This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The use of these systems is accelerating due to factors such as an increasing patient pool with diabetes, more patient awareness about blood sugar monitoring, and the development of novel monitoring devices by key companies. Furthermore, favorable reimbursement policies for self-monitoring blood glucose (SMBG) and Continuous Glucose Monitoring (CGM) systems in many countries are expected to increase the adoption of Blood Glucose Monitoring System and, as a result, propel market growth during the forecast period. The rising need for improved technologies and effective monitoring systems to regulate patients' blood glucose levels has resulted in significant revenue for the blood glucose monitoring system market.

Key market companies are investing heavily in research & development in order to create more affordable blood glucose monitoring choices. People's poor lifestyle choices, as well as increased stress from a hectic lifestyle and an unbalanced work-life balance, have dramatically increased market size. During the forecast period, these factors will be the driving forces in the blood glucose monitoring system market.

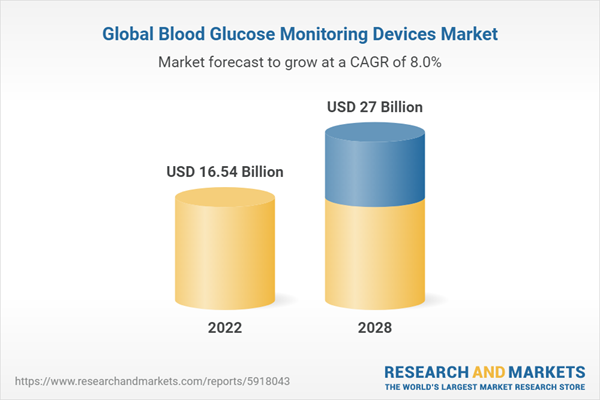

According to the research report, “Global Glucose Monitoring Devices Market Outlook, 2028”, the market is anticipated to cross USD 27 Billion by 2028, increasing from USD 16.54 Billion in 2022. The market is expected to grow with more than 8% CAGR by 2023-28. Global glucose monitoring devices provide real-time data, enabling individuals with diabetes and healthcare professionals to make informed decisions about treatment and lifestyle adjustments. Continuous Glucose Monitoring (CGM) devices, in particular, offer a comprehensive view of blood sugar trends, facilitating proactive management and reducing the risk of hyperglycemia and hypoglycemia. The need for personalized healthcare solutions is driving the development of glucose monitoring devices that cater to individual variations in lifestyle, physiology, and treatment response.

Advanced technologies such as artificial intelligence (AI) and machine learning (ML) are being integrated into these devices, offering insights into personalized treatment plans and optimizing insulin administration. Uncontrolled diabetes can lead to severe complications, including cardiovascular diseases, kidney failure, and vision impairment. Global glucose monitoring devices play a crucial role in preventing these complications by facilitating tight glycemic control. Timely detection of glucose fluctuations allows for proactive intervention, reducing the risk of long-term complications. Traditional blood glucose meters and the latest wearable devices contribute to improved patient compliance. These devices are designed to be user-friendly, requiring minimal effort for regular monitoring. Enhanced convenience and reduced invasiveness contribute to a better quality of life for individuals with diabetes, encouraging regular monitoring and adherence to treatment plans.

The need for accessible healthcare, especially in remote or underserved areas, has led to the development of glucose monitoring devices with remote capabilities. These devices enable healthcare providers to monitor patients' glucose levels remotely, facilitating timely interventions and reducing the need for frequent in-person visits.

Given the rising prevalence of obesity, poor diet, and physical inactivity, North America commanded the extensive blood glucose monitoring device market, accounting for major market share in 2022.

The region of North America has emerged as the largest market for blood glucose monitoring systems owing to the huge number of people suffering from blood glucose disorders and diabetes due to the rapid changes in lifestyle due to the increasing stress and workload on the people. A huge number of people belonging to the geriatric population reside in this region that suffer from diabetes as a common disorder and need constant monitoring to administer the required dosage of medicines and insulin. It becomes impossible for these people to visit the healthcare sector, so a portable blood glucose monitoring system becomes an essential factor for them. The increasing number of diabetes patients, growing adoption of technologically advanced medical devices and developed per capita medical expenses is some of the key factors principally accountable for the dominant share of regional market.

In the United States, there are new innovations from start-up companies in diabetes industries, like Glooko, OneDrop, verily, Vacate, Insulet, Noom, Bigfoot Biomedical, Virta Health, Diabeloop, Orgenesis, etc. The companies are joining together in diabetes field to bring new technologies, increasing the market in the forecasting period, for instance, In July 2020, Medtronic PLC and Tandem Diabetes Care Inc. announced that they entered into a non-exclusive patent cross-license agreement for certain technologies in the field of diabetes. As a result of the developed status of the country, these sedentary lifestyle practices have increased to a great extent, resulting from the huge number of multinational companies that demand long working hours.

Hence the increasing amount of stress and lifestyle disorders has proved to be the causative factors for diabetes and other blood glucose-related disorders. The demand for blood glucose monitoring systems has seen a tremendous boost in this region, supported by the high disposable income available to the people.

Self-monitoring blood glucose devices are leading the segment with higher revenue in 2022 and are expected to dominate the industry during the forecasted period.

Regular blood glucose monitoring is crucial for individuals with diabetes to manage their medications effectively. SMBG devices allow individuals to measure their blood glucose levels at home, providing immediate feedback on their current status. MBG devices have undergone significant technological advancements, making them more user-friendly, accurate, and convenient. Modern devices are often compact, portable, and require only a tiny blood sample. SMBG provides quick results and may feature features like memory storage, trend analysis, and connectivity to smartphones or other devices for data tracking and sharing with healthcare professionals. Regular monitoring of the patients’ blood glucose levels, makes them better understand how their bodies respond to different factors like diet, exercise, stress, and medication. SMBG is considered an important element of diabetes management daily.

Self-monitoring of blood sugar is an approach wherein people measure their blood sugar levels with the help of a glucose meter. It is sub-segmented into blood glucose meter, testing strips, and lancets. The testing strips segment accounted for the largest revenue share in 2022 owing to the high usage of these strips and affordability. The segment is expected to expand at a lucrative CAGR over the forecast period. However, the continuous blood glucose monitoring (CBGM) devices segment is expected to register the highest growth rate during the forecast period. CBGM is an important diabetes care tool for patients with type 1 diabetes, who are particularly vulnerable to severe and potentially life-threatening hypoglycemia. These devices help in analyzing the glucose level pattern as it provides continuous and real-time blood sugar reading every five minutes.

It is sub-segmented into sensors, insulin pumps, and transmitter and receiver. CGM works through a tiny sensor that is inserted under the skin. This sensor measures sugar level and the transmitter wirelessly sends the information to a monitor. The transmitter and receiver segment held the largest revenue share in 2022.

Based on the application, the type 2 diabetes segment dominated the global market share in 2022, led by the comparatively larger patient population with insulin-dependent type 2 diabetes.

Based on the type of diabetes, the increasing number of patients with type 2 diabetes has boosted the market to a great extent. The huge number of patients with this disorder increases the consumption of insulin and other anti-glycemic drugs used to control the glucose level in the blood. These patients are insulin dependent and hence require the use of glucose monitoring devices which are usually of the invasive type and produce a very minimal amount of pain in the individual’s body. Key market players are conducting extensive research and development programs to make these devices into a noninvasive pattern, making it easier for the geriatric population to administer these medicines. A notable contribution has been recorded on behalf of type 1 diabetes; hence, the requirement for continuous glucose monitoring systems has increased. This system provides high efficiency in monitoring the individual’s blood glucose level.

People who have type 1 diabetes have a high risk of low blood sugar levels or hypoglycemia, which might prove to be fatal for the body of the individual and lead to fainting spells or dizziness. The increasing prevalence of this type of diabetes has emerged as a leading market and is foreseen to show considerable growth during the forecast period. For instance, according to the estimates of the International Diabetes Federation (IDF), around 537 million individuals globally were living with type 2 diabetes in 2021, and among these, 1 in 10 of the patient population are at risk of developing type 2 diabetes. Besides, the type 1 diabetes segment is slated to record a notable CAGR due to the increasing use of Continuous Glucose Monitoring (CGM) systems, owing to its clinically proven efficiency in reducing risks of hypoglycemia in type 1 diabetes patients.

On the basis of end user, the hospital segment dominates the sector with prominent market share and is estimated to dominate the industry during the forecasted period.

The number of diabetic patients is higher in hospitals, particularly those with more complicated cases which have increased the demand for blood glucose monitoring devices. Real-time blood glucose monitoring of hospitalized patients is done by CGM systems and point-of-care (POC) glucose meters. These devices provide healthcare professionals with accurate and timely data, allowing them to adjust medication dosages and develop appropriate treatment plans. With Technological advancements, continuous glucose monitoring (CGM) systems have evolved to provide real-time glucose measurements, trend data, alarms, and data-sharing capabilities. Blood glucose monitoring devices are now easier to use, enabling healthcare professionals to make data-driven decisions for better patient care.

Moreover, the reliable data that BGM devices provide practitioners in a fraction of seconds and the improvement in patients' quality of life have increased their adoption in the outpatient as well as inpatient hospital settings. Hospitals have additional provisions to store and transfer patient information. Furthermore, during the COVID-19 pandemic, the FDA allowed the use of CGM devices in hospitals, and the possibility of another pandemic in the future is expected to enhance the segment growth. However, the home care segment is expected to register the fastest growth rate during the forecast period.

Home-based glucose monitoring is revolutionized by the self-monitoring of blood glucose and is the most widely used method of short-term glucose monitoring throughout the world. Self-monitoring blood glucose (SMBG) is an approach through which people with or without diabetes can measure their blood sugar levels in their homes. Based on the reading, the patient can check the effects of their treatment such as diet, insulin, exercise, and stress management.

Major Drivers

- Increasing Diabetes Prevalence: The primary driver for the global glucose monitoring devices market is the escalating prevalence of diabetes worldwide. The International Diabetes Federation reports a steady rise in the number of individuals living with diabetes, creating a substantial demand for effective monitoring solutions. As diabetes becomes more prevalent, the need for glucose monitoring devices intensifies, driving market growth. The increasing pool of individuals with diabetes fuels the demand for a variety of glucose monitoring devices, including continuous glucose monitoring systems, traditional blood glucose meters, and other innovative solutions.

- Technological Advancements: Rapid advancements in sensor technologies, data analytics, and connectivity have revolutionized the glucose monitoring devices market. The integration of artificial intelligence (AI) and machine learning (ML) has enhanced the accuracy and capabilities of these devices, providing users with real-time insights into their blood glucose levels. Additionally, the development of wearable technology and smart devices has contributed to the accessibility and user-friendliness of glucose monitoring solutions. Improved technology not only enhances the accuracy of glucose monitoring but also contributes to the development of innovative solutions such as continuous glucose monitoring (CGM) systems, smart insulin pens, and remote patient monitoring capabilities. These advancements drive market growth by meeting the evolving needs of both healthcare providers and individuals with diabetes.

Major Challenges

- Regulatory Hurdles: The glucose monitoring devices market faces challenges related to regulatory approvals and compliance. Stringent regulatory processes and varying approval timelines across different regions can impede the introduction of new devices to the market. Ensuring that devices meet the necessary safety and efficacy standards while navigating diverse regulatory landscapes poses a significant challenge for manufacturers. Delays in regulatory approvals can hinder the timely availability of advanced glucose monitoring technologies, limiting options for healthcare providers and individuals seeking the latest and most effective solutions.

- Data Security and Privacy Concerns: With the increasing integration of digital technologies and connectivity in glucose monitoring devices, there is a growing concern about the security and privacy of patient data. As these devices collect and transmit sensitive health information, ensuring robust cybersecurity measures and addressing privacy concerns become critical challenges. Data breaches or privacy issues can erode trust among users and healthcare providers, potentially slowing down the adoption of connected and smart glucose monitoring devices. Manufacturers need to prioritize data security to overcome this challenge.

Major Trends

- Rise of Wearable Glucose Monitoring: The trend towards wearable technology in the glucose monitoring devices market is gaining momentum. Wearable devices, such as continuous glucose monitors integrated into smartwatches or patches, provide individuals with a convenient and unobtrusive way to monitor their blood glucose levels. This trend aligns with the broader movement toward patient-centric care and the integration of health monitoring into daily life. Wearable glucose monitoring devices offer continuous data, promoting better adherence to monitoring routines and allowing for more informed decision-making regarding lifestyle and treatment adjustments.

- Integration of Telemedicine and Remote Patient Monitoring: The increasing adoption of telemedicine and remote patient monitoring is a notable trend in the glucose monitoring devices market. These technologies enable healthcare providers to remotely monitor patients' glucose levels, offer timely interventions, and provide virtual consultations. The trend gained further traction during the COVID-19 pandemic, emphasizing the importance of remote healthcare solutions. Integration with telemedicine enhances patient care by enabling real-time data transmission, reducing the need for in-person visits, and facilitating proactive management of diabetes, especially in remote or underserved areas.

COVID-19 Impact

The pandemic led to disruptions in global supply chains, affecting the production and distribution of medical devices, including glucose monitoring devices. Lockdowns, restrictions on international travel, and disruptions in manufacturing facilities contributed to delays in the production and availability of these devices. The healthcare industry experienced a significant shift in priorities during the pandemic. Resources and attention were redirected towards addressing the immediate challenges posed by COVID-19, impacting the focus on chronic disease management, including diabetes. Non-urgent medical visits and routine check-ups were postponed or canceled, affecting the adoption and usage of glucose monitoring devices. The pandemic accelerated the adoption of telehealth services as a means to provide healthcare while minimizing in-person interactions.This shift had implications for the glucose monitoring devices market, as remote patient monitoring and virtual consultations became more prominent. Patients and healthcare providers increasingly explored ways to manage diabetes remotely, leading to a rise in the use of glucose monitoring devices with telehealth capabilities. With the need to minimize hospital visits and reduce the risk of exposure to the virus, there was a heightened interest in remote patient monitoring solutions. Glucose monitoring devices with capabilities for remote data transmission gained significance, allowing healthcare professionals to monitor patients' blood glucose levels without the need for physical appointments.

Competitive Landscape

The blood glucose monitoring market is highly fragmented, with few major manufacturers present in the market. The CGM devices market is dominated by a few major players, like Dexcom, Medtronics, Abbott, and Senseonics. The market for BGM devices comprises more generic players like Roche, LifeScan, Arkray, Ascensia, etc. Technological innovations in the recent past helped the companies to strengthen their market presence. For example, In Feb 2021, Roche announced the launch of the new Accu-Chek Instant system, a new"connected" blood glucose monitoring (BGM) system, which supports and enables Roche's approach of integrated Personalised Diabetes Management (iPDM). Accu-Chek Instant features Bluetooth-enabled connectivity to the mySugr app, allowing wireless transfer of blood glucose results to the mySugr app.Key Developments

- March 2023 - Abbott received the U.S. FDA approval for its FreeStyle Libre 2 and FreeStyle Libre 3 integrated CGM sensors for integration with automated insulin delivery systems.

- February 2023 - Dexcom, Inc. received the U.S. CMS approval for coverage for its G7 CGM system.

- On February 2023, According to Bloomberg, Apple is progressing towards developing a non-invasive blood glucose monitoring device that could be incorporated into the Apple Watch. The non-invasive device will use lasers to detect glucose levels, replacing the traditional finger prick test. It is currently in the early stage and could be made commercially available once it is made smaller.

- In September 2023, Abbott acquired Bigfoot Biomedical with an aim to strengthen its portfolio of insulin delivery solution.

- In August 2023, Kakao Healthcare inked a partnership with Novo Nordisk with an aim to develop its diabetes management service with AI technology.

- In March 2023, Astellas Pharma collaborated with Roche Diabetes Care for the development and commercialization of Accu-Chek® blood glucose monitoring system with advanced accuracy as a combined medical product with BlueStar®.

Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Glucose Monitoring Devices market Outlook with its value and forecast along with its segments

- Region & Country-wise Glucose Monitoring Devices market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product

- Self-monitoring Devices

- Testing Strips

- Blood Glucose Meter

- Lancets

- Continuous Blood Glucose Monitoring Devices

- Sensors

- Transmitter & Receiver

- Insulin Pumps

By Application

- Type 2 Diabetes

- Type 1 Diabetes

- Gestational Diabetes

By End User

- Hospitals

- Home Care

- Diagnostic Centers

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Glucose Monitoring Devices industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Nipro Corporation

- B. Braun Melsungen AG

- Medtronic plc

- DexCom, Inc

- Ypsomed AG

- LifeScan, Inc

- Bionime Corporation

- Sanofi S.A.

- Senseonics Inc

- DarioHealth

- Nova Biomedical Corporation

- Tandem Diabetes Care

- Morepen Laboratories limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 16.54 Billion |

| Forecasted Market Value ( USD | $ 27 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |