Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion encounters significant obstacles regarding the complex regulatory frameworks that govern the safety and approval of genetically modified biological agents. Compliance with these rigorous international standards can lead to substantial delays in commercialization and escalated development costs for manufacturers. Highlighting the magnitude of the industries dependent on these biomolecules, MedTech Europe reported that the European medical technology market was estimated to be approximately €170 billion in 2024.

Market Drivers

The rising demand for In Vitro Diagnostic (IVD) kits and reagents acts as a primary catalyst for market growth, driven by the critical need for early disease detection. Clinical laboratories rely heavily on non-therapeutic biomolecules, such as monoclonal antibodies and polymerase enzymes, to execute sensitive assays for infectious diseases and oncological markers. This enduring reliance is reflected in the financial performance of major manufacturers; according to Roche's 'Full Year 2024 Results' released in January 2025, the company's diagnostics base business grew by 8 percent, underscoring the substantial volume of biological materials required for global testing. Additionally, the broader life sciences sector continues to fuel reagent consumption through massive capital allocation toward genomic research and drug discovery, with Thermo Fisher Scientific reporting full-year 2024 revenue of $42.88 billion in 2025, demonstrating the immense scale of the infrastructure supporting these research activities.The expanding application of enzymes in industrial manufacturing processes concurrently propels the market as industries transition toward bio-based efficiency. Sectors ranging from bioenergy to household care are substituting synthetic chemicals with catalytic proteins to lower energy consumption and reduce environmental impact, necessitating a consistent industrial-scale supply of specialized enzymes engineered for stability in harsh processing environments. The commercial viability of this transition is evident in the performance of leading biosolution providers; according to Novonesis' 'Annual Report 2024' published in February 2025, the company's Planetary Health Biosolutions segment achieved pro forma organic sales growth of 9 percent. This trajectory highlights the rising industrial dependency on biological catalysts to meet sustainability targets and regulatory standards for greener production methods.

Market Challenges

The intricate regulatory frameworks governing the approval and safety of genetically modified biological agents constitute a substantial impediment to the expansion of the Global Non-Therapeutic Biomolecules Market. Manufacturers in this sector, particularly those developing enzymes for industrial bioprocessing and reagents for diagnostic applications, face increasingly rigorous compliance requirements that vary significantly across jurisdictions. These stringent standards force companies to allocate extensive resources toward legal validation and safety data generation, diverting capital away from production capacity and innovation. Consequently, the prolonged approval timelines create severe bottlenecks, delaying the entry of advanced bio-based solutions into the market and eroding the competitive advantage of manufacturers attempting to commercialize sustainable alternatives to traditional chemical products.The impact of these regulatory hurdles is quantifiable and severe within the industry, creating a disparity that directly hampers market efficiency. According to EuropaBio in 2024, the average time required to obtain market authorization for biocontrol products - a key segment utilizing industrial biomolecules - was between seven and eight years in Europe, compared to just two to three years in other global regions. This extensive delay not only increases financial risk for developers but also disincentivizes regional investment, effectively stalling the sector’s momentum despite the underlying demand for bio-based industrial tools.

Market Trends

The expansion of peptide and protein applications in cosmeceuticals is steadily shifting market focus beyond clinical diagnostics and industrial processing. Personal care formulations are increasingly incorporating bioactive proteins and synthetic peptides to deliver functional benefits previously reserved for dermatological therapies, effectively blurring the line between cosmetics and pharmaceuticals. This trend is characterized by the commercialization of signal peptides and growth factors tailored for skin repair, driving substantial revenue streams for specialized ingredient suppliers. The commercial impact of this high-value segment is robust; according to L'Oreal's '2024 Annual Results' in February 2025, the company's Dermatological Beauty Division achieved like-for-like growth of 9.8 percent, generating sales of €7 billion, which highlights the accelerating consumer appetite for scientifically validated, biomolecule-enriched skincare products.Simultaneously, the integration of Artificial Intelligence for accelerated biomolecule discovery is revolutionizing the development pipeline for non-therapeutic agents. By leveraging generative models and machine learning, researchers can now predict protein structures and enzymatic functions with unprecedented speed, bypassing the iterative bottlenecks of traditional high-throughput screening. This technological convergence allows for the precise engineering of novel enzymes optimized for specific industrial or consumer applications, significantly reducing time-to-market and development costs. Validating this increasing reliance on computational biology, Ginkgo Bioworks reported in its 'Q3 2024 Financial Results' in November 2024 that the company added 25 new programs to its Cell Engineering platform, signaling a persistent industry shift toward data-driven bioprospecting to solve complex biological engineering challenges.

Key Players Profiled in the Non-Therapeutic Biomolecules Market

- Merck Group.

- Bio-Synthesis Inc.

- Eurogentec

- Aviva Systems Biology

- RayBiotech

- Biocon Limited

- Bio-Techne Corporation

- Danaher Corporation

Report Scope

In this report, the Global Non-Therapeutic Biomolecules Market has been segmented into the following categories:Non-Therapeutic Biomolecules Market, by Trade Pharma:

- Enzymes

- Recombinant Proteins

- Plasmids

- Peptides

- Oligonucleotides

- Monoclonal Antibodies

Non-Therapeutic Biomolecules Market, by End user:

- Research

- Pharma

- In vitro diagnostics(IVD)

- Others

Non-Therapeutic Biomolecules Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Non-Therapeutic Biomolecules Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Non-Therapeutic Biomolecules market report include:- Merck Group.

- Bio-Synthesis Inc.

- Eurogentec

- Aviva Systems Biology

- RayBiotech

- Biocon Limited

- Bio-Techne Corporation

- Danaher Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

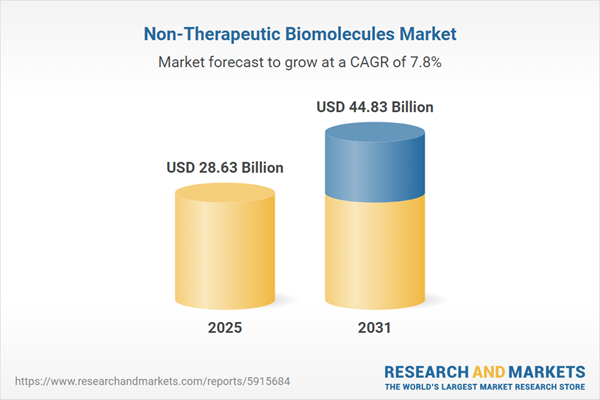

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 28.63 Billion |

| Forecasted Market Value ( USD | $ 44.83 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |