Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Global Demand for Oil and Gas

The global offshore drilling rigs market is significantly influenced by the rising global demand for oil and gas. As the world population continues to grow, coupled with urbanization and industrialization in emerging economies, there is an incessant need for energy resources. Offshore drilling rigs play a crucial role in meeting this escalating demand by exploring and extracting hydrocarbons from beneath the seabed. Offshore drilling offers access to vast untapped reserves that are often located in deepwater and ultra-deepwater regions.Technological advancements have enabled the industry to explore and exploit oil and gas reserves in increasingly challenging environments. As onshore resources become more constrained, offshore exploration becomes imperative. This growing demand for hydrocarbons, driven by the energy needs of both developed and developing nations, is a key driver propelling the expansion of the global offshore drilling rigs market.

Governments and energy companies are investing heavily in offshore exploration and production projects to secure future energy supplies. These investments, often in the form of exploration licenses, lease agreements, and partnerships, contribute to the sustained growth of the offshore drilling rigs market. Additionally, offshore reserves are frequently found in politically stable regions, which further incentivizes investment.

Technological Advancements and Innovation

The offshore drilling rigs market is strongly influenced by continuous technological advancements and innovation. The industry has witnessed a paradigm shift with the development of cutting-edge technologies that enhance the efficiency, safety, and environmental sustainability of offshore drilling operations.Automation and digitalization have become integral components of offshore drilling rigs, enabling real-time monitoring and control of drilling processes. Advanced sensors, robotics, and data analytics contribute to improved decision-making, reduced downtime, and enhanced overall performance. Robotics, in particular, is revolutionizing tasks that were traditionally performed by human operators, minimizing operational risks in hazardous offshore environments.

Innovations in drilling techniques, such as managed pressure drilling (MPD) and dual gradient drilling, have enabled operators to address complex geological challenges and enhance drilling efficiency. Additionally, advancements in materials and engineering have led to the development of more robust and resilient offshore drilling rigs capable of withstanding harsh environmental conditions, including extreme temperatures and high-pressure environments.

Depleting Onshore Reserves and Exploration of Deepwater Basins

Depleting onshore oil and gas reserves, coupled with the maturation of existing fields, has driven the offshore drilling industry to explore deepwater and ultra-deepwater basins. As easily accessible onshore resources diminish, the industry is compelled to move towards more challenging and technically demanding offshore environments.Deepwater basins, often located far from shore, present both opportunities and challenges. The untapped potential of these offshore reserves, with estimates suggesting significant hydrocarbon deposits, motivates energy companies to invest in advanced drilling technologies capable of operating in extreme depths. Offshore drilling rigs equipped for deepwater exploration are pivotal in unlocking these reserves and sustaining global energy needs.

Furthermore, deepwater drilling allows access to new geological formations that may contain substantial oil and gas resources. The quest for reserves in deeper waters has become a strategic imperative for many energy companies, driving the demand for specialized offshore drilling rigs designed for deepwater exploration and production.

In conclusion, the increasing global demand for energy, continuous technological advancements, and the exploration of deepwater basins are three interlinked drivers propelling the growth of the global offshore drilling rigs market. As the industry evolves, innovations in technology and exploration strategies will likely continue to shape the trajectory of offshore drilling.

Key Market Challenges

Regulatory and Environmental Compliance

One of the foremost challenges facing the global offshore drilling rigs market is the complex web of regulatory requirements and environmental compliance standards. As offshore drilling operations extend into deeper and more environmentally sensitive areas, governments and regulatory bodies are intensifying scrutiny to ensure that exploration and extraction activities adhere to stringent environmental protection measures.The regulatory landscape is intricate and varies across regions, with each jurisdiction imposing its set of rules and standards. Compliance with these regulations demands substantial financial investments from drilling companies to implement advanced technologies and methodologies that mitigate the environmental impact of their operations. For instance, regulations often mandate the deployment of blowout preventers, spill response plans, and comprehensive environmental impact assessments.

Stricter regulatory frameworks can result in increased operational costs and project timelines, posing a significant challenge for companies operating in the global offshore drilling rigs market. Navigating through the evolving regulatory landscape requires a proactive approach, continuous monitoring of compliance requirements, and a commitment to adopting sustainable practices to mitigate environmental risks.

Technological and Operational Risks

While technological advancements are a driver for the offshore drilling industry, they also present significant challenges. The complexity of offshore drilling operations, especially in deepwater and ultra-deepwater environments, introduces inherent technological and operational risks. The harsh offshore conditions, including extreme temperatures, high pressures, and corrosive environments, necessitate the use of sophisticated and resilient technologies.Moreover, the integration of automation, artificial intelligence, and robotics introduces a new dimension of operational challenges. While these technologies enhance efficiency, they also require skilled personnel for maintenance, monitoring, and troubleshooting. Ensuring the seamless integration of these advanced systems while maintaining safety standards is an ongoing challenge for the industry.

Unforeseen technical failures, equipment malfunctions, and operational errors can lead to catastrophic events such as blowouts, spills, and accidents. These risks not only pose threats to the safety of personnel but also result in reputational damage and financial losses for the companies involved. As the industry continues to push the boundaries of exploration, managing and mitigating technological and operational risks will remain a critical challenge for the global offshore drilling rigs market.

Volatility in Oil and Gas Prices

The global offshore drilling rigs market is intricately linked to the volatile nature of oil and gas prices. The industry's profitability is highly dependent on the market value of hydrocarbons, which is subject to geopolitical events, economic conditions, and supply-demand dynamics. Fluctuations in oil and gas prices can have a profound impact on exploration and production activities, influencing investment decisions and project viability.During periods of low oil prices, companies may face financial constraints, leading to deferred or canceled exploration projects. Conversely, during periods of high prices, there is increased pressure to accelerate exploration and production activities. The cyclical nature of the oil and gas market creates uncertainties for companies operating in the offshore drilling sector, making long-term planning and investment decisions challenging.

Additionally, the global transition towards renewable energy sources and the increasing emphasis on sustainability further contribute to the uncertainty in the oil and gas market. As the world moves towards a more diversified energy portfolio, companies in the offshore drilling rigs market must navigate the evolving energy landscape and adapt to changing market dynamics, adding another layer of complexity to the challenge of price volatility. Developing resilient strategies to cope with market fluctuations while maintaining financial stability is a persistent challenge for the global offshore drilling industry.

Key Market Trends

Digitalization and Automation Revolutionizing Offshore Operations

A prominent trend shaping the global offshore drilling rigs market is the increasing adoption of digitalization and automation technologies. As the industry undergoes a digital transformation, offshore drilling rigs are becoming more connected and data-driven. This trend is driven by the pursuit of efficiency, cost reduction, and improved safety in offshore operations.Digitalization involves the integration of sensors, Internet of Things (IoT) devices, and advanced data analytics to monitor and optimize various aspects of drilling operations in real time. These technologies provide valuable insights into equipment performance, drilling parameters, and environmental conditions. Automated systems, controlled by artificial intelligence (AI), enhance decision-making processes, enabling quicker responses to changing conditions and minimizing downtime.

Automation plays a crucial role in increasing the efficiency and safety of offshore drilling activities. Automated drilling systems can optimize drilling processes, reduce human errors, and enhance overall operational performance. Robotics is being employed for tasks such as pipe handling, equipment maintenance, and even remotely operated underwater vehicles (ROVs) for subsea operations. This not only improves the precision and speed of operations but also contributes to the safety of personnel by minimizing their exposure to hazardous environments.

The trend toward digitalization and automation is expected to continue, with ongoing innovations in AI, machine learning, and robotics further transforming the offshore drilling rigs market. Companies that invest in and embrace these technologies are likely to gain a competitive edge by achieving higher operational efficiency, reducing costs, and ensuring safer offshore drilling operations.

Increasing Focus on Sustainability and ESG (Environmental, Social, and Governance) Practices

Another significant trend influencing the global offshore drilling rigs market is the increasing emphasis on sustainability and ESG practices. As the world grapples with the challenges of climate change and environmental degradation, stakeholders across the energy sector, including offshore drilling companies, are under growing pressure to adopt environmentally responsible practices.The offshore drilling industry is inherently linked to environmental concerns due to the potential risks of oil spills, habitat disruption, and emissions associated with exploration and production activities. In response to these challenges, there is a notable shift towards sustainable practices, with companies prioritizing ESG considerations in their business strategies. This trend is not only driven by regulatory requirements but also by the growing demand from investors, customers, and the general public for responsible and ethical business practices.

Companies in the offshore drilling rigs market are investing in technologies and practices that minimize the environmental impact of their operations. This includes the development of advanced blowout prevention systems, subsea leak detection technologies, and the implementation of rigorous environmental impact assessments before drilling activities commence. Additionally, there is an increased focus on reducing greenhouse gas emissions through the use of cleaner energy sources and the implementation of energy-efficient technologies on drilling rigs.

The integration of sustainability and ESG practices is not only a response to regulatory pressures but also a strategic move to enhance the industry's reputation, attract socially responsible investors, and meet the evolving expectations of stakeholders. As the global focus on sustainability intensifies, companies that proactively embrace and communicate their commitment to ESG principles are likely to position themselves as leaders in the evolving offshore drilling rigs market.

Segmental Insights

Type Insights

The Jack-Up Rig segment emerged as the dominating segment in 2022. The Jack-Up Rig segment is a crucial component of the global offshore drilling rigs market, characterized by its unique design and operational capabilities. Jack-Up Rigs are mobile offshore drilling units with retractable legs that can be lowered to the seabed to provide stability during drilling operations.Jack-Up Rigs are designed to operate in shallow to intermediate water depths. Their distinctive feature is the ability to "jack up" above the water surface by extending their legs to the seafloor, essentially transforming the rig into a stable platform. This design allows for drilling in water depths ranging from a few feet to around 400 feet, making Jack-Up Rigs versatile and well-suited for various offshore environments. The mobility of Jack-Up Rigs sets them apart from other types of drilling rigs. They can be towed to different locations, providing flexibility for exploration and production activities in different offshore basins. This mobility is especially valuable for cost-effective drilling in multiple locations without the need for extensive disassembly and transportation.

The demand for Jack-Up Rigs is influenced by factors such as oil and gas prices, exploration and production activities, and the need for cost-effective drilling solutions. During periods of increased oil prices, there is typically a higher demand for exploration and production activities, leading to a surge in demand for Jack-Up Rigs. Conversely, when oil prices are low, companies may scale back drilling operations, impacting the demand for these rigs. Regions with extensive shallow to intermediate water depths, such as the Gulf of Mexico, the Middle East, and certain areas in Southeast Asia, are primary markets for Jack-Up Rigs. The adaptability of these rigs to different water depths and their relatively lower day rates compared to other types of rigs make them attractive for operators seeking cost-effective solutions.

Operating Depth Insights

The Shallow Water segment is projected to experience rapid growth during the forecast period. The Shallow Water segment is a critical component of the global offshore drilling rigs market, catering to exploration and production activities in relatively shallow water depths. Shallow water drilling operations typically occur in depths ranging from a few feet to around 500 feet. This segment is characterized by specific advantages and challenges that influence its significance within the broader offshore drilling industry.Shallow water drilling operations are characterized by their proximity to the coastline and the ability to use a variety of drilling rigs, including Jack-Up Rigs and some types of Semi-Submersible Rigs. The shallow water environment offers advantages in terms of drilling costs, accessibility, and overall operational simplicity compared to deeper water environments. Shallow water drilling is often associated with fields that are closer to the shore and exhibit less complexity in terms of logistics and operational challenges.

The demand for drilling rigs in shallow water is influenced by several factors, including the presence of hydrocarbon reserves, oil and gas prices, and regulatory environments. Regions with extensive shallow water basins, such as the Gulf of Mexico, the North Sea, and parts of Southeast Asia, are key markets for the Shallow Water segment. The economic viability of drilling in these regions is often tied to the relatively lower costs associated with shallow water operations. The demand for shallow water drilling rigs is also influenced by the maturity of existing fields and the need for brownfield exploration and redevelopment. Additionally, regulatory frameworks that facilitate or restrict shallow water drilling activities can impact market dynamics.

Regional Insights

Asia Pacific emerged as the dominating region in 2022, holding the largest market share. The Asia-Pacific region encompasses a vast expanse of maritime territories, including the South China Sea, the Indian Ocean, and the Australian offshore basins. These waters are known for their rich hydrocarbon potential, with substantial reserves of oil and natural gas. Countries like China, Australia, Malaysia, Indonesia, and India have been actively exploring and developing offshore oil and gas fields in both shallow and deepwater areas. The South China Sea, in particular, is a region of strategic importance and a focal point for offshore drilling activities. However, the geopolitical complexities and territorial disputes in this area have added challenges to exploration and production efforts.To tap into the offshore hydrocarbon potential, countries in the Asia-Pacific region are investing heavily in advanced technologies and infrastructure for offshore drilling. This includes the deployment of modern drilling rigs, subsea technologies, and digitalization to enhance efficiency and safety. International oil and gas companies, as well as national oil companies, are partnering to bring in expertise and capital for offshore exploration and production projects.

The regulatory environment in the Asia-Pacific region varies across countries, each with its set of rules governing offshore drilling activities. Governments are increasingly focusing on balancing economic development with environmental sustainability. Stricter regulations related to safety standards, environmental impact assessments, and decommissioning requirements are being implemented to mitigate the potential risks associated with offshore drilling.

Environmental concerns, particularly in ecologically sensitive areas such as the Great Barrier Reef in Australia or the coral-rich regions in Southeast Asia, have led to increased scrutiny and public awareness. This has influenced the regulatory frameworks and necessitated the adoption of advanced technologies to minimize the environmental impact of offshore drilling.

The development of offshore drilling in the Asia-Pacific region is closely linked to the establishment of supporting infrastructure. The construction of pipelines, offshore platforms, and onshore processing facilities is essential for the successful development of offshore reserves. Additionally, investments in connectivity, such as liquefied natural gas (LNG) terminals and transportation networks, play a crucial role in ensuring the efficient transportation of extracted resources to markets.

Countries in the Asia-Pacific region often engage in regional collaborations and partnerships to leverage collective resources and expertise for offshore exploration and production. Joint ventures and consortiums are formed to share risks and costs, facilitating the development of large-scale offshore projects.

In conclusion, the Asia-Pacific region is a dynamic and evolving market in the global offshore drilling rigs sector. The interplay of technological advancements, regulatory frameworks, economic development, and environmental considerations will shape the trajectory of offshore drilling activities in this region in the years to come.

Report Scope:

In this report, the Global Offshore Drilling Rigs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Offshore Drilling Rigs Market, By Type:

- Jack-Up Rig

- Drillship

- Semi-Submersible

Offshore Drilling Rigs Market, By Operating Depth:

- Shallow Water

- Deep Water

- Ultra-Water

Offshore Drilling Rigs Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Netherlands

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Malaysia

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Offshore Drilling Rigs Market.Available Customizations:

Global Offshore Drilling Rigs Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hercules Offshore Inc.

- Atwood Oceanics

- KCA Deutag

- Aban Offshore Limited

- Noble Corporation

- Ensco PLC

- Diamond Offshore Drilling Inc.

- Nabors Industries Ltd.

- Maersk Drilling

- China Oilfield Services Limited

Table Information

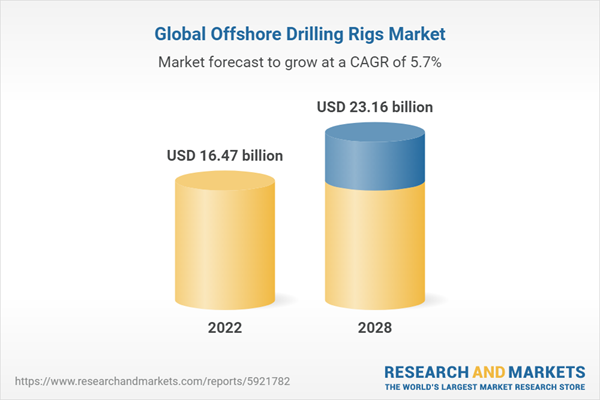

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 16.47 billion |

| Forecasted Market Value ( USD | $ 23.16 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |