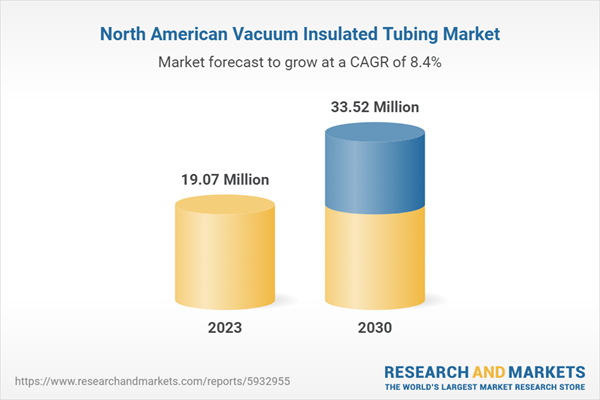

The North America vacuum insulated tubing market is expected to grow from US$ 19.07 million in 2023 to US$ 33.52 million by 2030. It is estimated to grow at a CAGR of 8.4% from 2023 to 2030.

Low-cost assets, reduced production costs, and a rise in oil-well efficiencies are contributing to the growth of the oil & gas industry in this region. As a result, the key market players in the oil & gas industry are investing considerable amounts to increase their market share. In January 2018, Exxon Mobil announced its plan to invest US$ 50 billion in the US over the next five years in order to increase production in the Permian basin, a shale oil region in western Texas and eastern New Mexico. Thus, rising investment in the oil & gas industry is expected to offer lucrative growth opportunities for the vacuum insulated tubing market in the coming years.

Based on application, the North America Vacuum insulated tubing market is segmented into onshore and offshore. The onshore segment held the larger share of the North America vacuum insulated tubing market in 2023.

Based on country, the North America vacuum insulated tubing market is segmented int o the US, Canada, and Mexico. The US dominated the North America vacuum insulated tubing market in 2023.

Andmir Group, Exceed Oilfield Equipment, Imex Canada Inc, ITP Interpipe, Dongying Lake Petroleum Technology Co Ltd (Lake Petro), Nakasawa Resources, Shengji Group, and Vallourec SA are some of the leading companies operating in the North America vacuum insulated tubing market.

Growing Adoption of Efficient Oil Extraction Technique Fuel North America Vacuum Insulated Tubing Market

The crude oil extraction process includes three phases - primary, secondary, and tertiary (enhanced) recovery. As most of the oil has already been recovered from several oil fields, producers are focusing on several tertiary or EOR techniques that help extract 30 to 60%, or more, of the reservoir's original oil in place. In recent years, thermal recovery EOR techniques have been gaining traction commercially. In October 2021, LUKOIL and Gazprom Neft announced a collaboration agreement to implement oil recovery enhancement projects. The company used advanced polymers to boost recoverable reserves up to 70% while unlocking additional barrels of Murban crude. Thus, the oil & gas industry is witnessing a trend of growing adoption of efficient oil extraction techniques, which is expected to support the growth of the vacuum insulated tube market in the coming years.North America Vacuum Insulated Tubing Market Overview

Based on country, the North America vacuum insulated tubing market is segmented into the US, Canada, and Mexico. North America is one of the leading oil-producing regions globally. The US and Canada are major oil producers, with significant reserves and advanced extraction techniques such as hydraulic fracturing (fracking) and horizontal drilling. According to Energy Information Administration (EIA) report, ~100 countries across the globe produce crude oil; of these 100 countries, the top five countries contribute to the 51% share of overall crude oil production in 2021. The US and Canada contribute 14.5% and 5.8% of total global crude oil production, respectively. The US has recently experienced a surge in oil production, becoming a leading global producer.Low-cost assets, reduced production costs, and a rise in oil-well efficiencies are contributing to the growth of the oil & gas industry in this region. As a result, the key market players in the oil & gas industry are investing considerable amounts to increase their market share. In January 2018, Exxon Mobil announced its plan to invest US$ 50 billion in the US over the next five years in order to increase production in the Permian basin, a shale oil region in western Texas and eastern New Mexico. Thus, rising investment in the oil & gas industry is expected to offer lucrative growth opportunities for the vacuum insulated tubing market in the coming years.

North America Vacuum Insulated Tubing Market Revenue and Forecast to 2030 (US$ Thousand)

North America Vacuum Insulated Tubing Market Segmentation

The North America vacuum insulated tubing market is segmented into application and country.Based on application, the North America Vacuum insulated tubing market is segmented into onshore and offshore. The onshore segment held the larger share of the North America vacuum insulated tubing market in 2023.

Based on country, the North America vacuum insulated tubing market is segmented int o the US, Canada, and Mexico. The US dominated the North America vacuum insulated tubing market in 2023.

Andmir Group, Exceed Oilfield Equipment, Imex Canada Inc, ITP Interpipe, Dongying Lake Petroleum Technology Co Ltd (Lake Petro), Nakasawa Resources, Shengji Group, and Vallourec SA are some of the leading companies operating in the North America vacuum insulated tubing market.

Table of Contents

1. Introduction

3. Research Methodology

4. North America Vacuum Insulated Tubing Market Landscape

5. North America Vacuum Insulated Tubing Market- Key Market Dynamics

6. North America Vacuum Insulated Tubing Market- Market Analysis

7. North America Vacuum Insulated Tubing Market Revenue and Forecast to 2030 - Application.

8. North America Vacuum Insulated Tubing Market- Country Analysis

9. Company Profiles

10. Appendix

List of Tables

List of Figures

Executive Summary

At 8.4% CAGR, the North America Vacuum Insulated Tubing Market is Speculated to be Worth US$ 33.52 Million by 2030.According to this research, the North America Vacuum insulated tubing market was valued at US$ 19.07 million in 2023 and is expected to reach US$ 33.52 million by 2030, registering a CAGR of 8.4% from 2023 to 2030. High crude oil prices and maximize oil reserves recovery and extend field life are among the critical factors attributed to the North America vacuum insulated tubing market expansion.

The demand for oil and gas is rising across the world owing to the increasing energy demand. According to a report published by the International Energy Agency (IEA) in May 2023, global oil demand is projected to increase by 2.2 million barrels per day (mb/d) year-on-year in 2023 to an average of 102 mb/d, 200 kb/d more than oil demand published in April 2023. Furthermore, the Russian Federation’s aggression in Ukraine has threatened the energy supply and tends to drive oil and gas prices up. In May 2022, European Council announced a partial ban on Russian oil imports. According to the IEA, European countries imported 23% of their oil from Russia in 2021. Thus, sourcing oil from more far-flung locations is expected to keep prices high. Such high crude oil prices enable market players to extract oil profitably with high-cost extraction techniques. EOR methods often involve additional costs compared to conventional oil extraction techniques. When oil prices are high, the increased revenue from selling oil can make EOR projects economically viable. Higher oil prices provide a stronger financial incentive for operators to invest in EOR technologies and maximize their production rates. Thus, the growing demand for crude oil and the rising costs are enabling key oil producers to focus on enhanced oil recovery (EOR) projects. Hence, implementation of EOR projects drives the North America vacuum insulated tubing market growth.

On the contrary, high cost of implementation of EOR and transition toward clean energy hampers the North America vacuum insulated tubing market.

Based on application, the North America vacuum insulated tubing market is segmented into onshore and offshore. The onshore segment held 74.2% share of North America vacuum insulated tubing market in 2023, amassing US$ 14.15 million. It is projected to garner US$ 24.34 million by 2030 to expand at 8.1% CAGR during 2023-2030.

Based on country, the North America vacuum insulated tubing market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US captured 71.2% share of North America vacuum insulated tubing market in 2023. It was assessed at US$ 13.57 million in 2023 and is likely to hit US$ 24.40 million by 2030, exhibiting a CAGR of 8.7% during 2023-2030.

Key players operating in the North America vacuum insulated tubing market are Andmir Group, Exceed Oilfield Equipment, Imex Canada Inc, ITP Interpipe, Dongying Lake Petroleum Technology Co Ltd (Lake Petro), Nakasawa Resources, Shengji Group, and Vallourec SA.

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Andmir Group

- Dongying Lake Petroleum Technology Co Ltd (Lake Petro)

- Exceed Oilfield Equipment

- Imex Canada Inc

- ITP Interpipe

- Nakasawa

- Shengji Group

- Vallourec SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 69 |

| Published | December 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value in 2023 | 19.07 Million |

| Forecasted Market Value by 2030 | 33.52 Million |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | North America |