Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This market encompasses the production, distribution, and utilization of BSA, serving a wide range of end-users, including academic and research institutions, pharmaceutical companies, biotechnology firms, and diagnostic laboratories. For instance, according to the National Library of Medicine, a total of 310 million major surgeries were conducted worldwide in 2022. Of these, approximately 40-50 million took place in the U.S., while around 20 million were performed across Europe. This highlights the significant global demand for surgical procedures, with the U.S. and Europe comprising a substantial portion of the total volume.

Key factors driving the global bovine serum albumin market's growth include its vital role in cell culture and various biochemical assays, its use as a stabilizer in a variety of diagnostic and therapeutic products, and its increasing demand in the pharmaceutical and biotechnology sectors. BSA serves as a critical component in cell culture media, providing essential nutrients, growth factors, and buffering capacity, thereby facilitating cell growth and protein production, making it indispensable in bioprocessing.

Key Market Drivers

Growing Biopharmaceutical Industry

The rapid expansion of the biopharmaceutical industry has significantly contributed to the growth of the global bovine serum albumin (BSA) market. This burgeoning sector, driven by the development of biologics such as monoclonal antibodies, vaccines, and gene therapies, heavily relies on BSA for its unique properties and functionalities. BSA serves as a stabilizing agent during the production of biopharmaceuticals, which are complex and fragile molecules. Its ability to protect these sensitive molecules from denaturation and aggregation is crucial for ensuring the safety and efficacy of the final drug products.The biopharmaceutical industry's increasing demand for BSA is rooted in several factors. First, the biologics market has experienced remarkable growth due to the effectiveness of these therapies in treating various diseases, including cancer, autoimmune disorders, and infectious diseases. As more biologics enter the market and new therapies are developed, the demand for BSA as a stabilizing and protecting agent in their production processes rises correspondingly.

Key Market Challenges

Ethical Concerns and Alternative Sources

One of the primary challenges facing the BSA market is the growing ethical concern surrounding the use of bovine-derived products. The extraction of BSA from cow's blood serum is associated with ethical dilemmas, as it raises questions about the welfare of animals involved in the process. Cows may undergo invasive procedures to collect serum, raising concerns about cruelty and the treatment of these animals.In response to these concerns, consumers, organizations, and researchers are advocating for more ethical practices in the production of BSA and seeking alternatives that do not involve animal exploitation. For instance, according to a July 2022 report from the Centers for Disease Control and Prevention, six in ten Americans have at least one chronic condition, including stroke, heart disease, cancer, or diabetes. The increasing prevalence of chronic illnesses and the growing demand for personalized medicine are anticipated to drive the demand for bovine serum albumin in the region.

The ethical concerns surrounding bovine-derived BSA have driven the exploration of alternative sources of albumin. Several promising alternatives have emerged, each aiming to address ethical, sustainability, and safety issues. Two notable alternatives are recombinant albumin and plant-based albumin.

Key Market Trends

Expansion of Cell Culture Applications

The expansion of cell culture applications is a key driver boosting the global bovine serum albumin (BSA) market. Cell culture techniques have gained widespread adoption in academic research, biotechnology, and the pharmaceutical industry. BSA, derived from cow's blood serum, is an indispensable component in cell culture media, providing essential nutrients, growth factors, and buffering capacity that are critical for cell growth and protein production.Researchers and manufacturers are increasingly relying on cell culture to propagate cells for various applications, such as drug development, vaccine production, and regenerative medicine. The ability to create a controlled environment that supports cell growth and replication is essential for the development of advanced therapies and bioprocessing. BSA plays a pivotal role in these processes, ensuring the optimal conditions for cell growth, enhancing productivity, and improving the reproducibility of experiments.

Key Market Players

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc (U.S.)

- Merck KGAA (Germany)

- Itoham Yonekyu Holdings Inc (Japan)

- Proliant Biologicals (U.S.)

- Kraeber & Co Gmbh (Germany)

- Rockland Immunochemicals Inc (U.S.)

- Rocky mountain biologicals (U.S.)

- BelHealth investment partners, LLC (U.S.)

- Bio-Techne Corporation (U.S.)

Report Scope:

In this report, the Global Bovine Serum Albumin Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bovine Serum Albumin Market, By Product:

- Human Serum Albumin

- Bovine Albumin

- Recombinant Serum Albumin

Bovine Serum Albumin Market, By Application:

- Therapeutic

- Drug Delivery

- Culture Media

- Vaccine Ingredient

- Others

Bovine Serum Albumin Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bovine Serum Albumin Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc (U.S.)

- Merck KGAA (Germany)

- Itoham Yonekyu Holdings Inc (Japan)

- Proliant Biologicals (U.S.)

- Kraeber & Co Gmbh (Germany)

- Rockland Immunochemicals Inc (U.S.)

- Rocky mountain biologicals (U.S.)

- BelHealth investment partners, LLC (U.S.)

- Bio-Techne Corporation (U.S.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | March 2025 |

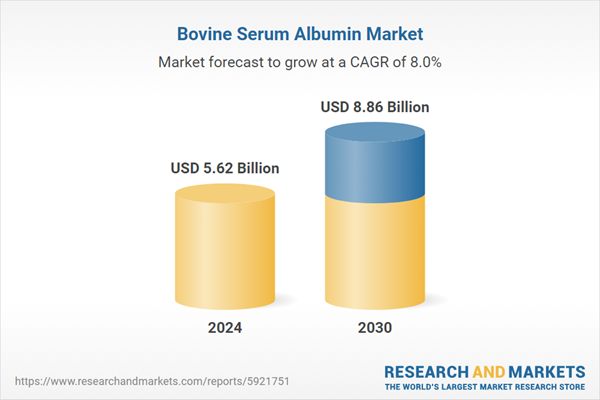

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.62 Billion |

| Forecasted Market Value ( USD | $ 8.86 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |