Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The growing demand for high-speed rail transportation, known for its efficiency and reduced travel times, has spurred investments in high-speed rail infrastructure. High-speed rail systems predominantly rely on electrification, driving the adoption of advanced overhead catenary systems.

Rapid urbanization and the need for efficient urban transit solutions have led to the expansion of metro rail networks in major cities worldwide. Many metro rail systems are electrified, requiring robust overhead catenary systems to ensure reliable power supply and smooth operations.

Ongoing technological advancements in catenary system components, including conductors, insulators, and support structures, contribute to the overall efficiency and performance of the system. Innovations such as lightweight materials, improved contact wire designs, and advanced monitoring systems enhance the reliability and maintenance of overhead catenary systems.

Governments across regions are investing in the modernization and expansion of rail infrastructure to meet the growing demand for passenger and freight transport. These investments include funding for electrification projects, presenting opportunities for the railway overhead catenary system market.

A notable trend in the railway overhead catenary system market is the exploration of contactless power supply technologies. These systems, such as wireless or inductive charging, aim to eliminate the need for physical contact between the train and the catenary wire, reducing wear and maintenance requirements.

Automation and digitalization are becoming integral to modern railway systems. The integration of automation technologies, including sensors and monitoring systems, enhances the efficiency of catenary systems by enabling real-time diagnostics, predictive maintenance, and improved overall performance.

There is a growing emphasis on developing catenary system components using lightweight and sustainable materials. This trend aligns with broader sustainability goals in the transportation sector and contributes to reducing the environmental impact of railway infrastructure.

Modular and flexible catenary system designs offer scalability and adaptability to diverse railway environments. This trend allows for easier customization, maintenance, and expansion of electrified rail networks to accommodate varying operational requirements.

The installation of overhead catenary systems involves significant upfront capital costs. Governments and railway operators may face financial challenges in funding large-scale electrification projects, particularly in regions with extensive rail networks.

Ensuring the ongoing maintenance and reliability of overhead catenary systems can contribute to lifecycle costs. Regular inspections, repairs, and component replacements are essential to prevent service disruptions and ensure the longevity of the electrified rail infrastructure.

Upgrading or retrofitting existing rail infrastructure with electrification systems can present compatibility challenges. Integration with legacy systems and addressing spatial constraints in built-up areas may require careful planning and engineering solutions.

The future of the global railway overhead catenary system market looks promising, driven by ongoing railway electrification projects, technological innovations, and a commitment to sustainable transportation solutions. As the demand for efficient, high-speed, and environmentally friendly rail transport continues to rise, the railway overhead catenary system will play a crucial role in shaping the future of electrified railways worldwide. Innovations in materials, automation, and contactless power supply are expected to further enhance the performance and sustainability of these systems, making them integral to the modernization of global rail networks.

Key Market Drivers:

Railway Electrification Initiatives:

Railway electrification initiatives represent a primary driving factor in the Global Railway Overhead Catenary System (OCS) Market. As countries worldwide strive to transition towards sustainable and energy-efficient transportation systems, the electrification of railway networks has gained significant momentum. Electrified railways are viewed as a cleaner and more environmentally friendly alternative to traditional diesel-powered trains, offering reduced emissions and operational costs. The adoption of electrified rail systems necessitates the installation of overhead catenary systems to provide a continuous and reliable power supply to electric trains.

The push for railway electrification is propelled by several factors. First and foremost is the environmental imperative to reduce the carbon footprint of transportation. Electric trains, when powered by clean energy sources, contribute to a substantial decrease in greenhouse gas emissions compared to their diesel counterparts. This aligns with global efforts to combat climate change and promote sustainable modes of transportation.

Additionally, electrified rail systems are known for their operational efficiency and performance advantages. Electric trains typically exhibit faster acceleration and deceleration, reduced maintenance requirements, and lower energy costs over the long term. These operational benefits further drive the adoption of railway electrification initiatives, creating a positive feedback loop that stimulates the demand for overhead catenary systems.

Countries with ambitious railway electrification programs often invest in the development and expansion of their overhead catenary infrastructure. The implementation of reliable and technologically advanced catenary systems becomes integral to the success of large-scale electrification projects. The growing trend towards electrification reflects a strategic vision for modernizing rail networks, enhancing energy efficiency, and meeting the increasing demand for sustainable transportation.

Expansion of High-Speed Rail Networks:

The expansion of high-speed rail networks globally serves as another major driving force in the Railway Overhead Catenary System Market. High-speed rail (HSR) has emerged as a preferred mode of transportation for its ability to significantly reduce travel times between major cities, enhance connectivity, and offer a comfortable and efficient travel experience.

High-speed rail systems predominantly rely on electrification to achieve the speeds and efficiency required for rapid transit. The overhead catenary system becomes an essential component, providing a constant and high-voltage power supply to support the operations of high-speed electric trains. As countries invest in the development and extension of their high-speed rail networks, the demand for advanced and reliable overhead catenary systems experiences substantial growth.

The expansion of high-speed rail is often driven by factors such as urbanization, population density, and the need for efficient inter-city transportation. Governments and transportation authorities recognize the economic, environmental, and social benefits of high-speed rail, leading to substantial investments in electrified rail infrastructure.

The intricate relationship between high-speed rail expansion and the Railway Overhead Catenary System Market underscores the importance of reliable and advanced catenary solutions in supporting the future of rapid and sustainable transportation.

Urbanization and the expansion of metro rail projects contribute significantly to the growth of the Railway Overhead Catenary System Market. Rapid urbanization, coupled with the increasing need for efficient and sustainable urban transit solutions, has led to the proliferation of metro rail systems in major cities worldwide. Metro rail projects, characterized by electrified rail lines, are a common feature in urban landscapes, providing a mass transit solution for densely populated areas.Metro rail systems are preferred for their ability to alleviate traffic congestion, reduce air pollution, and offer a convenient mode of transportation within urban centers. As cities expand and populations concentrate in metropolitan areas, the demand for effective urban transit solutions, including electrified metro rail networks, continues to rise.

The implementation of metro rail projects necessitates the deployment of overhead catenary systems to supply electric power to the trains. The catenary infrastructure plays a critical role in ensuring the reliable and continuous operation of metro rail services, meeting the transportation needs of urban commuters.

Urbanization trends, coupled with the increasing recognition of the benefits of sustainable urban transit, drive investments in metro rail projects. These investments, in turn, stimulate the demand for advanced and efficient Railway Overhead Catenary Systems, positioning them as integral components in the development of modern urban transportation networks. The growth in metro rail projects reflects a commitment to creating smart, interconnected, and environmentally friendly cities, where reliable catenary systems contribute to the success of sustainable urban transit initiatives.

Key Market Challenges

Integration Challenges with Existing Infrastructure:One of the significant challenges facing the Global Railway Overhead Catenary System (OCS) Market is the integration with existing railway infrastructure. Many rail networks around the world have extensive legacy systems, and the process of introducing or upgrading an overhead catenary system must seamlessly integrate with these pre-existing elements. This challenge is particularly pronounced in regions with well-established rail networks that have evolved over decades.

The integration challenge encompasses various aspects, including compatibility with different track configurations, signal systems, and power supply technologies. Upgrading to a new overhead catenary system may require modifications to existing bridges, tunnels, and other structures to accommodate the necessary clearance and support mechanisms. Additionally, ensuring a smooth transition between electrified and non-electrified sections of the rail network poses a complex engineering challenge.

In densely populated urban areas, where space constraints are common, integrating a new catenary system without disrupting existing services and structures becomes even more intricate. This challenge necessitates careful planning, collaboration with multiple stakeholders, and innovative engineering solutions to ensure a harmonious integration with the diverse landscapes of established rail networks.

Overcoming the integration challenges requires a comprehensive understanding of the existing rail infrastructure, effective project management, and a commitment to minimizing disruptions to ongoing rail operations. Rail operators and infrastructure providers need to strategically plan and execute the deployment or upgrade of overhead catenary systems to ensure compatibility with the existing rail ecosystem.

Technological Advancements and Standardization:

The rapidly evolving landscape of rail electrification technologies presents a challenge in the Global Railway Overhead Catenary System Market. As new innovations emerge, ranging from advanced materials for catenary components to cutting-edge monitoring and control systems, the industry faces the challenge of integrating these technologies cohesively while ensuring standardization across different rail networks.

The introduction of novel materials for catenary wires, support structures, and insulators, for example, requires careful consideration of their compatibility with existing infrastructure and adherence to industry standards. Standardization is essential to facilitate interoperability, streamline maintenance procedures, and enable the seamless exchange of components between different manufacturers and suppliers.

The challenge also extends to the integration of digital technologies for real-time monitoring, predictive maintenance, and adaptive control of overhead catenary systems. Implementing these advanced technologies necessitates a standardized approach to data formats, communication protocols, and cybersecurity measures to ensure the reliability and security of the entire rail electrification system.

Global collaboration and the establishment of industry-wide standards are crucial to addressing these technological challenges. Stakeholders, including rail operators, manufacturers, and regulatory bodies, must work collaboratively to set and adhere to standards that promote innovation while ensuring the compatibility and interoperability of diverse technological advancements in the Railway Overhead Catenary System Market.

Environmental and Regulatory Compliance:

Environmental and regulatory compliance poses a significant challenge in the Global Railway Overhead Catenary System Market, particularly concerning the materials used in catenary components and the environmental impact of rail electrification projects. Increasing emphasis on sustainability, carbon reduction, and adherence to stringent environmental regulations requires the industry to navigate complex compliance issues.

The materials used in catenary wires, support structures, and insulators must align with environmental standards, addressing concerns related to resource extraction, manufacturing processes, and end-of-life disposal or recycling. As sustainability becomes a central focus in infrastructure development, the challenge is to balance the need for durable and reliable materials with environmental considerations, such as reducing the carbon footprint and minimizing waste.

Rail electrification projects often involve extensive land use and may impact local ecosystems. Compliance with environmental regulations, including habitat protection, noise mitigation, and air quality standards, requires thorough environmental impact assessments and effective mitigation measures. These assessments are essential for obtaining regulatory approvals and ensuring responsible and sustainable rail electrification projects.

Regulatory compliance also extends to safety standards and operational protocols. The challenge lies in navigating diverse regulatory frameworks across different regions and ensuring that rail electrification projects meet or exceed safety requirements. Adherence to regulatory standards is vital for gaining public trust, obtaining necessary approvals, and ensuring the long-term sustainability of rail electrification initiatives.

Addressing the environmental and regulatory compliance challenges demands a proactive approach, involving collaboration with environmental agencies, adherence to international standards, and a commitment to sustainable practices throughout the life cycle of railway overhead catenary systems. Stakeholders must navigate a complex landscape of regulations, environmental considerations, and safety standards to ensure responsible and compliant rail electrification projects in the Global Railway Overhead Catenary System Market.

Key Market Trends

Electrification of High-Speed Rail Networks:A prominent trend in the Global Railway Overhead Catenary System (OCS) Market is the accelerating electrification of high-speed rail networks across the world. As countries seek to enhance their transportation infrastructure for rapid and efficient connectivity, the electrification of high-speed rail has gained significant momentum. High-speed rail systems, characterized by trains operating at speeds exceeding 250 kilometers per hour, rely on electrification to achieve the necessary performance levels for swift and sustainable transit.

The trend towards electrification is driven by various factors, including the environmental benefits of reducing carbon emissions, increased energy efficiency, and the operational advantages of electric trains. Overhead catenary systems play a pivotal role in supporting the electrification of high-speed rail networks by providing a reliable and continuous power supply to trains. The deployment of advanced catenary technologies, such as auto-tensioning systems and lightweight materials, contributes to the efficiency and performance of electrified high-speed rail systems.

The electrification of high-speed rail networks aligns with global efforts to promote sustainable and eco-friendly modes of transportation. This trend is expected to witness continued growth as countries invest in the expansion and modernization of their rail infrastructure to accommodate high-speed electric trains, driving the demand for innovative and efficient Railway Overhead Catenary Systems.

Integration of Digital Technologies for Smart Catenary Systems:

Another noteworthy trend in the Railway Overhead Catenary System Market is the integration of digital technologies to create smart catenary systems. The advent of the Internet of Things (IoT), sensors, and data analytics has paved the way for the development of intelligent and connected catenary systems that offer enhanced monitoring, diagnostics, and maintenance capabilities.

Smart catenary systems leverage sensors and monitoring devices installed along the overhead infrastructure to collect real-time data on various parameters such as tension, temperature, and wear. This data is then processed and analyzed through advanced analytics platforms, providing insights into the health and performance of the catenary system. Predictive maintenance algorithms can identify potential issues before they escalate, enabling proactive interventions and minimizing downtime.

The integration of digital technologies enhances the overall efficiency and reliability of Railway Overhead Catenary Systems by enabling condition-based maintenance, optimizing energy consumption, and improving safety. The trend towards smart catenary systems reflects a broader movement towards digitalization in the rail industry, where connectivity and real-time data play a crucial role in optimizing operations and ensuring the longevity of overhead electrification infrastructure.

Sustainable Materials and Environmental Considerations:

In response to growing environmental awareness and sustainability goals, the use of sustainable materials in the construction and maintenance of Railway Overhead Catenary Systems has emerged as a key trend. Stakeholders in the rail industry are increasingly prioritizing eco-friendly and recyclable materials to minimize the environmental impact of catenary infrastructure.

Catenary wires, support structures, and insulators are integral components of overhead systems, and the materials chosen for these elements significantly influence the system's overall sustainability. The trend involves the exploration and adoption of materials with reduced carbon footprint, lower energy consumption in manufacturing, and improved recyclability at the end of their lifecycle.

Sustainable materials contribute to environmental conservation, aligning with global initiatives to reduce the transportation sector's ecological footprint. Manufacturers and operators are embracing the trend by incorporating sustainable practices in the design and construction of catenary systems. Additionally, the trend extends to the responsible disposal or recycling of materials at the end of their service life, ensuring a closed-loop approach to sustainability in the Railway Overhead Catenary System Market.

This trend reflects the industry's commitment to balancing the need for robust and durable catenary infrastructure with environmental considerations. As sustainability continues to gain prominence in infrastructure development, the demand for Railway Overhead Catenary Systems constructed with sustainable materials is anticipated to grow, shaping the trajectory of the global rail electrification landscape.

Segmental Insights

Type Insights

The simple catenary segment is the dominating segment in the Global Railway Overhead Catenary System (OCS) Market. This dominance is primarily driven by the simplicity, cost-effectiveness, and versatility of simple catenary systems. Simple catenary systems consist of a single contact wire suspended from messenger wires or supporting structures. This design is relatively simple to install and maintain, making it a suitable choice for a wide range of railway applications, particularly on conventional and low-speed lines.Several factors contribute to the dominance of the simple catenary segment in the global railway OCS market:

Simplicity and Cost-Effectiveness: Simple catenary systems are the simplest and most cost-effective type of OCS. This is due to their straightforward design and the use of fewer components compared to other types of OCS, such as stitched catenary or compound catenary systems.

Versatility: Simple catenary systems can be used on a wide range of railway lines, including conventional, high-speed, and urban transit lines. This versatility makes them a popular choice for railway operators worldwide.

Reliability: Simple catenary systems are known for their reliability and durability. They can withstand a wide range of weather conditions and are relatively resistant to wear and tear.

Ease of Maintenance: Simple catenary systems are relatively easy to maintain. This is because they have fewer components and are less complex than other types of OCS. Maturity of Technology: Simple catenary technology is well-established and mature, having been used for decades in the railway industry. This means that there is a large body of knowledge and expertise available for the design, installation, and maintenance of simple catenary systems. While the simple catenary segment dominates the market, the stitched catenary and compound catenary segments are also experiencing significant growth. Stitched catenary systems are typically used on high-speed lines, where higher current carrying capacity and smoother power transfer are required. Compound catenary systems are used on complex lines, such as those with multiple tracks or frequent changes in grade, where additional overhead support is needed.

Regional Insights

Asia Pacific is the dominating region in the Global Railway Overhead Catenary System (OCS) Market, accounting for approximately 45% of the total market share. This dominance is primarily driven by the rapid growth of railway infrastructure and the expansion of high-speed rail networks in the region. Countries like China, India, and Japan are investing heavily in railway infrastructure development, leading to a significant demand for OCS systems.Here's a breakdown of the key factors contributing to the dominance of Asia Pacific in the Global Railway Overhead Catenary System (OCS) Market

Rapid Rail Infrastructure Development: Asia Pacific is experiencing rapid growth in railway infrastructure development, driven by urbanization, economic growth, and government initiatives to promote sustainable transportation. This growth is creating a strong demand for OCS systems to power the expanding railway networks.High-Speed Rail Expansion: Asia Pacific leads the world in high-speed rail development, with countries like China, Japan, and South Korea operating extensive high-speed rail networks. These networks require advanced OCS systems that can handle the high speeds and power demands of high-speed trains.

Urban Rail Transit Expansion: Urban rail transit is expanding rapidly in Asia Pacific to address traffic congestion and air pollution in major cities. This expansion is driving the demand for OCS systems for urban rail transit lines, including metros, light rail, and tramways.

Technological Advancements: Asia Pacific is at the forefront of OCS technology development, with companies like Alstom, Siemens, and Bombardier having a strong presence in the region. These companies are developing innovative and efficient OCS solutions to meet the growing demand for reliable and high-performance OCS systems.

Government Support: Governments in Asia Pacific are providing significant support for railway infrastructure development and the adoption of advanced OCS technologies. This support includes subsidies, tax incentives, and funding for research and development.

While Asia Pacific dominates the market, other regions such as Europe and North America are also significant players in the global OCS market. Europe has a long history of railway development and is committed to upgrading its existing OCS infrastructure. North America is investing in both new high-speed rail projects and the modernization of existing railway lines, creating a demand for OCS systems.

Overall, the global railway OCS market is expected to grow at a moderate pace in the coming years, driven by the continued expansion of railway infrastructure, the growing demand for high-speed rail, and the urbanization trend in developing countries. Asia Pacific is expected to maintain its dominance in the market, but other regions are also expected to experience significant growth as they invest in railway modernization and expansion.

Report Scope:

In this report, the Global Railway Overhead Catenary System (OCS) Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Railway Overhead Catenary System (OCS) Market, By Type:

- Simple Catenary

- Stitched Catenary

- Compound Catenary

Railway Overhead Catenary System (OCS) Market, By Application:

- Metro

- Light Rail

- High-Speed Rail

Railway Overhead Catenary System (OCS) Market, By Component:

- Catenary Wire

- Dropper

- Insulator

- Cantilever

- Other

Railway Overhead Catenary System (OCS) Market, By Material:

- Copper

- Aluminum Alloy

- Composite

Railway Overhead Catenary System (OCS) Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Railway Overhead Catenary System (OCS) Market.Available Customizations:

Global Railway Overhead Catenary System (OCS) market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Siemens AG

- ABB Group

- Alstom SA

- Hitachi, Ltd.

- CRRC Corporation Limited

- NKT A/S

- Siemens Mobility GmbH

- Wabtec Corporation

- Schneider Electric SE

- Enphase Energy, Inc.

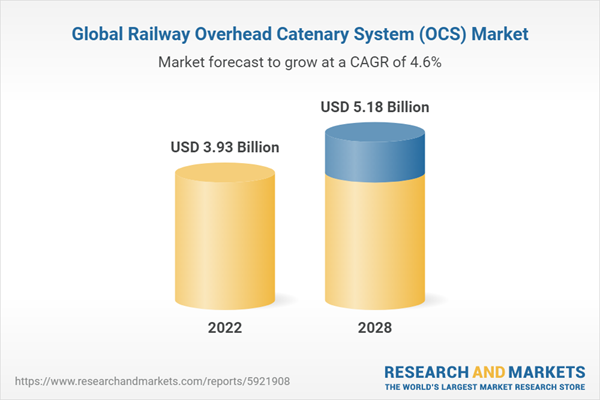

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.93 Billion |

| Forecasted Market Value ( USD | $ 5.18 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |