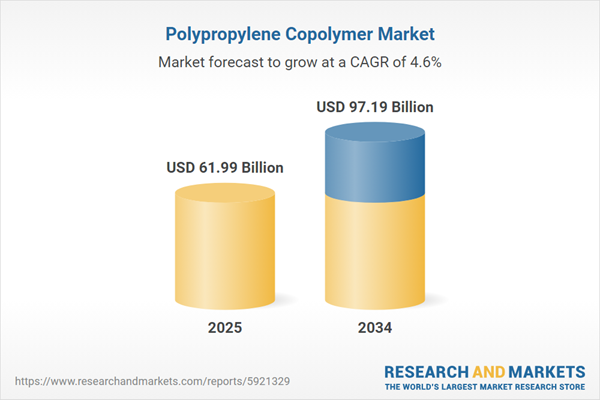

Polypropylene Copolymer Market Growth

Polypropylene copolymer is a thermoplastic resin produced by the polymerisation of propylene and ethylene. Originally it was a creation of Karl Rehn, a German chemist, but Natta perfected and synthesised the first polypropylene resin in Spain, in 1954. The main characteristics of polypropylene are its heat resistance, recyclability, and high tensile strength. Also, it is the second-most widely used thermoplastic in the world. The rising demand for lightweight, high-performance materials in the automotive and packaging industries is propelling growth of the polypropylene copolymers market. For example, automotive manufacturers are increasingly turning to PPC for interior and exterior vehicle components due to its superior impact resistance, flexibility, and lower density, which helps reduce overall vehicle weight and improve fuel efficiency.Similarly, the packaging industry uses PPC in the production of containers, films, and caps because of its excellent balance between strength and flexibility, which also ensures durability and reduces material usage. Additionally, advancements in medical devices like syringes and surgical tools, which require materials that are both flexible and biocompatible, are fuelling polypropylene copolymers demand in the healthcare sector. The healthcare sector values these materials for their heat resistance and transparency. In the automotive industry, lightweight polypropylene copolymers contribute to fuel efficiency by reducing vehicle weight without compromising safety or performance. Furthermore, the market is benefiting from development of recyclable polypropylene copolymer solutions to meet rising environmental standards.

Key Trends and Developments

Growing focus on recyclability initiatives, advanced in manufacturing technologies, and expansion in automotive applications are the key trends propelling the market growth.September 2024

Asahi Kasei decided to showcase its innovations like LEONATM 14G30 for valve applications, SunForceTM foam for thermal insulation, and XYRONTM plastic for enhanced battery safety in electric vehicles (EVs) at the 2024 International Motor Show in Munich. The company is also introducing a new grade of LASTANTM flame-retardant fabric to protect against thermal runaway in EV batteries. These solutions can improve EV performance and provide a favourable polypropylene copolymer market outlook.September 2024

KPT Piping System, a prominent manufacturer of PPR pipes, was recognised at the Brands Impact's International Quality Awards 2024 due its focus on producing high-quality and durable plumbing pipes. It uses advanced materials like Basel and Hyosung in pipes that resist corrosion and can withstand high temperatures.July 2024

In the US market, prices of polypropylene surged by approximately 17.5% due to increased production costs from higher feedstock propylene prices, which rose by about 6% in June. High crude oil prices and substantial rise in US electric and hybrid vehicle sales were other key drivers of price increases.June 2024

Polypropylene prices have decreased by 152 CNY/T, or 2.02%, since the start of 2024. The price is projected to reach around 7520.34 CNY/T by the end of October 2024 and is expected to further decline by 220.23 CNY/T in the next 12 months. The decline in polypropylene prices is likely to decrease the polypropylene copolymer market revenue. However, sustained demand from key sectors such as packaging and automotive may mitigate this effect in the forecast period.Growing Focus on Recyclability Initiatives

The focus on sustainability in the PPC market is growing rapidly as the chemical recycling rate of polypropylene is expected to see significant improvements in efficiency. As per industry reports, an estimated increase in the recycling rate of PPC from 10% to 20% by 2032 is expected. This shift is largely driven by companies like LyondellBasell, which is actively participating in initiatives such as NEXTLOOPP to develop food-grade recycled polypropylene. In Europe, regulations promoting the use of recyclable materials have further accelerated the polypropylene copolymers demand growth in industries such as packaging and automotive. Recycled PPC help companies meet stringent environmental standards while reducing production waste.Expansion in Automotive Applications

Polypropylene copolymers are becoming essential in the automotive sector, particularly as manufacturers seek lightweight materials that enhance fuel efficiency without compromising safety. In 2024, the push for electric vehicles (EVs) has changed polypropylene copolymers market dynamics in applications such as battery housings and lightweight structural components. For example, Toyota is using Mitsui Chemicals' polypropylene copolymers in their EV models to reduce weight and improve energy efficiency. Similarly, Ford has adopted polypropylene copolymers in their vehicle interiors for components like dashboards and door panels.Regulatory Changes Promoting Safety and Compliance

Regulatory frameworks focusing on safety and environmental compliance are influencing the adoption of polypropylene copolymers. In 2024, new regulations in various regions require that materials used in food contact applications meet stringent safety standards. Polypropylene copolymers have gained popularity due to their FDA compliance and excellent chemical resistance, making them suitable for direct contact with foodstuffs. For example, TotalEnergies produces a range of food-safe polypropylene copolymers that comply with European regulations for food contact materials. This regulatory trend encourages manufacturers to invest in high-quality materials that adhere to safety guidelines while enhancing their product offerings.Advanced in Manufacturing Technologies

The rise of advanced manufacturing technologies like 3D printing and injection moulding is a significant trend in the polypropylene copolymer market. The global demand for 3D printing materials is projected to grow significantly, which can also increase the demand for PPC as these materials are lightweight, flexible, and suitable for use in 3D printing processes. Moreover, as per industry reports, there are 871,000 3D printing machines in use worldwide, resulting in further growth. In addition, the use of PPC in automotive applications can contribute to a reduction of up to 15% in vehicle weight, which in turn reduces CO2 emissions and reduces fuel consumption. This trend is pushing manufacturers to invest in technologies that enable the production of high-performance PPC products.Polypropylene Copolymer Market Trends

The rise of e-commerce has significantly increased the demand for effective and protective packaging solutions, driving the use of polypropylene copolymers in this sector. These materials offer excellent moisture and chemical resistance, making them ideal for food packaging applications. According to the Packaging Industry Association of India, the packaging sector is currently one of the fastest-growing industries in the country, with an annual growth rate of 22-25%.Companies like Amcor are using polypropylene copolymers to produce flexible packaging solutions that are both durable and recyclable. According to Amcor’s 2024 Sustainability Report, over 94% of Amcor's flexible packaging portfolio by area featured a recycle-ready solution, and 95% of their rigid packaging was recyclable in practice and at scale. One notable product is the AmPrima Flowpack Pro, designed for bakery products, which achieved a carbon footprint reduction of up to 82% compared to traditional packaging.

Sealed Air is also at the forefront of using polypropylene copolymers to enhance product protection during shipping. Their Bubble Wrap brand, known for its cushioning properties, has been innovated using polypropylene copolymers to improve durability while reducing environmental impact. In 2024, Sealed Air introduced a new version of Bubble Wrap that incorporates 30% recycled content, demonstrating their commitment to sustainability while maintaining product performance.

Opportunities in Polypropylene Copolymer Market

The construction industry offers immense potential for growth of the market as PPC is increasingly being used in pipes and fittings materials due to its durability, resistance to heat and chemicals, and lightweight nature. In 2024, the global urbanisation level is projected to reach 57%, according to the United Nations. This rapid urban growth, particularly in regions like Asia-Pacific and the Middle East, is resulting in initiation of many infrastructure projects and is simultaneously creating polypropylene copolymer market opportunities. Notable initiatives include Saudi Arabia’s NEOM megacity, a USD 500 billion project aimed at creating a futuristic, sustainable urban hub, and India's Smart Cities Mission, which focuses on developing 100 smart cities to accommodate growing populations and enhance urban living.Another opportunity arises from technological advancements in polymer processing, allowing for more efficient production of high-performance PPC variants with enhanced insulation properties, such as flame retardancy, UV stability, and resistance to electrical conductivity, which cater to specific needs in electronics industries. The increased production of electronic devices such as smartphones, tablets, and electric vehicles is also impacting polypropylene copolymer demand forecast positively.

These factors, combined with the development of projects like China’s Belt and Road Initiative, which involves large-scale infrastructure development across multiple countries, underscore the rising opportunities for PPC.

Polypropylene Copolymer Market Restraints

One of the key restraints in the market is the volatility in raw material prices, primarily driven by fluctuations in crude oil prices, as polypropylene is derived from petrochemical feedstock. For instance, the price of Brent crude oil has shown significant fluctuations, ranging from USD 64 per barrel in 2019 to a peak of over USD 120 per barrel in 2022, which has had a direct impact on the cost of polypropylene production. This price instability affects the profitability of manufacturers, causing uncertainty in the supply chain and influencing overall polypropylene copolymer market dynamics and trends.Environmental concerns related to plastic waste also act as deterrent to market’s growth. According to a 2021 report by the European Union, over 29 million tonnes of plastic waste is generated annually, of which only 9% is recycled. In response, stringent policies like the EU’s Single-Use Plastics Directive, which aims to ban or reduce the use of plastic products such as cutlery and packaging, are impacting polypropylene copolymer demand. As a result, the market is experiencing slower growth. Many companies are also shifting towards biodegradable or reusable alternatives, further restraining the demand for PPC in many markets.

Polypropylene Copolymer Industry Segmentation

“Polypropylene Copolymer Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Application

- Fibre and Fabrics

- Automotive

- Packaging

- Construction

- Medical

- Consumer Goods

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Polypropylene Copolymer Market Share

Market Insights by Application

In non-woven fibres and fabrics, the use of polypropylene copolymer is steadily growing. For example, in 2024, INDA (Association of the Nonwoven Fabrics Industry) reported that polypropylene accounts for 55% of the raw material in non-woven products used for diapers, sanitary items, and medical wipes.As per polypropylene copolymer market overview, the product is also heavily used in automotive industries. In 2024, the European Automobile Manufacturers Association (ACEA) indicated that polypropylene copolymers now make up 45% of plastic materials in vehicle components, a 5% increase from 2022. The ongoing shift towards electric vehicles (EVs) has further accelerated the product’s demand due to its lightweight nature. The EU’s new emission standard for 2024 mandates a reduction of 5% in CO2 emissions for passenger cars, leading automakers like Tesla and Volkswagen to expand their use of polypropylene copolymer parts in battery cases and interior components.

However, the market is dominated by packaging applications. Smithers Pira reports that 65% of food and beverage packaging in North America now uses polypropylene copolymers, a rise of 10% over the past two years. The 2024 EU regulation demanding 35% recycled content in plastic packaging has driven increased adoption of polypropylene in eco-friendly packaging solutions. A 2024 survey in the U.S. revealed that 72% of consumers prefer products packaged with recyclable materials, further boosting the polypropylene copolymers market value.

The demand for polypropylene copolymer in medical devices is also surging. The World Health Organisation (WHO) reported that 85% of disposable medical devices, including syringes and IV tubes, now rely on polypropylene copolymers, an increase from 80% in 2022. The rising demand for medical testing devices is also pushing the production for medical-grade polypropylene products.

As per the polypropylene copolymer industry analysis, the material also finds applications in consumer goods. Recent reports indicate that Companies like IKEA and Unilever expanded their commitments to using 100% recycled plastics in their consumer products by 2030, which includes polypropylene. Moreover, IKEA’s 2024 sustainability report showcased a 20% increase in the use of recycled polypropylene in its furniture and storage items.

Polypropylene Copolymer Market Regional Insights

North America Polypropylene Copolymer Market Trends

North America remains a significant market for polypropylene copolymers, driven by the region’s automotive, packaging, and healthcare sectors. In 2024, the American Chemistry Council reported that the region’s demand for polypropylene copolymers grew in automotive applications. The U.S. automotive sector, led by Ford and General Motors, increased their use of polypropylene by 15% to meet new fuel efficiency and electric vehicle standards. In packaging, a 2024 survey by the Sustainable Packaging Coalition revealed that 68% of food and beverage companies in the U.S. adopted polypropylene-based recyclable packaging, driven by consumer demand for green packaging items.Asia Pacific Polypropylene Copolymer Market Drivers

Asia Pacific dominates the market due to robust growth of China's construction industry and Indian government’s plans for infra development. In India, the packaging industry also saw a surge in polypropylene demand due to rising e-commerce activities and government policies encouraging the use of recyclable plastics. Moreover, China being the largest importer and Singapore being the largest exporter of polypropylene copolymer, is further driving the polypropylene copolymer market share in Asia Pacific.According to China Customs Data, China’s polypropylene copolymer imports reached approximately 3.2 million metric tonnes in 2024, showcasing a 15% year-on-year increase in PPC imports. Similarly, Singapore exported over 2.5 million metric tonnes of the material in 2024, according to International Trade Centre (ITC) data. The country's well-established petrochemical industry, coupled with advanced manufacturing capabilities, enables it to supply large quantities of polypropylene copolymer to countries like China, India, and other Southeast Asian markets. This strong trade flow between China and Singapore further enhances the market’s growth in APAC.

Europe Polypropylene Copolymer Market Opportunities

Europe is a key market, but it faces challenges due to stringent environmental regulations. The 2024 EU directive mandating 35% recycled content in all plastic packaging is significantly affecting the polypropylene market. This has led to a 9% decline in single-use polypropylene demand in sectors like food packaging. However, the automakers like Volkswagen and BMW are increasing their use of recycled polypropylene copolymer parts by 12% to meet the 2024 EU CO2 emission targets. Additionally, Germany reported a 6% growth in polypropylene use in medical applications, particularly in disposable devices, boosting the market’s growth in EU region.Middle East and Africa Polypropylene Copolymer Market Dynamics

MEA region is an emerging market for polypropylene copolymer. In 2024, Gulf Petrochemicals and Chemicals Association (GPCA) reported a 9% growth in polypropylene production in Saudi Arabia and UAE, driven by investments in petrochemical facilities. Africa saw an increase in polypropylene demand, particularly in the packaging sector, due to the growth of consumer goods and food products. In South Africa, government infrastructure projects stimulated a 6% rise in polypropylene use in construction materials, like pipes and geotextiles.Innovative Start-ups in Polypropylene Copolymer Market

Start-ups are focused on developing eco-friendly copolymer grades that are easier to recycle and have lower carbon footprints. Additionally, many are working on chemical recycling methods to convert waste polypropylene into reusable raw materials, reducing reliance on virgin petrochemicals. These start-ups are also targeting industries like packaging, automotive, and healthcare, where lightweight, durable, and recyclable materials are in high demand. Some start-ups that are working towards polypropylene copolymer market development are:PureCycle Technologies, founded in 2015 and based in Florida, United States, is engaged in recycling of polypropylene waste into virgin-quality polypropylene. It has raised over USD 1.2 billion in funding through its public market debut in 2021. The company’s proprietary technology helps in processing 119,000 tonnes of polypropylene annually at its flagship facility in Ironton, Ohio. Additionally, PureCycle has secured partnerships with industry giants like Procter & Gamble and other consumer brands to supply ultra-pure recycled polypropylene, positioning itself as a key player in the polypropylene copolymer market.

Ioniqa Technologies, founded in 2009 and headquartered in Eindhoven, Netherlands, offers chemical recycling technology for turning plastic waste, including polypropylene, into high-quality raw materials.

It has developed a patented magnetic recycling process and has secured EUR 10 million in investment from the European Circular Bioeconomy Fund. The company has also established partnerships with global brands like Unilever and Coca-Cola due to its capacity to recycle 10,000 metric tonnes of plastic annually.

Competitive Landscape of Polypropylene Copolymer Market

Market players are diversifying their product lines to meet specific industry needs. For example, LyondellBasell has developed various grades of polypropylene copolymers tailoured for applications in automotive interiors and packaging. Companies like BASF SE are investing in bio-based polypropylene copolymers and recycling technologies to reduce environmental impact. Firms such as ExxonMobil are actively engaging in R&D to innovate new formulations. Companies like SABIC are establishing production facilities in regions like APAC to profit from the local demand. Players like Mitsui Chemicals are focusing on producing recyclable polypropylene copolymers.LyondellBasell Industries Holdings B.V.

LyondellBasell Industries Holdings B.V. was founded in 2005 and is headquartered in Texas, United States. It is one of the largest plastics, chemicals, and refining companies globally, which specialises in the production of polyolefins, advanced polymers, and other chemical products.

China Petrochemical Corporation (Sinopec Group)

China Petrochemical Corporation (Sinopec Group) was founded in 2000 and is headquartered in Beijing, China. It is one of the largest integrated energy and chemical companies in China. It operates in oil and gas exploration, refining, and the production of petrochemicals. Sinopec is renowned for its significant contributions to China's energy security.PetroChina Company Limited

PetroChina Company Limited was founded in 1999 and is headquartered in Beijing, China. It is the largest oil and gas producer in China and one of the largest companies in the world by revenue. It engages in exploration, production, refining, and distribution of petroleum products.SABIC (Saudi Basic Industries Corporation)

SABIC (Saudi Basic Industries Corporation) was founded in 1976 and is headquartered in Riyadh, Saudi Arabia. It is a leading global manufacturer of chemicals, polymers, and fertilisers. SABIC operates in over 50 countries and is partially owned by Saudi Aramco. The company plays a crucial role in transforming oil by-products into valuable materials.Other polypropylene copolymer market players include Braskem S.A., among others.

Table of Contents

Companies Mentioned

The key companies featured in this Polypropylene Copolymer market report include:- LyondellBasell Industries Holdings B.V.

- China Petrochemical Corporation (Sinopec Group)

- SABIC

- PetroChina Company Limited

- Braskem S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 61.99 Billion |

| Forecasted Market Value ( USD | $ 97.19 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |