The low speed vehicle market growth is being driven by the increasing trend for low speed cars in gated societies, resorts, industrial, and university campuses.

Key Trends and Developments

Rising use of low speed vehicles in short-distance commutes; increasing trend of customisation; growing demand for low speed electric vehicles; and integration of advanced technologies are favouring the low speed vehicle market expansion.October 2024

EMOBI Manufacturing launched its low-speed electric two-wheeler, the AKX Low-Speed Commuter. The vehicle, priced at INR 90,000, is purpose-built for last-mile delivery applications, catering to small-scale businesses and gig workers requiring efficient and affordable transportation options. Through the launch, the company aims to capture 20-25% of India’s B2B last-mile delivery sector by 2027.January 2024

WiTricity, along with ICON EV, announced the launch of the 2024 ICON Low-Speed Vehicles (LSVs) featuring a wireless charging option. WiTricity's wireless charging, including the WiTricity Halo™ Receiver and the WiTricity Halo™ Power Hub, operates with speed comparable to traditional plug-in power.December 2023

Speedways Electric introduced its Low-Speed Electric Vehicle (LSEV), Emigo UT4. The vehicle boasts improved design, performance, and sustainability while offering an unparalleled driving experience. It also features a formidable battery system that enables it to cover a distance of up to 80 kilometers on a single charge.October 2023

Joyride partnered with GEM to deploy IoT-connected low-speed vehicles (LSVs) for shared use. The partnership enables operators to build and maintain a shared-used GEM fleet profitably and efficiently while providing an excellent rider experience to end users. Through the partnership, the company aims to transform urban mobility and revolutionise sustainable travel.Rising use of low speed vehicles in short-distance commutes

Low speed vehicles such as neighborhood electric vehicles and electric golf carts are gaining significant popularity for short-distance commutes, especially for local travel within neighborhoods, business districts, or resorts due to their cost-effectiveness and ability to reduce traffic congestion.Growing trend of customisation

With customers increasingly seeking personalised features, LSV manufacturers are offering diverse design options, such as different wheel designs, colours, custom body kits, and upholstery materials. Moreover, businesses operating LSV fleets, including tourism companies, hotels, retail centres, and golf courses, are seeking LSVs including modifications such as cargo space for deliveries, larger passenger capacities, and specialised seating arrangements to meet the unique demands of their operations.Increasing demand for low speed electric vehicles

Amid the growing emphasis on sustainability, there is a rising demand for low speed electric vehicles that offer ease of maintenance, low carbon emissions, and improved fuel economy. Advancements in battery management systems and smart and flexible charging infrastructure are also boosting the adoption of low speed electric vehicles.Integration of smart technologies

The integration of smart technologies such as electric propulsion, advanced telematics, and autonomous driving technologies, is boosting the low speed vehicle market revenue. Advanced cameras, radar systems, and cameras aimed at enabling LSVs to detect pedestrians and obstacles and reduce the risk of accidents are also propelling the market.Market Segmentation

A low speed vehicle is a four-wheeled motor vehicle with a speed of 30 kmph to 40kmph and gross vehicle weight of up to 1,360 kg.The various types of low speed vehicle include:

- Passenger Vehicle

- Heavy-Duty Vehicle

- Utility Vehicle

- Off-Road Vehicle

The end uses of low speed vehicle are:

- Golf Courses

- Tourist Destinations

- Hotels and Resorts

- Airports

- Residential and Commercial Premises

Market Breakup by Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

The global low speed vehicle market is being driven by the enactment of strict laws and regulations by the governments on vehicle emissions. The rise in pollution, technological advances, and the automotive industry, along with the fall in fossil fuel stocks, are further fuelling the demand growth of the global low speed vehicles industry. In addition, advances in ride-hailing and embedded mobility alternatives is expected to support the anticipated growth of the low speed vehicle industry. However, since the authorities have not defined the security requirements for these cars, it might hinder the growth of the industry.Competitive Landscape

Key low speed vehicle market players are focusing on the development of electric low-speed vehicles (ELSVs) that offer zero emissions, lower operational costs, and improved energy efficiency, aligning with the rising demand for sustainable transportation. They are also incorporating advanced safety technologies, including seat belts, collision avoidance systems, rollover protection, LED lights, and rearview cameras, to enhance passenger and vehicle safety.Polaris Industries Inc.

Polaris Industries Inc., established in 1954 and headquartered in Minnesota, United States, is a company that is engaged in marketing, manufacturing, and distributing powersports. With a global employee base of 16,000, the company serves customers in more than 120 countries globally.

Deere & Co.

Deere & Co., established in 1837 and headquartered in Illinois, United States, is a leader in the agricultural, forestry, construction, and power system sectors. Boasting around 75,000 employees, the company’s net sales and revenue amounted to USD 51.7 billion in 2024.

Kubota Corporation

Kubota Corporation, headquartered in Osaka, Japan, and founded in 1890, is a company that sells and manufactures a diverse range of machinery and other consumer and industrial products. The company’s technology is used in more than 80% of the advanced water purification facilities that provide safe and drinkable tap water in Japan.Textron Inc.

Textron Inc.

Textron Inc., founded in 1923 and headquartered in Rhode Island, United States, is a prominent multi-industry company. Some of its renowned brands include Arctic Cat, Bell, Cessna, E-Z-GO, and Beechcraft. With nearly 34,000 employees and a global presence, the company provides integrated services, solutions, and products to customers globally.

Other key players in the low speed vehicle market are Ingersoll Rand Inc. (Club Car), and Yamaha Motor, among others.

Table of Contents

Companies Mentioned

The key companies featured in this Low Speed Vehicle market report include:- Polaris Industries Inc.

- Deere & Co.

- Kubota Corporation

- Ingersoll Rand Inc. (Club Car)

- Textron Inc.

- Yamaha Motor

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 153 |

| Published | August 2025 |

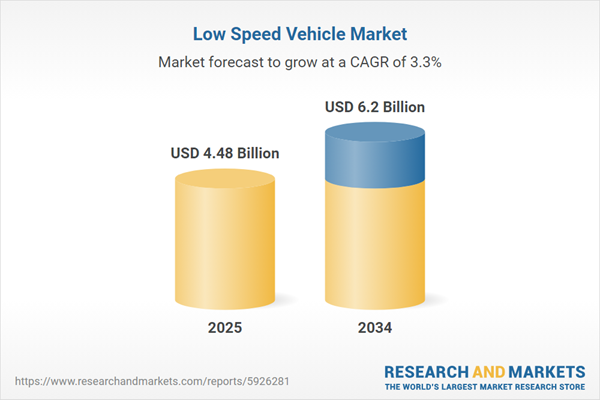

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.48 Billion |

| Forecasted Market Value ( USD | $ 6.2 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |