Use of Artificial Intelligence (AI) in Gastroenterology Fuel to the North America Endoscopy Procedures Market

The application of artificial intelligence (AI) in gastrointestinal (GI) endoscopy is drawing a great amount of attention because it has the potential to improve the quality of endoscopy at all levels, compensating for human errors and limitations by bringing more accuracy, consistency, and higher speed. It will make a breakthrough and a big revolution in the development of GI endoscopy. AI has the advantage of limiting inter-operator variability. It can compensate for the limited experience of novice endoscopists and the errors of even the most experienced endoscopists. Over the past four decades, the incidence of esophageal adenocarcinoma (EAC) has risen rapidly due to the increasingly prevalent excess body weight. AI assistance shows promising results in terms of improving the detection and diagnosis of esophageal adenocarcinoma (EAC), thus, reducing the mortality and morbidity related to this type of malignancy with a poor prognosis when diagnosed at an advanced stage.The Canadian Association of Gastroenterology (CAG) has formed a special interest group (SIG) in AI to further develop and promote the use of AI. This CAG AI SIG core group comprises six gastroenterologists from five Canadian institutions across three provinces. They have started evaluating AI technologies using cohort studies and randomized controlled trials. They are in the process of establishing video and data biobanks to accrue raw data from which additional novel AI solutions can be created. Further activities of group members include developing and implementing AI curricula since the next generation of gastroenterologists needs to be trained to develop and implement AI solutions at institutions across Canada. The CAG AI SIG has an open model inviting new members, and AI researchers to maximize this novel technology's potential in improving endoscopy quality and patient outcomes.

Recently, a few AI-driven endoscopy products were approved in North American region. For instance, in November 2021, Medtronic Canada ULC, a subsidiary of Medtronic plc, announced that it had received a Health Canada license for the GI Genius intelligent endoscopy module. GI Genius is a computer-aided detection (CADe) system that uses artificial intelligence (AI) to highlight regions of the colon suspected to have visual characteristics consistent with different types of mucosal abnormalities. Hence, the use of artificial intelligence (AI) in gastroenterology is likely to propel the growth of endoscopy procedures in near future.

Ibex Medical Analytics, a pioneer in AI-powered cancer diagnostics, developed the world’s first artificial intelligence (AI) platform to detect cancer. Its AI algorithms analyze images of biopsies and can pinpoint their location and grade the tumor. These results help pathologists diagnose gastric cancer accurately. In June 2021, the U.S. Food and Drug Administration (FDA) granted Breakthrough Device Designation to Ibex’s Galen platform, which will expedite the clinical review and regulatory approval of its platform. Galen Gastric is an integrated diagnostics and quality control solution that supports pathologists in the detection of gastric cancer, dysplasia, H. pylori, and other important clinical findings.

In November 2019, AI Medical Service Inc., one of the world's first real-time endoscopic AI developers, secured Breakthrough Device Designation by the US FDA for its AI programs that analyze endoscopy images for potential diagnosis of gastric cancer.

Thus, such development of AI-based endoscopes for cancer diagnostics are likely to introduce new trends in the endoscopy procedure market during the forecast period.

North America Endoscopy Procedures Market Overview

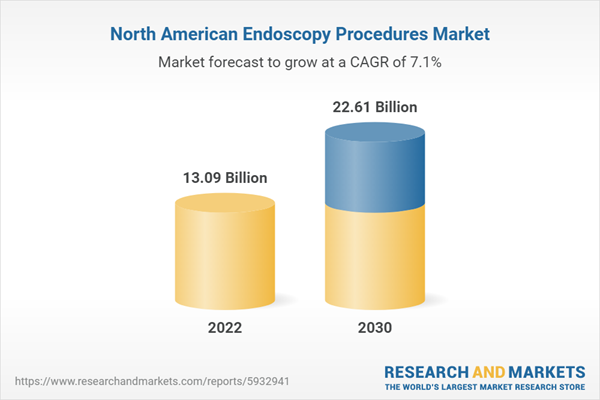

The North America endoscopy procedure market is segmented into US, Canada, and Mexico. US is the largest market for endoscopy procedure followed by Canada and Mexico. Growing preference for minimally invasive surgeries and increasing prevalence of chronic diseases in the US and North America are likely to drive the endoscopy procedure market in the forecasted period. In addition, the technological advancement by market players leading to enhanced applications is likely to foster the growth of the market in the forecasted period.North America Endoscopy Procedures Market Revenue and Forecast to 2030 (US$ Million)

North America Endoscopy Procedures Market Segmentation

The North America endoscopy procedures market is segmented into procedure, offering, product type, and end user.Based on procedure, the North America endoscopy procedures market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. The others segment held the largest share of the North America endoscopy procedures market in 2022.

Based on offering, the North America endoscopy procedures market is segmented endoscopes, ERCP accessories, visualization system, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostats clip, polyps’ traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others. The endoscopes segment held the largest share of the North America endoscopy procedures market in 2022.

Based on product type, the North America endoscopy procedures market is bifurcated into disposable and reusable. The reusable segment held a larger share of the North America endoscopy procedures market in 2022.

Based on end user, the North America endoscopy procedures market is segmented into hospitals and clinics, ambulatory surgical centres, diagnostic laboratories, and others. The hospitals and clinics segment held the largest share of the North America endoscopy procedures market in 2022.

Based on country, the North America endoscopy procedures market is segmented int o the US, Canada, and Mexico. The US dominated the North America endoscopy procedures market in 2022.

Stryker Corp, Merit, Medical Systems Inc, Smith & Nephew Plc, Arthrex Inc, Steris Plc, Conmed Corp, Olympus Corp, Boston Scientific Corp, and Cook Medical LLC are some of the leading companies operating in the North America endoscopy procedures market.

Table of Contents

Executive Summary

At 7.1% CAGR, the North America Endoscopy Procedures Market is Speculated to be Worth US$ 22,611.24 million by 2030.According to this research, the North America endoscopy procedures market was valued at US$ 13,087.30 million in 2022 and is expected to reach US$ 22,611.24 million by 2030, registering a CAGR of 7.1% from 2022 to 2030. Growing preference for minimally invasive surgeries and increasing prevalence of cancer attributed to the North America endoscopy procedures market expansion.

Minimally Invasive Surgeries (MIS) cause less post-operative pain, so patients receive less painkillers. As minimal cuts or stitches are involved, hospitalization is relatively shorter, and patients need not visit the hospital frequently. People prefer minimally invasive procedures to traditional open surgeries involving long incisions made through the muscles. These muscles take a huge amount of time to heal. MIS involves smaller incisions, leading to faster recovery. Also, the body scars involved in MIS are barely noticeable. The main advantage of MIS over conventional open surgeries is the accuracy due to video-assisted equipment, which produces a better and magnified image of the organs or body parts being operated. These surgeries are gaining popularity among the geriatric population due to the relatively shorter recovery time. According to the article "Anatomic Study of Endoscopic Trans nasal Approach to Petrous Apex," published in January 2020, endoscopy systems are commonly used in MIS to find the cause of specific issues and symptoms. Traditionally, most of the space difficult to observe by microscope can be exposed through endoscopic-assisted technology. Endoscopy can flexibly change the angle and observe the surrounding anatomical structure through the natural human foramen. It can provide the surgeon an open visual field and an operation channel without retraction, significantly improving the surgery's quality. Thus, flexible endoscopy systems are mostly preferred by surgeons. Thus, the major factors leading to the market growth are the growing inclination toward minimally invasive surgeries (MIS).

On the contrary, risks of infections associated with endoscopic procedures hampers the North America endoscopy procedures market.

Based on procedure, the North America endoscopy procedures market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. The others segment held 25.0% share of North America endoscopy procedures market in 2022, amassing US$ 3,277.63 million. It is projected to garner US$ 5,494.96 million by 2030 to expand at 6.7% CAGR during 2022-2030.

Based on offering, the North America endoscopy procedures market is segmented into endoscopes, ERCP accessories, visualization system, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostats clip, polyps’ traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others. The endoscopes segment held 34.7% share of North America endoscopy procedures market in 2022, amassing US$ 4,535.84 million. It is projected to garner US$ 7,932.87 million by 2030 to expand at 7.2% CAGR during 2022-2030.

Based on product type, the North America endoscopy procedures market is bifurcated into disposable and reusable. The reusable segment held 79.5% share of North America endoscopy procedures market in 2022, amassing US$ 10,405.32 million. It is projected to garner US$ 16,950.23 million by 2030 to expand at 6.3% CAGR during 2022-2030.

Based on end user, the North America endoscopy procedures market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. The hospitals and clinics segment held 57.9% share of North America endoscopy procedures market in 2022, amassing US$ 7,580.26 million. It is projected to garner US$ 12,931.86 million by 2030 to expand at 6.9% CAGR during 2022-2030.

Based on country, the North America endoscopy procedures market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US captured 75.3% share of North America endoscopy procedures market in 2022. It was assessed at US$ 9,851.38 million in 2022 and is likely to hit US$ 17,105.63 million by 2030, exhibiting a CAGR of 7.1% during 2022-2030.

Key players operating in the North America endoscopy procedures market are Stryker Corp, Merit, Medical Systems Inc, Smith & Nephew Plc, Arthrex Inc, Steris Plc, Conmed Corp, Olympus Corp, Boston Scientific Corp, and Cook Medical LLC, among others.

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Stryker Corp

- Merit Medical Systems Inc

- Smith & Nephew Plc

- Arthrex Inc

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- Cook Medical LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | December 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 13.09 Billion |

| Forecasted Market Value by 2030 | 22.61 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | North America |