Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for the Commercial Space Payload Revolution Through Innovative Technologies and Strategic Collaborations Shaping Tomorrow

Over the past decade, the commercial space payload arena has evolved from a niche government-driven activity into a dynamic ecosystem propelled by private investment and entrepreneurial innovation. Breakthroughs in launch automation, miniaturized electronics and additive manufacturing have collectively reduced barriers to entry, enabling a broader spectrum of organizations to develop, integrate and deploy payloads across diverse missions. Consequently, satellite constellations, scientific instruments and cargo modules now benefit from economies of scale and modular architectures that accelerate mission timelines while optimizing cost efficiency.Moreover, the convergence of reusable launch vehicles, rideshare programs and strategic alliances among industry incumbents and disruptors has reshaped how payloads are conceived, fabricated and operated. By sharing launch capacity and leveraging standardized interfaces, stakeholders have unlocked new service models where mission-specific requirements are balanced against flexible deployment schedules. This collaborative paradigm extends to cross-sector partnerships encompassing telecommunications, earth observation, in-orbit servicing and defense applications, each drawing on tailored payload configurations.

This executive summary synthesizes key insights into the transformative forces driving the commercial space payload segment. It explores technological shifts, regulatory headwinds, and the cumulative impact of emerging tariff regimes, while offering a nuanced analysis across payload typologies, mass classifications, launch modalities, orbital regimes and application verticals. Finally, it presents actionable recommendations and regional perspectives to equip decision-makers with the intelligence needed to capitalize on market opportunities and navigate an increasingly complex environment.

Throughout this period of rapid evolution, collaborative initiatives between commercial entities and governmental agencies have emerged as critical enablers of large-scale missions. Public funding frameworks and milestone-based contract structures have de-risked early-stage development for payload prototypes, while private capital infusion has fostered a vibrant venture ecosystem. Consequently, payload designers are iterating faster, integrating advanced sensors and autonomous systems, and refining lifecycle support strategies to ensure that in-orbit performance aligns with stringent mission assurance standards.

Examining the Groundbreaking Technological and Regulatory Shifts Redefining the Commercial Space Payload Sector and Driving Unprecedented Opportunities

The commercial space payload landscape is being reshaped by a convergence of technological breakthroughs and evolving regulatory frameworks that collectively chart a new course for mission capabilities and market participation. Rapid advancements in propulsion and launch systems have ushered in the era of reusable launch vehicles, lowering the marginal cost of access to orbit and enabling frequent deployments at unprecedented cadence. Concurrently, miniaturization of sensors, improved power management and lightweight structural materials have enhanced the performance envelope for small and medium satellites, while also enabling larger payloads to assume more sophisticated mission profiles without prohibitive mass penalties.Concurrently, the regulatory domain is adapting to foster innovation while safeguarding national security, spectrum integrity and orbital sustainability. Streamlined licensing pathways have emerged alongside enhanced satellite coordination mechanisms to address growing congestion in critical low Earth orbit bands. Export control regimes are undergoing recalibration to balance strategic collaboration with technology protection, and newly minted guidelines for in-orbit servicing and debris mitigation reflect an increasing emphasis on long-term orbital resilience. These shifts underscore the importance of proactive engagement with policymaking bodies and spectrum authorities at both national and supranational levels.

In this transforming environment, leading stakeholders are leveraging digital twin simulations, predictive analytics and model-based systems engineering to accelerate design cycles and optimize payload performance against regulatory constraints. By fostering public-private partnerships and participating in international working groups, industry participants are aligning technological roadmaps with emerging standards, ensuring that next-generation payloads not only push technical frontiers but also adhere to evolving compliance requirements. This symbiotic relationship between innovation and policy is unlocking new mission paradigms, from responsive launch frameworks to adaptive multifunction payloads capable of evolving in orbit.

Environmental stewardship and sustainability considerations are also influencing payload designs and operational practices. The adoption of green propellants, advanced deorbit mechanisms and reusable components is gaining traction, as stakeholders prioritize the long-term viability of orbital environments. Additionally, initiatives focused on space debris tracking and collision avoidance are driving the integration of sensors and algorithms that can dynamically adjust payload operations, reinforcing a culture of responsible space utilization.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Supply Chains, Partnerships, and Competitive Dynamics in Space Payloads

In 2025, the United States implemented a new tariff structure targeting a range of aerospace components, subsystems and raw materials critical to space payload manufacturing. These measures, designed to bolster domestic production and reduce reliance on foreign suppliers, have introduced incremental cost pressures across key stages of the supply chain. Suppliers of high-purity metals, specialized electronics and custom composite materials have adjusted pricing to reflect tariff pass-through, leading payload integrators to reevaluate sourcing strategies and supplier contracts.Subsequently, many payload developers have accelerated onshore manufacturing initiatives and explored partnerships with qualified domestic vendors to mitigate exposure to cross-border duties. This shift has fostered greater investment in local machining, additive manufacturing and electronics assembly capabilities, albeit at the expense of certain economies of scale previously achieved through established global supply networks. As a result, lead times for critical components may lengthen in the near term, even as the broader ecosystem gains resilience against geopolitical disruptions.

Meanwhile, strategic alliances between domestic firms and select international partners have been renegotiated to incorporate tariff mitigation clauses, joint ventures and technology transfer arrangements. While these collaborations aim to preserve access to specialized expertise and unique payload architectures, they also navigate complex export control and intellectual property considerations. Consequently, the competitive landscape is seeing an emergence of vertically integrated entities that combine manufacturing, integration and launch services under one roof, positioning themselves to absorb tariff impacts more effectively than leaner, outsourced configurations.

International responses to these tariff policies have been varied, with European and Asia-Pacific firms exploring alternative manufacturing hubs in regions less affected by duties. Partnerships are emerging in South America and the Middle East to establish new assembly and test facilities, diversifying the geographic footprint of payload production. This global rebalancing underscores the criticality of proactive supply chain mapping and highlights the interdependence of regional manufacturing capabilities in sustaining mission-critical operations.

Looking forward, industry leaders are carefully balancing the tradeoffs between cost, agility and supply chain sovereignty, recognizing that sustained investment in domestic capabilities can yield strategic independence, even as it challenges traditional operating models. Transitioning to a hybrid supply framework, underpinned by dual-source strategies and real-time supply chain visibility, is proving essential to maintaining programmatic momentum in the face of evolving tariff dynamics.

Unveiling Critical Segmentation Trends Across Payload Types, Mass Categories, Launch Modes, Orbit Profiles, and Application Verticals in the Space Payload Market

Segmentation by payload type reveals a market where satellite payloads overwhelmingly outnumber cargo and crew-related modules, driven by exponential growth in constellation deployments. Within satellite payloads, communication and surveillance architectures command the lion’s share of integration efforts, as operators seek to expand broadband coverage and fortify intelligence-gathering capabilities. Navigation systems leveraging global navigation satellite signals are experiencing steady iterations to support autonomous applications, while scientific instruments for remote sensing and deep space exploration continue to push the boundaries of miniaturization and power efficiency. Conversely, cargo payloads supporting resupply missions to space stations have matured into predictable logistics operations, and crew-related modules remain a highly specialized niche with stringent safety and life-support requirements.When evaluating payload mass categories, small and medium classes are surging due to the democratization of access to space afforded by shortened development cycles and streamlined launch booking. CubeSats and microsatellites in the sub-2,500 kilogram range benefit from standardized platforms and economies of scale, whereas large and heavy payloads continue to serve high-value missions such as deep space probes and complex communication arrays. In turn, launch service providers are optimizing vehicle performance envelopes, ensuring that mass accommodation across the spectrum aligns with bespoke mission profiles without compromising reliability.

Launch mode segmentation offers a clear dichotomy: dedicated services provide full control over mission design and schedule, attracting clients with stringent latency and orbital slot requirements, while hosted payload solutions allow for cost-sharing on-board larger primary missions, appealing to organizations seeking affordable technology demonstrations and secondary experiments. These parallel pathways coexist, with emerging hybrid models enabling faster integration and shared risk mitigation.

The distribution across orbital regimes underscores distinct value propositions: low Earth orbit supports massive constellations for broadband, remote sensing and enterprise IoT, geostationary orbit remains indispensable for fixed-beam broadcasting and communications, and medium Earth orbit excels in precision navigation and specialized monitoring tasks. Each orbital band demands tailored design considerations, from radiation hardening to propulsion budgets.

The interplay between payload mass and launch mode further drives demand for flexible integration solutions. Small payload developers often favor hosted arrangements on larger platforms to sidestep the complexity of securing dedicated lifts, while operators of heavy and large satellites continue to demand dedicated services with comprehensive integration support. This dynamic informs the evolution of launch service portfolios, prompting providers to offer modular interface kits and customizable payload accommodation zones.

Finally, application-driven segmentation spans communication and broadcasting, earth observation and remote sensing, in-orbit servicing, interplanetary exploration, scientific research, space tourism support modules, and technology demonstrations. These verticals reflect a maturing ecosystem where payload developers align their ecosystems to serve both traditional revenue streams and nascent commercial niches, ensuring that capabilities remain adaptable to emerging mission demands.

Illuminating Regional Dynamics and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Shaping the Global Payload Landscape

In the Americas, the commercial space payload ecosystem thrives on a foundation of robust private investment, supportive regulatory mechanisms and a deep industrial heritage in aerospace. The United States, buoyed by a vibrant landscape of launch providers, subsystem specialists and research institutions, continues to catalyze innovation through public-private partnerships and incentivized procurement programs. North American players are deploying multi-orbit constellations and pioneering in-orbit servicing architectures, while Latin American nations are exploring regional capacity building and collaborative downstream applications for remote sensing and communications.Across Europe, the Middle East and Africa, a multi-faceted landscape is emerging. European Union member states, working closely with continental research agencies, emphasize strategic autonomy in satellite manufacturing, driving standardization efforts and pooling procurement to achieve scale. In parallel, Middle Eastern nations are establishing sovereign space agencies and launching technology demonstration missions, leveraging local investments to cultivate homegrown payload development capabilities. Meanwhile, African governments are engaging in capacity-building initiatives to harness earth observation payloads for agriculture, resource management and disaster response, signaling the region’s intent to integrate into the broader supply chain.

The Asia-Pacific region is characterized by dynamic growth underpinned by escalating government expenditure and a surge in indigenous entrepreneurship. China’s state-backed programs continue to advance large-scale orbital infrastructure, while India’s cost-leadership model is gaining traction among international clients. Japan and South Korea focus on specialized scientific and defense payloads, leveraging sophisticated electronics and precision integration. Furthermore, Australia’s nascent new space ecosystem is fostering startup innovation through regulatory liberalization and venture capital interest, collectively positioning the Asia-Pacific corridor as a pivotal driver of global payload deployment in the coming decade.

Cross-regional partnerships are increasingly prevalent, as firms seek to leverage complementary strengths across geographies. North American integration centers are collaborating with European payload test facilities to optimize design validation, while Asia-Pacific startups partner with Middle Eastern agencies for technology transfers and launch manifest sharing. These alliances create a mosaic of capabilities that transcends individual markets and underscores the value of global collaboration.

Assessing the Strategic Positioning, Technological Differentiation, and Collaborative Ecosystems of Leading Space Payload Industry Players

Several key players are defining the competitive battlefield by forging differentiated value propositions through vertical integration, agile development and strategic partnerships. One prominent launch provider has leveraged a reusable first stage to offer cost-effective rideshare programs, enabling rapid deployment of small and medium satellites while maintaining tight control over schedule reliability. Concurrently, that same organization is developing an in-house constellational architecture, demonstrating expertise that extends from payload design to operational network management.Emerging innovators specializing in small-lift vehicles have captured significant attention by tailoring their offerings to the burgeoning CubeSat and microsatellite sectors. These companies emphasize rapid cadence, streamlined payload interfaces and adaptive launch windows, appealing to technology demonstrators and commercial imaging firms seeking expedited time-to-orbit. Their lean engineering culture and modular integration facilities underscore a shift towards on-demand launch services that complement existing legacy infrastructure.

At the same time, established aerospace conglomerates continue to invest in next-generation payload buses and integrated spacecraft systems for high-value defense, scientific and communications missions. By leveraging decades of institutional knowledge and global supply chain networks, these firms deliver large-scale satellites with rigorous mission assurance protocols. Collaborative efforts with specialized subsystem vendors and research institutions further reinforce their capabilities, particularly in advanced propulsion, sensor fusion and secure data handling.

Risk mitigation strategies are becoming integral to payload architecture, with leading companies embedding cybersecurity protocols and radiation-hardened electronics to fortify assets against emerging threats. Investments in secure data encryption, real-time anomaly detection and fault-tolerant designs ensure that payload performance remains robust amid contested orbital environments and potential cyber incursions.

Collectively, these industry participants are forging alliances across complementary domains-ranging from ground segment operators and space situational awareness vendors to telecommunications providers-thereby constructing an ecosystem that spans the full payload lifecycle. As a result, competitive dynamics hinge not only on individual technological prowess but also on the ability to orchestrate multi-party collaborations that accelerate innovation and mitigate programmatic risks.

Strategic Imperatives and Forward-Looking Strategies to Navigate Market Complexities and Accelerate Commercial Space Payload Success in Coming Years

To thrive in an environment defined by rapid technological evolution and regulatory complexity, industry leaders must embrace a set of strategic imperatives that fortify their competitive positioning and foster sustainable growth. First, organizations should invest heavily in digital twin simulations and model-based systems engineering to accelerate design iterations, validate performance in virtual environments and reduce costly physical prototyping cycles. This approach will enable payload developers to anticipate integration challenges, optimize subsystem interactions and streamline mission assurance processes.Equally critical is the establishment of resilient supply chain frameworks that blend domestic manufacturing capabilities with selective international sourcing. Companies should cultivate dual-source strategies for critical components, integrate real-time supply chain monitoring tools and forge strategic partnerships with emerging vendors in additive manufacturing and advanced electronics. By diversifying supplier portfolios and embedding risk mitigation clauses within procurement contracts, stakeholders can maintain operational continuity amidst evolving tariff landscapes and geopolitical uncertainties.

Furthermore, proactive engagement with regulatory authorities and standardization bodies is essential to shape policy outcomes that accelerate market entry. Payload integrators should participate in industry working groups, contribute to spectrum coordination initiatives and collaborate on sustainable debris mitigation guidelines. This collaborative posture not only streamlines licensing processes but also positions organizations as thought leaders influencing the next generation of orbital safety protocols.

Cultivating interdisciplinary talent and fostering cross-sector alliances will unlock new innovation pathways. By recruiting multidisciplinary teams skilled in data analytics, artificial intelligence and systems integration, and by partnering with universities and research centers, companies can accelerate the development of advanced payload architectures. Additionally, exploring co-investment models with downstream service operators-such as earth observation analytics firms and in-orbit servicing specialists-can create symbiotic relationships that expand commercial applications and generate recurring revenue streams.

Moreover, embracing circular economy principles-such as designing for component reuse, modular upgrade paths and end-of-life disposal mechanisms-can reduce material waste and foster sustainable growth. By integrating deorbit kits and leveraging in-orbit servicing partnerships, industry leaders can extend asset lifespans and enhance return on investment through refurbishment and redeployment cycles.

Detailing the Rigorous Analytical Framework, Data Collection Techniques, and Validation Processes Underpinning the Comprehensive Space Payload Research

The research methodology underpinning this analysis combines a robust mix of primary and secondary investigative approaches to ensure comprehensive coverage and high data integrity. Initial desk research involved a systematic review of regulatory filings, public domain technical papers and industry white papers to establish foundational knowledge of payload architectures, launch trends and policy developments. This secondary data was complemented by detailed financial disclosures and annual reports from key industry participants, providing insight into strategic investments and program roadmaps.To enrich the qualitative dimension, a series of structured interviews was conducted with senior executives, technical leads and regulatory specialists across launch providers, satellite operators and component manufacturers. These engagements yielded firsthand perspectives on supply chain challenges, innovation cycles and market entry strategies. Interviewees were selected to represent a cross-section of stakeholders spanning North America, Europe, the Middle East, Africa and the Asia-Pacific region, ensuring a balanced view of regional dynamics.

Quantitative data points-such as payload integration timelines, mass distribution profiles and orbital allocation statistics-were meticulously aggregated and triangulated against publicly available databases and expert estimates. A segmentation framework was applied to categorize findings across payload type, mass class, launch mode, orbit type and application verticals, providing a structured lens through which to interpret market patterns. Data validation processes, including cross-referencing multiple sources and conducting consistency checks, were implemented to enhance accuracy and reduce bias. Any identified anomalies were reconciled through follow-up interviews or supplemental research, resulting in a cohesive and reliable analytical foundation.

Looking ahead, this framework can be refined through expanded primary research, deeper engagement with emerging market entrants and longitudinal studies tracking post-launch performance metrics. Future iterations of this analysis may integrate real-time telemetry data and advanced econometric modeling to capture evolving trends with greater precision.

Synthesizing Core Insights and Strategic Considerations to Inform Decision-Making in the Rapidly Evolving Commercial Space Payload Sector

The commercial space payload domain stands at an inflection point, characterized by accelerating technological innovation, shifting regulatory landscapes and evolving competitive paradigms. Key insights reveal a pronounced shift toward modular, reusable designs, an expanded role for small- and medium-class satellites, and a nuanced interplay between tariff regimes and supply chain resilience. Regional dynamics underscore the significance of local manufacturing ecosystems, while segmentation trends highlight diverse mission requirements across payload typologies and orbital regimes.As market participants navigate these complexities, the ability to integrate advanced modeling tools, forge strategic alliances and actively shape policy frameworks will prove decisive. Companies that balance cost efficiency with agility, and that align their technical roadmaps with emerging standards, will unlock sustainable growth pathways. In this rapidly transforming environment, decision-makers must adopt a forward-looking mindset, embracing cross-sector collaboration, investment in domestic capabilities and a data-driven approach to mitigate risks. Ongoing vigilance is necessary, as policy adjustments, technological breakthroughs and competitive moves will continue to reshape the contours of the commercial payload sector.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Commercial Space Payload Market

Companies Mentioned

The key companies profiled in this Commercial Space Payload market report include:- ABL Space Systems

- Airbus SE

- Antrix Corporation Limited

- ArianeGroup SAS

- Astrocast

- BAE Systems PLC

- Blacksky Technology Inc.

- Blue Origin, LLC

- Busek Co. Inc.

- Capella Space Corp. by IonQ, Inc.

- China Aerospace Science and Technology Corporation

- D-Orbit S.p.A.

- EnduroSat AD

- Firefly Aerospace

- GomSpace

- International Launch Services, Inc.

- L3Harris Technologies, Inc.

- Leonardo DRS

- Lockheed Martin Corporation

- Maxar Technologies Inc.

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- OHB SE

- Paragon Space Development Corporation

- Phantom Space Corporation

- Planet Labs PBC

- Rocket Lab USA, Inc.

- RTX Corporation

- SEAKR Engineering LLC

- Sierra Nevada Corporation

- Skyroot Aerospace

- Space Forge Limited

- SpaceX, Inc.

- Thales Group

- The Boeing Company

- Tyvak International by Terran Orbital Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

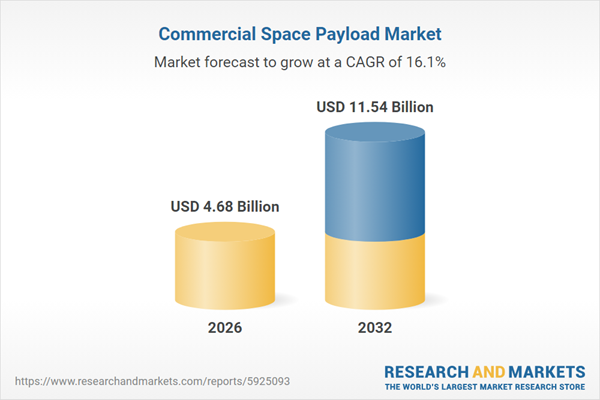

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.68 Billion |

| Forecasted Market Value ( USD | $ 11.54 Billion |

| Compound Annual Growth Rate | 16.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |