This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This dynamic sector encompasses a wide range of devices designed to improve and maintain health, offering innovative solutions for both acute and chronic conditions. As the demand for personalized healthcare continues to rise, the therapeutic devices industry is poised for unprecedented growth and evolution.

The therapeutic devices industry comprises a diverse array of products, including electrotherapy devices, physical therapy aids, heat and cold therapy tools, ultrasound therapy devices, massage and relaxation equipment, and more. The industry's growth is fueled by factors such as an aging population, increasing prevalence of chronic diseases, and a shift towards home-based healthcare solutions. The Therapeutic Devices industry stands at the intersection of healthcare and technology, encompassing a vast array of tools designed to enhance the well-being of individuals across the globe. From alleviating pain to promoting rehabilitation, these devices play a pivotal role in transforming the landscape of modern healthcare. The Therapeutic Devices industry is incredibly diverse, spanning a spectrum of devices tailored to address various health conditions.

Electrotherapy devices, physical therapy aids, heat and cold therapy tools, massage equipment, and wearable health tech are just a few examples. This diversity underscores the industry's commitment to offering a wide range of solutions to meet the unique needs of individuals seeking therapeutic interventions.

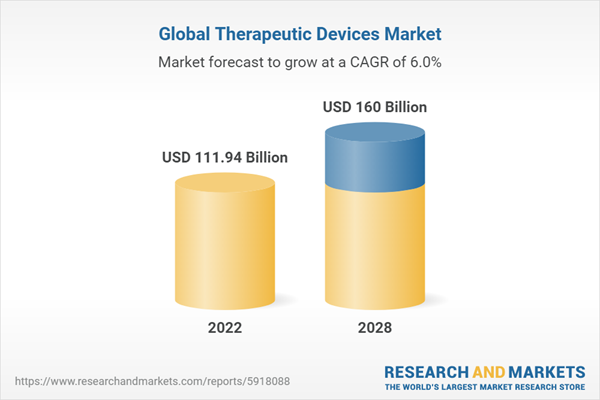

According to the research report, “Global Therapeutic Devices Market Outlook, 2028”, the market is anticipated to cross USD 160 Billion by 2028, increasing from USD 111.94 Billion in 2022. The market is expected to grow with more than 6% CAGR by 2023-28. As populations around the world age, there is a higher prevalence of chronic conditions and musculoskeletal issues, leading to an increased demand for therapeutic interventions. Therapeutic devices play a crucial role in managing and alleviating symptoms associated with aging, such as chronic pain and reduced mobility. At the heart of the Therapeutic Devices industry is a culture of innovation.

The constant quest for improvement and the integration of cutting-edge technologies drive the evolution of these devices. From the development of smart rehabilitation tools to the incorporation of artificial intelligence in treatment plans, innovation is a fundamental force propelling the industry forward.

A notable shift in the industry's nature is the increasing focus on a patient-centric approach. Therapeutic devices are no longer just tools for healthcare professionals; they empower individuals to actively participate in their well-being. Wearable devices, for instance, provide users with real-time health data, fostering a sense of autonomy and awareness. The convergence of various technologies is a defining characteristic of the Therapeutic Devices industry. Wearable seamlessly integrate sensors, data analytics, and connectivity to provide a holistic picture of an individual's health. This technological convergence not only enhances the effectiveness of therapeutic interventions but also contributes to the growing field of digital health. The nature of the Therapeutic Devices industry extends beyond borders, impacting healthcare on a global scale.

As awareness of health and wellness grows worldwide, there is an increasing demand for these devices in both developed and emerging markets. This global impact reflects the industry's commitment to improving healthcare accessibility and outcomes on a broader scale. Given the critical nature of healthcare, the industry operates within a robust regulatory framework. Regulatory bodies set standards to ensure the safety, efficacy, and quality of therapeutic devices.

There is a growing trend towards home-based healthcare, driven by the desire for more convenient and cost-effective solutions. Therapeutic devices that can be used at home, such as wearable health tech, smart rehabilitation tools, and home-use medical devices, are becoming increasingly popular. This shift is particularly relevant in the context of post-surgical recovery, chronic disease management, and preventive care. The healthcare landscape is evolving from a predominantly reactive model to one that emphasizes preventive care and early intervention. Therapeutic devices that aid in preventive measures, such as wearable fitness trackers and biofeedback devices for stress management align with this shift in focus and contribute to the market's growth. Global health challenges, such as the COVID-19 pandemic, have underscored the importance of accessible and remote healthcare solutions.

Telehealth and remote monitoring, often facilitated by therapeutic devices, have become essential components of healthcare delivery, contributing to the market's expansion. The commitment to research and development within the healthcare industry has led to the creation of more sophisticated and targeted therapeutic devices. Ongoing investments in R&D contribute to the introduction of novel technologies and therapies, driving market growth. Transcutaneous Electrical Nerve Stimulation (TENS) units have gained widespread popularity. These portable devices deliver low-voltage electrical currents to targeted areas, providing relief from various types of pain, including chronic conditions like arthritis and back pain. Light therapy devices, originally designed to treat conditions like seasonal affective disorder (SAD), have found applications beyond their initial scope.

They are now being explored as non-pharmacological interventions for mood disorders, showcasing the versatility and adaptability of therapeutic devices. Biofeedback devices have gained recognition for their role in stress management. These devices provide real-time information about physiological processes such as heart rate and muscle tension, empowering individuals to learn and control these functions for stress reduction and relaxation.

The North American region, comprising the United States and Canada, is leading the global therapeutic devices market rooted in a combination of economic, technological, and healthcare-related factors.

North America is home to many of the world's leading technology and innovation hubs. The region boasts a robust ecosystem of research and development, fostering technological advancements in healthcare. The integration of cutting-edge technologies, such as artificial intelligence, IoT, and wearable health tech, into therapeutic devices has been more pronounced in North America. The United States and Canada have well-established and sophisticated healthcare infrastructures. The presence of advanced medical facilities, research institutions, and a network of healthcare professionals contributes to the development, adoption, and utilization of therapeutic devices in clinical settings and home healthcare. The United States, in particular, has one of the highest healthcare spending rates globally.

This significant investment in healthcare infrastructure, research, and technology creates an environment where innovative therapeutic devices are not only developed but also readily adopted into clinical practice. North America has a robust venture capital ecosystem and access to substantial funding for healthcare startups and research initiatives. This financial support accelerates the development and commercialization of novel therapeutic devices, allowing companies to bring innovative solutions to market more quickly. There is a heightened awareness of health and wellness in North America. The population's proactive approach to health management, combined with a willingness to embrace new technologies, has led to a greater acceptance and utilization of therapeutic devices for preventive care and overall well-being. The competitive landscape in North America fosters a culture of innovation among companies vying for market share. This environment encourages collaboration, partnerships, and the sharing of expertise, driving the development and commercialization of new therapeutic devices.

Based on the product type, the wound care management segment has become a dominant force in the therapeutic devices market due to the critical role these devices play in addressing a widespread and diverse range of healthcare needs.

Chronic wounds, including diabetic ulcers, venous ulcers, and pressure ulcers, are increasingly prevalent globally. The aging population, along with the rising incidence of conditions like diabetes, contributes to a higher demand for effective wound care solutions. Therapeutic devices designed for wound management address these prevalent and often challenging healthcare issues. As the global population ages, there is a higher prevalence of chronic health conditions that can lead to non-healing wounds. The elderly population is more susceptible to conditions that impair wound healing, making wound care management devices crucial in providing effective and timely interventions. The field of wound care management has seen significant technological advancements. Advanced wound dressings, negative pressure wound therapy (NPWT) devices, and electrical stimulation devices are examples of innovations that have improved the efficiency and effectiveness of wound healing.

These advancements contribute to the dominance of the wound care management segment. Therapeutic devices in wound care management are not only used for treating existing wounds but also for preventive measures and early intervention. Pressure relief devices, for instance, help prevent the development of pressure ulcers, showcasing the proactive role of these devices in maintaining patient health. The global increase in surgical procedures, whether elective or necessary, contributes to a higher demand for post-operative wound care management. Therapeutic devices play a crucial role in supporting wound healing after surgeries, reducing the risk of infections, and improving overall recovery outcomes. Diabetes is a significant contributor to chronic wounds, particularly in the form of diabetic foot ulcers.

With the global rise in diabetes cases, there is a corresponding increase in the demand for advanced wound care management solutions to address the unique challenges posed by diabetic wounds. The trend towards home-based healthcare and patient preference for non-invasive and convenient solutions has boosted the demand for therapeutic devices in wound care management that can be used at home. This includes wearable devices for continuous monitoring and smart dressings that facilitate remote patient management. In many cases, therapeutic devices offer cost-effective alternatives to traditional wound care methods. Devices such as NPWT systems can accelerate healing, reduce the length of hospital stays, and ultimately lower healthcare costs, making them attractive options for healthcare providers and payers.

Hospitals and clinics serve as primary points of access to healthcare for a large population. The high patient footfall in these settings translates into a substantial demand for therapeutic devices, which are often integral to the treatment plans and interventions prescribed by healthcare professionals.

Hospitals and clinics provide a wide range of healthcare services, covering everything from routine check-ups to complex surgeries. Therapeutic devices, such as those used for wound care, physical therapy, and patient monitoring, are essential components of these comprehensive services, contributing to their widespread use in these settings. Leading hospitals and clinics invest heavily in advanced medical technologies, including therapeutic devices, to provide state-of-the-art care to patients. The availability of cutting-edge therapeutic devices enhances the overall quality of healthcare services offered by these institutions, making them attractive choices for patients seeking advanced treatments. Hospitals provide inpatient care, while clinics offer both inpatient and outpatient services. The diverse healthcare needs of patients receiving various levels of care contribute to a broad demand for therapeutic devices.

For instance, inpatient care may involve the use of devices for post-surgical recovery, while outpatient care may involve devices for chronic disease management or rehabilitation. Hospitals typically have specialized departments and units, such as rehabilitation centers, wound care clinics, and intensive care units, where therapeutic devices play a central role. The presence of these specialized units increases the overall utilization of therapeutic devices within the hospital setting. Hospitals serve as hubs for emergency and critical care. Therapeutic devices, such as life support equipment, ventilators, and cardiac monitoring devices, are critical in these settings to provide immediate and life-saving interventions. The demand for such devices is higher in hospitals due to their capability to handle emergencies. Hospitals and clinics house a diverse range of healthcare professionals, including physicians, nurses, physical therapists, and specialists.

These professionals leverage therapeutic devices as integral components of treatment plans, ensuring proper usage, monitoring, and adjustment of therapeutic interventions based on individual patient needs. Leading hospitals often engage in research and clinical trials to advance medical knowledge and treatment modalities. Therapeutic devices are frequently utilized in these research initiatives, contributing to both the development of new technologies and the validation of existing ones within the hospital setting.

The diabetes segment is experiencing substantial growth within the therapeutic devices market due to increasing prevalence of diabetes worldwide and the demand for effective management and treatment options.

Diabetes is a global health concern, with the number of people affected by the condition steadily increasing. According to the International Diabetes Federation (IDF), millions of people worldwide live with diabetes, and this prevalence is expected to rise. The growing diabetic population creates a significant market for therapeutic devices designed to manage the condition. Type 2 diabetes, often linked to lifestyle factors, is becoming more prevalent globally. The rise in sedentary lifestyles, poor dietary habits, and obesity contributes to an increased incidence of type 2 diabetes. Therapeutic devices play a crucial role in the management and control of blood glucose levels in individuals with type 2 diabetes. The development of advanced insulin delivery devices has significantly improved the ease and precision of insulin administration.

Insulin pumps, insulin pens, and other insulin delivery systems offer more convenient and accurate ways for individuals with diabetes to manage their insulin therapy, contributing to better glycemic control. The integration of technology into insulin delivery devices, such as smart insulin pens and connected devices, allows for better tracking of insulin doses and glucose levels. These devices often sync with mobile apps to provide users and healthcare professionals with comprehensive data for diabetes management. There is a growing emphasis on patient-centric care in diabetes management. Therapeutic devices that empower individuals to actively participate in their diabetes care, such as wearable glucose monitors and smartphone apps for tracking and managing diabetes-related data, align with this trend and contribute to the market growth.

Awareness campaigns, educational initiatives, and healthcare advocacy have increased public awareness of diabetes and the importance of early detection and effective management. This heightened awareness has led to more individuals seeking and adopting therapeutic devices for diabetes care. The integration of telehealth and remote monitoring technologies has become more prevalent, especially in the wake of the COVID-19 pandemic. Telehealth platforms and remote monitoring devices enable healthcare professionals to remotely assess and manage diabetes, enhancing accessibility to care and contributing to the growth of the diabetes therapeutic devices market.

Market Drivers

- Aging Population: The aging demographic, particularly in developed nations, stands as a paramount driver for the global therapeutic devices market. As population’s age, the prevalence of chronic diseases and health conditions increases, necessitating advanced therapeutic interventions. The expanding elderly population seeks solutions that enhance the quality of life, manage age-related health issues, and provide effective treatment options. Consequently, there is a growing demand for therapeutic devices that address conditions prevalent among the elderly, such as cardiovascular diseases, diabetes, and orthopedic disorders. This demographic shift not only propels the need for innovative therapeutic devices but also emphasizes the importance of designing solutions that cater to the unique healthcare requirements of an aging population.

- Technological Advancements: The continuous evolution of technology serves as a significant driver for the global therapeutic devices market. Advancements in miniaturization, connectivity, and materials science are transforming the landscape of therapeutic interventions. Miniaturized and smart therapeutic devices offer enhanced precision, improved usability, and better patient outcomes. From wearable devices that monitor health parameters in real-time to implantable technologies that deliver targeted treatments, technological innovation is at the forefront of improving the efficacy and accessibility of therapeutic interventions. This driver fosters a competitive environment where manufacturers strive to develop cutting-edge devices that not only meet clinical needs but also leverage the latest technological breakthroughs for optimal patient outcomes.

Market Challenges

- Regulatory Compliance: Stringent regulatory requirements and standards set by health authorities worldwide demand rigorous testing and documentation for market approval. Manufacturers encounter hurdles in navigating these regulatory processes, often leading to prolonged timelines for product introduction. Delays in obtaining regulatory approvals not only impede the timely market entry of new therapeutic devices but also increase the financial burden on manufacturers. Striking a balance between innovation and compliance becomes a critical challenge as companies endeavor to meet regulatory standards without compromising the speed of product development and market entry.

- Cost Containment Pressures: Cost containment within healthcare systems globally presents a formidable challenge for manufacturers in the therapeutic devices market. The pressure to control healthcare expenses prompts heightened scrutiny on the pricing of therapeutic devices. Manufacturers must grapple with the dual challenge of maintaining product quality and efficacy while simultaneously adhering to cost constraints. Striking this delicate balance is essential for ensuring affordability and accessibility of therapeutic devices, but it necessitates operational efficiency, innovative cost management strategies, and the ability to demonstrate value in healthcare outcomes. As healthcare providers and payers seek cost-effective solutions, manufacturers must navigate the intricacies of pricing structures without compromising on the integrity of their products.

Market Trends

- Wearable Health Technology: A prominent trend shaping the global therapeutic devices landscape is the widespread adoption of wearable health technology. Wearables, ranging from smartwatches to fitness trackers, are increasingly being leveraged as therapeutic devices for monitoring various health parameters. These devices empower individuals to actively participate in their health management by providing real-time data on fitness, vital signs, and even chronic disease management. The integration of therapeutic functionalities into wearables, such as continuous glucose monitoring for diabetes or electrocardiogram (ECG) capabilities for heart health, exemplifies a trend towards more accessible and consumer-oriented therapeutic solutions.

- 3D Printing in Therapeutic Devices Manufacturing: The utilization of 3D printing technology in the manufacturing of therapeutic devices represents a transformative trend. This trend enables the production of customized implants, prosthetics, and medical components with unprecedented precision and efficiency. 3D printing allows for intricate designs that match the specific anatomical features of individual patients, enhancing the therapeutic efficacy of devices. This trend not only facilitates rapid prototyping and customization but also has the potential to revolutionize supply chains, reducing costs and improving accessibility to personalized therapeutic solutions. The integration of 3D printing technology aligns with the broader trend of advanced manufacturing in healthcare, fostering innovation and pushing the boundaries of what is achievable in therapeutic device development.

COVID-19 Impact

The pandemic triggered widespread disruptions in global supply chains, affecting the production and distribution of therapeutic devices. Lockdowns, travel restrictions, and workforce challenges led to delays in manufacturing, shortages of raw materials, and logistical bottlenecks. This not only slowed down the production of new devices but also impacted the availability of replacement parts and maintenance for existing therapeutic equipment. As healthcare systems worldwide grappled with the surge in COVID-19 cases, there was a significant shift in healthcare priorities. Resources, including manpower and infrastructure, were redirected towards the immediate needs of managing the pandemic. Non-urgent medical procedures, including elective surgeries that often involve therapeutic devices, were postponed or canceled. This led to a decline in the demand for certain therapeutic devices as healthcare facilities focused on addressing the pressing challenges posed by the virus.The pandemic accelerated the adoption of digital health technologies, impacting the therapeutic devices market. Telemedicine and remote patient monitoring gained prominence as healthcare providers sought ways to continue patient care while minimizing in-person interactions. This shift influenced the development of therapeutic devices with enhanced connectivity features, facilitating remote monitoring and telehealth applications. The integration of digital health solutions became a key trend, enabling healthcare professionals to manage and monitor patients effectively from a distance. On the other hand, the pandemic intensified the demand for certain therapeutic devices critical in managing COVID-19 cases.

Devices such as ventilators, oxygen concentrators, and other respiratory support equipment became essential in treating severe respiratory complications associated with the virus. The increased demand for these critical care devices strained global supply chains and prompted a surge in production to meet the heightened healthcare requirements.

Competitive Landscape

The competitive landscape of the global therapeutic devices market is dynamic and characterized by the presence of numerous established players, as well as emerging companies. The landscape is shaped by factors such as technological innovation, regulatory dynamics, strategic collaborations, and market expansion efforts. Some of the major companies profiled in the market are Novo Nordisk A/S, Sanofi S.A., Medtronic plc, Terumo Corporation, Becton, Dickinson and Company, F. Hoffmann-La Roche AG,, B. Braun Melsungen AG, Baxter International Inc., Nipro Corporation, Fresenius Medical Care AG & Co. KGaA, GE HealthCare Technologies, Inc., Toray Industries, Inc, Drägerwerk AG & Co. KGaA, Mindray Medical International Limited, Nihon Kohden Corporation, Cochlear Ltd., WS Audiology A/S, Koninklijke Philips N.V., Teleflex Incorporated and Nikkiso Co., Ltd.Key Developments

- Abbott Libre Sense Glucose Sport Biosensor: This new biosensor is designed for athletes and active individuals who need to monitor their glucose levels during exercise. The biosensor is water-resistant and sweat-resistant, and it can be worn for up to 14 days.

- Philips DreamMapper Sleep Apnea App: This new app is designed to help people with sleep apnea track their sleep quality and manage their treatment. The app provides users with personalized insights into their sleep patterns and can help them to identify and address potential triggers for their sleep apnea.

- Medtronic Guardian Connect CGM System: This new continuous glucose monitoring (CGM) system is designed to help people with diabetes manage their blood sugar levels. The system is easy to use and provides users with real-time glucose data.

- Tandem Diabetes Control-IQ Technology: This new technology is designed to help people with diabetes manage their blood sugar levels more effectively. The technology uses an algorithm to automatically adjust insulin delivery based on the user's blood sugar levels.

- Zoll LifeVest Wearable Defibrillator: This new wearable defibrillator is designed to protect people at risk of sudden cardiac arrest (SCD). The device can detect and automatically deliver a shock to the heart if the wearer experiences SCD.

Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Therapeutic Device market with its value and forecast along with its segments

- Region & Country-wise Therapeutic Device market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product:

- Insulin Delivery Devices

- Dialysis Equipment

- IV Equipment

- Wound Care Management

- Others (ventilators, sleep apnea therapeutic device, respiratory care, hearing aids)

By End User:

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Care Centers (ACCs)

- Other End User

By Indication:

- Wound Care

- Diabetes

- Respiratory Diseases

- Cardiovascular Disorders & Hypertension

- Cancer

- Pregnancy

- Hearing Disorders

- Movement Disorders

- Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Therapeutic Device industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk A/S

- Sanofi S.A.

- Medtronic plc

- Terumo Corporation

- Becton, Dickinson and Company

- F. Hoffmann-La Roche AG

- B. Braun Melsungen AG

- Baxter International Inc.

- Nipro Corporation

- Fresenius Medical Care AG & Co. KGaA

- GE HealthCare Technologies, Inc.

- Toray Industries, Inc

- Drägerwerk AG & Co. KGaA

- Mindray Medical International Limited

- Nihon Kohden Corporation

- Cochlear Ltd.

- WS Audiology A/S

- Koninklijke Philips N.V.

- Teleflex Incorporated

- Nikkiso Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 111.94 Billion |

| Forecasted Market Value ( USD | $ 160 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |