This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Real-time data transmission facilitates timely interventions and adjustments to treatment plans. ECG devices aid in assessing the risk of cardiovascular events and help healthcare professionals manages patients with known risk factors. By monitoring heart activity over time, clinicians can tailor preventive strategies and lifestyle interventions to mitigate the risk of heart-related complications. Patients who have undergone cardiac procedures or surgeries require post-treatment monitoring. ECG devices allow healthcare providers to track recovery progress, detect potential complications, and adjust treatment plans as needed, ensuring optimal post-treatment care.

ECG devices are used to assess the effects of medications on the heart. This is particularly important for patients taking medications that impact cardiac function. Monitoring changes in ECG patterns helps healthcare professionals adjust medication dosages or switch to alternative treatments when necessary.

Holter monitors, a type of ECG device, provide continuous recording of the heart's electrical activity over an extended period (usually 24 to 48 hours). This allows for the detection of intermittent or infrequent abnormalities that not be captured during a standard ECG, aiding in the diagnosis of certain conditions. Self-monitoring and remote patient management will likely play a more significant role in the future, fostering a sense of autonomy and responsibility among individuals for their heart health.

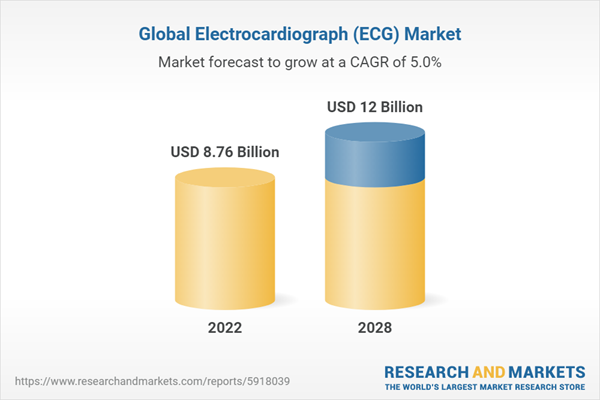

According to the research report, “Global Electrocardiograph (ECG) Market Outlook, 2028”, the market is anticipated to cross USD 12 Billion by 2028, increasing from USD 8.76 Billion in 2022. The market is expected to grow with more than 5% CAGR by 2023-28. In the ever-evolving landscape of healthcare technology, the electrocardiogram (ECG) devices industry holds a crucial position. The ECG devices industry is characterized by a diverse range of products, from traditional stationary machines found in clinical settings to modern, portable, and wearable devices. This diversity caters to the varying needs of healthcare professionals, patients, and individuals seeking proactive heart health management. Technological innovation is at the heart of the ECG devices industry's nature. The transition from analog to digital technology, coupled with advancements in miniaturization and connectivity, has paved the way for more accessible and efficient cardiac monitoring solutions.

Wearable ECG devices, smart-watches, and patches exemplify the industry's commitment to embracing cutting-edge technologies. The ECG devices industry is increasingly intertwined with the broader digital health ecosystem. Seamless integration with electronic health records (EHRs), telemedicine platforms, and other health monitoring devices is a defining characteristic. This integration not only enhances the overall patient experience but also contributes to a more interconnected and data-driven healthcare system. One of the notable shifts in the nature of the ECG devices industry is its emphasis on preventive healthcare.

Continuous monitoring, early detection of cardiac irregularities, and personalized treatment plans are becoming integral components. This shift aligns with the broader trend in healthcare toward proactive measures and individualized care. The integration of artificial intelligence (AI) and machine learning into ECG devices holds immense potential.

AI algorithms can analyze vast amounts of ECG data, providing valuable insights into cardiac health and contributing to more accurate diagnostics and personalized treatment plans. Efforts to make ECG devices more accessible globally are gaining momentum. The development of cost-effective solutions and partnerships to deploy ECG technology in resource-limited settings will contribute to improving healthcare outcomes on a global scale. As ECG devices become more user-friendly and portable, there is a growing emphasis on empowering patients to actively participate in their healthcare.

On the basis of geography, the region of North America has dominated the segment globally as a result of the huge number of cardiac patients that reside in this region.

North America, particularly the United States, is a hub for technological innovation and research. The region has been at the forefront of developing and adopting advanced healthcare technologies, including ECG devices. The presence of leading medical device manufacturers and a robust ecosystem for research and development contribute to the continuous evolution of ECG technology in the region. North America is expected to dominate the ECG Devices market during the forecast period due to the rising prevalence of cardiovascular disease, rising adoption of sedentary lifestyles, and rising healthcare organization awareness of novel technologies used for the early detection of cardiac-related issues. People's dietary habits have been severely hindered as a result of modern living activities. People's sedentary living practices have greatly raised the occurrence of numerous cardiovascular ailments.

The growing emphasis on patient care and needs, aided by a well-developed infrastructure and a technologically advanced healthcare system, as well as the rising burden of cardiovascular diseases in the United States, are expected to drive the growth of the electrocardiograph (ECG) market in the United States. Furthermore, a few of the country's leading market players are producing unique items and technologies to compete with existing products, while others are acquiring and partnering with other market-trending organizations. For example, in June 2022, the US Food and Drug Administration approved Qpatch, an ECG wearable unit developed by Medicalgorithmics professionals. Qpatch, according to the business, is a wearable gadget that measures individual ECG impulses to provide an accurate cardiac arrhythmia diagnosis. Implicity also gained FDA approval in December 2021 for a revolutionary medical algorithm that analyzes ECG data from Implantable Loop Recorders (ILRs).

North America has a well-defined regulatory framework, with agencies such as the U.S. Food and Drug Administration (FDA) setting standards for medical devices. While stringent, these regulations also provide a level of confidence in the safety and efficacy of ECG devices, encouraging both manufacturers and healthcare providers to adopt and integrate these technologies.

Depending on product, the resting electrocardiograph (ECG) segment dominated the market in 2022, owing to as these ECG devices are highly adopted for the basic cardiac monitoring of patients.

Electrocardiograph devices are primarily designed to record the patient's cardiac activities, which aid in the monitoring of the heart's status. Rapid research & development by leading market players to develop advanced electrocardiograph systems that will allow for an accurate diagnosis in the event of a condition has proven to be a major growth factor for the industry. The increased use of resting ECG systems in hospitals, clinics, and ambulatory surgical centers can be attributed to improved information exchange via Cardiovascular Information Systems (CVIS) and Electronic Health Record (EHRs), which simplify ECG workflow and reduce the complexity associated with custom integration. During the forecast period, the segment is likely to be propelled by the development and launch of technologically improved electrocardiogram devices (recently developed ECG monitoring systems are designed to improve workflow and simplify operation).

The constantly expanding market need for this product to detect cardiac arrhythmias, which aids in the accurate diagnosis of the heart disease, proves to be a wonderful potential for the industry. The number of people in the senior population is increasing, so does the use of stress electrocardiographs. The number of persons in the old age group has increased dramatically in recent years as people's life expectancy has increased, increasing the demand for accurate and precise electrocardiograph devices. The leading market participants are keen to seize the developing market in order to generate significant income over the forecast period. Additionally, the collaborations between the companies that manufacture the Holter ECG devices will augment the growth of this segment.

For instance, in September 2021, Astellas Pharma, Nitto Denko Corporation, and M. Heart Co., Ltd concluded a memorandum of concerning an ECG testing service. Based on this memorandum of understanding, Astellas, Nitto, and M. Heart will continue to look into Nitto developing and manufacturing the 'EG Holter' a novel disposable Holter ECG device.

The hospitals & clinics segment dominated the market in 2022 owing to large-scale adoption of ECG systems by hospitals along with routine utilization of the ECG tests by the physicians.

Hospitals and clinics serve as central hubs for healthcare delivery, where patients receive comprehensive medical services. These facilities are equipped with a range of diagnostic tools, including ECG devices, to conduct thorough assessments and provide timely and accurate diagnoses. Hospitals and clinics handle a wide spectrum of medical cases, including complex cardiovascular conditions. The diverse patient population presents a need for advanced diagnostic equipment, and ECG devices are essential for evaluating cardiac health. These facilities often require a variety of ECG devices to cater to different patient needs and conditions.

Hospitals provide both inpatient and outpatient services, offering a continuum of care. ECG devices are utilized in various settings within hospitals, from emergency departments and critical care units to outpatient clinics and specialty cardiac units. This versatility contributes to the widespread use of ECG devices across different hospital departments.

ECG devices have become an integral part of routine healthcare protocols in hospitals and clinics. They are routinely used for initial assessments, pre-operative evaluations, monitoring patients with known cardiac conditions, and conducting follow-up examinations. The seamless integration of ECG devices into daily clinical workflows enhances their adoption in these settings. Hospitals and clinics are staffed with skilled healthcare professionals, including cardiologists, electrophysiologists, and specialized nursing staff. The expertise of these professionals ensures accurate interpretation of ECG results, contributing to effective patient management and treatment planning. Hospitals, especially emergency departments, frequently encounter patients with acute cardiac issues. ECG devices are crucial in emergency situations for rapid assessment and triage.

The ability to quickly diagnose and initiate treatment based on ECG findings is vital for improving patient outcomes in critical scenarios. Hospitals generally have the financial capacity to invest in advanced medical equipment, including ECG devices. The availability of budget allocations for medical technology acquisitions enables hospitals to keep their diagnostic equipment up-to-date and aligned with the latest technological advancements. Hospitals typically handle a high volume and diverse range of patients, making them significant users of ECG devices. The prevalence of cardiovascular diseases varies across demographics, and hospitals cater to a broad patient base, necessitating the use of ECG devices for comprehensive cardiac assessments.

A 6-lead ECG offers a more comprehensive view of the heart's electrical activity compared to a standard 3-lead ECG. This additional information can aid healthcare professionals in diagnosing a broader range of cardiac conditions and abnormalities, contributing to the segment's popularity.

The 6-lead ECG is often considered a balance between the simplicity of a basic ECG and the complexity of a 12-lead ECG. Its versatility makes it suitable for a variety of clinical settings, from routine check-ups to more specialized applications, making it a preferred choice for healthcare providers looking for flexibility. While offering more leads than a standard 3-lead ECG, a 6-lead configuration is generally more cost-effective than a 12-lead setup. This makes it an attractive option for healthcare facilities seeking an intermediate solution that balances diagnostic capabilities with budget considerations.

A 6-lead ECG is often more straightforward to use and interpret than a 12-lead ECG. This can be particularly advantageous in settings where quick assessments are necessary, such as emergency departments or primary care clinics. In ambulatory care settings and outpatient clinics, where portability and ease of use are crucial, 6-lead ECG devices may be preferred.

These devices offer a good compromise between diagnostic capabilities and the practicality of a more compact and portable setup. The increasing trend of incorporating ECG monitoring into wearable devices has fueled the demand for 6-lead ECG technology. Wearables often prioritize a balance between data richness and device size, making 6-lead configurations suitable for continuous heart monitoring in everyday settings. For specific cardiac conditions or patient populations, a 6-lead ECG may provide sufficient diagnostic accuracy without the need for a more complex 12-lead setup. This can be advantageous in scenarios where streamlined diagnostics are paramount.

Based on technology, portable ECG devices are dominating in 2022 as it offer enhanced convenience for patients as they can be used in various settings, including home environments.

The convenience offered by portable ECG devices aligns with the growing trend of patient-centric care, empowering individuals to monitor their heart health outside of traditional healthcare facilities. The rise of telemedicine and remote patient monitoring has driven the demand for portable ECG devices. These devices enable healthcare providers to remotely monitor patients' cardiac health, facilitating early detection of abnormalities and timely interventions without requiring patients to visit healthcare facilities frequently. Portable ECG devices provide healthcare professionals with the ability to perform on-the-spot diagnostics.

This is particularly valuable in emergency situations, ambulatory care settings, or during patient consultations where immediate insights into cardiac health are crucial. Many portable ECG devices are designed to integrate seamlessly with mobile technology, allowing users to connect the device to smartphones or tablets for data transmission and analysis.

This connectivity enhances user experience, enables real-time monitoring, and facilitates easy sharing of data with healthcare providers. The increasing popularity of wearable technology, including smartwatches and fitness trackers with built-in ECG capabilities, has contributed to the dominance of the portable ECG segment. Wearable ECG devices offer continuous monitoring, encouraging users to engage in proactive heart health management. Portable ECG devices are well-suited for home healthcare settings, where patients can perform regular ECG monitoring without the need for frequent visits to medical facilities. This trend aligns with efforts to shift certain aspects of healthcare from hospitals to patients' homes, promoting patient autonomy and reducing healthcare costs. The emphasis on preventive healthcare has led to increased interest in monitoring cardiovascular health proactively.

Portable ECG devices cater to individuals who wish to engage in regular self-monitoring as part of their overall wellness and preventive care practices. Technological advancements have led to the miniaturization of ECG devices without compromising diagnostic accuracy. Portable devices are now smaller, lighter, and more user-friendly, making them attractive to both healthcare professionals and consumers.

On the basis of indication, cardiovascular disorders, including conditions such as coronary artery disease, arrhythmias, and heart failure, are highly prevalent worldwide.

Given the significant burden of cardiovascular diseases on global health, there is a substantial demand for diagnostic tools like ECG devices that aid in the early detection, monitoring, and management of these disorders. The growing emphasis on preventive healthcare has led to increased awareness and screenings for cardiovascular disorders. ECG devices play a critical role in preventive care by enabling the early identification of abnormalities in heart rhythm, ischemic events, and other cardiac irregularities, allowing for timely intervention and lifestyle modifications. Hypertension (high blood pressure) is a major risk factor for cardiovascular diseases. The increasing incidence of hypertension globally has driven the demand for ECG devices in monitoring and managing patients with elevated blood pressure. ECGs can provide valuable information on cardiac function and detect changes associated with hypertensive heart disease.

Cardiovascular emergencies, such as acute myocardial infarction or arrhythmias, require prompt diagnosis and intervention. ECG devices are vital in emergency settings for rapidly assessing cardiac function and guiding immediate treatment decisions. Their diagnostic significance in critical situations contributes to their dominance in the market. The integration of ECG devices with remote patient monitoring systems has facilitated continuous monitoring of individuals with cardiovascular disorders and hypertension. This connectivity allows healthcare providers to receive real-time data, enabling proactive management and reducing the risk of adverse events. Clinical guidelines often recommend the use of ECG as a standard diagnostic tool for assessing cardiovascular health.

Adherence to these guidelines by healthcare professionals contributes to the widespread utilization of ECG devices in the diagnosis and management of cardiovascular disorders and hypertension. ECG devices provide a non-invasive and cost-effective means of obtaining a comprehensive assessment of cardiac function. This makes them valuable in routine clinical practice for evaluating patients with cardiovascular risk factors or existing heart conditions.

Market Drivers

- Growing Incidence of Cardiovascular Diseases: The increasing prevalence of cardiovascular diseases (CVDs) worldwide is a significant driver for the ECG devices market. The rising burden of conditions such as heart failure, arrhythmias, and coronary artery diseases has led to an increased demand for diagnostic tools, including ECG devices, for early detection and continuous monitoring.

- Technological Advancements in ECG Devices: Advances in technology, such as the development of portable and wireless ECG devices, have expanded the market by providing more convenient and accessible monitoring options for patients. Innovations like mobile ECG apps, smart wearables with ECG capabilities, and remote monitoring solutions contribute to the market's growth.

Market Challenges

- Regulatory Compliance and Stringent Approval Processes: ECG devices are medical devices subject to regulatory approval processes. Compliance with stringent regulatory requirements poses a challenge for manufacturers, as they must ensure that their products meet the necessary safety and efficacy standards. Delays in regulatory approvals can impact the market entry of new devices.

- Limited Reimbursement Policies: Reimbursement policies for ECG procedures vary across regions and healthcare systems. Limited coverage or reimbursement challenges may affect the adoption of ECG devices, especially in emerging markets or regions where healthcare budgets are constrained.

Market Trends

- Integration of Artificial Intelligence (AI) in ECG Analysis: The incorporation of AI and machine learning algorithms in ECG analysis is a growing trend. AI can enhance the accuracy of ECG interpretation, assist in early detection of abnormalities, and provide more personalized insights. This trend is contributing to the development of more advanced and intelligent ECG devices.

- Telemedicine and Remote Patient Monitoring: The increasing adoption of telemedicine and remote patient monitoring solutions is influencing the ECG devices market. Patients can now undergo ECG monitoring from the comfort of their homes, and healthcare providers can remotely assess and manage cardiac conditions. This trend has gained prominence, especially in the context of the COVID-19 pandemic, driving the demand for remote healthcare solutions.

COVID-19 Impact

The pandemic has accelerated the adoption of remote patient monitoring solutions to minimize in-person interactions and reduce the risk of virus transmission. ECG devices equipped for remote monitoring have been in higher demand, enabling healthcare providers to monitor patients' cardiac health remotely, especially for those diagnosed with or at risk of COVID-19. With the rise of telehealth services during the pandemic, there has been an increased need for ECG devices that can be used in telemedicine consultations. Patients can perform ECG tests at home, and the results can be transmitted to healthcare professionals for virtual assessments.This trend has underscored the importance of portable and user-friendly ECG devices. Some manufacturers faced delays or disruptions in the supply of components and raw materials, impacting the availability of ECG devices in certain regions. In the early stages of the pandemic, there was an increased emphasis on emergency response and critical care.

ECG devices played a crucial role in monitoring the cardiac health of patients in intensive care units (ICUs) and emergency departments, contributing to the overall management of COVID-19 patients. The medical community has been studying the cardiac complications associated with COVID-19. ECG devices have been used in research to monitor and analyze the impact of the virus on the cardiovascular system, leading to a better understanding of the disease and its implications for cardiac health. The pandemic prompted changes in healthcare policies and reimbursement models, including increased support for telehealth services. These changes have influenced the adoption of ECG devices, especially those integrated into remote monitoring and telehealth solutions.

Competitive Landscape

The global ECG devices market is consolidated, with a few key players accounting for a major share. Most companies are making significant investments in research & development activities. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by the players. Key players operating in the market include Koninklijke Philips N.V., GE HealthCare Technologies, Inc., Midmark Corporation, Schiller AG, Nihon Kohden Corporation, Biomedical Instruments Co., Ltd., Baxter International Inc., Medline Industries, EDAN Instruments, Inc., Applied Cardiac Systems, Fukuda Denshi Co Ltd, OSI Systems, Inc., Mindray Medical International Limited, Bittium Corporation, EB Neuro S.p.A. and Omron Corporation.Key Developments

- In February 2022, AliveCor launched the KardiaMobile Card, the slimmest, most convenient personal ECG device in the United States. It is the only personal ECG slim enough to fit in a wallet for instant feedback on heart health anytime, anywhere.

- In January 2022, Philips introduced the industry's first full-service, at-home, 12-lead electrocardiogram (ECG) solution for use in decentralized clinical trials.

- In April 2022, Biotricity officially launched the commercial sales of its FDA-cleared wireless wearable cardiac monitoring device, Biotres. The product has been available for pre-order to physicians, medical offices, hospitals, and individual use since late February 2022.

- In January 2022, Philips announced the industry's first full-service, at-home 12-lead electrocardiogram (ECG) solution for usage in decentralized clinical trials. The clinical-grade solution is the company's most sophisticated patient-centric ECG product, combining data readings that are equivalent to clinical, site-based ECGs with Philips' leading cloud-based data gathering and analysis capabilities. This latest addition to Philips' digitally enabled monitoring solution suite aids in driving innovation across the care continuum and supports decentralized clinical trials.

Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Electrocardiograph (ECG) market with its value and forecast along with its segments

- Region & Country-wise Electrocardiograph (ECG) market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product:

- Resting Electrocardiograph (ECG)

- Stress Electrocardiograph (ECG)

- Holter Monitors

- Event Recorders

- Others

By End User:

- Hospitals & Clinics

- Home Settings & Ambulatory Surgical Centers (ASCs)

- Others

By Lead type:

- 6-Lead ECG

- 12-Lead ECG

- 3-Lead ECG

- 2-Lead ECG

- Single Lead ECG

By Technology:

- Portable ECG System

- Wireless ECG System

By Indication:

- Cardiovascular Disorders & Hypertension

- Cancer

- Diabetes

- Respiratory Diseases

- Pregnancy

- Movement Disorders

- Wound Care

- Hearing Disorders

- Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Electrocardiograph (ECG) industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Koninklijke Philips N.V.

- GE HealthCare Technologies, Inc.

- Midmark Corporation

- Schiller AG

- Nihon Kohden Corporation

- Biomedical Instruments Co., Ltd.

- Baxter International Inc.

- Medline Industries

- EDAN Instruments, Inc.

- Bionet Co., Ltd.

- Fukuda Denshi Co Ltd

- OSI Systems, Inc.

- Mindray Medical International Limited

- Bittium Corporation

- EB Neuro S.p.A.

- Omron Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 8.76 Billion |

| Forecasted Market Value ( USD | $ 12 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |