Automotive Bushing Market Growth

The automotive bushing industry is witnessing huge growth propelled by two major innovations: sophisticated material technology and the advent of electric vehicles (EVs). These drivers are transforming the industry, enabling businesses to improve product performance as well as profitability.Technological advancements in composite and self-lubricating materials have transformed bushing efficiency and durability. Automakers are using materials like high-performance polymers and metal-reinforced elastomers to enhance wear resistance, lower friction, and increase service life. This saves maintenance costs for automakers and increases vehicle performance, making such bushings very desirable. Companies that are spending on R&D to create proprietary materials and manufacturing processes are acquiring a competitive advantage, winning long-term contracts from OEMs, and increasing profitability, thus propelling the automotive bushing market expansion.

The rapid growth of the EV market has generated new requirements for lightweight and high-efficiency parts, such as bushings. Since EVs need bushings that reduce vibration and noise levels and can support high torque, unlike conventional combustion engines, businesses addressing this trend by creating specialized EV-compatible bushings are establishing profitable partnerships with automakers. By improving manufacturing processes and presenting bespoke solutions, organizations are widening their market share and fueling automotive bushing market revenues.

These technologies not only improve car performance but also enable companies to lead the industry, ultimately boosting profitability and market share.

Key Trends and Recent Developments

The market is driven by 3D sensing, miniaturization for wearables, touchless technology adoption, and renewable energy applications, creating new growth opportunities in automation, consumer electronics, and sustainability, and thus shaping the automotive bushing market dynamics and trends.February 2025

FangChen introduces its latest Suspension Bushing Set, designed for Mercedes-Benz, BMW, and Audi models. Engineered for enhanced durability, stability, and vibration reduction, these high-quality bushings ensure superior handling, driving comfort, and long-term performance for premium vehicles.February 2025

Tenneco announced a strategic investment from Apollo Fund X and American Industrial Partners to accelerate growth in Clean Air and Powertrain businesses, enhancing financial flexibility, operational performance, and expansion opportunities while maintaining its existing management and strategic priorities.January 2025

A new Polyurethane Suspension Bush range for Nissan and Renault vehicles solves OEM bush failures. The 12AN Polyurethane Bush replaces weak factory parts, enhancing durability, handling, and comfort, preventing premature failure in Juke, X-Trail, Leaf, and more.December 2024

Continental announced plans to spin off its Automotive sector as an independent European company (SE) listed on the Frankfurt Stock Exchange by end-2025, led by Philipp von Hirschheydt. Additionally, ContiTech’s OESL unit sale will begin Q1 2025.Increased Adoption of Lightweight Materials

Automotive manufacturers are favoring light-duty bushings in the form of advanced polymers and composites to enhance fuel economy as well as emissions reduction. Those investing in new materials have a competitive advantage through the delivery of long-lasting, high-performance products that meet strict environmental requirements and the increasing demand for energy-efficient vehicles, thus pushing the growth of the automotive bushing market.Rising Demand for Noise, Vibration, and Harshness (NVH) Reduction

Customers look for smoother and quieter rides, challenging automakers to incorporate sophisticated bushings that reduce NVH levels to the minimum. Firms creating bespoke elastomer-based and self-lubricating bushings gain from fulfilling performance expectations of automakers, earning them long-term contracts and market leaders in comfort-improving automotive parts.Expansion of Electric Vehicle (EV) Market

The rise in EV demand demands bushings with ability to handle specific stress factors, including regenerative braking and high torque. EV-specific bushing manufacturers gain through fulfilling automakers' changing demands, striking partnerships, and increasing their presence in the fast-expanding electric mobility industry, thereby helping to create new trends in the automotive bushing market.Integration of Smart and Sensor-Based Bushings

Technological advances in smart bushings with embedded sensors allow vehicle wear and performance to be monitored in real-time. Businesses investing in IoT-enabled bushings provide a competitive edge through predictive maintenance, minimizing vehicle downtime for vehicle owners, and attracting automakers concerned with making vehicles safer and more efficient.Automotive Bushing Market Trends

The automobile bushing market is changing with new trends enhancing vehicle performance and longevity. The two emerging trends are the use of 3D printing technology for bush manufacturing and the introduction of environmentally friendly, recyclable materials.Manufacturers are more and more relying on 3D printing to produce tailor-made bushings with intricate geometries and improved material characteristics. This permits quicker prototyping, less material waste, and greater design freedom, which makes it easier for companies to address precise OEM requirements in an efficient manner while minimizing production expenses, thereby shaping trends in the automobile bushing market.

With increasing environmental laws, manufacturers are creating bushings using recycled and biodegradable materials. These eco-friendly alternatives not only lower the carbon footprint of the automotive sector but also make it easier for manufacturers to attract environmentally aware buyers and automakers with green priority, enhancing market competitiveness and profitability.

Automotive Bushing Industry Segmentation

The report titled “automotive bushing Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Market Breakup by Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Market Breakup by Application

- Engine

- Suspension

- ChassisI

- Interior

- Exhaust

- Transmission

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Automotive Bushing Market Share

The market for automotive bushing is seeing rising demand in passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs) on account of changing industry trends and technology developments.As per automotive bushing market analysis, passenger cars are leading notable growth because of the escalating vehicle production, growing demand from consumers for comfort, and efforts to curb noise, vibration, and harshness (NVH). Automotive manufacturers are implementing high-performance bushings to improve ride quality and longevity, especially in luxury and electric vehicles.

As per automotive bushing industry analysis, light commercial vehicles (LCVs) are becoming popular with the growth of e-commerce and last-mile delivery services. Demand for robust and high-load-carrying bushings in vans and pickup trucks is increasing, providing long life and reduced maintenance costs to fleet operators.

Heavy commercial vehicles (HCVs) are facing increasing demand for high-end bushings as a result of expanding logistics and building activities. Producers are targeting high-strength, wear-resistant bushings to enhance load handling, service life, and minimize downtime, making them critical to fleet efficiency and profitability.

Competitive Landscape

Key automotive bushing market players are emphasizing innovation, sustainability, and strategic alliances to improve market position. They are spending money on high-end materials such as self-lubricating composites and intelligent bushings with sensors for predictive maintenance. Sustainability tops the agenda, with initiatives towards recyclable and environmentally friendly materials. Firms are also increasing their worldwide presence through acquisitions, mergers, and partnerships with automakers to create niche bushings for EVs, lightweight vehicles, and high-performance use, ensuring long-term profitability and competitiveness.ContiTech AG

ContiTech AG, founded in 1871, based in Hannover, Germany, provides high-performance automotive bushings from advanced elastomers and polymers with a focus on vibration control, durability, and NVH reduction for improved vehicle performance and comfort in passenger and commercial vehicle segments.Sumitomo Riko Company Limited

Sumitomo Riko Company Limited, established in 1929, headquartered in Komaki, Japan, is engaged in advanced rubber and resin bushings for outstanding noise and vibration damping, serving automakers globally with an emphasis on sustainability and future mobility solutions.Vibracoustic SE

Vibracoustic SE, founded in 2001 and headquartered in Darmstadt, Germany, specializes in state-of-the-art automotive bushings designed to deliver utmost damping efficiency, ride comfort, and durability to serve global OEMs with customized passenger car, electric vehicle, and heavy-duty applications.Hyundai Polytech India Pvt. Ltd.

Hyundai Polytech India Pvt. Ltd., established in 2002, Chennai, India, produces high-quality rubber and polyurethane bushings with a focus on improved durability, shock absorption, and cost-efficient solutions for the automotive industry, with particular support to Hyundai and other Indian automobile original equipment manufacturers.

Other key players in the automotive bushing market report include Tenneco Inc, Teknorot AS, Hutchinson Paulstra, Dayton Lamina Corporation, The Benara Udyog Limited, Mahle GmbH, DuPont de Nemours, Inc., OILES CORPORATION, Cooper Standard, BOGE Elastmetall GmbH, and Paulstra Snc, among others.

Table of Contents

Companies Mentioned

The key companies featured in this Automotive Bushing market report include:- ContiTech AG

- Sumitomo Riko Company Limited

- Vibracoustic SE

- Hyundai Polytech India Pvt. Ltd.

- Tenneco Inc

- Teknorot AS

- Hutchinson Paulstra

- Dayton Lamina Corporation

- The Benara Udyog Limited

- Mahle GmbH

- DuPont de Nemours, Inc.

- OILES CORPORATION

- Cooper Standard

- BOGE Elastmetall GmbH

- Paulstra Snc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

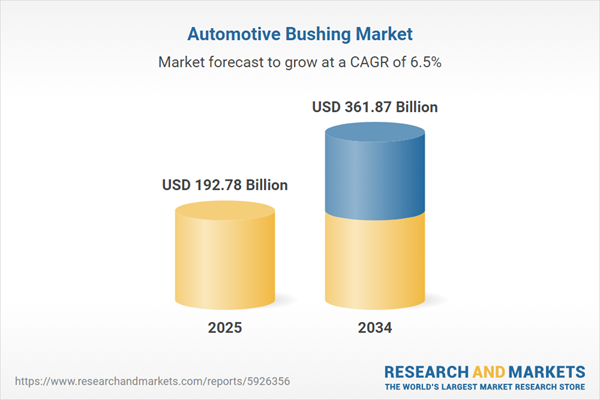

| Estimated Market Value ( USD | $ 192.78 Billion |

| Forecasted Market Value ( USD | $ 361.87 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |