This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Seniors often prefer to age in place, and home healthcare services enable them to do so by providing assistance with daily activities, medication management, and companionship. This can significantly enhance their quality of life and independence. Following surgeries, injuries, or illnesses, home healthcare services offer rehabilitation and therapeutic interventions tailored to the individual's needs. Physical therapists, occupational therapists, and other skilled professionals can provide specialized care in the comfort of the patient's home, promoting a smoother recovery process. Home healthcare services often involve family members in the caregiving process. This engagement provides a support system for the patient and ensures continuity of care. Caregivers can be educated and trained to assist with the patient's needs, creating a collaborative approach to healthcare.

Advances in healthcare technology allow for the integration of telemedicine, remote monitoring, and wearable devices into home healthcare services. This enables healthcare professionals to monitor patients' vital signs, provide virtual consultations, and track the effectiveness of treatments, enhancing the overall quality of care. Home healthcare services can help prevent or delay the need for institutionalized care, such as nursing homes or assisted living facilities. By providing comprehensive care at home, individuals can maintain their independence and avoid the potential challenges associated with institutional living.

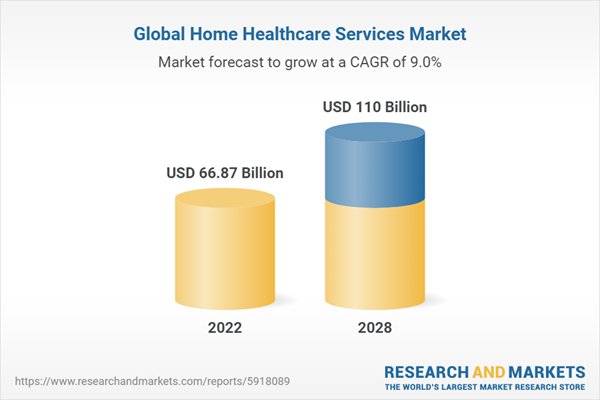

According to the research report, “Global Home healthcare Services Market Outlook, 2028”, the market is anticipated to cross USD 110 Billion by 2028, increasing from USD 66.87 Billion in 2022. The market is expected to grow with more than 9% CAGR by 2023-28. Recovering from an illness or managing a chronic condition can be stressful, and being able to receive necessary care at home can alleviate some of this burden. Patients can remain in familiar surroundings, which can positively impact their mental and emotional well-being. Home healthcare services are designed to be highly personalized and tailored to the specific needs of each patient. Cares plans are developed in collaboration with healthcare professionals, taking into account the individual's medical condition, lifestyle, and preferences. This level of customization often leads to more effective and efficient care delivery.

Home healthcare services play a crucial role in reducing hospital readmissions, particularly for patients recovering from surgeries or managing chronic illnesses. Continuous monitoring and follow-up at home can help identify potential issues early, preventing complications and the need for hospitalization. This not only benefits patients but also contributes to more efficient healthcare resource utilization. The cost-effectiveness of home healthcare services is another significant factor driving their popularity. Home-based care can be more affordable than prolonged hospital stays or frequent clinic visits. It also helps in optimizing healthcare resources, as the demand for hospital beds and facilities is reduced when certain services are provided in the home setting. Advancements in healthcare technology have facilitated the integration of various tools and devices into home healthcare services.

Telemedicine, remote monitoring, and wearable devices enable healthcare professionals to monitor patients' vital signs, provide virtual consultations, and track the effectiveness of treatments. This not only improves the quality of care but also enhances the overall patient experience. Home healthcare services extend beyond direct patient care to provide support and education for family caregivers. Caregivers often play a crucial role in the well-being of patients at home, and home healthcare services can equip them with the necessary skills and resources to fulfill their caregiving responsibilities effectively. As the population ages and the prevalence of diseases increases, the demand for services is likely to grow. These services are particularly beneficial for seniors who wish to age in place and individuals with chronic conditions that require ongoing management.

Based on the region, North America boasts a robust and advanced healthcare infrastructure, providing a solid foundation for the development and expansion of home healthcare services.

The home healthcare market has witnessed remarkable growth and transformation in recent years, with North America emerging as a dominant force in shaping the landscape of in-home healthcare services. The region's commitment to technological innovation, evolving healthcare policies, and a growing aging population has propelled it to the forefront of this burgeoning industry. The region's well-established network of hospitals, clinics, and healthcare facilities complements the integration of in-home care seamlessly into the broader healthcare ecosystem. Technological innovation has played a pivotal role in the growth of the home healthcare market in North America. The region has been at the forefront of adopting and developing cutting-edge technologies such as telehealth, remote patient monitoring, and digital health platforms.

These advancements enhance the efficiency of care delivery, enable real-time monitoring, and facilitate remote consultations between healthcare providers and patients. The demographic shift toward an aging population in North America has fueled the demand for home healthcare services. As individuals age, there is an increased prevalence of chronic conditions and the desire for personalized, in-home care. The region's home healthcare market has responded adeptly to these demographic changes by providing tailored services to meet the unique needs of seniors and those managing chronic illnesses. North America benefits from a supportive regulatory environment and healthcare policies that encourage the growth of home healthcare services. Government initiatives and reimbursement policies have played a crucial role in incentivizing healthcare providers to offer in-home care, making it a viable and attractive option for both patients and service providers.

The home healthcare market in North America has attracted significant investments from both public and private sectors. Healthcare companies and investors recognize the growth potential of in-home care and are actively contributing to the expansion of services, fostering innovation, and enhancing the overall quality of care provided at home. The COVID-19 pandemic highlighted the importance of home healthcare services in ensuring the safety and well-being of patients, especially during times of crisis. North America's ability to quickly adapt and leverage in-home care as a solution for managing healthcare delivery during the pandemic underscored the resilience and flexibility of the region's home healthcare infrastructure.

Skilled home healthcare services represent a paradigm shift in healthcare delivery, emphasizing the delivery of advanced medical care within the intimate and supportive setting of patients' homes.

Skilled home healthcare services have emerged as a crucial component of modern healthcare, providing specialized and high-quality medical care in the comfort of patients' homes. As the demand for personalized healthcare solutions continues to rise, skilled home healthcare services play a pivotal role in addressing the diverse needs of patients requiring advanced medical attention. Skilled home healthcare services encompass a broad spectrum of medical care provided by trained professionals, including registered nurses, physical therapists, occupational therapists, and other skilled practitioners. These professionals bring advanced medical expertise to patients' homes, facilitating the management of complex medical conditions and post-surgical care. Skilled home healthcare services are particularly valuable in post-acute care and rehabilitation.

Patients recovering from surgeries, traumatic injuries, or serious illnesses can benefit from the continuity of care provided by skilled professionals in their home environment. This seamless transition from hospital to home contributes to a smoother recovery process and reduces the risk of complications. Individuals with chronic conditions, such as diabetes, heart failure, or respiratory diseases, often require ongoing medical supervision and management. Skilled home healthcare services offer a proactive and personalized approach to chronic disease management, helping patients adhere to treatment plans, manage symptoms, and prevent exacerbations - all within the familiar and supportive setting of their homes. Skilled home healthcare professionals play a vital role in medication management and monitoring. They ensure that patients take their medications as prescribed, educate them on potential side effects, and monitor for any adverse reactions.

This level of oversight helps enhance medication adherence and contributes to better health outcomes. Skilled nursing care provided at home goes beyond basic medical assistance. Registered nurses in home healthcare services are equipped to administer complex treatments, wound care, intravenous therapies, and other advanced medical interventions. This level of expertise allows patients to receive specialized care without the need for prolonged hospital stays. Physical therapists, occupational therapists, and speech-language pathologists bring rehabilitative therapies directly to patients' homes. This is especially beneficial for individuals with mobility issues, cognitive impairments, or speech disorders. Skilled home healthcare services focus on restoring and improving patients' functional abilities within the context of their home environment.

Rehabilitation therapy services have emerged as leaders in the home healthcare services market due their effectiveness in providing specialized care, promoting patient recovery, and contributing to overall healthcare outcomes.

Rehabilitation therapy services, including physical therapy, occupational therapy, and speech therapy, are inherently personalized and patient-centered. These services are tailored to address the specific needs and goals of individual patients, taking into account their unique conditions, abilities, and challenges. The emphasis on personalization enhances the effectiveness of rehabilitation in a home setting. After surgeries or medical procedures, patients often require rehabilitation to regain strength, mobility, and function. Home-based rehabilitation therapy allows individuals to receive targeted care in a familiar and comfortable environment, promoting a smoother recovery process. This approach also reduces the risk of hospital readmissions and complications. Rehabilitation therapy services, including physical therapy, occupational therapy, and speech therapy, are inherently personalized and patient-centered.

These services are tailored to address the specific needs and goals of individual patients, taking into account their unique conditions, abilities, and challenges. The emphasis on personalization enhances the effectiveness of rehabilitation in a home setting. After surgeries or medical procedures, patients often require rehabilitation to regain strength, mobility, and function. Home-based rehabilitation therapy allows individuals to receive targeted care in a familiar and comfortable environment, promoting a smoother recovery process. This approach also reduces the risk of hospital readmissions and complications.

Rehabilitation therapy services adopt a holistic approach to functional improvement. Beyond addressing specific physical challenges, therapists often consider the broader aspects of a patient's life, including their home environment, daily activities, and personal goals. This comprehensive approach contributes to a more well-rounded and effective rehabilitation experience.

Home-based rehabilitation therapy services often involve family caregivers. Therapists educate caregivers on exercises, techniques, and strategies to support the patient's rehabilitation journey. This collaborative approach ensures that the benefits of rehabilitation extend beyond therapy sessions, promoting long-term functional gains.

Respiratory diseases require some of the highest levels of healthcare services due to the complexity and seriousness of these conditions.

Respiratory diseases encompass a wide range of disorders affecting the lungs and respiratory system, including chronic conditions like asthma and chronic obstructive pulmonary disease (COPD) and acute illnesses such as pneumonia and respiratory infections. Respiratory diseases are highly prevalent worldwide and represent a significant burden on public health. Conditions like asthma and COPD affect millions of people globally, requiring ongoing medical attention, monitoring, and management. Respiratory diseases come in various forms, each with its own set of challenges and complexities. From chronic conditions that require long-term management to acute illnesses that demand immediate and intensive care, the diversity of respiratory diseases necessitates a broad spectrum of healthcare services. Respiratory diseases can profoundly impact an individual's quality of life.

Symptoms such as shortness of breath, coughing, and fatigue can limit daily activities, leading to a decreased overall well-being. Addressing these symptoms and providing comprehensive care often involves a multidisciplinary healthcare approach. Many respiratory diseases, particularly chronic conditions like COPD, are prone to acute exacerbations. These episodes can result in severe respiratory distress and may require emergency medical intervention, including hospitalization, ventilatory support, and other intensive care measures. Chronic respiratory diseases often require ongoing management and monitoring to prevent exacerbations and optimize the patient's respiratory function. This includes medication management, pulmonary rehabilitation, lifestyle modifications, and regular follow-up with healthcare providers. Effective healthcare services for respiratory diseases aim not only to manage symptoms but also to prevent complications.

Respiratory conditions can lead to complications such as respiratory failure, pneumonia, and cardiovascular issues. Timely and appropriate healthcare services are crucial to prevent or manage these complications. Patients with respiratory diseases benefit significantly from education on disease management and self-care. Healthcare services must include patient education on medication adherence, recognizing symptoms, lifestyle modifications, and techniques to manage and prevent exacerbations. Environmental factors, such as air pollution and occupational exposures, contribute to the development and exacerbation of respiratory diseases. Healthcare services must address these external factors, emphasizing preventive measures and patient education on environmental risk reduction.

Market Drivers

- Aging Population and Chronic Diseases: The increasing aging population worldwide, coupled with the rising prevalence of chronic diseases, stands as a significant driver for the global home healthcare services market. As individuals age, there is a higher likelihood of developing chronic conditions that require ongoing medical attention and assistance. Home healthcare services provide a viable solution by offering personalized care in the comfort of patients' homes. This not only improves the quality of life for the elderly but also reduces the burden on traditional healthcare facilities. The convenience and cost-effectiveness of home healthcare services make them a crucial component in addressing the healthcare needs of the aging population.

- Technological Advancements: Rapid advancements in healthcare technology play a pivotal role in driving the growth of the global home healthcare services market. The integration of telehealth, wearable devices, and smart healthcare solutions has revolutionized the delivery of healthcare services at home. Remote patient monitoring, telemedicine consultations, and smart devices for medication management enhance the efficiency and effectiveness of home healthcare. These technological innovations not only empower patients to actively participate in their care but also enable healthcare providers to remotely monitor and manage patients' health conditions. The adoption of technology in home healthcare services enhances accessibility, reduces hospital readmissions, and contributes to overall healthcare cost savings.

Market Challenges

- Regulatory and Reimbursement Challenges: One of the primary challenges facing the global home healthcare services market is the complex regulatory landscape and reimbursement issues. Different countries and regions have varying regulations governing home healthcare services, making it challenging for providers to navigate and adhere to compliance standards. In addition, reimbursement policies for home-based care services may not be well-established or may vary, creating financial uncertainties for both providers and patients. Overcoming these regulatory and reimbursement challenges requires collaboration between healthcare providers, policymakers, and insurance companies to establish clear guidelines that facilitate the seamless delivery of home healthcare services.

- Workforce Shortages and Training Needs: The growing demand for home healthcare services has resulted in an increased need for skilled healthcare professionals. However, the industry faces challenges related to workforce shortages and the specific training required for home-based care. Home healthcare providers must recruit and retain qualified personnel, including nurses, therapists, and home health aides, to meet the diverse needs of patients. Training programs must be comprehensive and tailored to address the unique aspects of delivering care in a home setting. Addressing these workforce challenges is crucial to ensuring the quality and sustainability of home healthcare services on a global scale.

Market Trends

- Patient-Centric Care Models: A prominent trend in the global home healthcare services market is the shift towards patient-centric care models. Healthcare providers are increasingly focusing on delivering personalized and patient-specific care plans that cater to individual needs and preferences. This trend aligns with the broader movement towards value-based care, emphasizing improved patient outcomes and experiences. Home healthcare services are evolving to offer more comprehensive and tailored solutions, leveraging patient engagement tools, remote monitoring technologies, and collaborative decision-making to enhance the overall care experience for individuals in their homes.

- Integration of Artificial Intelligence (AI) and Remote Monitoring: The integration of artificial intelligence (AI) and remote monitoring technologies is emerging as a transformative trend in the global home healthcare services market. AI-driven algorithms can analyze patient data, predict health trends, and provide timely insights to healthcare professionals. Remote monitoring devices, such as wearable sensors and smart home health devices, enable continuous tracking of vital signs and health parameters. This real-time data facilitates proactive intervention, reducing the risk of complications and hospital readmissions. As technology continues to advance, the integration of AI and remote monitoring is expected to play a pivotal role in enhancing the effectiveness and efficiency of home healthcare services on a global scale.

COVID-19 Impact

The pandemic posed challenges to the global supply chain and created resource constraints in the home healthcare services market. Shortages of personal protective equipment (PPE), medical supplies, and skilled healthcare professionals impacted the delivery of services. Home healthcare providers faced the dual challenge of ensuring the safety of both patients and caregivers while coping with disruptions in the availability of essential resources. COVID-19 highlighted the vulnerability of individuals with underlying health conditions, emphasizing the importance of effective chronic disease management.Home healthcare services played a crucial role in supporting patients with chronic illnesses by providing ongoing care, medication management, and monitoring of vital signs. The pandemic underscored the need for robust and scalable home-based solutions to manage chronic conditions and prevent avoidable hospitalizations.

In response to the pandemic, there was an increased emphasis on infection prevention and control measures within home healthcare services. Providers implemented rigorous protocols to minimize the risk of COVID-19 transmission during home visits. This included training caregivers on proper hygiene practices, ensuring the availability of PPE, and implementing screening processes to identify potential cases early. The pandemic prompted a significant surge in the demand for home-based healthcare services as individuals sought to minimize their exposure to the virus in traditional healthcare settings.

Patients with chronic conditions and those requiring post-acute care increasingly turned to home healthcare as a safer alternative. The shift towards home-based care during the pandemic highlighted the flexibility and adaptability of these services in addressing healthcare needs while minimizing the risk of infection.

COVID-19 accelerated the adoption of telehealth and virtual care solutions within the home healthcare services sector. With lockdowns, social distancing measures, and concerns about in-person healthcare visits, telemedicine became a crucial tool for remote consultations, monitoring, and follow-up care. The integration of telehealth technologies allowed healthcare providers to maintain continuity of care and enabled patients to receive medical attention without leaving their homes.

Competitive Landscape

The competitive landscape of the global home healthcare services market is dynamic and characterized by the presence of numerous established players, as well as emerging companies. The landscape is shaped by factors such as technological innovation, regulatory dynamics, strategic collaborations, and market expansion efforts. Some of the major companies profiled in the market are Becton, Dickinson and Company, UnitedHealth Group Incorporated, Terumo Corporation, Baxter International Inc, Fresenius SE & Co. KGaA, CVS Health Corporation, Johnson & Johnson, Novartis AG, Abbott Laboratories, ICU Medical, Inc, F. Hoffmann-La Roche AG, Siemens Healthineers, Cardinal Health, Inc., Genesis HealthCare and VITAS Healthcare.Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Home Healthcare Services market with its value and forecast along with its segments

- Region & Country-wise Home Healthcare Services market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Type:

- Skilled Services

- Unskilled Services

By Skilled Services Type:

- Rehabilitation Therapy Services

- Hospice and Palliative Care Services

- Respiratory Therapy Services

- Infusion Therapy Services

- Pregnancy Care Services

- Others (Transportation, Laboratory and X-ray imaging, Pharmaceutical services)

By Indication:

- Respiratory Diseases

- Movement Disorders

- Pregnancy

- Cardiovascular Disorders & Hypertension

- Cancer

- Diabetes

- Wound Care

- Hearing Disorders

- Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Home Healthcare Services industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Becton, Dickinson and Company

- UnitedHealth Group Incorporated

- Baxter International Inc

- Fresenius SE & Co. KGaA

- CVS Health Corporation

- Johnson & Johnson

- Novartis AG

- Abbott Laboratories

- ICU Medical, Inc

- F. Hoffmann-La Roche AG

- Siemens Healthineers

- Cardinal Health, Inc.

- Genesis HealthCare

- VITAS Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 66.87 Billion |

| Forecasted Market Value ( USD | $ 110 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |