This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The Testing, Screening, and Monitoring Devices industry is at the forefront of revolutionizing healthcare delivery. With technological advancements, a focus on preventive healthcare, and the increasing demand for convenient and efficient diagnostic solutions, the industry is poised for continued growth. These devices play a pivotal role in early detection, continuous monitoring, and the overall enhancement of healthcare outcomes. TSM Devices find applications across various healthcare domains, including diagnostics, preventive care, chronic disease management, and emergency medical situations. This diversity highlights their versatility in addressing different aspects of healthcare. TSM Devices have the potential to make a substantial global health impact by improving healthcare accessibility and outcomes.

However, challenges such as regulatory differences and disparities in healthcare infrastructure must be addressed to ensure equitable access. The TSM industry has witnessed innovative developments in wearable biometrics, with devices capable of monitoring not only traditional health metrics but also advanced biometrics such as glucose levels, hydration, and stress indicators.

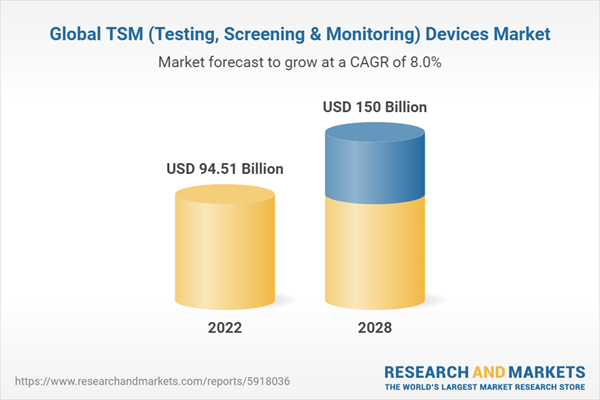

According to the research report, “Global Testing, Screening, and Monitoring (TSM) Devices Market Outlook, 2028”, the Global Testing Screening and Monitoring (TSM) market is anticipated to cross USD 150 Billion by 2028, increasing from USD 94.51 Billion in 2022. The market is expected to grow with more than 8% CAGR by 2023-28. One of the key drivers of the TSM Devices industry is the continuous innovation in technology. Advances in sensor technology, data analytics, artificial intelligence, and connectivity have revolutionized the capabilities of diagnostic and monitoring devices. Wearable devices equipped with sensors can now provide real-time data on vital signs, allowing for proactive health management. Point-of-care testing (POCT) has emerged as a crucial component of the TSM Devices industry, enabling rapid and convenient diagnostics outside traditional laboratory settings.

The demand for POCT devices has increased, driven by the need for quick and accurate results in emergency situations, remote locations, and home healthcare settings. The integration of remote patient monitoring (RPM) solutions has gained prominence, especially with the rise of telehealth and digital healthcare. RPM allows healthcare providers to monitor patients' vital signs and chronic conditions remotely, enhancing the quality of care and reducing the burden on healthcare facilities. This has become particularly important in the context of the global healthcare challenges, such as the COVID-19 pandemic. Several trends are shaping the TSM Devices industry, including the increasing adoption of wearable devices for health monitoring, the rise of personalized medicine, and the integration of digital health platforms.

Collaborations between technology companies and healthcare providers are becoming more common, driving the development of integrated solutions that offer comprehensive health insights. TSM Devices are contributing to the integration of personalized medicine into healthcare practices. The ability to gather real-time, individualized health data allows for more tailored and effective treatment plans.

North America is leading the global market as the region has a well-established infrastructure for technological advancements, fostering the development of cutting-edge TSM Devices.

North America, particularly the United States, is a hub for technological innovation and research and development. The presence of numerous tech companies and startups contributes to the rapid pace of innovation. North America boasts a robust and well-developed healthcare infrastructure. The presence of advanced healthcare facilities, research institutions, and a highly skilled workforce creates an environment conducive to the development, adoption, and integration of TSM Devices into the healthcare system. Significant investments in research and development (R&D) by both public and private entities in North America drive innovation in the TSM Devices sector. Government funding, venture capital, and corporate investments contribute to the growth of companies involved in developing advanced medical devices. The region's large and aging population, coupled with a high prevalence of chronic diseases, creates a substantial market demand for TSM Devices.

Increased awareness of preventive healthcare measures and the importance of early detection are driving the adoption of these devices. North America has a well-established regulatory framework, with agencies such as the U.S. Food and Drug Administration (FDA) setting standards for the approval and commercialization of medical devices. The rigorous but transparent regulatory process provides a level of assurance to both developers and users, fostering trust in the market. The adoption of telehealth and digital health solutions has been significant in North America, especially in recent years. TSM Devices, including remote monitoring tools and wearable technologies, align well with the growing trend of remote healthcare services, contributing to their widespread use in the region. The region's strong economic environment provides companies with the resources needed for research, development, and commercialization of TSM Devices. Access to funding, venture capital and a supportive business environment contribute to the success of companies in this sector.

The dominance of Blood Glucose Monitors (BGMs) in the Testing, Screening, and Monitoring (TSM) Devices Market can be attributed the importance of these devices in managing and monitoring a prevalent health condition:diabetes.

Diabetes is a widespread chronic condition globally, and its prevalence has been increasing, particularly in developed countries. The need for regular monitoring of blood glucose levels is essential for individuals with diabetes to manage their condition effectively. Unlike some other health conditions that require periodic testing, diabetes management often necessitates frequent and ongoing monitoring of blood glucose levels. This continuous monitoring requirement makes Blood Glucose Monitors a vital tool for individuals with diabetes. There has been a significant shift towards home-based healthcare, and Blood Glucose Monitors align perfectly with this trend. These devices empower individuals to monitor their blood glucose levels in the comfort of their homes, reducing the need for frequent visits to healthcare facilities. Blood Glucose Monitoring technology has advanced considerably over the years.

Modern BGMs offer features such as rapid results, smaller sample requirements, connectivity to mobile devices for data tracking, and continuous glucose monitoring (CGM) systems that provide real-time data. Blood Glucose Monitors empower individuals with diabetes to take an active role in managing their health. By providing immediate feedback on blood glucose levels, these devices enable users to make informed decisions about their diet, medication, and lifestyle. Blood Glucose Monitoring is not only crucial for managing diabetes but also for preventing complications associated with uncontrolled blood sugar levels. Regular monitoring allows for early intervention and adjustments to treatment plans, promoting overall health and well-being. Many Blood Glucose Monitors are now integrated with digital health platforms and mobile applications.

This integration enables users to track and analyze their data over time, facilitating better communication with healthcare providers and enhancing the overall management of diabetes. The global increase in the aging population has contributed to the rise in chronic conditions like diabetes. As older individuals are more susceptible to diabetes, the demand for Blood Glucose Monitors is likely to remain high.

Based on the end users, hospitals serve as comprehensive healthcare institutions that offer a wide range of services, from diagnostics and testing to treatment and monitoring.

Hospitals often deal with acute care and emergency situations where rapid testing, screening, and monitoring are essential. TSM Devices, such as point-of-care testing tools and monitoring equipment, are critical in these settings to facilitate quick decision-making and timely interventions. Hospitals typically have centralized electronic health record (EHR) systems, allowing for streamlined data management. TSM Devices used in hospitals can seamlessly integrate with these systems, ensuring that patient information is readily available to healthcare professionals for informed decision-making. Hospitals have specialized departments and wards catering to various medical specialties, such as cardiology, endocrinology, and critical care. Each of these departments often requires specific TSM Devices tailored to their diagnostic and monitoring needs, contributing to the overall dominance of hospitals in the TSM Devices Market.

Many hospitals house advanced imaging and diagnostics centers equipped with sophisticated TSM Devices, including MRI machines, CT scanners, and other diagnostic equipment. These devices are pivotal in providing accurate and detailed information for disease detection and monitoring. Hospitals provide both inpatient and outpatient care services. Inpatient care involves continuous monitoring of patients' vital signs and health metrics, while outpatient care often involves testing and screening services. TSM Devices are integral to both settings, contributing to their widespread use in hospitals. Hospitals are often part of larger integrated healthcare systems that encompass primary care clinics, specialty centers, and affiliated healthcare providers. TSM Devices used in hospitals can be part of a broader ecosystem that promotes seamless data exchange and continuity of care across different healthcare settings.

Cardiovascular disorders, including hypertension, hold a dominant position in the Testing, Screening, and Monitoring (TSM) Devices Market due to the prevalence, seriousness, and continuous monitoring requirements of these conditions.

Cardiovascular disorders, such as heart disease and hypertension, are among the leading causes of morbidity and mortality globally. The high prevalence of these conditions necessitates regular monitoring and management, driving the demand for TSM Devices. Cardiovascular disorders often require continuous monitoring of vital signs, including blood pressure, heart rate, and other relevant parameters. TSM Devices, such as blood pressure monitors, ECG machines, and wearable devices, play a crucial role in providing real-time data for effective management. Given the serious consequences associated with cardiovascular disorders, there is a growing emphasis on preventive healthcare. Regular testing, screening, and monitoring enable early detection of risk factors and the implementation of preventive measures, contributing to better outcomes.

TSM Devices have increasingly found their way into home healthcare settings, allowing individuals with cardiovascular conditions to monitor their health regularly. Home blood pressure monitors and wearable devices provide a convenient means for continuous monitoring without the need for frequent hospital visits. Advances in technology have led to the development of sophisticated cardiac monitoring devices. Continuous ECG monitoring, implantable devices and remote monitoring systems enable healthcare providers to gather detailed and accurate data for diagnosing and managing cardiovascular conditions. The global ageing population and lifestyle factors, such as sedentary lifestyles and poor dietary habits, contribute to the increasing prevalence of cardiovascular disorders.

As individual’s age, the risk of hypertension and other cardiovascular conditions rises, leading to a higher demand for monitoring solutions. Governments and healthcare organizations worldwide run initiatives and public health campaigns to raise awareness about cardiovascular health. These campaigns often emphasize the importance of regular testing, screening, and monitoring, contributing to increased adoption of TSM Devices.

Market Drivers

- Technological Advancements and Innovation: The global Testing, Screening, and Monitoring (TSM) Devices Market is experiencing a significant push driven by rapid technological advancements and continuous innovation. With the advent of cutting-edge technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT), TSM devices have become more sophisticated and capable than ever before. These advancements enable the development of highly accurate and efficient testing, screening, and monitoring solutions, enhancing the overall performance and reliability of these devices. For instance, the integration of AI algorithms in medical monitoring devices allows for real-time data analysis, enabling quicker and more precise diagnostics. This technological progress not only enhances the capabilities of TSM devices but also opens up new possibilities for applications in various industries, including healthcare, security, and environmental monitoring.

- Increasing Healthcare Awareness and Preventive Medicine: A key driver propelling the global Testing, Screening, and Monitoring (TSM) Devices Market is the rising awareness of healthcare and a shift towards preventive medicine. As individuals become more health-conscious, there is a growing demand for TSM devices that empower users to monitor and manage their health proactively. Wearable devices, such as fitness trackers and smartwatches, have gained popularity as they provide users with real-time data on various health metrics, encouraging healthier lifestyles. Additionally, TSM devices used in preventive screenings contribute to early disease detection, enabling timely interventions and reducing healthcare costs. The emphasis on preventive medicine aligns with global healthcare trends, influencing the development and adoption of TSM devices across diverse demographics.

Market Challenges

- Regulatory Compliance and Stringent Standards: One of the primary challenges facing the global TSM Devices Market is the complex landscape of regulatory compliance and the adherence to stringent standards. As the demand for these devices continues to rise, manufacturers must navigate a web of regulations imposed by different countries and regions. Meeting these regulatory requirements involves significant time and resources, and failure to comply can result in severe consequences, including legal actions and market restrictions. Moreover, as technology evolves, regulatory bodies often struggle to keep pace, leading to potential gaps in standards that manufacturers must proactively address. Navigating this intricate regulatory landscape requires a careful balance between innovation and adherence to established guidelines, making it a persistent challenge for companies operating in the TSM Devices Market.

- Data Security and Privacy Concerns: A significant challenge confronting the global TSM Devices Market is the escalating concern over data security and privacy. TSM devices, especially those connected to the internet or healthcare systems, collect and transmit sensitive personal and health-related data. The increasing frequency of cyber threats and data breaches raises apprehensions among users regarding the confidentiality and integrity of their information. Manufacturers face the challenge of implementing robust cybersecurity measures to protect against unauthorized access and ensure the secure transmission of data. Striking the right balance between connectivity and safeguarding user privacy is crucial for the sustained growth of the TSM Devices Market, necessitating continuous investment in cybersecurity technologies and adherence to evolving privacy regulations.

Market Trends

- Remote Monitoring and Telehealth Solutions: A prominent trend shaping the global TSM Devices Market is the increasing adoption of remote monitoring and telehealth solutions. The integration of TSM devices with digital health platforms has revolutionized healthcare by enabling the continuous monitoring of patients outside traditional healthcare settings. This trend has gained substantial momentum, particularly in response to global health crises, such as the COVID-19 pandemic, which highlighted the importance of remote healthcare delivery. TSM devices, ranging from wearable fitness trackers to advanced medical monitoring devices, now facilitate real-time data transmission to healthcare professionals, allowing for proactive intervention and personalized patient care. The shift towards remote monitoring aligns with the growing emphasis on preventive healthcare and patient-centric approaches, fostering a transformative impact on the TSM Devices Market and its role in the broader healthcare ecosystem.

- Integration of Artificial Intelligence in Diagnostic Devices: An emerging trend in the Testing, Screening, and Monitoring (TSM) Devices Market is the integration of artificial intelligence (AI) in diagnostic devices. AI technologies, including machine learning algorithms, are increasingly being employed to enhance the accuracy and efficiency of diagnostic processes. In medical screenings, AI-driven image recognition and pattern analysis enable more precise and rapid identification of abnormalities. This trend not only streamlines the diagnostic workflow but also contributes to the development of smart, self-learning devices that can adapt to evolving healthcare challenges. The integration of AI in TSM devices represents a paradigm shift towards more intelligent and autonomous diagnostic solutions, offering significant benefits in terms of speed, accuracy, and personalized healthcare delivery.

COVID-19 Impact

The COVID-19 pandemic has exerted a profound and transformative impact on the global Testing, Screening, and Monitoring (TSM) Devices Market. The urgent need for widespread testing and monitoring solutions to contain the spread of the virus has catalyzed unprecedented innovation and accelerated the adoption of advanced technologies. Diagnostic testing devices, including rapid antigen tests and PCR machines, have been at the forefront of the pandemic response, playing a pivotal role in identifying and isolating infected individuals. Moreover, the pandemic has underscored the importance of remote monitoring and telehealth solutions, leading to a surge in demand for wearable devices and home-based monitoring tools.The TSM Devices Market has witnessed a paradigm shift as healthcare systems and consumers alike recognize the value of continuous health monitoring. While the pandemic has posed challenges such as supply chain disruptions and increased regulatory scrutiny, it has also served as a catalyst for resilience and innovation within the TSM Devices Market, fostering a more adaptive and responsive landscape for future healthcare challenges.

Competitive Landscape

The competitive landscape of the global Testing, Screening, and Monitoring (TSM) Devicess market is dynamic and characterized by the presence of numerous established players, as well as emerging companies. The landscape is shaped by factors such as technological innovation, regulatory dynamics, strategic collaborations, and market expansion efforts. Some of the major companies profiled in the market are XX.Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Testing, Screening, and Monitoring (TSM) Devices market with its value and forecast along with its segments

- Region & Country-wise Testing, Screening, and Monitoring (TSM) Devices market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product:

- Blood Glucose Monitor

- Heart Rate Monitors

- Multi Parameter Patient Monitoring Device

- Drug Screening

- ECG Devices

- Others (ventilators, sleep apnea Testing, Screening, and Monitoring (TSM) Devices, respiratory care, hearing aids)

By End User:

- Hospitals

- Home

- Others

By Indication:

- Cardiovascular Disorders & Hypertension

- Diabetes

- Pregnancy

- Respiratory Diseases

- Cancer

- Movement Disorders

- Hearing Disorders

- Wound Care

- Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Testing, Screening, and Monitoring (TSM) Devices industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Koninklijke Philips N.V.

- Nihon Kohden Corporation

- Siemens Healthineers

- Mindray Medical International Limited

- Medline Industries LP

- Baxter International Inc.

- GE HealthCare Technologies, Inc.

- Omron Corporation

- Beurer GmbH

- Drägerwerk AG & Co. KGaA

- Teledyne Technologies Incorporated

- Midmark Corporation

- Cardinal Health, Inc

- Microlife Corporation

- Medtronic plc

- Garmin Ltd.

- Samsung Medison Co., Ltd

- 3M

- OSI Systems, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 94.51 Billion |

| Forecasted Market Value ( USD | $ 150 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |