Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these growth drivers, market expansion is notably hindered by a broadening skills gap and a shortage of qualified professionals equipped to manage these intricate frameworks. This lack of expertise obstructs the successful implementation and application of advanced portfolio strategies within companies. For instance, data from the Association for Project Management in 2024 reveals that 56% of businesses identified the challenge of recruiting new talent as a significant obstacle to the advancement of the project management profession.

Market Drivers

The incorporation of Artificial Intelligence and Predictive Analytics is fundamentally transforming the Global Project Portfolio Management Market by moving the focus from historical reporting to proactive strategic planning. Modern PPM solutions are increasingly integrating generative AI to automate standard administrative duties, refine resource scheduling, and pinpoint risks prior to their effect on project outcomes. This integration allows organizations to analyze vast quantities of unstructured data for improved forecasting and capacity planning, making system upgrades a competitive necessity for vendors. According to Asana’s 'State of AI at Work 2024' report from June 2024, 52% of knowledge workers utilize generative AI on a weekly basis, a high adoption rate that forces PPM providers to expedite the creation of AI-driven features to satisfy user demands for intelligent automation.Simultaneously, the widespread adoption of Agile and Hybrid Project Methodologies is fueling market growth, as enterprises require platforms that support varied working styles within a unified portfolio. As companies transition away from rigid, uniform frameworks, they need adaptive tools that combine the structure of traditional waterfall methodologies with the iterative flexibility inherent in agile practices. The Project Management Institute’s 'Pulse of the Profession 2024' report, released in March 2024, notes that the utilization of hybrid project management strategies rose to 31% in 2023, emphasizing the need for versatile governance structures. This methodological shift is closely tied to better business results; Planview’s '2024 Project to Product State of the Industry Report' from October 2024 indicates that elite organizations are twice as likely to adopt a product operating model compared to lower-performing peers, highlighting the vital connection between modern portfolio strategies and organizational success.

Market Challenges

The growth of the Global Project Portfolio Management Market is severely constrained by a substantial scarcity of qualified talent and an expanding skills gap. As companies attempt to deploy complex portfolio management frameworks, they often face a shortage of personnel proficient in using these advanced tools effectively. This gap between the sophisticated features of modern PPM software and the actual proficiency of the workforce results in the underutilization of purchased technologies. Consequently, businesses often postpone or reduce their investments in new systems, fearing that without competent operators, expensive software will fail to generate the expected return on investment or achieve strategic alignment.This lack of core competencies directly lowers market adoption rates, as enterprises unable to hire professionals with the requisite analytical and strategic abilities cannot fully utilize a comprehensive view of their operations. According to the Association for Project Management, 83% of project professionals in 2024 reported a skills gap within their specific industry sectors. This widespread deficiency serves as a significant impediment to market growth, leading potential buyers to prioritize basic workforce development initiatives over the procurement of advanced management solutions.

Market Trends

The emergence of remote and asynchronous collaboration capabilities is reshaping the market as distributed teams require tools that separate productivity from real-time availability. With organizations facing issues like meeting fatigue and digital burnout, PPM platforms are focusing on functionalities that streamline communication and centralize context, enabling users to advance work without the need for constant synchronization. This transition tackles the inefficiencies of fragmented digital interactions, compelling vendors to redesign interfaces to support distributed efficiency. As noted in Atlassian’s 'State of Teams 2024' report from June 2024, 93% of executives believe their teams could achieve similar results in half the time with more effective collaboration, prompting a rise in demand for platforms that enhance asynchronous workflows to reclaim lost productivity.In parallel, the integration of Sustainability and ESG metrics is broadening the scope of portfolio management beyond financial parameters to encompass environmental and social impact monitoring. Companies are increasingly incorporating carbon footprint analysis and governance compliance into their project selection and oversight frameworks to adhere to regulatory standards and stakeholder demands. This shift represents a strategic pivot wherein long-term ecological viability becomes a primary success metric, necessitating that software suites adjust their reporting mechanisms. According to Green Project Management’s 'Insights into Sustainable Project Management 2024' report from May 2024, 31% of organizations have noted that sustainability has had a greater influence on their strategic objectives since 2021, driving vendors to embed specific ESG reporting features into their solutions to support these evolving governance needs.

Key Players Profiled in the Project Portfolio Management Market

- Oracle Corporation

- Planview, Inc.

- Broadcom, Inc.

- SAP SE

- Microsoft Corporation

- Adobe Inc.

- Hexagon AB

- ServiceNow, Inc.

- Upland Software

- Atlassian Corporation

Report Scope

In this report, the Global Project Portfolio Management Market has been segmented into the following categories:Project Portfolio Management Market, by Component:

- Software

- Services

Project Portfolio Management Market, by Deployment:

- On Premise

- Cloud-based

- Hosted

Project Portfolio Management Market, by Enterprise Type:

- Large Enterprises

- Small

- Medium Enterprises

Project Portfolio Management Market, by Application:

- Project & Portfolio Governance

- Portfolio Dashboards & Analytics

- Visibility & Reporting

- Resource Management

- Financial Planning & Management

- Others

Project Portfolio Management Market, by Vertical:

- IT & Telecommunications

- BFSI

- Government

- Engineering & Construction

- Healthcare

- Others

Project Portfolio Management Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Project Portfolio Management Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Project Portfolio Management market report include:- Oracle Corporation

- Planview, Inc.

- Broadcom, Inc.

- SAP SE

- Microsoft Corporation

- Adobe Inc.

- Hexagon AB

- ServiceNow, Inc.

- Upland Software

- Atlassian Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

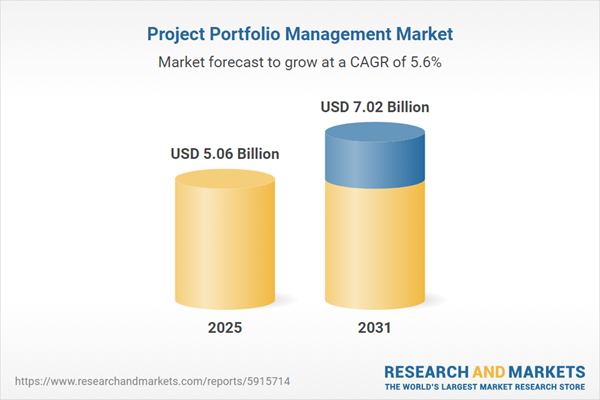

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.06 Billion |

| Forecasted Market Value ( USD | $ 7.02 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |