Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

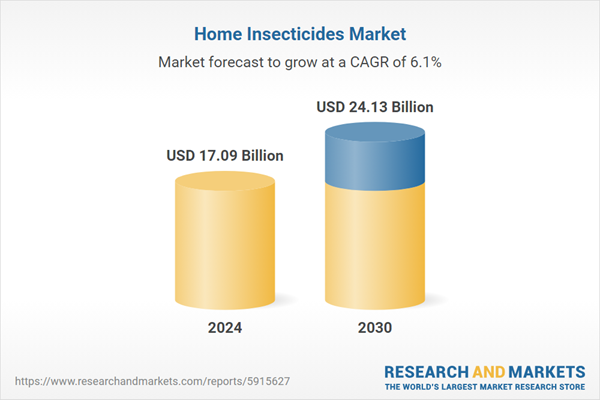

Home insecticides comprise a broad portfolio of products aimed at eliminating common household pests such as mosquitoes, flies, ants, cockroaches, and others. The market’s growth is primarily fueled by increasing urbanization, rising global population, evolving consumer lifestyles, and heightened focus on health and sanitation.

A key trend shaping the industry is the rising demand for eco-friendly and low-toxicity insecticide formulations. With increasing consumer concern over the environmental and health impacts of conventional chemical-based products, manufacturers are innovating with safer, more sustainable alternatives. This includes the introduction of natural and organic repellents that appeal to environmentally conscious consumers.

The market is also experiencing advancements in product delivery mechanisms. New user-friendly formats - such as electric mosquito repellents, automated sprayers, and convenient aerosol cans - are enhancing product efficacy and improving the consumer experience. The surge in demand during the COVID-19 pandemic, as people spent more time indoors, further emphasized the importance of maintaining pest-free living environments - a trend expected to continue in the long term.

Key Market Drivers

Urbanization and Population Growth

Rapid urbanization and population growth remain primary factors contributing to the increasing demand for home insecticides globally. In high-income regions such as Western Europe, North America, Australia, Japan, and the Middle East, over 80% of the population resides in urban areas. In upper-middle-income countries - including those in Eastern Europe, East Asia, Southern Africa, and parts of South America - urbanization rates fall between 50% and 80%.As individuals migrate from rural to urban settings in pursuit of better living standards and economic opportunities, population densities in cities rise. Such conditions create ideal environments for pest proliferation, intensifying the need for effective household pest control solutions.

Key Market Challenge

Chemical Resistance

One of the most pressing challenges facing the global home insecticides market is the growing resistance of household pests to chemical treatments. Prolonged and repetitive use of insecticides with similar active ingredients has allowed pests to adapt and build resistance, diminishing the effectiveness of traditional chemical solutions.Mosquitoes, especially those transmitting diseases such as malaria and dengue, serve as a prominent example. In endemic regions, long-term insecticide usage has resulted in resistant mosquito strains - most notably against pyrethroids. This resistance significantly impairs public health interventions and complicates disease control strategies.

The issue of resistance is not limited to mosquitoes. Other household pests, including cockroaches, ants, and bedbugs, have similarly developed resistance to multiple classes of insecticides, making infestations more difficult to manage for both consumers and pest control professionals.

Key Market Trend

Innovative Delivery Systems

Technological innovation in product delivery is playing a critical role in driving growth in the home insecticides sector. To meet rising consumer expectations for convenience and effectiveness, manufacturers are developing advanced delivery systems that improve usability and extend protection.A notable example is the Scion Insecticide with UVX Technology, which offers up to 90 days of residual protection even in extreme conditions such as high temperatures, harsh surfaces, and direct sunlight. This product is tailored for extended service intervals and is particularly effective against resilient pests in challenging environments.

Additionally, electric mosquito repellents represent a major innovation in this category. Using technologies such as ultrasonic waves or heat dispersion, these devices offer a continuous, hassle-free alternative to traditional coils or topical applications. Their plug-and-play design, quiet operation, and non-intrusive functionality make them increasingly attractive to consumers seeking a more modern approach to pest control.

Key Market Players

- Amplecta AB

- FMC Global Speciality Solutions

- Godrej Consumer Products Inc.

- Natural Insecto Products Inc.

- Nicols International SA

- Shogun Organics

- Spectrum Brands holdings

Report Scope:

In this report, the Global Home Insecticides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Home Insecticides Market, By Insect Type:

- Mosquitoes & Flies

- Rats & other Rodents

- Termites

- Bedbugs & Beetles

- Other Insect Types

Home Insecticides Market, By Chemical Type:

- Synthetic

- Natural

Home Insecticides Market, By Form:

- Dust and Granules

- Liquids

- Aerosol Sprays

- Other Forms

Home Insecticides Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Home Insecticides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amplecta AB

- FMC Global Speciality Solutions

- Godrej Consumer Products Inc.

- Natural Insecto Products Inc.

- Nicols International SA

- Shogun Organics

- Spectrum Brands holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.09 Billion |

| Forecasted Market Value ( USD | $ 24.13 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |