The increasing demand for co-working spaces drives the office furniture market. Co-working spaces offer cost savings and convenience by sharing common infrastructure. Such spaces also provide opportunities for networking with other companies and start-ups. In 2022, the global average capacity of co-working spaces was approximately 98 workstations across regions like the Asia-Pacific, Central America, Europe, North America, and Latin America.

One of the major factors driving the office furniture market growth is the growing demand for sustainable and environmentally sound furniture, which is encouraging manufacturers to adopt green products that help in reducing waste disposal, pollution levels, and deforestation. The enactment of several programmes by governments across the globe to boost start-ups through the introduction of favourable policies aimed at driving sustainability are further aiding the market.

Key Trends and Developments

Rising demand for sustainable furniture; favorable government initiatives promoting startup culture; growing focus on employee health; and the surging penetration of online retail channels support the office furniture market growth.November 13th 2023

MillerKnoll: Replicated its successful combined showroom model in Dallas, Texas, by renovating the 10,000 square-foot space at 23 Geary St in San Francisco.November 8th 2023

MillerKnoll: Expanded its OE1 Workspace Collection, designed by Industrial Facility, to include new productivity-enhancing solutions.September 19th 2023

Steelcase: Partnered with Ecomedes, an online platform, to facilitate sustainable product sourcing for architects, designers, and customers.September 6th 2023

Sedus: Inaugurated the latest production line, "Futura 2," at its Geseke facility with an investment of approximately EUR 21 million.Growing demand for sustainable and eco-friendly furniture

The growing demand for sustainable office furniture is encouraging manufacturers to adopt green products that help reduce waste disposal, environmental pollution, and deforestation.Growing popularity of start-up culture

The introduction of favourable policies by governments across the globe is boosting start-up culture. There are about 1,220 unicorns globally.Growing concerns about employee health

Growing concerns about employee health and productivity are driving the demand for ergonomic office furniture.Increasing popularity of aesthetically pleasing furniture

Modern offices with collaborative, open spaces and green spaces create a surge in the demand for aesthetically pleasing office furniture.Global Office Furniture Market Trends

With a booming startup culture, the demand for coworking spaces has increased as they provide a cost-effective working space. Coworking spaces provide all amenities which otherwise would have been expensive, including access to different locations and networking opportunities.Major startup and entrepreneurship initiatives in several economies like the USA and India expand the demand for office furniture. Such initiatives include The Small Business Innovation Research (SBIR) grant program in the USA, ASPIRE - A Scheme for the Promotion of Innovation, Rural Industries and Entrepreneurship in India, The Seed Enterprise Investment Scheme in the United Kingdom, and others.

Table: Top 10 Countries With The Most Number of Workstations Per Coworking Space, in 2022

Figure: Top 10 Countries by Average Square Footage, 2022 (Sq. ft.)

Furthermore, increased demand for office furniture is evident due to the establishment of new offices, improvements in ergonomic design, and the expansion of home-office setups. The introduction of collaborative spaces in modern offices to ensure effective collaboration and teamwork has become a crucial part. To ensure privacy and effective communication pods, phone cabins, booths, silent rooms, privacy boxes, and cubes, are increasingly utilised in various commercial open-plan settings.Market Segmentation

"Global Office Furniture Market Report and Forecast 2025-2034" offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Seating

- Systems

- Tables

- Storage Units and File Cabinets

- Overhead Bins

- Others

Market Breakup by Material Type

- Wood

- Metal

- Plastic and Fibre

- Glass

- Others

Market Breakup by Distribution Channel

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

Market Breakup by Price Range

- Low

- Medium

- High

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Wood accounts for a significant share of the office furniture market as it is a reliable, low-maintenance, durable, and versatile material. The rising popularity of wooden office furniture can also be attributed to its ability to enhance the aesthetic appeal of the workplace.

The presence of FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) labels assures customers that the wood used in products comes from forests managed sustainably. These forests are conscientiously treated and replenished to avoid harm to ecosystems.

Additionally, the increasing demand for stainless steel office furniture is driven by various factors, including the need for durable and low-maintenance furnishings in modern offices.

Direct sales are expected to dominate the office furniture market share in the coming years

Direct sales are anticipated to hold a significant market share as organised business channels, such as contracts, retailers, showrooms, and importers, have experienced rapid growth. The omnichannel retail approach serves as a complementary business model to access a broader customer base. The expansion of new stores/showrooms, proprietary websites, and global e-commerce platforms is aiding the office furniture market growth.The sales of office furniture from specialist stores are considerably rising as customers increasingly seek customisability, unique pieces, and personalised shopping experiences. The increasing expansion of specialist stores by key players is further fuelling the segment’s growth.

Due to the growing focus on comfort, the demand for ergonomic office seatings is significantly increasing

The demand for office chairs is supported by the integration of wellness features, such as built-in heating, massage, and ventilation systems. The development of innovative office chairs that promote the physical fitness of employees is boosting the segment’s growth.

The increasing launches of innovative office chairs with enhanced comfort are propelling the office furniture market growth. For instance, in June 2023, Humanscale launched the Path Office Chair, featuring mesh-like fabric upholstery and a counterbalancing mechanism that supports the bodies of users.

Meanwhile, office tables boost work satisfaction, help maintain an organised and clean space, and reduce the risk of back pain. Besides, the development of adjustable tables, the rising popularity of modualarised displays, and the integration of technologies like AI in tables and workstations are likely to favour the office furniture market expansion in the coming years.

Competitive Landscape

Players in the office furniture market are increasing their collaboration, partnership, and research and development activities to gain a competitive edgeOther key players in the global office furniture market include Sedus Stoll AG, Kimball International, Inc., and KOKUYO Co., Ltd.

Global Office Furniture Market Analysis by Region

The Asia-Pacific region is anticipated to hold a dominant position in the office furniture market. This is due to the fact that the region is a thriving hub of innovation, boasting 159 startup ecosystems in the global top 1,000 in 2023. The Asia-Pacific region leads the global market for coworking spaces, hosting approximately 300 such spaces in key cities like Singapore, Hong Kong, Shanghai, Tokyo, Sydney, and Melbourne.The market in Europe is driven by the implementation of a circular economy through sustainable product availability, subscription-based models, and improved product quality among others, in the Europe furniture industry. The region recorded a total of 6,064 sq. ft. coworking space size and more than 2500 in numbers in 2022.

North America holds a significant office furniture market share, driven by the booming startup culture. The United States has the most startups worldwide, accounting for 77,195. The demand for office furniture in North America is driven by the growing startup industry and flexible work culture. The region has over 81,009 startups as of November 2023. It has also the largest average square footage of coworking space at over 9,548 Square Feet in 2022.

Table of Contents

Companies Mentioned

The key companies featured in this Office Furniture market report include:- Haworth Inc.

- MillerKnoll, Inc.

- Steelcase Inc.

- Bene GmbH

- Stoll AG

- Kimball International, Inc.

- KOKUYO Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | August 2025 |

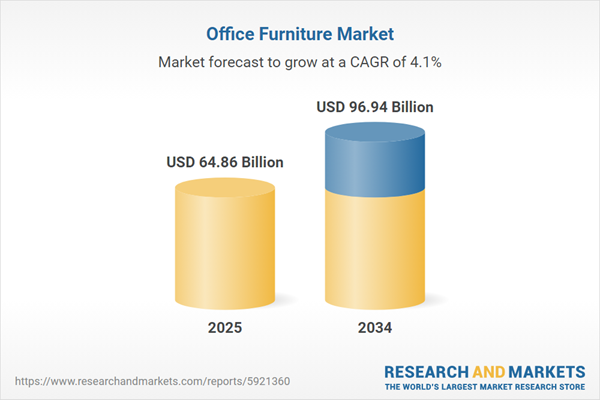

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 64.86 Billion |

| Forecasted Market Value ( USD | $ 96.94 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |