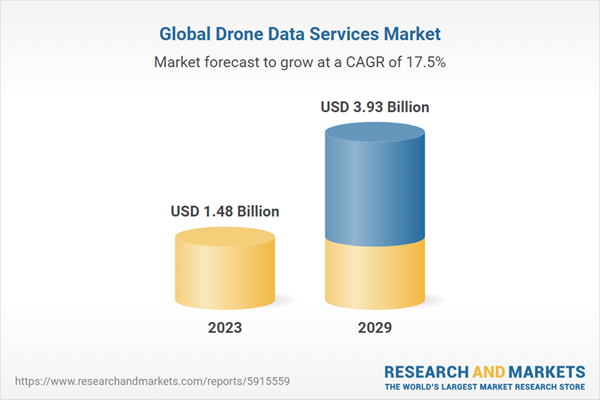

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.48 Billion |

| Forecasted Market Value ( USD | $ 3.93 Billion |

| Compound Annual Growth Rate | 17.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |