Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Furthermore, the market's growth is driven by the evolving preferences of consumers who are increasingly looking for unique and premium tea experiences. The rise of specialty tea shops, cafes, and tea lounges globally has further fueled this trend, providing a platform for the exploration of diverse tea blends and brewing techniques.

As the market continues to expand, it is witnessing a convergence of traditional and modern elements. While classic tea varieties retain their popularity, there is a simultaneous surge in demand for ready-to-drink and on-the-go tea options. This shift aligns with the fast-paced lifestyles of consumers, emphasizing convenience without compromising on quality.

In summary, the global out-of-home tea market is thriving due to a confluence of factors such as health consciousness, innovation in product offerings, and a dynamic shift in consumer preferences towards diverse and convenient tea experiences. The market's trajectory is likely to remain upward as it caters to the evolving tastes and lifestyles of a diverse and discerning global consumer base.

Key Market Drivers

Health and Wellness Trends

One of the primary drivers propelling the out-of-home tea market is the overarching global trend towards health and wellness. As consumers become increasingly conscious of their dietary choices, there is a growing inclination towards beverages that offer perceived health benefits. Tea, known for its antioxidant properties and various health-promoting compounds, aligns well with this trend. The market has responded by promoting tea as a healthier alternative to sugary and carbonated beverages, positioning it as a functional drink that not only quenches thirst but also contributes positively to well-being.Consumers are actively seeking beverages that cater to specific health needs, such as herbal teas for relaxation or teas with immune-boosting ingredients. This has led to an influx of innovative tea blends and formulations, including those featuring adaptogens, superfoods, and other natural ingredients. The out-of-home tea market's growth is, therefore, intricately linked to the broader movement towards healthier lifestyle choices.

Innovation in Product Offerings

The out-of-home tea market is characterized by a constant influx of innovative product offerings designed to capture consumer interest and meet evolving preferences. Manufacturers and vendors are actively experimenting with flavor profiles, brewing techniques, and presentation styles to differentiate their products in a competitive landscape. This innovation extends beyond traditional tea varieties, with an emphasis on creating unique and exotic blends that cater to diverse palates.Ready-to-drink (RTD) tea products have emerged as a significant driver within this category, providing convenient options for consumers on the go. These products often feature appealing packaging and marketing strategies that position them as refreshing and convenient alternatives to other beverages. The market's receptivity to such innovations underscores the importance of staying abreast of consumer trends and preferences in shaping product development strategies.

Diverse Consumer Preferences

The out-of-home tea market thrives on its ability to cater to a broad spectrum of consumer preferences. Tea, with its rich cultural history and global appeal, allows for a diverse range of offerings that can resonate with various taste preferences and cultural backgrounds. From classic black and green teas to herbal infusions, fruit blends, and specialty teas, the market's diversity is a key driver of its sustained growth.Moreover, the emergence of specialty tea shops and cafes has provided a platform for consumers to explore and appreciate the nuances of different tea varieties. This trend reflects a desire for unique and premium tea experiences, with consumers actively seeking out high-quality and artisanal teas. The ability of the out-of-home tea market to accommodate and celebrate this diversity contributes significantly to its attractiveness to a wide and discerning consumer base.

Changing Lifestyles and On-the-Go Consumption

Shifts in consumer lifestyles, characterized by busier schedules and an increased emphasis on convenience, have fueled the demand for on-the-go and ready-to-drink tea options. The out-of-home tea market has adapted to these changing dynamics by offering products that align with the fast-paced nature of contemporary living. RTD teas, often available in convenient packaging such as bottles or cans, cater to consumers seeking quick refreshment without compromising on quality.The convenience factor extends to the broader out-of-home consumption landscape, encompassing cafes, restaurants, and other foodservice outlets. Tea is increasingly becoming a staple on the menu of such establishments, with a variety of options ranging from traditional tea services to innovative tea-based cocktails and mocktails. This integration into diverse consumption spaces aligns with the evolving preferences of consumers who value both the experience and the convenience of enjoying tea outside the confines of their homes.

Globalization and Cultural Exchange

The out-of-home tea market is greatly influenced by the interconnectedness of cultures and the globalization of food and beverage trends. As international travel and communication continue to bridge cultural gaps, there is a growing appreciation for diverse culinary and beverage traditions. Tea, deeply rooted in the cultural practices of various regions, has become a global phenomenon, with consumers embracing and celebrating the unique flavors and rituals associated with different tea cultures.This cultural exchange is evident in the availability of teas from around the world in diverse markets. From Japanese matcha and Chinese oolong to Indian chai and Moroccan mint tea, the out-of-home tea market benefits from a rich tapestry of global tea offerings. This cross-cultural integration not only broadens the choices available to consumers but also contributes to the market's resilience and adaptability.

Key Market Challenges

Competition and Saturation

One of the primary challenges facing the out-of-home tea market is the increasing competition and market saturation. As the popularity of tea as a beverage option rises, numerous players, from established brands to new entrants, are vying for consumer attention. This saturation poses challenges for businesses in terms of differentiating their products and establishing a unique value proposition in a crowded marketplace.To address this challenge, companies need to invest in strategic branding, marketing, and product innovation. Creating a distinct identity through unique tea blends, flavor profiles, or sustainable sourcing practices can help a brand stand out. Additionally, forming strategic partnerships with cafes, restaurants, and other foodservice outlets can provide avenues for increased visibility and consumer engagement. The ability to navigate and rise above the competitive landscape is crucial for sustained success in the out-of-home tea market.

Economic Uncertainties and Pricing Pressures

Global economic uncertainties, currency fluctuations, and inflationary pressures pose challenges to the out-of-home tea market. Consumers may alter their spending habits during economic downturns, leading to a shift in preferences towards more affordable options. This can impact premium tea offerings and potentially create pricing pressures for manufacturers and vendors.To mitigate the impact of economic uncertainties, businesses in the out-of-home tea market should maintain agility in their pricing strategies. Offering a range of products at different price points can appeal to a broader consumer base. Additionally, emphasizing value propositions such as health benefits, unique flavors, or ethical sourcing can help justify premium pricing. Adapting to economic fluctuations and implementing flexible pricing strategies are essential for navigating the complex financial landscape of the global market.

Supply Chain Disruptions and Sustainability Concerns

The out-of-home tea market is vulnerable to supply chain disruptions, which can arise from various factors, including natural disasters, geopolitical tensions, and pandemics. The global nature of the tea supply chain, with tea sourced from different regions worldwide, makes it particularly susceptible to interruptions. Moreover, sustainability concerns related to sourcing practices, environmental impact, and fair trade practices are gaining prominence, and companies are under increasing pressure to address these issues.To tackle supply chain disruptions, businesses should invest in diversifying their sourcing locations and establishing contingency plans. Building resilient and transparent supply chains helps mitigate risks and ensures a steady tea supply even in challenging circumstances. Addressing sustainability concerns requires a commitment to ethical and environmentally friendly practices, which can be leveraged as a competitive advantage. Certification programs, such as organic and fair trade certifications, can enhance a brand's credibility and appeal to socially conscious consumers.

Regulatory and Compliance Challenges

The out-of-home tea market is subject to a complex web of regulations and compliance standards, both at the national and international levels. These regulations cover aspects such as food safety, labeling requirements, and health claims. Navigating this regulatory landscape can be challenging, especially for businesses operating in multiple regions with varying regulatory frameworks.To overcome regulatory challenges, companies must stay informed about the evolving regulatory landscape and ensure strict compliance with all relevant standards. This may involve investment in testing, certification, and quality control measures. Collaborating with industry associations and regulatory bodies can provide valuable insights and help businesses stay ahead of regulatory changes. Additionally, a proactive approach to transparency in labeling and communication with consumers can foster trust and compliance.

Key Market Trends

Functional and Wellness Teas

A significant trend in the out-of-home tea market is the rising demand for functional and wellness teas. Consumers are increasingly seeking beverages that offer not only refreshment but also health benefits. This has led to the popularity of teas infused with ingredients known for their health-promoting properties, such as antioxidants, adaptogens, and herbal extracts.Functional teas designed to address specific health concerns, such as digestion, relaxation, or immune support, are gaining traction. Matcha, turmeric, and ginger-infused teas are examples of functional blends that have found favor among health-conscious consumers. The out-of-home tea market is responding by incorporating these functional offerings into menus at cafes, tea houses, and restaurants, catering to a growing segment of consumers looking for holistic well-being through their beverage choices.

Premiumization and Artisanal Offerings

The trend towards premiumization in the out-of-home tea market reflects consumers' willingness to pay for unique and high-quality tea experiences. Artisanal and specialty teas, often sourced from specific regions and featuring distinctive flavor profiles, are gaining popularity. This trend aligns with the broader consumer interest in exploring and appreciating the nuances of tea, similar to the way fine wines or craft beers are savored.Tea establishments, from upscale tea rooms to specialty cafes, are capitalizing on this trend by curating premium tea menus and offering elevated tea experiences. The emphasis on craftsmanship, authenticity, and storytelling around the origin of teas contributes to the premiumization of the out-of-home tea market. As consumers increasingly view tea consumption as a sophisticated and cultural experience, this trend is likely to continue influencing the industry.

Sustainable and Ethical Practices

The sustainability trend is making significant inroads into the out-of-home tea market, driven by consumer awareness and demand for environmentally friendly and socially responsible practices. Businesses are increasingly adopting sustainable sourcing methods, reducing packaging waste, and implementing eco-friendly initiatives throughout the supply chain.Tea brands are emphasizing ethical sourcing practices, fair trade certifications, and eco-friendly packaging to align with consumers' values. Additionally, the concept of "farm-to-cup" transparency is gaining traction, with consumers expressing interest in knowing the journey of their tea from cultivation to consumption. Sustainability is not just a buzzword; it has become a key factor influencing purchasing decisions, and brands that prioritize ethical and sustainable practices are likely to gain a competitive edge in the out-of-home tea market.

Innovative Tea Formats

Innovation in tea formats is reshaping the out-of-home tea market, offering consumers a diverse range of options beyond traditional brewed teas. Ready-to-drink (RTD) teas, cold brews, tea-infused cocktails, and tea-based mocktails are gaining popularity, catering to the changing lifestyles and preferences of consumers. These innovative formats provide convenience, refreshing alternatives, and new taste experiences.RTD teas, in particular, are experiencing a surge in demand as consumers seek on-the-go options. The convenience of grabbing a bottled or canned tea from a store or vending machine aligns with the fast-paced nature of modern life. The out-of-home tea market is witnessing a creative fusion of tea with other beverages, creating novel and appealing offerings that cater to a diverse range of tastes and occasions.

Technology Integration in Tea Experiences

The integration of technology is transforming the out-of-home tea experience, from ordering and customization to immersive tea education. Mobile apps, self-service kiosks, and digital menu boards are becoming commonplace in tea establishments, offering customers a seamless and interactive experience. Technology is also being used to enhance tea brewing precision, ensuring that each cup meets the desired flavor profile.Tea brands are leveraging social media platforms to connect with consumers, share stories, and create communities around their products. Virtual tea tastings and online educational sessions are gaining popularity, allowing consumers to explore the world of tea from the comfort of their homes. The use of technology not only enhances convenience but also provides opportunities for tea brands to engage with consumers in innovative and personalized ways.

Global Tea Fusion and Culinary Exploration

The trend of global tea fusion and culinary exploration is reshaping the flavor landscape of the out-of-home tea market. Consumers are increasingly open to trying teas that incorporate diverse ingredients and culinary influences from around the world. Tea blends infused with spices, herbs, fruits, and botanicals create a symphony of flavors, appealing to adventurous palates.Tea houses and cafes are experimenting with tea-based culinary creations, incorporating tea into desserts, savory dishes, and even cocktails. This trend reflects a broader shift in consumer expectations, where tea is not just a beverage but a versatile ingredient that can elevate culinary experiences. The fusion of global culinary influences with traditional tea offerings adds an exciting dimension to the out-of-home tea market, attracting consumers who appreciate innovation and diversity in their gastronomic adventures.

Segmental Insights

Product Type Insights

Green tea has emerged as a rapidly growing segment in the global beverage market, driven by increasing consumer awareness of its numerous health benefits and unique flavor profile. Recognized for its high antioxidant content and potential health-promoting properties, green tea has gained popularity among health-conscious consumers seeking beverages that contribute to overall well-being.The growing interest in green tea is fueled by its association with weight management, improved metabolism, and potential cardiovascular benefits. As consumers prioritize healthier lifestyle choices, green tea's natural and holistic image aligns well with these preferences. The beverage's versatility is reflected in its availability in various forms, from traditional loose-leaf options to convenient ready-to-drink formulations, catering to different consumer preferences and lifestyles.

Moreover, the surge in interest in diverse tea cultures and premium tea experiences has contributed to the green tea segment's expansion. Artisanal and high-quality green teas, often sourced from specific regions, are gaining traction, appealing to consumers seeking a more refined and authentic tea-drinking experience. As the demand for natural, functional, and sustainable beverages continues to grow, green tea stands out as a vibrant and evolving segment, poised to capture an even larger share of the global beverage market in the foreseeable future.

Sales Channel Insights

The online segment of the tea market is experiencing significant growth, reflecting the broader trend of digital transformation in consumer behavior. With the increasing prevalence of e-commerce platforms, online tea sales have become a dynamic and flourishing segment. Consumers now have the convenience of exploring a vast array of tea options from the comfort of their homes, contributing to the online segment's expanding market share.This growth is fueled by several factors, including the ease of online purchasing, a wide variety of tea choices, and the ability to access information and reviews instantly. Online tea retailers offer an extensive selection, ranging from traditional loose-leaf teas to innovative blends, catering to diverse tastes and preferences. Moreover, the online platform provides a space for specialty tea vendors and niche brands to reach a global audience, fostering a dynamic and competitive marketplace.

The shift to online tea shopping is also influenced by the desire for convenience, subscription services, and the availability of exclusive offerings. With the integration of technology, virtual tea tastings, educational content, and interactive platforms enhance the online tea-buying experience. As the digital landscape continues to evolve, the online tea segment is poised to be a driving force, shaping the future of the tea market and providing consumers with unparalleled access to a world of tea varieties and experiences.

Regional Insights

The Asia-Pacific region stands out as a rapidly growing segment in the global tea market, reflecting the rich cultural heritage and deep-rooted tradition of tea consumption across diverse nations. As the birthplace of tea, Asia-Pacific holds a pivotal position, with countries like China, India, Japan, and Taiwan contributing significantly to the region's prominence in the tea industry.China, renowned for its centuries-old tea culture, boasts diverse tea varieties such as green tea, black tea, oolong, and Pu-erh, each with distinct flavors and brewing techniques. India, another tea powerhouse, is globally recognized for its robust black teas, including the iconic Assam and Darjeeling varieties. Additionally, Japan is celebrated for its matcha and sencha teas, known for their vibrant green hues and unique preparation methods.

The Asia-Pacific region's growth in the tea market is fueled by increasing international demand for authentic and specialty teas, driven by a growing appreciation for Asian tea cultures and the health benefits associated with tea consumption. Moreover, the rise of tea tourism and the emergence of specialty tea shops further contribute to the region's prominence.

As consumer preferences evolve, the Asia-Pacific tea segment is poised to expand further, offering a diverse range of traditional and innovative tea options. The region's influence on global tea trends is undeniable, making it a key player in shaping the future landscape of the worldwide tea market.

Report Scope:

In this report, the Global Out of Home Tea Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Out of Home Tea Market, By Product Type:

- Black Tea

- Green Tea

- Herbal Tea

- Others

Out of Home Tea Market, By End User:

- Restaurants

- Hotels

- Bars & Pubs

- Others

Out of Home Tea Market, By Sales Channel:

- Supermarket/Hypermarket

- Online

- Specialty Stores

- Others

Out of Home Tea Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Argentina

- Colombia

- Brazil

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Out of Home Tea Market.Available Customizations:

Global Out of Home Tea market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tata Global Beverages Ltd.

- Nestle S.A

- Celestial Seasonings Inc.

- Unilever Plc.

- Ito En Ltd

- Barry’s Tea

- Associated British Foods

- Dilmah Ceylon Tea Company

- The Republic of Tea

- Bettys and Taylors Group Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2023 |

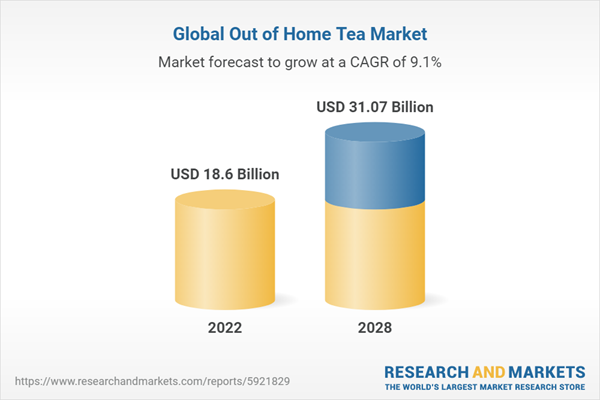

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 18.6 Billion |

| Forecasted Market Value ( USD | $ 31.07 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |