Introduction to Europe Pathogen or Plant Disease Detection and Monitoring Market:

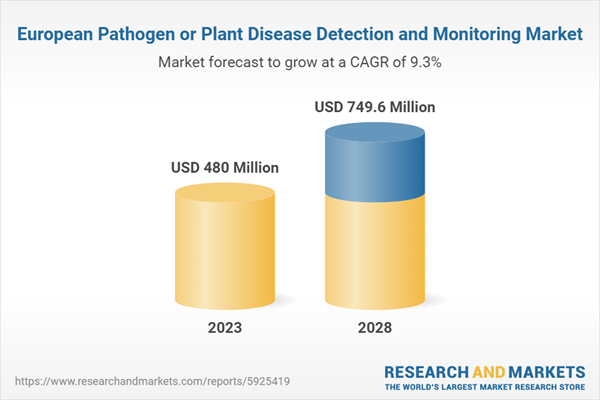

The Europe pathogen or plant disease detection and monitoring market (excluding U.K.) was valued at $480.0 million in 2023, and it is expected to grow with a CAGR of 9.33% during the forecast period 2023-2028 to reach $749.6 million by 2028. Provided that plant diseases are a major cause of significant crop production losses and post-harvest management difficulties in developing countries, the market for pathogen and plant disease detection and monitoring is expected to grow as demand for food security and quality increases. Furthermore, the advancements in the creation of novel and creative techniques for identifying plant pathogens, such as biosensors, point-of-care instruments, remote sensing, and nanotechnology, provide the possibility of quick, trustworthy, and affordable solutions for in-field diagnostics.Market Introduction

Cutting-edge technology facilitates swift and precise detection, along with continuous monitoring of pathogens and plant diseases, transforming agricultural health and crop management practices in the European market. This sector encompasses the development, production, and sale of essential tools and services for agriculture and horticulture, crucial for early disease identification. These tools are instrumental in implementing timely intervention and management strategies to safeguard crops, ensuring food security.The market in Europe is propelled by factors such as climate change, international trade dynamics, intensified agriculture practices, and regulatory frameworks. Notably, plant pathogens cause an annual loss of up to 40% in yield for economically significant crops, posing a substantial threat to the industry. Invasive pests contribute to an annual financial burden of at least $70 billion, playing a role in the broader global decline of biodiversity.

Market Segmentation:

Segmentation 1: by Application

- Open Field

- Controlled Environment

Segmentation 2: by Product

- Diagnostic Kits

- Digital Solutions

- Laboratory Services

Segmentation 3: by Country

- Germany

- France

- Italy

- Spain

- Netherlands

- Belgium

- Switzerland

- Bulgaria

- Ukraine

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: In the realm of plant disease, technological advancements are transforming agricultural landscapes. Pathogen or plant disease detection and monitoring market solutions utilize diverse technologies such as IoT sensors, drones, and data analytics. These tools offer precise insights into crop health, optimizing irrigation, pest management, and harvest times. Innovations such as satellite imaging and remote sensing provide a holistic view of fields, empowering farmers to make informed decisions. The market encompasses a range of solutions, from real-time monitoring platforms to AI-driven predictive analysis, enabling farmers to enhance productivity and reduce resource wastage significantly.Growth/Marketing Strategy: The pathogen or plant disease detection and monitoring market has witnessed remarkable growth strategies by key players. Business expansions, collaborations, and partnerships have been pivotal. Companies are venturing into European market, forging alliances, and engaging in research collaborations to enhance their technological prowess. Collaborative efforts between tech companies and agricultural experts are driving the development of cutting-edge monitoring tools. Additionally, strategic joint ventures are fostering the integration of diverse expertise, amplifying the market presence of these solutions. This collaborative approach is instrumental in developing comprehensive, user-friendly, and efficient phytopathogen detection and monitoring systems.

Competitive Strategy: In the competitive landscape of plant disease diagnosis, manufacturers are diversifying their product portfolios to cover various crops and farming practices. Market segments include soil analysis tools, disease detection systems, and climate analysis solutions. Competitive benchmarking illuminates the strengths of market players, emphasizing their unique offerings and regional strengths. Partnerships with research institutions and agricultural organizations are driving innovation.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abingdon Health

- BIOREBA AG

- Drone Ag

- Libelium Comunicaciones Distribuidas S.L.

- Agricolus

- GeoPard Agriculture

- Dronegy

- FIXAR-AERO, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | January 2024 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 480 Million |

| Forecasted Market Value ( USD | $ 749.6 Million |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 8 |