The global sugar market is experiencing rapid growth due to rising consumption in emerging economies. Population growth, urbanization, and increasing disposable incomes in Asia and Africa are key contributors. According to industry reports, the global consumption of sugar was estimated to reach 182.867 million tonnes in 2024-25. India and China are also leading this surge, with growing middle classes consuming more processed foods and sugary beverages.

Government biofuel mandates and evolving energy market trends are shaping decisions in the sugar industry, particularly in countries where sugarcane is a key feedstock for ethanol production. Brazil and India are largely implementing ethanol blending programs. In October 2024, India accelerated its ethanol blending targets with a 20% ethanol-petrol blending by 2025. These policies are incentivizing producers to divert sugarcane from sugar production to ethanol when fuel prices are high or blending mandates are increased.

Packaging innovations are boosting the sugar market dynamics for improving product freshness, convenience, and sustainability. Advanced packaging materials and recyclable plastics are limiting environmental impacts, appealing to eco-conscious consumers. In June 2024, prominent French sugar brand Cristalco transitioned its 500g Daddy Sugar icing sugar container from plastic to a fully recyclable Sonoco cardboard design. These innovations are enhancing brand differentiation and shelf appeal, allowing companies to attract new customers and enter niche markets.

Key Trends and Recent Developments

October 2024

Shree Renuka Sugars' subsidiary Anamika Sugar Mills approved a ₹183.8 crore investment to increase its cane crushing capacity to 7,000 tonnes from 4,000 per day and establish a 15 MW power plant in Uttar Pradesh. This expansion helped to utilize additional cane availability and enhance operational efficiency.October 2024

Nestlé India introduced new Cerelac variants with zero refined sugar to address criticism over added sugars in its baby food products sold in developing countries. This launch is part of Nestlé's broader effort to align its products with global health guidelines and address consumer concerns about sugar consumption in infant foods.June 2024

Amul, via the Gujarat Cooperative Milk Marketing Federation, expanded its organic product line by introducing Amul Organic Tea, Sugar, and Jaggery. The new products were sourced from certified organic farms and processed in certified facilities while being free from harmful chemicals and pesticides.January 2024

Global commodity intelligence platform Vesper partnered with Sugar Industry International to enhance its coverage of the sugar sector. This collaboration helped to provide more comprehensive insights into the European sugar markets, including agricultural developments and pricing information.Technological Advancements in Farming

Innovations in sugarcane cultivation, such as drip irrigation, pest-resistant varieties, and mechanized harvesting for improving yields and reducing input costs is driving the sugar market expansion. Brazil and Australia are leading in precision agriculture, using satellite data, AI, and GPS-guided machinery to optimize planting and harvesting. In November 2024, Brazil’s Centro de Tecnologia Canavieira launched its innovative cane seed project to revolutionize sugarcane cultivation. These advances are helping to mitigate climate-related risks and labour shortages, especially in regions where sugarcane labour is intensive.Sustainability and ESG Pressures

The environmental, social, and governance criteria are increasingly reinforcing the sugar industry growth. Consumers and investors are demanding ethically sourced, low-carbon sugar, driving innovations in production. In April 2025, SEDL launched India's first boiler less, zero emission sugarcane-processing platform near Guwahati. Certification schemes are growing, with major companies committing to 100% sustainable sourcing. Water usage, land degradation, and labour practices are also under scrutiny, especially in developing nations.Expansion in African Markets

Africa is emerging as a significant contributor to sugar consumption and production, adding to the sugar market dynamics. Rising urban populations, improving incomes, and changing diets are driving the demand. Ethiopia, Kenya, and Nigeria are investing in sugar infrastructure to reduce imports and develop local industries. In March 2025, Zimbabwe-based agri-processing firm Tongaat Hulett invested R460 million in off-season maintenance to prepare for the 2025/26 sugar season. International firms are also eyeing Africa as a frontier market with long-term potential, both for sugar exports and as a production base.Rising Rate of Exports

The positive export scenario is contributing to the sugar market by boosting demand and stabilizing prices globally. Rising production in Brazil, India, China and Thailand is increasing sugar shipments abroad, further helping to balance supply-demand gaps in importing countries, often offsetting domestic shortfalls. As per industry reports, Thailand imported USD 177M of raw sugar in 2023. This surge is supporting sugar prices and encouraging producers to maintain or expand cultivation.Innovations in Production

Rapid advances in sugar production are transforming the sugar market for increasing yields, reducing costs, and promoting sustainability. Innovations, such as genetically improved sugarcane varieties to enhance resistance to pests and diseases, boosting crop productivity. In August 2022, India’s National Sugar Institute developed a sugar syrup from sweet sorghum stems for offering a healthier alternative to traditional sugar. These improvements are enabling producers to meet the rising global demand, stabilize supply, and offer more competitive pricing, adding to the market growth.Sugar Industry Segmentation

The report titled “Sugar Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- White

- Brown

- Liquid

Market Breakup by Form

- Granulated

- Powdered

- Syrup

Market Breakup by Source

- Sugar Beet

- Sugarcane

Market Breakup by End User

- Food and Beverages

- Pharma and Personal Care

- Household

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Sugar Market Share

Brown Sugar & Liquid Sugar to Gain Prominence

Brown sugar holds a significant share in the sugar market, as it is favoured for its richer flavour and moist texture, especially in baking cookies, barbecue sauces, and ethnic dishes. In September 2023, SunOpta launched its SOWN® Brown Sugar Organic Oat Creamer to expand its plant-based lineup to offer a warm and comforting flavour. Brown sugar is preferred in premium or niche segments due to its perceived artisanal quality. The popularity of brown sugar is further rising with the emerging trends of less processed foods.Liquid sugar industry is expanding with its significance in industrial use. This sugar is commonly used in beverages, canned fruits, and dairy products for its ease of mixing and processing. Superior solubility and consistency are making liquid sugar a preferred choice in various applications and processed foods. Brands, such as PepsiCo and Unilever are utilizing liquid sugar in manufacturing to streamline production and maintain consistency. Additionally, liquid sugar remains vital in high-volume, mechanized food processing environments.

Powdered Sugar & Sugar Syrup to Garner Significant Popularity

The demand for powdered sugar or icing sugar is growing with significant usage in baking, dessert decoration, and confectionery. Specialty brands are launching ultrafine powdered sugars for catering to professional bakers and home users. The convenience in smooth texture and quick dissolving properties also makes powdered sugar popular for frostings, glazes, and dustings, especially in major European and North American countries with high bakery consumption.Sugar syrup is contributing to the sugar market revenue as it remains vital in industrial food production and beverages. This form of sugar is widely used in soft drinks, confectionery fillings, baked goods, and canned fruits. Several producers are supplying various syrups, including high-fructose corn syrup and invert sugar syrup. The segment is further growing with trends favouring liquid sweeteners for easier blending and processing. For instance, in July 2024, IHOP, in partnership with Kraft Heinz, introduced bottled pancake syrups in two flavors.

Rising Interest in Sugar Beet-Sourced Sugar

Sugar beet is another leading segment of the global sugar market, due to its advantages in colder regions. Sugar beet is primarily cultivated in temperate climates, with major producers including Germany, France, Poland, the United States, and Russia. In Europe, sugar beet is a critical part of the agro economy, supported by technological innovations and government policies. In August 2024, Ukraine's largest sugar producer Astarta commenced the processing of the 2024 sugar beet harvest at its Vinnytsia refinery. This growing focus of companies on beet-based processing is adding to the segment growth.Surging Applications of Sugar in Pharma and Personal Care & Households

The pharmaceutical and personal care segment accounts for a significant share of the sugar market. In pharmaceuticals, sugar is largely used as a binding agent, preservative, and flavour enhancer in syrups, tablets, and lozenges. In personal care, sugar is found in scrubs, exfoliants, and other skincare products due to its gentle abrasive properties and moisturizing benefits. With growing demand for organic and natural ingredients in health and beauty products, the role of sugar in this sector is expanding.The household segment is contributing to the sugar market. Consumers are largely using sugar daily for cooking, baking, sweetening beverages, and preserving foods at home. As per industry reports, an average American consumes around 71.14 grams of added sugar per day. In many cultures, homemade desserts and traditional recipes heavily rely on sugar, sustaining consistent demand. This segment also benefits from retail packaging innovations, such as resealable bags and organic or specialty sugars, such as brown, coconut, and powdered sugar.

Sugar Market Regional Analysis

Thriving Sugar Industry in North America & Europe

North America is contributing to the sugar demand growth, primarily driven by the presence of leading companies operating across a robust value chain. The United States has a well-established refining industry and stringent import quotas under trade agreements. The growth also stems from the food and beverage sector, which relies heavily on sugar for processed foods, confectionery, and soft drinks. As per industry reports, the United States imported USD 2.58B of raw sugar in 2024. This dependence on imports to meet the growing demand is also keeping the region influential.Europe sugar market value is growing in terms of raw sugar production and rising importance as a refined sugar consumer and exporter. Germany, France, and the United Kingdom are leading the regional sugar industry, with companies, such as Südzucker and Nordzucker driving operations. The European Union’s Common Agricultural Policy and sugar quotas are historically shaping the market. Furthermore, the demand for beet sugar and sustainable production practices are maintaining Europe’s relevance in the global sugar value chain.

Competitive Landscape

Key players in the sugar market are deploying strategic approaches to stay competitive and manage the volatility inherent in the industry. Many companies are expanding beyond traditional sugar production into value-added products. This is reducing the reliance on sugar prices and opens additional revenue streams, especially in countries where ethanol blending policies support demand. Vertical integration is another key approach. By controlling the entire supply chain from sugarcane cultivation to processing and distribution, companies can improve efficiency, reduce costs, and ensure consistent quality and supply.Global players are engaging in trade optimization and global sourcing by importing and exporting sugar based on price differentials between regions, taking advantage of trade agreements and tariff structures to enhance profitability and manage supply risks. Technological innovation is critical for increasing agricultural yields and refining efficiency. Advancements, such as precision farming, automation, and biotechnology are helping to reduce input costs and environmental impact while improving crop resilience. Many sugar companies are adopting eco-friendly practices to meet regulatory requirements and cater to environmentally conscious consumers.

Cosan S.A.

Cosan S.A., founded in 1936 and headquartered in São Paulo, Brazil, is a major player in the sugar and ethanol industry, offering products such as sugar, ethanol, bioenergy, and logistics services. The company focuses on sustainable production and global market reach.

AB Sugar

AB Sugar, established in 2005 and headquartered in London, the United Kingdom, is a global sugar producer operating in multiple countries. AB Sugar’s portfolio includes raw and refined sugar products, as well as bioethanol with a focus on sustainable agriculture and innovation to meet growing global demand.Südzucker AG

Südzucker AG, founded in 1926 and headquartered in Mannheim, Germany, is one of the world’s largest sugar producers. The company’s offerings include sugar, special products, starch, and bioethanol for serving both food industry clients and energy sectors with diversified product lines.Nordzucker AG

Nordzucker AG, launched in 1838 and headquartered in Braunschweig, Germany, supplies sugar products primarily in Europe, including beet sugar and specialty sugars. Nordzucker focuses on efficiency and sustainability within its agricultural and production processes.Other players in the sugar market are COFCO International, Tereos Group, Mitr Phol Group., Dalmia Bharat Sugar and Industries Limited, Louis Dreyfus Company, Wilmar International Ltd, The Savola Group, E.I.D. - Parry (India) Limited, Rusagro Group, Thai Roong Ruang Sugar Group, and Cargill, Incorporated., among others.

Key Features of the Sugar Market Report:

- Comprehensive quantitative analysis of global sugar market size and growth projections.

- Detailed segmentation by type, form, source, end user and geography with market share data.

- Insights into key drivers, challenges, and emerging opportunities shaping the industry.

- Competitive landscape overview, profiling major sugar producers and their strategies.

- Analysis of supply chain trends, pricing, and trade dynamics impacting the market.

- Forecasts up to 2034, incorporating technological innovations and sustainability trends.

- Trusted source for accurate, data-driven sugar market insights and forecasts.

- Access to in-depth research by industry experts and experienced analysts.

- Timely updates ensuring relevance to current sugar market trends and shifts.

- Customized reports tailored to specific business needs and market segments.

Table of Contents

Companies Mentioned

The key companies featured in this Sugar market report include:- Cosan S.A.

- AB Sugar

- Südzucker AG

- Nordzucker AG

- COFCO International

- Tereos Group

- Mitr Phol Group

- Dalmia Bharat Sugar and Industries Limited

- Louis Dreyfus Company

- Wilmar International Ltd

- The Savola Group

- E.I.D. - Parry (India) Limited

- Rusagro Group

- Thai Roong Ruang Sugar Group

- Cargill, Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | August 2025 |

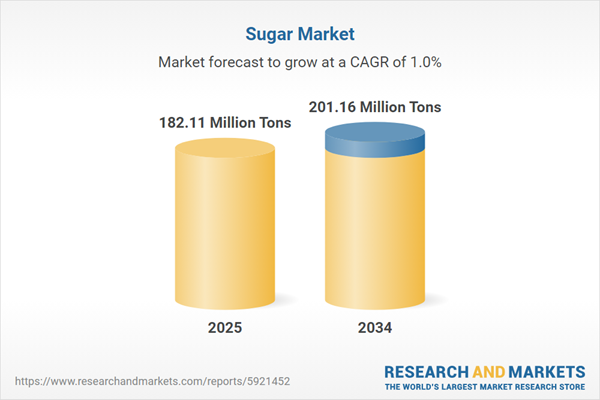

| Forecast Period | 2025 - 2034 |

| Estimated Market Value in 2025 | 182.11 Million Tons |

| Forecasted Market Value by 2034 | 201.16 Million Tons |

| Compound Annual Growth Rate | 1.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |