In the United States, home decor has come to be a pervasive cultural phenomenon, driven by a burgeoning interest in interior design and self-expression. Social media systems amplify trends, fostering a dynamic and inclusive community of design fans. The upward thrust of home development shows and committed design influencers has propelled a heightened awareness of decor possibilities. With an emphasis on less expensive alternatives and DIY tasks, Americans are increasingly engaging personalizing their living spaces. The industry's boom is evidenced by the proliferation of home decor stores, both physical and online, imparting numerous styles to cater to individual alternatives. As a reflection of lifestyle and identification, home decor in the U.S. stands as a popular method of creative expression and a testimony to the evolving importance of personal space.

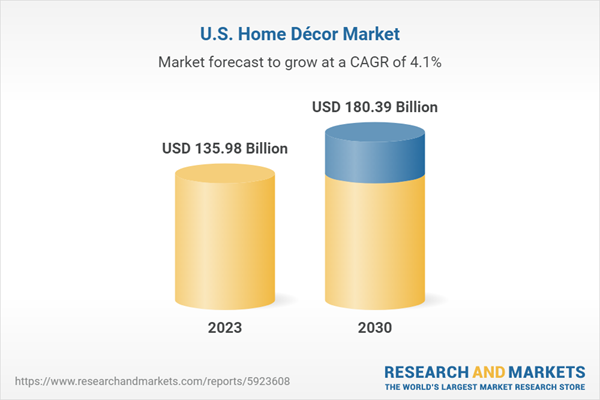

United States Home Décor Market is expected to grow at a CAGR of 4.12% from 2024-2030

A holistic shift in US home decor displays a growing consumer choice for sustainability, incorporating natural materials like timber and stone, and embracing eco-friendly products. The upward push of biophilic design emphasizes the integration of nature into interiors, promoting well-being. Contrary to minimalist tendencies, maximalism gains traction, encouraging bold expressions and individuality. Compact living spaces power demand for multifunctional furniture and smart home technology integration. The pursuit of personalization fuels interest in hand made objects, DIY projects, and upcycling. Wellness-focused decor consists of soothing elements, even as technology, from smart devices to global inspirations, in addition diversifies and personalizes the house environment in a dynamic and evolving market.With growing disposable earning, specifically remarkable amongst younger generations, there is a heightened monetary ability to spend money on non-important items like home décor. This economic flexibility is driving a surge in the reputation of top rate and designer domestic décor brands, indicating a willingness to pay more for unique, premium pieces. The growing homeownership rate in the US amplifies this trend, as new house owners actively are searching to customise and style their living areas. Viewing homes as long-term investments, house owners are more willing to spend on home improvements and enhancements, with domestic décor playing a pivotal position in developing comfortable, inviting, and fashionable living environments that contribute to the overall value and appeal in their residences. Hence, the United States home décor market was valued at US$ 135.98 Billion in 2023.

Floor coverings are gaining prominence in the United States home decor market

By products, the United States Home Decor Market is divided into Furniture, Floor Covering, Home Textiles, and Others. Floor coverings are pivotal in shaping a home's aesthetic, providing warm temperature, coziness, and sophistication. The evolving landscape introduces innovative alternatives, meeting numerous options in styles, textures, and shades. Versatile floor coverings, adapting to multifunctional living areas, benefit traction for formal gatherings and daily activities.Health-conscious tendencies force reputation in eco-friendly, anti-microbial, and stain-resistant floors. Technological integration, like smart flooring systems, provides convenience. Floor coverings become a canvas for expressing specific patterns, with customization, antique, and hand-made alternatives growing. Sustainability echoes in recycled and herbal fibre floors. Increasing affordability and accessibility broaden choices, seamlessly incorporating floor coverings into home décor without compromising on style or quality.

Specialty stores hold a dominant position in the US home décor market

By distribution channel, the United States Home Decor Market is fragmented into Supermarkets & Hypermarkets, Specialty Stores, E-Commerce, Others. Specialty stores redefine the home décor shopping experience with a carefully curated choice, emphasizing specific patterns or developments. This meticulous method ensures customers find a cohesive collection aligned with their aesthetic, aided by an informed body of workers providing expert steering and personalised consultations.Setting themselves apart from mass shops, those stores unique, precise, wonderful products, along with hand-made and imported items, establish recognition for trust and excellence. Actively engaging with their groups via events and collaborations, specialised stores foster local vibrancy, contributing to customer loyalty. Their niche awareness lets in tailor-made services, making sure adaptability to evolving trends and sustained relevance in the dynamic home décor market.

United States home décor market is still dominated by households with higher incomes

By income group, the China Baby Food Market is broken up into Higher Income, Upper-middle Income, and Lower-middle Income. Higher-income families, buoyed by increased disposable profits, allocate big price range to fashionable and personalized home décor. This demographic's propensity for homeownership aligns with a commitment to long-time property investments, viewing improvements as value additions. Valuing home décor for life-style enhancement, they accomplice it with personal expression and accomplishment.A desire for premium manufacturers displays an appreciation for craftsmanship and exclusivity, and a readiness to spend money on renovations underscores the notion that improvements add property value. Exposure to international tendencies amplifies interest in precise, imported, or handcrafted objects, while a commitment to sustainability drives a choice for eco-friendly home décor. Seeking experiential retail and personalised service, they prioritize specialty stores, spotting the classy and functional value of domestic décor in elevating dwelling spaces and well-being.

Key Players

Inter IKEA Systems B.V., Bed Bath & Beyond Inc, Herman Miller Inc., Mohawk Industries Inc., Williams-Sonoma, Inc., Kimball International, Inc, HNI Corporation are present in the United States home décor market.This research report provides a detailed and comprehensive insight of the United States Home Décor Industry.

Products - United States Home Décor Market breakup from 4 viewpoints:

- Furniture

- Floor Covering

- Home Textiles

- Others

Distribution Channel - United States Home Décor Market breakup from 4 viewpoints:

- Supermarkets & Hypermarkets

- Specialty Stores

- E-Commerce

- Others

Income group - United States Home Décor Market breakup from 3 viewpoints:

- Higher Income

- Upper-middle Income

- Lower-middle Income

All companies have been covered from 3 viewpoints:

- Overview

- Recent Development

- Revenue

Company Analysis

- Inter IKEA Systems B.V.

- Bed Bath & Beyond Inc

- Herman Miller Inc.

- Mohawk Industries Inc.

- Williams-Sonoma, Inc.

- Kimball International, Inc

- HNI Corporation

Table of Contents

Companies Mentioned

- Inter IKEA Systems B.V.

- Bed Bath & Beyond Inc

- Herman Miller Inc.

- Mohawk Industries Inc.

- Williams-Sonoma, Inc.

- Kimball International, Inc

- HNI Corporation

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | January 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 135.98 Billion |

| Forecasted Market Value ( USD | $ 180.39 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 7 |