China Wire and Cable Market Overview:

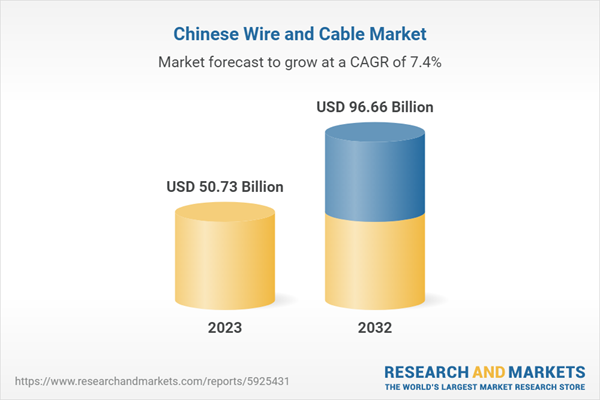

The China wire and cable market was valued by revenue at $45.18 billion in 2022, and it is expected to grow at a CAGR of 7.43% and reach $96.66 billion by 2032. The growth in the China wire and cable market is anticipated to be driven by rapid urbanization, expanding infrastructure projects, and the increasing demand for energy transmission and communication solutions. Technological advancements and government initiatives supporting innovation and sustainable development further contribute to the market's positive trajectory.

The China wire and cable market is undergoing a significant transformation driven by the growing emphasis on sustainability, environmental concerns, and technological advancements. The China wire and cable market is critical in various sectors, including renewable energy systems, building and construction, telecommunications and data centers, industrial applications, transportation infrastructure, healthcare facilities, and others.

However, the growth of the market is not without its challenges. Regulatory complexities pose hurdles, requiring market players to navigate intricate standards and compliance measures. Intense market competition also prevails, urging companies to differentiate themselves and continuously adapt to evolving technological requirements.

Amid these challenges lie significant opportunities for the wire and cable market in China. China's escalating demands for infrastructure development, coupled with a growing emphasis on sustainable practices, create favorable conditions for market expansion. The push for technological innovations in the sector opens doors for companies to explore new solutions and enhance their competitive edge.

Strategic collaborations and partnerships are pivotal in this dynamic landscape. Successful navigation of challenges and leveraging opportunities will determine the sustained growth and resilience of the China wire and cable market, solidifying its crucial role in the nation's technological evolution and infrastructure advancement.

Impact

The China wire and cable market is propelled by evolving technological landscapes, increasing urbanization, infrastructure development projects, regulatory initiatives, and the growing emphasis on energy efficiency and environmental sustainability.

Moreover, in China, wire and cable manufacturers are actively engaged in the development of sustainable wire and cable and low-smoke halogen-free products, channeling substantial investments into research and development (R&D) while forming strategic partnerships with key stakeholders in the wire and cable ecosystem. These manufacturers are fostering collaborations within the industry to collectively pursue sustainable solutions. By aligning with other significant stakeholders, they aim to drive innovation and advance sustainability practices. Concurrently, the Chinese government is placing increased emphasis on sustainability, offering incentives, subsidies, and policies to encourage the adoption of eco-friendly products. This governmental support is expected to further stimulate the demand for wire and cable in China throughout the forecast period 2023-2032, promoting the integration of sustainable practices in the industry.

Market Segmentation

Segmentation 1: by Application

- Electronics

- Energy and Power

- Infrastructure

- Mining and Farming

- Leisure and Entertainment

- Others

In the China wire and cable market (by application), the infrastructure application is expected to lead during the forecast period 2023-2032, indicating a strong demand for wiring and cabling solutions in construction and development projects. This dominance highlights the crucial role of wire and cable products in supporting the region's expanding infrastructure needs. Among the infrastructure, the construction and building industry is expected to dominate the China wire and cable market during the forecast period 2023-2032. The dominance is attributed to escalating demands in construction projects, urbanization, and infrastructure development initiatives. This underscores the pivotal role of wire and cable solutions in supporting diverse applications critical for the region's growing infrastructure needs.

Segmentation 2: by Product

- Fiber Optic Cables

- Coaxial Cables

- Enameled/Magnet Cables

- Low Voltage Energy Cable < 1kV

- Power Cables >1kV, MV, HV, EHV

- Signal and Control Cables

- Telecom and Data Cables

- Others

Segmentation 3: by Voltage Type

- Low Voltage

- Medium Voltage

- High Voltage

Low voltage energy cables (< 1kV) (by product) is leading the China wire and cable market in 2023 due to their widespread applications and compatibility with diverse electrical systems. These cables are preferred for their efficiency in power distribution, safety, and cost-effectiveness. As industries and infrastructure projects expand, the demand for these cables rises, solidifying their dominance in the product category.

Moreover, in 2023, low voltage cables is dominating the China wire and cable market (by voltage type). This reflects the significant demand for low voltage applications in various industries and infrastructure development.

Recent Developments in the China Wire and Cable Market

- In January 2023, China's State Grid Corporation announced a $77 billion investment in grid transmission for the year 2023, as well as a commitment to modernize and expand its power grids with $442 billion in investments over the Five-Year Plan 2021-2025. As China intensifies its focus on power infrastructure, particularly grid expansion, the demand for the wire and cable industry is poised to surge, necessitating increased investments to meet the burgeoning requirements of the country's ambitious power grid initiatives.

- The investment in hydropower energy generation is a critical factor in the growth of the China wire and cable market. China invested $34.3 billion (238.8 billion yuan) in water conservation and hydropower from January 2023 to September 2023. With the investment in hydropower projects, the need for electricity transmission and management will increase, along with the number of wires and cables used for the same.

- In August 2022, HELUKABEL GmbH inaugurated its new production site for wires and cables in Changzhou, China.

Demand – Drivers and Limitations

Following are the demand drivers for the China wire and cable market:

- Increase of Investments in the Telecommunications Industry

- Increase in Demand for Sustainable Wire and Cable Products

- Rise of Industrial Revolution 4.0

- Increase in Sales of Electric Vehicles

- Rise in the Demand for Energy Produced from Renewable Sources

Following are the limitations of the China wire and cable market:

- Fluctuations in Raw Material Prices

- Ban by the Government on Materials Used in Wire and Cable Production

How can this report add value to an organization?

Product/Innovation Strategy: The product strategy helps the readers understand the different aftermarket solutions provided by the industry participants.

Growth/Marketing Strategy: The China wire and cable market is growing at a significant pace and holds enormous opportunities for market players. Some of the strategies covered in this segment are product launches, partnerships, collaborations, business expansions, and investments. The companies' preferred strategy has been product launches, partnerships, and collaborations to strengthen their positions in the wire and cable market in China.

Competitive Strategy: The key players in the China wire and cable market analyzed and profiled in the study include wire and cable manufacturers, raw material suppliers, and wholesalers and distributors. Moreover, a detailed competitive benchmarking of the players operating in the China wire and cable market has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and regional presence.

Some of the prominent established names in the this market are:

- Belden Inc.

- Fujikura Ltd.

- LS Cable & System Ltd.

- Nexans

- Prysmian S.p.A.

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- HELUKABEL GmbH

- HUBER+SUHNER AG

- PHOENIX CONTACT

- Murrelektronik GmbH

Other related companies in the China wire and cable market ecosystem are:

- Far East Cable Co., Ltd.

- Jiangsu Shangshang Cable Group Co., Ltd.

- Huadong Cable Group

- Baosheng Science & Technology Innovation Co., Ltd.

- Yanggu Cable Group Co., Ltd.

- Wanma Group Co., Ltd.

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

This product will be delivered within 3-5 business days.

Table of Contents

Scope of the Study

Companies Mentioned

- Belden Inc.

- Fujikura Ltd.

- LS Cable & System Ltd.

- Nexans

- Prysmian S.p.A.

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- HELUKABEL GmbH

- HUBER+SUHNER AG

- PHOENIX CONTACT

- Murrelektronik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 50.73 Billion |

| Forecasted Market Value ( USD | $ 96.66 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | China |

| No. of Companies Mentioned | 11 |