The global furniture market is developing steadily, supported by trends of urbanization, the rise in disposable incomes, and increased home improvement activities. Sustainability and eco-awareness are also a big driver and have consumers seeking recyclable material and modular designs. Among the trends observed are multi-functional furniture for small spaces, smart furniture that integrates with technology, and nature-inspired designs in organic materials like wood and ceramics, thus boosting the furniture market growth.

An example is IKEA's effort to expand the e-commerce platform while making furniture that is eco-friendly and recycled. The company incorporates IoT features such as smart lighting and app-controlled furniture. In addition, government incentives for energy-efficient production methods help IKEA save costs, increase sustainability, and respond to increased demand for green products.

The demand for stylish yet affordable furniture has become central to business models as consumers seek functional and aesthetically pleasing designs at competitive prices. For instance, modular furniture sales have skyrocketed with increased mobility and smaller living spaces. As the urban population is expected to reach 68% by 2050, according to the UN, furniture companies are focusing on innovative, space-saving designs to meet evolving consumer needs.

Key Trends and Developments

October 2024

Nilkamal launched Nilkamal Homes with 60 stores nationwide, offering premium home furniture and decor, available through both physical and online platforms. The collection includes stylish sofas, elegant beds, dining sets, utility furniture, and essential household items such as décor, bedding, crockery, cookware, and mattresses.December 2024

Nitori, Japan's largest furniture retailer, opened its first Indian store in Mumbai's R City Mall in December 2024, marking the company’s entry into India’s growing home furnishings market. With plans to open 289 stores by 2032, the Nitori Group aims to expand its network of stores. It also aims to operate 3,000 stores globally and achieve a sales target of 3 trillion yen (approximately INR 1.65 lakh crore) by the same year.June 2024

British designer John Pawson launched a bespoke wooden furniture collection for Dinesen, emphasizing timber's natural proportions, celebrating their 30-year collaboration. The collection contains two sets of furniture the recently released Lounge Series and an update to the Dining Series.May 2024

Remax Furnitures launched its flagship store offering customized luxury furniture and interior design solutions, enhancing home aesthetics and customer experiences.Sustainability in Furniture Production

Sustainability continues to dominate the global furniture market, where consumers are demanding more and more green, recyclable, and renewable products. The United States Environmental Protection Agency emphasizes that wood is one of the biggest material categories for furniture production, where wood, textiles, and metals are being recycled and recovered. Also, there is the utilization of environmentally friendly materials. For instance, there are FSC-certified woods in the market. More than that, awareness of consumers with regards to the impact on the environment in making traditional furniture has increased consumers' interest in brands that practice eco-friendly materials and processes, shaping the furniture market dynamics and trends.Smart Furniture Integration

Smart furniture is one innovation that is transforming the furniture market through technological integration in enhancing functionality. The desk with a built-in charging station, the smart bed that adjusts to the user's preference, and the sofa with an embedded speaker are examples of this. Smart furniture is designed for modern consumers who are tech-savvy and want convenience and efficiency in the home office. According to the United States Environmental Protection Agency (EPA), innovations in furniture technology also support more sustainable manufacturing processes, helping brands reduce their environmental footprint. Smart features in furniture are also set to continue growing due to the increasing use of technology in daily life.Minimalism and Multifunctionality

The increasing trend in demand for multi-functional and minimalist furniture grows as living spaces become smaller in the city. This is because of the optimization of space that can be achieved with furniture that integrates multiple functions like storage and seating, in compact apartments and homes, pushing the furniture demand. For instance, modular couches which double up as beds, or coffee tables that have secret storages. This trend reflects a larger shift toward efficient use of space and resources, which is aligned with the growing desire for sustainable living. According to the EPA, this movement helps reduce material waste and encourages the development of more adaptable and resource-efficient furniture.Recycled and Reused Materials

The global furniture market has seen a dramatic shift to recycled and reused materials lately. Manufacturers have started infusing their designs with products like reclaimed wood, plastic from recycled items, and upcycled fabrics. The EPA stated that in 2018, more than 9 million tons of furniture were generated in the United States. However, a significant part of it ends up in landfills, while efforts to recycle or recover materials such as wood and metals are increasing. The use of recycled materials mitigates environmental damage and supports the circular economy, whereby products are designed to be reused, refurbished, or recycled instead of being disposed of.Global Furniture Industry Segmentation

The report titled “Global Furniture Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Metal

- Wood

- Plastic

- Glass

- Others

Market Breakup by End Use

- Residential

- Commercial

Market Breakup by Distribution Channel

- Offline

- Online

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Furniture Market Share

Growing Demand for Metal and Plastic Furniture in Commercial and Budget-Conscious Segments

Metal furniture is gaining prominence in commercial environments, particularly in office spaces, outdoor setups, and hospitality sectors due to its durability, low maintenance, and sleek aesthetics, aiding the furniture market. The rising demand for industrial-style interiors in urban homes has also pushed residential adoption. Metal furniture, particularly for desks and seating, is favored for its ability to withstand heavy use in high-traffic environments like co-working spaces and corporate offices. The industrial-style interior trend, popular in urban homes, has driven residential demand for metal furniture, such as steel-framed tables and chairs. Social media platforms like Instagram and Pinterest are fueling this trend, with consumers seeking minimalist, durable pieces for compact living spaces.Plastic furniture is widely used in budget-conscious and temporary setups. Its appeal lies in affordability, ease of movement, and resistance to moisture, making it ideal for outdoor use, events, and mass-market residential use, particularly in developing regions. The rise of quick-service restaurants and urban eateries has driven adoption of plastic chairs and tables, valued for their ease of cleaning and portability. A January 2025 UN Tourism report highlights the near-full recovery of international tourism, boosting demand for cost-effective furniture solutions in hospitality.

Commercial Furniture Market Gains Traction with Smart, Ergonomic, and Sustainable Innovations

The commercial segment is witnessing strong momentum with the expansion of office spaces, hospitality chains, and educational institutions. Demand for furniture market is focused on ergonomic, durable, and space-efficient designs, especially in metro cities and business hubs across Asia-Pacific and North America. In North America, corporate headquarters and tech firms are investing in furniture that integrates smart technology, such as IoT-enabled desks for posture correction and productivity monitoring, reflecting a shift toward health-focused workspaces. Recent industry events, such as NEOCON 2025 in Chicago (June 9-11), showcased brands like KOHO Starlook debuting sustainable and ergonomic collections, including height-adjustable desks and modular seating to support hybrid work models.Surge in Online Furniture Sales Driven by Urbanization and Digital Innovation

Online sales are growing rapidly due to increased internet access, wider product availability, and improved delivery logistics. Digital-native brands and virtual try-before-you-buy technologies have improved consumer confidence in buying furniture online, especially among urban millennials. As of 2024, over 56% of the global population lives in urban areas, where high-speed internet is more accessible, facilitating e-commerce adoption. This urban shift is expected to intensify, with the United Nations projecting 68% urbanization by 2030, further expanding the online furniture market’s reach.Furniture Market Regional Analysis

Asia’s Expansion and Europe’s Eco Focus Drive Furniture Demand

The Asia Pacific furniture market is growing due to rapid urbanization, mainly in China and India. In India, the number of houses under PMAY (Pradhan Mantri Awas Yojana) to be constructed by 2024 is approximately 20 million, which will add to the demand for furniture. In China, over 60% of sales occur through e-commerce in furniture. Rising middle-class income in the region and interest in multi-functional furniture drives innovation. Modular furniture is gaining acceptance in Japan, where compact living spaces have become the norm.Stringent EU environmental regulations promote circular economy models in Europe's furniture industry. Horizon Europe funds innovation in sustainable materials, which promote biodegradable materials. Scandinavian countries are dominant in minimalist design trends. The Artisan Support Policy in Italy strengthens traditional craftsmanship. Brexit-related trade readjustments offer opportunities for local production within the UK to focus on supply chain resilience.

Competitive Landscape

Furniture market players are currently differentiating through sustainability, innovative designs, smart technology integration, and customization options. Companies like IKEA emphasize recyclable materials and modular designs, whereas startups are using 3D printing for efficiency. Integration of e-commerce and virtual tools like AR/VR are also helping to enhance the customer experience, thereby demonstrating flexibility toward changing consumer preferences and regional demands. Premium furniture companies, on the other hand, focus on craftsmanship and high-end luxury products that appeal to premium markets.Steelcase Inc.

Steelcase Inc. is a prominent furniture company, based in Michigan, the United States. It was established in 1912, and it is involved in designing and manufacturing furniture for commercial purposes. Its products are sold in more than 770 locations around the world.

Haworth Inc.

Haworth Inc. is one of the largest office furniture manufacturers in the world. It was founded in 1948 and is headquartered in Michigan, the United States. With a presence in over 150 countries, the company aims to develop high-quality furniture that can enhance the productivity of employees.

Kinnarps AB

Kinnarps AB, established in 1942, is a company that designs, manufactures, and markets furniture for use in schools, hospitals, and offices, among others. Its furniture pieces are known for their quality, functionality, ergonomics, and aesthetics.Other furniture market players include Poltrona Frau S.p.a., VITRA INTERNATIONAL AG, Knoll®, Inc., NOWY STYL Sp. z o.o., Design Holding Group, Nitori Co., Ltd., Hooker Furnishings, Natuzzi S.p.A., and Ethan Allen Global, Inc.

Key Features of the Report:

- Covers market size, share, and forecasts from 2025 to 2034

- Provides segment-wise analysis by type, end use, distribution channel, and region

- Evaluates key trends shaping residential and commercial furniture demand

- Assesses market drivers, challenges, and investment opportunities globally

- Includes profiles of leading furniture manufacturers and competitive landscape

- Offers detailed import-export data and supply chain insights

- Trusted source for reliable and up-to-date market intelligence

- Customised solutions tailored to your strategic business goals

- Backed by expert analysts with deep industry knowledge

- Actionable insights that support smart investment decisions

Table of Contents

Companies Mentioned

The key companies featured in this Furniture market report include:- Steelcase Inc.

- Haworth Inc.

- Kinnarps AB

- Poltrona Frau S.p.a.

- VITRA INTERNATIONAL AG

- Knoll®, Inc.

- NOWY STYL Sp. z o.o.

- Design Holding Group

- Nitori Co., Ltd.

- Hooker Furnishings

- Natuzzi S.p.A.

- Ethan Allen Global, Inc.

Table Information

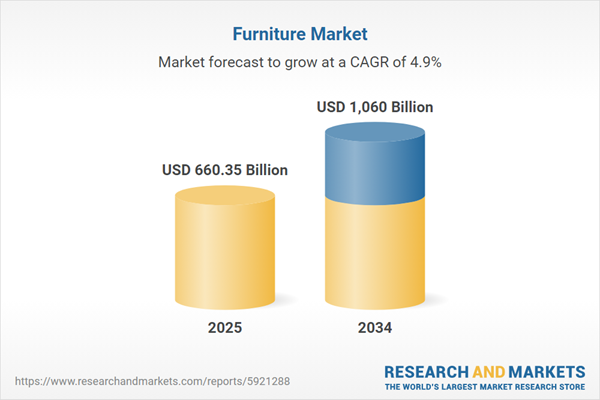

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 660.35 Billion |

| Forecasted Market Value ( USD | $ 1060 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |