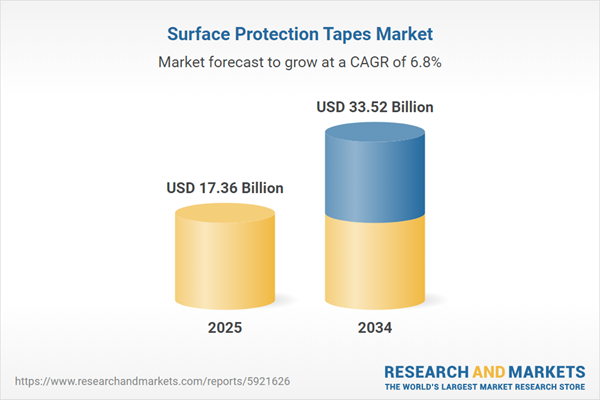

Global Surface Protection Tapes Market Growth

Surface protection tapes provide numerous benefits, including preventing scratches during handling, transport, and installation. They offer robust protection for materials such as glass, metal, plastic, and wood, helping reduce repair costs, which impacting the surface protection tapes market revenue. These tapes are adaptable, ideal for sectors like automotive, construction, and electronics, and can be easily applied and removed without leaving residue. In November 2024, Resonac Corporation transferred its surface protection film business to Sun A. Kaken, following an agreement made in August. This move supports Resonac's focus on sustainable growth and resource optimisation, aiming to drive business expansion with minimal impact on performance.The tapes help preserve the clarity of transparent surfaces like glass and acrylic, enhancing the aesthetic appeal of finished products, which is driving the growth of the surface protection tapes market. Additionally, they provide resistance to oils, solvents, and other chemicals, as well as UV and water resistance, protecting surfaces from fading, corrosion, and moisture-related damage.

Key Trends and Recent Developments

The surface protection tapes market is growing due to a focus on sustainability, the adoption of advanced adhesives, technological integration, and the expansion of e-commerce and logistics.January 2025

ALP Group launched its new Paint Protection Film (PPF) line at the Bharat Mobility Global Expo. The product, featuring three variants- Defender, Armor, and Ranger, offers protection for vehicle surfaces from environmental damage. The films incorporate self-healing technology and UV protection. ALP Group plans global distribution through existing partners.October 2024

Tredegar Surface Protection launched its innovative Obsidian Automotive Protective Films. These films, designed for automotive applications, provide advanced protection for surfaces such as displays, glass, cameras, and plastic components. The product line caters to both interior and exterior needs, responding to the growing demand for surface protection in the automotive industry.October 2024

Tredegar Surface Protection launched its innovative Optennia packaging film. Designed to be 30% thinner and use less petroleum-based resin, it offers superior performance and supports sustainability goals. The product aligns with Tredegar's commitment to eco-friendly manufacturing while maintaining the high-quality standards that define its brand.October 2024

Avient launched an ultra-high adhesion series of Versaflex™ PF Thermoplastic Elastomers for surface protective films. Designed for high-performance protection across industries like electronics and construction, the series enhances adhesion by 20%, offers flexibility, and supports sustainability by reducing VOC emissions and enabling recyclability.Growing Focus on Sustainability Drives the Growth of the Surface Protection Tapes Market

As companies prioritise environmental responsibility, the demand for eco-friendly and biodegradable surface protection tapes has risen. Tapes made from recyclable materials are becoming more popular, reflecting a shift towards sustainable production methods. Lohmann's DuploCOLL® ECO portfolio, featuring biobased, solvent-free adhesives and recyclable liners, exemplifies this trend. Manufactured using the energy-efficient TwinMelt® process, the tapes contribute to reduced CO2 emissions while offering high performance for diverse industrial applications.Adoption of Advanced Adhesives is Increasing Opportunities in the Surface Protection Tapes Market

The surface protection tapes market has experienced a shift towards advanced adhesives that enhance bonding strength, durability, and ease of removal. These adhesives ensure efficient surface protection without residue, making them perfect for delicate materials like glass, wood, and metals. This advancement improves overall user experience and performance. RideWrap introduced the Lotus Pro™ 10, a bicycle-specific protection film made from 77% recycled materials, featuring superhydrophobic ceramic and self-healing properties, blending high-performance protection with sustainability.Technological Integration is Shaping the Surface Protection Tapes Market Dynamics and Trends

The integration of advanced technologies, such as UV-resistant and heat-resistant coatings, is becoming a significant trend in the surface protection tapes market. These innovations help protect surfaces from environmental damage like UV radiation and extreme temperatures, particularly in industries such as automotive and construction. Berry Global introduced the Patco 8275-92 UVProtek Surface Protection Film, which provides UV resistance and abrasion protection, making it perfect for outdoor applications like marine equipment and high-wear surfaces.E-Commerce and Logistics Growth is Fueling Surface Protection Tapes Market Expansion

The surge in e-commerce and global logistics has increased the demand for protective solutions during shipping and handling. Surface protection tapes are now widely used in packaging and transit to prevent damage such as scratches and dents. The growth of online retail and international shipping is driving this trend. According to the Australian Bureau of Statistics (ABS), the e-commerce retail sector accounted for 41.5% of the growth in digital activities' value-added in Australia during the 2020-21 period.Global Surface Protection Tapes Market Trends

Surface protection tapes help maintain cleanliness by preventing the accumulation of dirt, dust, and debris. They offer heat resistance to shield surfaces from high temperatures. Customisation options are available in various sizes, colours, and designs, with strong adhesives that hold securely but are easy to remove without leaving residue.Many tapes are eco-friendly and non-toxic, supporting sustainability initiatives. They also reduce the risk of contamination during shipping or manufacturing and protect surfaces during assembly and installation processes, boosting the demand for the surface protection tapes market. By minimising damage risks and downtime, these tapes enhance operational efficiency, ensuring smoother production and delivery.

Global Surface Protection Tapes Industry Segmentation

The report titled “Global Surface Protection Tapes Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Market Breakup by Surface Material

- Polished Metals

- Glass

- Plastics

- Others

Market Breakup by End Use

- Electronics and Appliances

- Building and Construction

- Automotive

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Global Surface Protection Tapes Market Share

Surface protection tapes are essential in the electronics and appliances industry, protecting sensitive components from scratches, dust, and damage during manufacturing, shipping, and installation. They help preserve the appearance and functionality of delicate surfaces, ensuring durability and reducing repair costs. In October 2021, Panasonic introduced BEYOLEX™, a stretchable substrate film for printed electronics, offering high temperature resistance, durability, and compatibility with various inks, suitable for industries like health, automotive, IoT, and aerospace.In the building and construction sector, surface protection tapes are employed to shield surfaces like glass, floors, and walls from dirt, stains, and scratches during construction, transport, and handling, thereby driving the demand of the surface protection tapes market. They provide UV resistance and chemical protection, ensuring materials remain pristine and reducing the need for costly post-construction repairs.

Surface protection tapes are vital in the automotive industry for preserving both vehicle exteriors and interiors during manufacturing, transportation, and assembly. These tapes protect against scratches, abrasions, and environmental damage, helping maintain the vehicle's aesthetic appeal and ensuring a high-quality final product. In August 2024, GoMechanic expanded into car detailing, offering Ceramic Coating and Paint Protection Film (PPF) services to improve vehicle protection and appearance, with plans to expand across 50 cities in India.

Competitive Landscape

The surface protection tapes market key players specialise in products across various industries, including electronics, automotive, healthcare, and industrial applications. They are recognised for their innovative solutions, such as adhesive tapes, optical films, and components used in consumer electronics, medical devices, and automotive products. With a strong emphasis on research and development, these companies consistently work to create advanced technologies that address the evolving needs of their customers.Saint-Gobain S.A.

Headquartered in Paris, France, Saint-Gobain was established in 1665. It is a global leader in the design, production, and distribution of building materials, with a focus on innovative solutions for construction, mobility, and healthcare. The company is committed to sustainability and advancing materials for a sustainable future.

Nitto Denko Corporation

Nitto Denko Corporation, founded in 1918, is headquartered in Osaka, Japan. It is a leading manufacturer of innovative materials, focusing on adhesive tapes, optical films, and industrial products. The company’s technology-driven solutions cater to industries such as electronics, automotive, and healthcare, with a strong commitment to sustainability.Tesa SE

Tesa SE, based in Hamburg, Germany, was established in 1906. It is renowned for its high-performance adhesive tapes used in various industries, including automotive, electronics, and construction. Tesa focuses on sustainability and innovation, providing advanced adhesive solutions that meet the evolving needs of global markets.Avery Dennison Corporation

Avery Dennison Corporation, founded in 1935 and headquartered in California, United States is a global leader in labelling and packaging materials. The company provides innovative solutions across industries, including retail, logistics, and consumer goods. Avery Dennison focuses on sustainability, creating smarter, more efficient, and sustainable products for customers worldwide.Other key players in the surface protection tapes market report are Toray Industries, Inc., and Berry Global Group, Inc. among others.

Table of Contents

Companies Mentioned

The key companies featured in this Surface Protection Tapes market report include:- Saint-Gobain S.A.

- Nitto Denko Corporation

- Tesa SE

- Avery Dennison Corporation

- Toray Industries, Inc.

- Berry Global Group, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 17.36 Billion |

| Forecasted Market Value ( USD | $ 33.52 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |