Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Incidence of Syphilis

Syphilis, a sexually transmitted infection caused by the bacterium Treponema pallidum, has been making a resurgence on the global health landscape. The increasing incidence of syphilis has far-reaching implications, not only for public health but also for the diagnostic industry.After decades of decline and effective treatment, syphilis is making a troubling comeback. This resurgence is driven by a combination of factors, including changing sexual behaviors, decreased emphasis on safe sex practices, and the increased use of recreational drugs. The consequences of this resurgence are alarming, with syphilis leading to severe health complications if left untreated. As a result, there is a heightened focus on early detection and diagnosis, which in turn is boosting the demand for syphilis immunoassay diagnostic tests.

The most direct impact of the rising incidence of syphilis is the increased demand for diagnostic testing. Individuals who engage in high-risk sexual behaviors or are exposed to syphilis-positive partners are more likely to seek testing. This growing demand is prompting healthcare facilities to invest in a wider range of syphilis immunoassay diagnostic tools to cater to this need.

Timely diagnosis of syphilis is crucial to prevent the progression of the disease to its more severe and dangerous stages. The rising incidence has highlighted the importance of early detection and treatment, leading to a proactive approach in diagnosing the infection. This emphasis on early intervention not only benefits patients but also fuels the growth of the diagnostic market.

Advancements in diagnostic technology have made the detection of syphilis more accurate and accessible. Modern syphilis immunoassay diagnostics, such as enzyme immunoassays (EIAs) and rapid diagnostic tests (RDTs), offer high sensitivity and specificity, ensuring that cases are not missed during screening. These advancements have contributed to the efficiency of syphilis diagnosis, further spurring market growth.

The rising incidence of syphilis has placed an emphasis on rapid, on-site testing to ensure early diagnosis and treatment. Point-of-care testing (POCT) for syphilis provides healthcare providers with the ability to diagnose the infection within minutes, reducing the time to treatment and minimizing the risk of transmission. The convenience and rapid results of POCT solutions are driving their adoption, contributing to market expansion.

The resurgence of syphilis has prompted many governments and health organizations to launch public health initiatives aimed at raising awareness about the infection and its risks. These initiatives educate individuals about the importance of syphilis testing, contributing to an increased willingness to get tested and driving demand for diagnostic services.

Point-of-Care Testing (POCT)

Point-of-care testing (POCT) is revolutionizing the healthcare landscape by providing quick and convenient diagnostic solutions that can be performed at the patient's bedside, in clinics, or other healthcare settings. One area where POCT has demonstrated remarkable potential is in the global syphilis immunoassay diagnostic market.

One of the key advantages of POCT in the syphilis immunoassay diagnostic market is the accessibility and convenience it offers. With POCT, patients do not need to wait for extended periods for laboratory results. Instead, healthcare providers can conduct syphilis testing and provide immediate results. This instant feedback can be a game-changer, especially for individuals who might not return for follow-up appointments.

POCT solutions for syphilis enable rapid diagnosis, with results available within minutes. This is particularly crucial for a disease like syphilis, which can progress quickly to more severe stages if left untreated. Rapid diagnosis means that treatment can begin promptly, preventing the progression of the infection and potential complications.

Syphilis is a sexually transmitted infection, and timely diagnosis plays a critical role in preventing its transmission. POCT allows for quick identification of the infection, helping to initiate treatment and reduce the risk of transmitting the disease to sexual partners. In this way, POCT contributes to both individual patient care and public health efforts to control the spread of syphilis.

POCT is particularly valuable in resource-limited settings, where access to centralized laboratories for testing may be limited. These settings often lack the infrastructure for traditional laboratory testing, making on-site diagnostics a more practical solution. By providing immediate test results, POCT can improve the effectiveness of syphilis diagnosis and treatment in these environments.

POCT can also improve patient compliance with syphilis screening recommendations. Patients are more likely to undergo testing if they know that the results will be available quickly, and they can receive immediate follow-up care if needed. This can contribute to higher testing rates and earlier diagnosis.

The adoption of POCT for syphilis diagnosis is opening up new markets and opportunities for diagnostic companies. As healthcare providers increasingly recognize the value of rapid, on-site testing, there is a growing demand for POCT devices and assays. This expansion of the market is expected to continue as healthcare systems and providers seek more efficient and patient-centric solutions.

Public Health Initiatives and Awareness

Syphilis, a sexually transmitted infection (STI) caused by the bacterium Treponema pallidum, continues to be a significant public health concern. The rising incidence of syphilis has prompted governments, healthcare organizations, and advocacy groups to launch public health initiatives aimed at increasing awareness, prevention, and early detection. These initiatives play a vital role in the fight against syphilis and, interestingly, also contribute to the growth of the global syphilis immunoassay diagnostic market.One of the primary functions of public health initiatives is to raise awareness about syphilis. Many individuals may not be aware of the risks associated with the infection, its symptoms, or the importance of regular testing. Awareness campaigns serve to educate the public about the prevalence of syphilis, its potential complications, and the need for early diagnosis. As awareness spreads, more individuals become motivated to get tested, increasing the demand for syphilis immunoassay diagnostics.

Public health initiatives also aim to reduce the stigma surrounding syphilis and other STIs. Stigma can be a significant barrier to seeking testing and treatment. By fostering an environment of openness and acceptance, these initiatives help individuals overcome the fear of judgment and encourage them to access testing and diagnostic services.

Awareness campaigns often include messaging about the importance of syphilis testing, especially for individuals engaged in high-risk behaviors. This encouragement to get tested is a direct driver of growth in the syphilis immunoassay diagnostic market. As more people heed the call for testing, healthcare providers must invest in diagnostic tools and tests to meet the increased demand.

Public health initiatives often receive support and funding from government agencies. Governments recognize the public health significance of syphilis and understand the economic and societal costs associated with untreated infections. This support bolsters the efforts of healthcare organizations, enabling them to provide free or low-cost syphilis testing services. Government-backed initiatives are instrumental in boosting the demand for diagnostic tests, thereby driving market growth.

Public health initiatives frequently include targeted screening programs. These programs aim to identify and test individuals at higher risk of syphilis, such as pregnant women, men who have sex with men, and those in high-prevalence areas. This focused testing not only identifies syphilis cases earlier but also ensures a steady demand for syphilis immunoassay diagnostic tests.

Early detection of syphilis through public health initiatives not only benefits individuals but also contributes to the prevention of the disease's progression to more severe stages. Early treatment can help prevent complications, making the case for regular testing and the adoption of diagnostic tools even stronger.

Increasing Healthcare Expenditure

The global healthcare landscape is witnessing a significant transformation, marked by an increase in healthcare expenditure worldwide. This heightened investment in healthcare infrastructure and services is playing a pivotal role in the growth and expansion of various healthcare sectors, including the global syphilis immunoassay diagnostic market.One of the most direct effects of increasing healthcare expenditure is improved access to healthcare services. This means more people have the opportunity to receive medical care, including syphilis testing and diagnosis. A larger pool of patients availing healthcare services naturally leads to a higher demand for syphilis immunoassay diagnostic tests.

Rising healthcare expenditure often involves investments in healthcare infrastructure, including the development of healthcare facilities and laboratories. Enhanced infrastructure supports the expansion of diagnostic services, including those related to syphilis. As healthcare facilities become better equipped, they can offer a wider range of diagnostic tests, leading to the growth of the market.

A direct outcome of improved access to healthcare and better healthcare infrastructure is the increased testing rates for syphilis. With more individuals able to afford and access healthcare services, there is a higher likelihood of testing for syphilis. This surge in testing drives the demand for syphilis immunoassay diagnostics.

Governments play a pivotal role in the allocation of healthcare funds. Many governments worldwide have recognized the public health significance of syphilis and allocate resources to support syphilis screening programs. These initiatives result in free or low-cost testing services, which in turn contribute to a surge in diagnostic testing demand.

Increased healthcare expenditure often translates into greater investment in research and development. This impacts the syphilis immunoassay diagnostic market in several ways. First, it facilitates the development of more accurate and efficient diagnostic tests. Second, it encourages the exploration of innovative technologies, which can improve the diagnosis and treatment of syphilis. Moreover, R&D investment can lead to the identification of new biomarkers and diagnostic targets.

A higher healthcare expenditure often correlates with a higher quality of healthcare services. This includes not only the quality of care provided but also the quality and accuracy of diagnostic tests. With improved healthcare quality, individuals are more likely to receive accurate and reliable syphilis diagnostic results.

Increasing healthcare expenditure also promotes preventative care, including regular check-ups and screening for STIs like syphilis. Preventative care is essential in early detection and treatment, which contributes to better health outcomes and reduces the spread of the disease.

Key Market Challenges

Resource Constraints

In resource-limited settings, particularly in low-income countries, there may be insufficient infrastructure and funding for comprehensive syphilis testing and diagnostics. Access to diagnostic tools and trained healthcare personnel may be limited, hindering early detection and treatment. Bridging the gap in healthcare resources is essential to expanding the market's reach.Stigma and Lack of Awareness

Stigma surrounding sexually transmitted infections, including syphilis, remains a persistent challenge. Many individuals may avoid seeking testing and diagnosis due to the fear of judgment or social repercussions. Lack of awareness about the prevalence of syphilis, its modes of transmission, and the importance of early detection exacerbates this problem. Addressing these issues is critical to boosting testing rates and market growth.Antibiotic Resistance

Syphilis strains that are resistant to common antibiotics, such as penicillin, have emerged. This resistance poses a significant challenge in the treatment of syphilis. In response, diagnostic tests must be continuously updated to identify these resistant strains, which can be a resource-intensive process for manufacturers.Key Market Trends

Multiplex Testing

Multiplex testing is on the horizon for syphilis diagnostics. These tests enable the simultaneous detection of multiple infections, including syphilis and other STIs, using a single sample. This trend aligns with the broader push for comprehensive and cost-effective diagnostic solutions, which can be particularly valuable in high-prevalence areas.Rise in Home Testing Kits

With the increasing availability of home testing kits for various health conditions, including STIs, syphilis immunoassay diagnostics are making their way into the hands of consumers. This trend empowers individuals to take charge of their health by self-testing for syphilis from the comfort and privacy of their homes.Global Market Expansion

With the increasing prevalence of syphilis in various regions, the global syphilis immunoassay diagnostic market is expanding its reach. As healthcare infrastructure improves in low- and middle-income countries, diagnostic companies are eyeing new markets, and governments are launching screening programs to combat syphilis more effectively.Segmental Insights

Product Insights

Based on the category of Product, the Kit & Reagent segment is poised to capture a substantial market share during the forecast period within the Global Syphilis Immunoassay Diagnostic Market. This can be attributed to several key factors. First and foremost, the growing prevalence of syphilis worldwide necessitates accurate and efficient diagnostic solutions, driving demand for high-quality kits and reagents. Moreover, the increasing awareness about the importance of early syphilis detection and the availability of advanced immunoassay technologies have further bolstered the attractiveness of this segment. Furthermore, the ease of use, rapid results, and cost-effectiveness associated with these kits and reagents make them an appealing choice for healthcare professionals and laboratories. With continuous innovation and research in the field, The Kit & Reagent segment is expected to maintain its robust market position throughout the forecast period, ultimately contributing to the overall growth of the Global Syphilis Immunoassay Diagnostic Market.Technology Insights

Based on Technology, ELISA (Enzyme-Linked Immunosorbent Assay) is anticipated to secure a substantial market share during the forecast period in the Global Syphilis Immunoassay Diagnostic Market for several compelling reasons. Firstly, ELISA offers high sensitivity and specificity in detecting syphilis antibodies, making it a reliable choice for healthcare practitioners and diagnostic laboratories. Its ability to provide quantitative results, along with its cost-effectiveness and scalability, makes ELISA a preferred diagnostic method in a range of healthcare settings. Additionally, the adaptability of ELISA for multiplex testing, enabling the simultaneous detection of multiple diseases, adds to its appeal. As the global healthcare landscape continues to emphasize the importance of precise and rapid diagnostic tools, ELISA's enduring relevance and continuous advancements in the field are expected to secure a significant and growing market share in the Syphilis Immunoassay Diagnostic Market throughout the forecast period.Regional Insights

North America is poised to dominate the Global Syphilis Immunoassay Diagnostic Market for several compelling reasons. Firstly, the region boasts a well-established and sophisticated healthcare infrastructure, coupled with a high level of awareness regarding sexually transmitted diseases, including syphilis. The prevalence of syphilis cases and the urgency of early detection have driven significant demand for advanced diagnostic tools. North America has consistently been at the forefront of adopting innovative medical technologies, including immunoassay diagnostics. Additionally, the presence of leading healthcare companies, research institutions, and a robust regulatory framework has accelerated the development and commercialization of state-of-the-art syphilis immunoassay diagnostics in this region. Furthermore, a well-informed patient population and insurance coverage for diagnostic tests contribute to the region's dominance. With these factors in play, North America is well-positioned to maintain its leading position in the Global Syphilis Immunoassay Diagnostic Market.Report Scope:

In this report, the Global Syphilis Immunoassay Diagnostic Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Syphilis Immunoassay Diagnostic Market, By Product:

- Analyzer

- Kit & Reagent

Syphilis Immunoassay Diagnostic Market, By Technology:

- CLIA

- ELISA

Syphilis Immunoassay Diagnostic Market, By End User:

- Blood Bank

- Diagnostic Lab

- Hospital

- Others

Syphilis Immunoassay Diagnostic Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Syphilis Immunoassay Diagnostic Market.Available Customizations:

Global Syphilis Immunoassay Diagnostic market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories Inc

- Danaher Corp

- Becton Dickinson SA

- F Hoffmann-La Roche AG

- Siemens Healthineers AG

- DiaSorin SpA

- Abbott Laboratories Inc

- Ortho-Clinical Diagnostics Inc

- Fujirebio Diagnostics Inc

- BioMerieux SA

Table Information

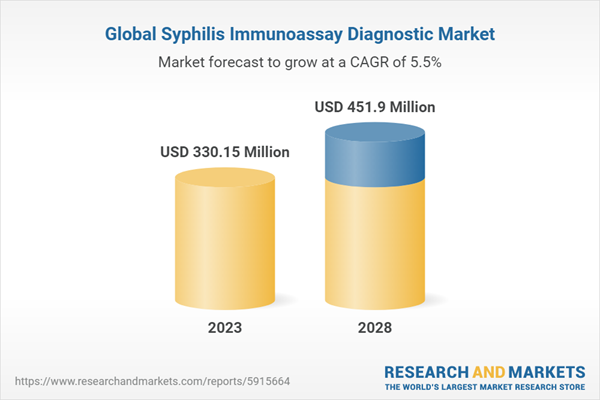

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 330.15 Million |

| Forecasted Market Value ( USD | $ 451.9 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |