Oil And Gas Industry is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The rising demand for efficient power generation significantly influences the Global Steam Water Analysis System Market. Global industrialization and urbanization necessitate a reliable, efficient power supply, mandating stringent control over water and steam chemistry. This prevents equipment degradation, ensures operational safety, and optimizes energy conversion in power plants, where high-purity water and steam cycles are essential. Failures from corrosion or scaling result in costly downtime.Key Market Challenges

A significant impediment to market expansion for the Global Steam Water Analysis System Market is the substantial capital investment and sustained maintenance expenditures associated with complex steam and water systems. These costs encompass not only the SWAS infrastructure but also related components within industrial operations. Such high financial outlays can deter adoption, particularly in markets sensitive to upfront expenditures and long-term operational costs.This financial burden directly impedes market growth by making the integration of advanced monitoring solutions less attractive, especially for entities with constrained budgets or those prioritizing other capital-intensive projects.

Key Market Trends

The integration of IoT and artificial intelligence for advanced monitoring enhances Steam Water Analysis Systems through real-time data collection, predictive analytics, and automated decision-making. These technologies offer precise insights into water chemistry, enabling immediate anomaly identification and proactive maintenance, minimizing operational disruptions and optimizing performance.According to a Ubisense survey, by February 2025, over 62% of manufacturers had embraced IoT technologies in their manufacturing processes, highlighting its streamlining potential. Siemens introduced AI-driven analysis for water utilities in September 2024, assisting in quickly identifying and addressing leaks, potentially reducing water loss by up to 50%. This evolution shifts SWAS from reactive fault detection to a proactive, intelligent monitoring paradigm, improving system reliability.

Key Market Players Profiled:

- Emerson Electric Co

- Siemens AG

- Yokogawa Electric Corporation

- Danaher Corporation

- Honeywell International Inc.

- SUEZ SA

- Endress+Hauser Group Services AG

- Thermo Fisher Scientific Inc.

- General Electric Company

- Hach Company

Report Scope:

In this report, the Global Steam Water Analysis System Market has been segmented into the following categories:By Type:

- Condensate Analysis

- Boiler Feed Water Analysis

By Application:

- Power And Energy Industry

- Oil And Gas Industry

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Steam Water Analysis System Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Steam Water Analysis System market report include:- Emerson Electric Co

- Siemens AG

- Yokogawa Electric Corporation

- Danaher Corporation

- Honeywell International Inc.

- SUEZ SA

- Endress+Hauser Group Services AG

- Thermo Fisher Scientific Inc.

- General Electric Company

- Hach Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

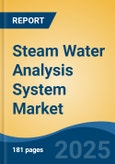

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.68 Billion |

| Forecasted Market Value ( USD | $ 5.81 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |