Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A major obstacle to market advancement is the difficulty of assimilating modern mainboards into legacy industrial infrastructure. Numerous manufacturing plants depend on older systems that are incompatible with current hardware, requiring costly retrofitting or total operational overhauls. This gap in interoperability frequently demands significant capital expenditure and technical skill, causing cost-conscious enterprises to hesitate in modernizing their equipment, which subsequently impedes broader technological adoption.

Market Drivers

The escalating demand for industrial automation and robotics serves as a primary driver for the Global Industrial Mainboard Market. As production facilities shift toward fully autonomous workflows, there is an essential need for ruggedized mainboards that can manage complex robotic controllers and motion systems. These components must withstand persistent vibration and thermal stress while providing the computational stability required for exact mechanical movements. This trend is highlighted by the sector's growth; according to the International Federation of Robotics' 'World Robotics 2025' report from September 2025, global industrial robot installations hit 542,000 units in 2024, demonstrating the immense scale of hardware deployment needed to sustain this automation surge.Concurrently, the swift adoption of Industry 4.0 and smart manufacturing is transforming technical requirements, pushing the market toward high-performance computing solutions. Modern industrial mainboards are increasingly required to handle edge-level artificial intelligence processing to enable real-time predictive maintenance and machine vision analysis, eliminating reliance on cloud latency. This movement toward intelligent infrastructure is reflected in strategic spending; according to Rockwell Automation's '10th Annual State of Smart Manufacturing Report' from June 2025, 95 percent of manufacturers have invested in or intend to invest in AI and machine learning technologies within the next five years. This investment trend directly favors hardware suppliers, as shown by Advantech's financial results in 2025, where third-quarter consolidated revenue grew 19 percent year-over-year, fueled by continuous demand for industrial IoT and edge computing platforms.

Market Challenges

The principal barrier hindering the Global Industrial Mainboard Market is the significant technical challenge involved in incorporating modern components into legacy industrial setups. Manufacturing settings often maintain long lifecycles, leading to a predominance of aging machinery that is inherently incompatible with the protocols and interfaces of current mainboards. This lack of interoperability compels enterprises to decide between costly, extensive retrofitting or persisting with outdated hardware, creating a substantial financial deterrent to modernization. As a result, cost-conscious organizations frequently postpone essential upgrades to prevent operational interruptions, which directly curbs the volume of new mainboard units shipped.This reluctance to commit to capital-intensive modernization notably restricts market growth. When manufacturers hesitate to replace legacy systems because of integration complexities and high costs, the demand for sophisticated electronic infrastructure diminishes. This retardation in technology adoption is reflected in recent sector performance data. According to ZVEI, production in the electrical and digital industry was projected to decrease by 7 percent in 2024, demonstrating the concrete effects of lowered investment activity and the difficulties manufacturers encounter when shifting to updated hardware standards.

Market Trends

The shift toward Next-Generation DDR5 Memory and PCIe Gen 5 Interfaces is fundamentally redesigning industrial mainboards to accommodate the exponential increase in data throughput demanded by modern connected factories. In contrast to legacy standards, these advanced interfaces offer the bandwidth needed for high-speed peripheral communication and immediate data access, effectively eliminating bottlenecks in data-intensive control systems that govern complex automation. This hardware evolution is supported by explosive growth in the component market as manufacturers enhance their infrastructure capabilities. According to the Semiconductor Industry Association's 'Global Semiconductor Sales Report' from February 2025, annual sales of memory products jumped by 78.9 percent in 2024, signaling a massive industrial shift toward high-bandwidth computing architectures to sustain data-heavy workloads.At the same time, the emphasis on Sustainable and Eco-Friendly PCB Manufacturing Practices has become a definitive operational priority, evolving from simple regulatory compliance to a core market prerequisite for mainboard production. Manufacturers are increasingly utilizing halogen-free laminates, lead-free soldering, and energy-efficient manufacturing processes to meet strict global environmental standards and lower the carbon footprint of industrial electronics. This strategic move toward circular economy principles is measurable across the wider electronics supply chain. According to IPC International's 'Sustainability in the Global Electronics Supply Chain' survey from March 2025, 59 percent of electronics manufacturing firms stated plans to ramp up their sustainability initiatives in 2025, highlighting the sector's growing dedication to green production standards.

Key Players Profiled in the Industrial Mainboard Market

- ASUSTeK Computer Inc.

- Gigabyte Technology Co., Ltd.

- ASRock Inc.

- Super Micro Computer Inc.

- Advantech Co., Ltd.

- Micro-Star International Co., Ltd.

- Biostar

- Axiomtek Co., Ltd.

- ICP DAS Co., Ltd.

- Kontron AG

Report Scope

In this report, the Global Industrial Mainboard Market has been segmented into the following categories:Industrial Mainboard Market, by Type:

- ATX

- Mini ITX

- Micro ATX

- Nano ITX

- Pico ITX

- COM Express

Industrial Mainboard Market, by Application:

- Building Automation

- Manufacturing

- Military Application

- Security & Surveillance

- Factory Automation

- Transportation

- Automotive industry

- Medical

- Gaming

Industrial Mainboard Market, by Component:

- CPU

- GPU

- Chipset

- Memory

Industrial Mainboard Market, by Sales Channel:

- OEM

- Aftermarket

Industrial Mainboard Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Mainboard Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Industrial Mainboard market report include:- ASUSTeK Computer Inc.

- Gigabyte Technology Co., Ltd.

- ASRock Inc.

- Super Micro Computer Inc.

- Advantech Co., Ltd.

- Micro-Star International Co., Ltd.

- Biostar

- Axiomtek Co., Ltd.

- ICP DAS Co., Ltd.

- Kontron AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

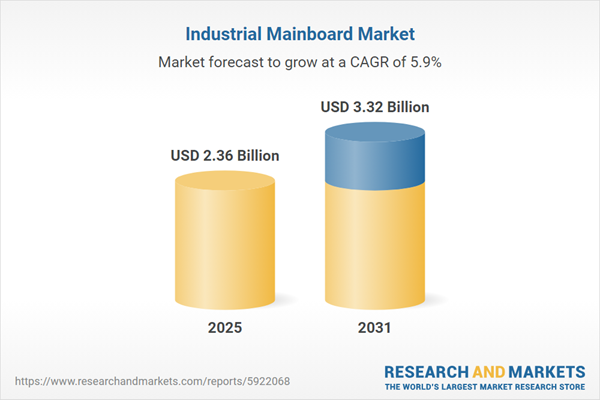

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.36 Billion |

| Forecasted Market Value ( USD | $ 3.32 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |