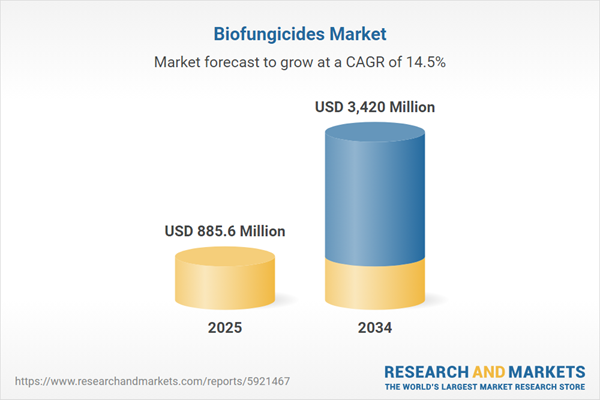

Global Biofungicides Market Growth

The biofungicides market provides various benefits, including eco-friendly and sustainable solutions that help reduce soil and water pollution. These products leave minimal chemical residues, ensuring safer food for consumers. Biofungicides support soil health, enhance crop yields, and comply with stricter regulations, offering a safer alternative to chemical fungicides. In February 2024, the Indian government introduced initiatives to boost pulse production to 24 million metric tons, highlighting the significance of biofungicides in managing diseases that could affect yield, thereby promoting food security and agricultural economic stability.They enhance plant resistance, reduce health risks, and are ideal for organic farming, influencing the biofungicides market dynamics and trends. Although initially more expensive, biofungicides offer long-term cost savings, have a minimal environmental impact, and help preserve biodiversity. As demand for eco-friendly products rises, the biofungicides market is expanding, with a wide variety of products designed for different crops and farming conditions. In November 2023, the USDA launched programs to assist vegetable farmers with integrated pest management strategies, incorporating biofungicides to promote sustainability, ensure high-quality produce, and reduce chemical residues in food systems.

Key Trends and Recent Developments

Rising demand for eco-friendly and sustainable farming practices, integration of advanced technologies, and shift towards systemic fungicides are propelling the biofungicides market.October 2024

Biotalys introduced BioFun-8, a research initiative aimed at developing biofungicides to combat Alternaria fungal diseases in crops. Leveraging their AGROBODY technology platform, this programme seeks to offer sustainable and effective solutions for growers facing major crop threats.January 2024

BASF unveiled BioGuard Dry, a new dry biofungicide designed to protect crops from soil-borne pathogens. This product supports sustainable farming practices and provides an eco-friendly alternative to traditional chemical fungicides, promoting better crop health.January 2024

Indigo Agriculture launched Biotrinsic® X19, a biological fungicide derived from the microbe “Kosakonia cowanii”. This product is designed to enhance crop protection by offering tailored solutions for disease management across diverse field conditions.September 2023

Rovensa Next introduced three new biofungicides in Brazil: Row-Vispo, Ospo Vi55, and Milarum. These products are aimed at effectively controlling various fungal pathogens while supporting environmentally sustainable agricultural practices.Adoption of Biological Fungicides is Driving Opportunities in the Biofungicides Market

The rising demand for eco-friendly and sustainable farming practices has led to the growing adoption of biological fungicides. These products, derived from natural organisms, effectively control diseases while minimising environmental impact, offering farmers a safer alternative to traditional chemical fungicides. In April 2023, the USDA announced new funding initiatives to promote the use of biological fungicides among farmers, emphasising their role in supporting sustainable agriculture and advancing research into their effectiveness and application.Integration of Advanced Technologies is Impacting Biofungicides Market Revenue

Integrating advanced technologies such as AI and IoT is improving the efficiency of fungicide applications. These innovations enable precise monitoring of crop conditions, facilitating more targeted treatments, reducing chemical usage, and enhancing disease management strategies, leading to increased yields. In August 2021, Syngenta launched BotriStop, a biofungicide utilising advanced microbial technology to combat Botrytis cinerea, showcasing the role of cutting-edge technology in developing effective biological pest management solutions.Shift Towards Systemic Fungicides is a Significant Trend in the Biofungicides Market

Systemic fungicides, which plants absorb to offer long-lasting protection, are becoming increasingly popular. These fungicides provide more effective disease control with fewer applications, making them cost-effective and environmentally friendly. In March 2024, AgroFresh introduced "AgroShield," a systemic biofungicide designed to protect crops from internal fungal infections. This product represents a significant innovation in crop protection, allowing for deeper penetration into plant tissues for enhanced efficacy.Growth In Organic Farming is Driving Demand of the Biofungicides Market

As organic farming practices expand globally, there is an increased need for organic fungicides. These biofungicides meet organic certification standards, allowing farmers to manage fungal diseases without resorting to synthetic chemicals, thus supporting the shift towards sustainable agriculture. According to the FAO in January 2024, around 187 countries worldwide practice organic farming, boosting the demand for biofungicides that comply with organic standards and encouraging market growth.Global Biofungicides Industry Segmentation

The report titled “Global Biofungicides Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Source

- Microbial

- Biochemical

- Plant-incorporated Protectants

Market Breakup by Formulation

- Dry

- Liquid

Market Breakup by Application

- Cereals and Grains

- Oil Seeds and Pulses

- Fruits and Vegetables

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Global Biofungicides Market Share

According to the biofungicides market analysis, dry biofungicides lead the market due to their advantages, such as longer shelf life and ease of application. They can be transported and stored without refrigeration, making them ideal for different agricultural settings. Furthermore, they provide targeted delivery of active ingredients, improving their effectiveness against fungal pathogens while reducing environmental impact. In February 2024, Certis USA launched "MycoShield Dry," a dry biofungicide made from beneficial fungi, designed for organic farmers. It controls various fungal diseases while promoting soil health and sustainable agricultural practices.The biofungicides market growth is further driven by liquid biofungicides, which offer fast absorption and immediate action against fungal diseases. This segment is expected to see significant growth, with a projected CAGR of 17.80% from 2024 to 2032. These biofungicides allow precise application and can be combined with other agrochemicals for comprehensive pest control. They also include surfactants to improve adherence and penetration, optimising disease control in crops. In May 2024, FMC Corporation launched "FMC Protect Liquid," a biofungicide designed to target root rot pathogens in various crops. This product enhances plant resilience and supports sustainable agricultural practices by reducing the need for synthetic chemicals.

Competitive Landscape

The biofungicides market key players specialise in the development, production, and distribution of innovative biotechnological solutions for agriculture. These companies prioritise sustainable products that improve soil health, increase crop yields, and reduce the environmental impact of traditional farming methods. Their product ranges include biofertilisers, biostimulants, and biocontrol products, all designed to promote plant growth, enhance disease resistance, and boost overall crop productivity. These companies are committed to integrating advanced microbial technologies into their solutions, ensuring they are both effective and eco-friendly.Bayer AG

Headquartered in Leverkusen, Germany, Bayer AG was established in 1863. A global leader in healthcare and agriculture, it focuses on innovations in crop science, pharmaceuticals, and consumer health. Bayer's diverse portfolio includes plant protection, seeds, and advanced therapies for various medical conditions.Gujarat State Fertilizers and Chemicals Ltd.

It is based in Vadodara, India, and was founded in 1962. It manufactures a wide range of fertilisers, industrial chemicals, and petrochemicals. GSFC focuses on sustainable solutions for agriculture and industry, contributing to economic development and food security in India.

FMC Corporation

Founded in 1883 and headquartered in Philadelphia, USA, FMC Corporation is a global chemical company. FMC operates across agriculture, health, and technology sectors, providing crop protection products, solutions for food safety, and advanced materials. It strives to enhance agricultural productivity and promote sustainable practices globally.Certis USA LLC

Established in 2001 and headquartered in Columbia, Maryland, USA, focuses on providing innovative crop protection solutions. The company offers a broad range of biological and conventional products to enhance agricultural efficiency. Certis USA is committed to sustainable farming and effective pest management strategies.Other key players in the biofungicides market report include Symborg Corporate S.L and Biotech International Ltd., among others.

Table of Contents

Companies Mentioned

The key companies featured in this Biofungicides market report include:- Bayer AG

- Gujarat State Fertilizers and Chemicals Ltd.

- FMC Corporation

- Certis USA LLC

- Symborg Corporate S.L

- Biotech International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 153 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 885.6 Million |

| Forecasted Market Value ( USD | $ 3420 Million |

| Compound Annual Growth Rate | 14.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |