Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Urbanization and Population Growth

One of the primary drivers of the global water utility services market is the rapid increase in urbanization and population growth. As more people migrate to urban areas in search of better economic opportunities and improved living standards, the demand for water services escalates. Urbanization brings with it a surge in the construction of residential and commercial buildings, as well as industrial facilities, all of which require reliable and efficient water supply and wastewater management systems.The growing urban population puts immense pressure on existing water infrastructure, prompting governments and municipalities to invest in the expansion and modernization of water utility services. This involves the development of new water treatment plants, distribution networks, and wastewater treatment facilities. Additionally, the need for smart water management solutions becomes crucial to optimize resource utilization and minimize water wastage in densely populated urban areas. Therefore, the increasing urbanization trend acts as a major catalyst for the growth of the global water utility services market.

Escalating Water Scarcity and Climate Change Impact

The escalating global water scarcity crisis, exacerbated by the adverse impacts of climate change, is a significant driver shaping the water utility services market. Climate change-induced events such as droughts, floods, and unpredictable precipitation patterns have led to irregularities in water availability, affecting both the quality and quantity of water resources. This has heightened the importance of efficient water management practices and the development of resilient water infrastructure.Water utilities are compelled to adopt advanced technologies and sustainable practices to address the challenges posed by climate change and water scarcity. This includes the implementation of water recycling and reuse systems, adoption of desalination technologies, and the deployment of smart water meters for better monitoring and management. Governments and regulatory bodies are also enacting policies to promote water conservation and sustainable water resource management, further propelling the growth of the global water utility services market.

Technological Advancements and Digitalization

The integration of advanced technologies and the digital transformation of water utility services play a pivotal role in driving market growth. Innovations such as Internet of Things (IoT) sensors, artificial intelligence (AI), and data analytics enable water utilities to monitor, analyze, and optimize their operations in real-time. Smart water meters and sensor networks provide accurate data on water consumption, leak detection, and system performance, facilitating proactive maintenance and resource allocation.Digitalization also enhances the efficiency of water treatment processes, ensuring the delivery of high-quality water to end-users. Furthermore, it enables the implementation of demand-responsive water supply systems, improving overall operational efficiency and reducing energy consumption. The adoption of cloud-based platforms for data storage and analytics further streamlines decision-making processes for water utilities.

In conclusion, the convergence of increasing urbanization, water scarcity challenges, and technological advancements is steering the global water utility services market towards a trajectory of growth and transformation. As the world grapples with these interconnected issues, the demand for innovative and sustainable water solutions is expected to remain robust, driving investments and developments in the water utility services sector.

Key Market Challenges

Aging Infrastructure and Deferred Maintenance

One of the significant challenges facing the global water utility services market is the aging infrastructure of water systems coupled with deferred maintenance. Many regions around the world rely on water supply and distribution networks that were established decades ago, and the lack of regular maintenance and upgrades has led to the deterioration of crucial components. Aging pipelines, treatment plants, and pumping stations are more prone to leaks, bursts, and inefficiencies, resulting in water loss and decreased overall system performance.The challenge is compounded by the financial burden on water utilities, as the cost of repairing or replacing outdated infrastructure is often substantial. Balancing the need for upgrades with budgetary constraints becomes a delicate task for utilities and governing bodies. Addressing this challenge requires strategic planning, long-term investment commitments, and the adoption of innovative financing models to ensure the sustainability and resilience of water infrastructure in the face of aging assets and deferred maintenance.

Regulatory Compliance and Water Quality Standards

Stringent regulatory standards and evolving water quality requirements pose a significant challenge to the global water utility services market. Governments and regulatory bodies worldwide are continually raising the bar on water quality standards to safeguard public health and the environment. Compliance with these standards necessitates water utilities to invest in advanced treatment technologies, monitoring systems, and operational practices that meet or exceed regulatory thresholds.Meeting stringent water quality standards often requires substantial financial investments, which can strain the resources of water utilities. Additionally, the dynamic nature of regulations means that utilities must stay abreast of changes and adapt swiftly to comply with new requirements. Striking a balance between regulatory compliance and financial viability is a persistent challenge for water utility services, as failure to meet standards can result in penalties, legal repercussions, and damage to the utility's reputation.

Water Scarcity and Climate-Induced Vulnerabilities

The escalating global water scarcity crisis, exacerbated by climate change, presents a multifaceted challenge for water utility services. Changes in precipitation patterns, prolonged droughts, and extreme weather events can lead to fluctuations in water availability and quality. Water utilities must grapple with the uncertainty of future water supplies, making long-term planning and resource management challenging.Climate-induced vulnerabilities also impact the energy requirements of water treatment and distribution processes. Water utilities may face increased energy costs due to the need for additional pumping, treatment, and distribution efforts to manage changing water availability. Moreover, extreme weather events, such as floods and storms, can damage infrastructure and disrupt water services, leading to emergency situations that require swift response and recovery efforts.

Addressing the challenges posed by water scarcity and climate-induced vulnerabilities requires a holistic and adaptive approach. Water utilities must invest in resilient infrastructure, implement water conservation measures, and develop contingency plans to ensure continuity of service in the face of climate-related uncertainties. Collaboration between water utilities, governments, and other stakeholders is crucial to developing sustainable strategies that mitigate the impacts of water scarcity and climate change on the global water utility services market.

Key Market Trends

Smart Water Management and IoT Integration

A prominent trend shaping the landscape of the global water utility services market is the widespread adoption of smart water management solutions and the integration of Internet of Things (IoT) technologies. As the world becomes more interconnected, water utilities are leveraging IoT devices, sensors, and data analytics to transform traditional water infrastructure into intelligent, data-driven systems.Smart water management encompasses a range of technologies that enhance the monitoring, control, and optimization of water supply and distribution networks. IoT sensors are deployed across the infrastructure to gather real-time data on factors such as water quality, pressure, and flow rates. This wealth of information enables utilities to detect leaks promptly, identify inefficiencies in the distribution system, and optimize resource allocation.

The integration of IoT technologies also facilitates the development of smart meters, allowing for accurate measurement of water consumption and enabling real-time billing and monitoring. Consumers benefit from increased transparency and the ability to track their water usage, encouraging more responsible water management practices.

Furthermore, the data generated by smart water systems enables predictive maintenance, reducing downtime and minimizing the impact of infrastructure failures. This trend not only improves the operational efficiency of water utilities but also contributes to water conservation efforts by minimizing water losses and optimizing the use of resources. As the global water utility services market continues to evolve, the integration of smart water management solutions driven by IoT technologies is expected to be a key trend, enhancing overall sustainability and resilience of water infrastructure.

Emphasis on Water Reuse and Circular Economy Practices

An emerging trend in the global water utility services market is the increasing emphasis on water reuse and the adoption of circular economy principles within the water industry. As concerns over water scarcity intensify, and the demand for water rises due to population growth and industrial expansion, the focus is shifting towards sustainable water management practices that prioritize the efficient use and recycling of water resources.Water reuse involves treating and repurposing wastewater for various non-potable applications, such as industrial processes, irrigation, and even indirect potable reuse. This trend is driven by the recognition that wastewater can be a valuable resource rather than a mere byproduct of urban and industrial activities. Advanced treatment technologies, including membrane filtration, reverse osmosis, and ultraviolet disinfection, enable the purification of wastewater to meet specific quality standards, making it suitable for a variety of non-drinking purposes.

Circular economy principles emphasize closing the loop in water usage, promoting the idea that water is a finite resource that should be managed in a sustainable and cyclical manner. This involves minimizing waste, maximizing resource efficiency, and encouraging the recovery and reuse of water at various stages of the water supply and treatment process.

Governments, industries, and water utilities are increasingly incorporating circular economy practices into their water management strategies to achieve environmental sustainability and reduce the overall environmental impact of water-related activities. This trend aligns with broader global goals of achieving a more sustainable and resilient water future, emphasizing the need for a holistic and integrated approach to water resource management in the global water utility services market.

Segmental Insights

Application Insights

The Industrial segment emerged as the dominating segment in 2022. Water treatment services form a foundational segment of the global water utility services market. This segment includes the processes involved in purifying raw water from natural sources to make it safe for consumption and other applications. Key components of water treatment services include filtration, chemical treatment, sedimentation, and disinfection. As water quality standards become more stringent, the demand for advanced water treatment technologies and processes continues to rise. Companies in this segment focus on developing innovative solutions for efficient and sustainable water purification.The distribution and infrastructure segment involves the physical networks and systems responsible for transporting treated water from treatment plants to end-users. This includes pipelines, pumping stations, storage tanks, and distribution networks. Aging infrastructure and the need for modernization are significant challenges in this segment, driving investments in the replacement and upgrade of water distribution systems. Smart technologies, such as IoT-enabled sensors and advanced monitoring systems, play a crucial role in optimizing the efficiency of water distribution networks.

Wastewater management is a critical segment that addresses the treatment and disposal of used water and sewage. This includes wastewater treatment plants, sewer systems, and methods for treating industrial effluents. With increasing awareness of environmental sustainability, there is a growing emphasis on the reuse of treated wastewater for non-potable purposes, contributing to the circular economy approach. Advanced technologies, such as membrane bioreactors and anaerobic digestion, are becoming integral to wastewater treatment processes.

In conclusion, the global water utility services market is characterized by a diverse set of industry segments that collectively contribute to ensuring the sustainable management of water resources. From water treatment and distribution to wastewater management and the integration of smart technologies, each segment plays a unique role in addressing the challenges and opportunities within the broader water utility services market.

Type Insights

The Integrated Water System segment is projected to experience rapid growth during the forecast period. The concept of an Integrated Water System (IWS) represents a holistic approach to water resource management, combining various components to create a comprehensive and interconnected network.In an Integrated Water System, technology plays a pivotal role in enhancing efficiency, monitoring, and decision-making. Advanced technologies such as Internet of Things (IoT), sensors, and data analytics are integrated into water treatment plants, distribution networks, and wastewater management systems. This enables real-time monitoring of water quality, leak detection, and predictive maintenance, contributing to overall system resilience and performance.

The water treatment component of an Integrated Water System focuses on the purification of raw water from natural sources. This involves the use of advanced treatment technologies, including membrane filtration, UV disinfection, and chemical processes. The integration of smart technologies in water treatment plants allows for precise monitoring of treatment processes, ensuring that water quality meets stringent standards. Integrated systems also facilitate the optimization of treatment parameters to address specific contaminants and emerging water quality challenges.

Integrated Water Systems aim to optimize the entire water distribution network. This involves the integration of smart meters, pressure sensors, and flow monitoring devices to enhance the efficiency of water distribution. By utilizing real-time data, water utilities can identify and address leaks promptly, optimize pressure levels, and ensure equitable distribution. The result is a more resilient and responsive distribution network capable of adapting to changing demand patterns and minimizing water losses.

Regional Insights

North America emerged as the dominating region in 2022, holding the largest market share. The water utility services market in North America is subject to stringent regulations that govern water quality, environmental protection, and infrastructure standards. Regulatory bodies at federal, state, and local levels play a crucial role in shaping the industry. The Safe Drinking Water Act (SDWA) and the Clean Water Act (CWA) at the federal level set the foundation for water quality standards and wastewater discharge regulations. State regulatory agencies further refine and enforce these standards, creating a complex yet comprehensive regulatory environment.In North America, Public-Private Partnerships (PPPs) are increasingly being explored as a means to address the challenges associated with funding large-scale water infrastructure projects. These partnerships involve collaboration between government entities and private companies to finance, design, build, and operate water facilities. PPPs provide an avenue for leveraging private sector expertise and funding while allowing public entities to meet growing infrastructure needs without solely relying on taxpayer dollars.

Sustainability is a key driver in the North American water utility services market. Utilities are increasingly adopting sustainable practices, including water reuse and recycling, to ensure the long-term availability of water resources. The emphasis on circular economy principles encourages the efficient use of water and the reduction of environmental impact. Additionally, there is a growing trend toward green infrastructure projects that enhance resilience, reduce stormwater runoff, and contribute to overall environmental sustainability.

The increasing frequency of extreme weather events, such as hurricanes and wildfires, has prompted a focus on resilience planning within North America's water utility services sector. Utilities are developing strategies to enhance system resilience, protect against disruptions, and ensure continued water supply during emergencies. This includes investments in backup infrastructure, redundant systems, and emergency response planning.

In summary, the North American water utility services market is characterized by a combination of advanced infrastructure, regulatory rigor, and a growing emphasis on sustainability. Addressing challenges related to aging infrastructure, water scarcity, and climate resilience requires ongoing investments, technological innovation, and collaborative efforts between the public and private sectors. As the region continues to evolve, the adoption of smart technologies and sustainable practices will play a crucial role in shaping the future of the water utility services market in North America.

Report Scope:

In this report, the Global Water Utility Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Water Utility Services Market, By Application:

- Residential

- Commercial

- Industrial

Water Utility Services Market, By Type:

- Single Function Water System

- Integrated Water System

Water Utility Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Netherlands

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Malaysia

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Water Utility Services Market.Available Customizations:

Global Water Utility Services Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Veolia Environment SA

- Suez SA

- American Water Works Company Inc.

- Aqua America Inc.

- United Utilities Group PLC

- Severn Trent PLC

- Thames Water Utilities Limited

- Yorkshire Water Services Limited

- Anglian Water Services Limited

- Southern Water Services Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2023 |

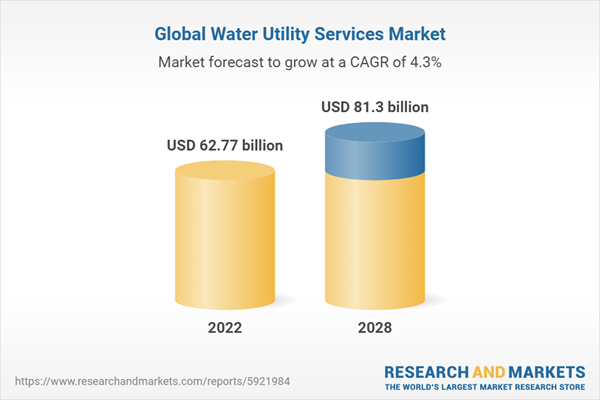

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 62.77 billion |

| Forecasted Market Value ( USD | $ 81.3 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |