1 Markets

1.1 Industry Outlook

1.1.1 Overview: LiDAR System-on-Chip (SoC)

1.1.2 Trends: Current and Future

1.1.2.1 4D LiDAR Technology

1.1.2.2 Ongoing Efforts by the Industry Players

1.1.2.3 LiDAR System-on-Chip with On-Chip Signal Processing

1.1.3 Supply Chain Network/MAP

1.1.4 Ecosystem/Ongoing Programs

1.1.4.1 Consortiums, Associations, and Regulatory Bodies

1.1.4.2 Government Initiatives

1.1.4.3 Programs by Research Institutions and Universities

1.1.5 Key Patent Mapping

1.1.5.1 Analyst View

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Rapid Technological Advancement in LiDAR in the Automotive Industry

1.2.1.2 Surge in Investments and Funding in LiDAR System-on-Chip Manufacturing Startups for R&D Activities

1.2.1.3 Cost-Effectiveness of LiDAR System-on-Chip

1.2.1.4 Growing Demand for the Miniaturization of Products

1.2.2 Business Restraints

1.2.2.1 Growing Complexity in Integrating All the Components on a Chip Due to Lack of Knowledge

1.2.2.2 Constant Review of Regulatory Policies on Standardization of Chips

1.2.2.3 Semiconductor Shortage Effect

1.2.3 Business Strategies

1.2.3.1 Product Development

1.2.3.2 Market Development

1.2.4 Corporate Strategies

1.2.4.1 Mergers and Acquisitions

1.2.4.2 Partnerships, Joint Ventures, Collaborations, and Alliances

1.2.5 Business Opportunities

1.2.5.1 Growing Trend for the Development of Autonomous Vehicles

1.2.5.2 Manufacturing LiDAR System-on-Chip at Scale

1.2.5.3 Deployment of LiDAR System-on-Chip in Other Applications such as Robotics and Industrial Automation

1.3 LiDAR System-on-Chip (SoC) Architecture and Fabrication

1.3.1 Software and Hardware Systems for LiDAR System-on-Chip (SoC) Industry

1.4 Emerging Applications in LiDAR System-on-Chip (SoC) Industry

1.4.1 Industrial Automation

1.4.2 Robotics

1.4.3 Others

1.5 Measurement Process in LiDAR System-on-Chip (SoC) Industry

1.5.1 Time of Flight (ToF)

1.5.2 Frequency Modulated Continuous Wave (FMCW)

1.6 Impact of COVID-19 on the Industry

2 Regions

2.1 Europe

2.1.1 Market

2.1.1.1 Buyer Attributes

2.1.1.2 Key Manufacturers of Automotive LiDAR in Europe

2.1.1.3 Competitive Benchmarking

2.1.1.4 Business Challenges

2.1.1.5 Business Drivers

2.1.2 Application

2.1.2.1 Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.1.2.2 Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.1.2.3 Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.1.3 Product

2.1.3.1 Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.1.3.2 Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

2.1.4 Europe: Country-Level Analysis

2.1.4.1 Germany

2.1.4.1.1 Market

2.1.4.1.1.1 Buyer Attributes

2.1.4.1.1.2 Key Manufacturers of Automotive LiDAR in Germany

2.1.4.1.1.3 Business Challenges

2.1.4.1.1.4 Business Drivers

2.1.4.1.2 Application

2.1.4.1.2.1 Germany Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.1.4.1.2.2 Germany Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.1.4.1.2.3 Germany Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.1.4.1.3 Product

2.1.4.1.3.1 Germany Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.1.4.1.3.2 Germany Automotive LiDAR System-on-Chihiuuuuuuuuq9823ip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

2.1.4.2 France

2.1.4.2.1 Market

2.1.4.2.1.1 Buyer Attributes

2.1.4.2.1.2 Key Manufacturers of Automotive LiDAR in France

2.1.4.2.1.3 Business Challenges

2.1.4.2.1.4 Business Drivers

2.1.4.2.2 Application

2.1.4.2.2.1 France Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.1.4.2.2.2 France Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.1.4.2.2.3 France Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.1.4.2.3 Product

2.1.4.2.3.1 France Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.1.4.2.3.2 France Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

2.1.4.3 Italy

2.1.4.3.1 Market

2.1.4.3.1.1 Buyer Attributes

2.1.4.3.1.2 Key Manufacturers of Automotive LiDAR in Italy

2.1.4.3.1.3 Business Challenges

2.1.4.3.1.4 Business Drivers

2.1.4.3.2 Application

2.1.4.3.2.1 Italy Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.1.4.3.2.2 Italy Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.1.4.3.2.3 Italy Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.1.4.3.3 Product

2.1.4.3.3.1 Italy Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.1.4.3.3.2 Italy Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

2.1.4.4 Rest-of-Europe

2.1.4.4.1 Market

2.1.4.4.1.1 Buyer Attributes

2.1.4.4.1.2 Key Manufacturers of Automotive LiDAR in Rest-of-Europe

2.1.4.4.1.3 Business Challenges

2.1.4.4.1.4 Business Drivers

2.1.4.4.2 Application

2.1.4.4.2.1 Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.1.4.4.2.2 Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.1.4.4.2.3 Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.1.4.4.3 Product

2.1.4.4.3.1 Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.1.4.4.3.2 Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

2.2 U.K.

2.2.1 Market

2.2.1.1 Buyer Attributes

2.2.1.2 Key Manufacturers of Automotive LiDAR in the U.K.

2.2.1.3 Competitive Benchmarking

2.2.1.4 Business Challenges

2.2.1.5 Business Drivers

2.2.2 Application

2.2.2.1 U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.2.2.2 U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.2.2.3 U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.2.3 Product

2.2.3.1 U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.2.3.2 U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

3 Markets - Competitive Benchmarking & Company Profiles

3.1 Competitive Benchmarking

3.2 Market Ranking Analysis

3.3 Company Profiles

3.3.1 Type 1 Companies: Automotive LiDAR System-on-Chip (SoC) Manufacturers

3.3.1.1 Scantinel

3.3.1.1.1 Company Overview

3.3.1.1.1.1 Role of Scantinel in the Automotive LiDAR System-on-Chip (SoC) Market

3.3.1.1.1.2 Product Portfolio

3.3.1.1.2 Business Strategies

3.3.1.1.2.1 Scantinel: Product Development

3.3.1.1.3 Analyst View

3.3.2 Type 3 Companies: Autonomous Vehicle Manufacturers

3.3.2.1 Volkswagen AG

3.3.2.1.1 Company Overview

3.3.2.1.1.1 Role of Volkswagen AG in the Automotive LiDAR System-on-Chip (SoC) Market

3.3.2.1.2 Corporate Strategies

3.3.2.1.2.1 Volkswagen AG: Partnerships, Joint Ventures, Collaborations, and Alliances

3.3.2.1.3 Production Sites and R&D Analysis

3.3.2.1.4 Analyst View

3.3.2.2 BMW Group

3.3.2.2.1 Company Overview

3.3.2.2.1.1 Role of BMW Group in the Automotive LiDAR System-on-Chip (SoC) Market

3.3.2.2.2 Production Sites and R&D Analysis

3.3.2.2.3 Analyst View

4 Research Methodology

4.1 Data Sources

4.1.1 Primary Data Sources

4.1.2 Secondary Data Sources

4.2 Data Triangulation

4.3 Market Estimation and Forecast

4.3.1 Factors for Data Prediction and Modeling

List of Figures

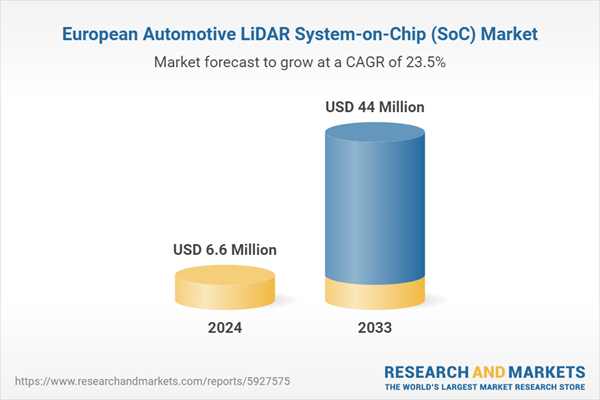

Figure 1: Europe Automotive LiDAR System-on-Chip (SoC) Market Overview, Thousand Units, 2024-2033

Figure 2: Europe Automotive LiDAR System-on-Chip (SoC) Market Overview, $Million, 2024-2033

Figure 3: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Figure 4: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Figure 5: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Figure 6: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Figure 7: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), $Million, 2024-2033

Figure 8: Automotive LiDAR System-on-Chip (SoC) Market (by Region), $Million, 2024

Figure 9: LiDAR System-on-Chip

Figure 10: LiDAR System-on-Chip (SoC) Market Supply Chain Analysis

Figure 11: Stakeholders in Automotive LiDAR System-on-Chip (SoC) Market

Figure 12: Business Dynamics for LiDAR System-on-Chip (SoC) Market

Figure 13: Key Business Strategies, 2020-2022

Figure 14: Product Development (by Company), 2020-2022

Figure 15: Market Development (by Company), 2020-2022

Figure 16: Key Corporate Strategies, 2020-2022

Figure 17: Partnerships, Joint Ventures, Collaborations, and Alliances (by Company), 2020-2022

Figure 18: Timeline for Autonomous Vehicles

Figure 19: Block Diagram of LiDAR System-on-Chip (SoC)

Figure 20: Time of Flight (ToF) Principle

Figure 21: Frequency Modulated Continuous Wave (FMCW) Principle

Figure 22: Competitive Benchmarking for Automotive LiDAR System-on-Chip (SoC) Manufacturers in Europe

Figure 23: Europe Automotive LiDAR System-on-Chip (SoC) Market, $Million and Thousand Units, 2024-2033

Figure 24: Competitive Benchmarking for Automotive LiDAR System-on-Chip (SoC) Manufacturers in U.K.

Figure 25: U.K. Automotive LiDAR System-on-Chip (SoC) Market, $Million and Thousand Units, 2024-2033

Figure 26: Competitive Benchmarking

Figure 27: Volkswagen AG: R&D Expenditure, $Billion, 2020-2022

Figure 28: BMW Group: R&D Expenditure, $Billion, 2020-2022

Figure 29: Research Methodology

Figure 30: Data Triangulation

Figure 31: Top-Down and Bottom-Up Approach

Figure 32: Assumptions and Limitations

List of Tables

Table 1: Europe Automotive LiDAR System-on-Chip (SoC) Market Overview

Table 2: Key Companies Profiled

Table 3: Consortiums, Associations, and Regulatory Bodies

Table 4: Government Initiatives for Autonomous Vehicles

Table 5: Programs by Research Institutions and Universities

Table 6: Key Patent Mapping

Table 7: Impact of Business Drivers

Table 8: Impact of Business Restraints

Table 9: Impact of Business Opportunities

Table 10: Automotive LiDAR System-on-Chip (SoC) Market (by Region), Thousand Units, 2024-2033

Table 11: Automotive LiDAR System-on-Chip (SoC) Market (by Region), $Million, 2024-2033

Table 12: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 13: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 14: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 15: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 16: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 17: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 18: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 19: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 20: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 21: Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), $Million, 2024-2033

Table 22: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 23: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 24: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 25: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 26: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 27: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 28: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 29: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 30: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 31: Germany Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 32: France Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 33: France Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 34: France Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 35: France Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 36: France Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 37: France Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 38: France Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 39: France Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 40: France Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 41: France Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 42: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 43: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 44: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 45: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 46: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 47: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 48: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 49: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 50: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 51: Italy Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 52: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 53: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 54: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 55: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 56: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 57: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 58: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 59: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 60: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 61: Rest-of-Europe Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 62: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 63: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 64: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 65: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 66: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 67: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 68: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 69: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 70: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 71: U.K. Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), $Million, 2024-2033

Table 72: Automotive LiDAR System-on-Chip (SoC) Market: Market Ranking Analysis, 2024

Table 73: Scantinel: Product Portfolio

Table 74: Scantinel: Product Development

Table 75: Volkswagen AG: Partnerships, Joint Ventures, Collaborations, and Alliances