Rising Preference for Gypsum Board in Construction Industry fuel the South & Central America FGD Gypsum Market

A gypsum board, also known as a drywall panel, is preferred over plaster since it is easier to install and repair, less expensive, and more durable. It takes less time to mount and is also widely available. Fire-resistant properties and feasibility of utilization are common factors increasing the use of gypsum in residential and nonresidential construction activities. Gypsum boards are widely used as a substitute for wooden panels and concrete walls in modern buildings and interiors, as they can be installed easily and quickly. Gypsum boards also contain recycled content such as Flue Gas Desulfurization (FGD) gypsum. FGD gypsum boards are extensively used as a finishing material in the construction of modern buildings - mainly for ceilings, partitions, and interior walls. Also, they are lightweight, flexible to use, cost-effective, and durable. These panels are available in different colors and varieties such as regular, green board, blue board, purple, paperless, type X fire-resistant, and soundproof drywall, which helps add desirable and luxurious aesthetics to the interiors of a building. In addition, drywall panels comply with all the requirements for design in architecture, thus preferred over other construction materials. The rising preference and utilization of gypsum boards in residential, commercial, industrial, and utility spaces, owing to their advantages such as low cost, ease of installation, fire resistance, non-toxicity, sound attenuation, and availability is contributing to the FGD gypsum for drywall market growth.South & Central America FGD Gypsum Market Overview

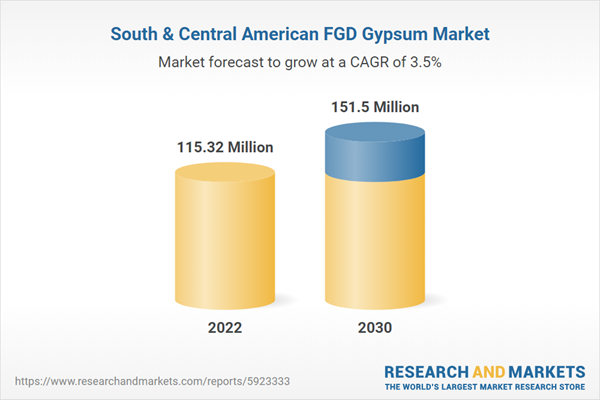

South & Central America is significantly investing significantly in green and sustainable construction. According to the US and the Brazilian Green Building Councils, Brazil accounted for more than 1.2 million square meters of certified buildings, thereby ranking seventh in Leadership in Energy and Environmental Design (LEED) registrations worldwide in 2021. According to the International Trade Administration, the Argentine government is focused of infrastructure projects in the range of US$ 20 million. The augmented focus on construction activities and infrastructure development is driving the demand for construction materials drywall panels, wallboard, cement and other sustainable building materials. FGD gypsum is widely used synthetic gypsum for construction applications such as production of drywall, wallboard, and cement. Therefore, rising investment in construction activities and growing demand for sustainable construction materials in the region is expected to drive the FGD gypsum market.South & Central America FGD Gypsum Market Revenue and Forecast to 2030 (US$ Million)

South & Central America FGD Gypsum Market Segmentation

The South & Central America FGD gypsum market is segmented based on application and country. Based on application, the South & Central America FGD gypsum market is segmented into wallboard/drywall, cement, agriculture, water treatment, and others. The wallboard/drywall segment held the largest market share in 2022.Based on country, the South & Central America FGD gypsum market is segmented into Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America FGD gypsum market share in 2022.

Georgia-Pacific LLC, Holcim Ltd, Knauf Gips KG, and Compagnie de Saint-Gobain SA are some of the leading players operating in the South & Central America FGD gypsum market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America FGD gypsum market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America FGD gypsum market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South & Central America market trends and outlook coupled with the factors driving the South & Central America FGD gypsum market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- Georgia-Pacific LLC

- Holcim Ltd

- Knauf Gips KG

- Compagnie de Saint-Gobain SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 59 |

| Published | November 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 115.32 Million |

| Forecasted Market Value by 2030 | 151.5 Million |

| Compound Annual Growth Rate | 3.5% |

| No. of Companies Mentioned | 4 |