Increasing Incidences of Cardiovascular Diseases Fuels North America Endothelial Dysfunction Market

According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are among the leading causes of death worldwide, and ~30 million people experience a stroke each year. CVDs include cerebrovascular disease, coronary heart disease, rheumatic heart disease, and coronary artery disease (CAD). CAD is the most common disease among all cardiovascular diseases, and it is characterized by the accumulation of lipids and immune cells in the subendothelial space of the coronary arteries or atherosclerosis. It involves the inflammatory response of the vascular endothelium. CAD is characterized by ischemia, hypoxia, or necrosis of the myocardium resulting from narrowing, spasm, or obstruction of the coronary artery lumen by atherosclerosis. It has become the leading cause of death worldwide. According to the Centers for Disease Control and Prevention (CDC), over 60 million women (44%) in the US suffer from some form of heart disease. Heart disease is the leading cause of death among women in the US and can affect women of any age. In 2021, it caused 310,661 deaths among women, i.e., nearly one in five female deaths.According to the American Heart Association, almost half of all adults in the US suffer from a type of CVD. Over 130 million people, i.e., 45.1% of the US population, are projected to suffer from a type of CVD by 2035. Therefore, the high prevalence of cardiovascular diseases due to endothelial dysfunction drives the market.

North America Endothelial Dysfunction Market Overview

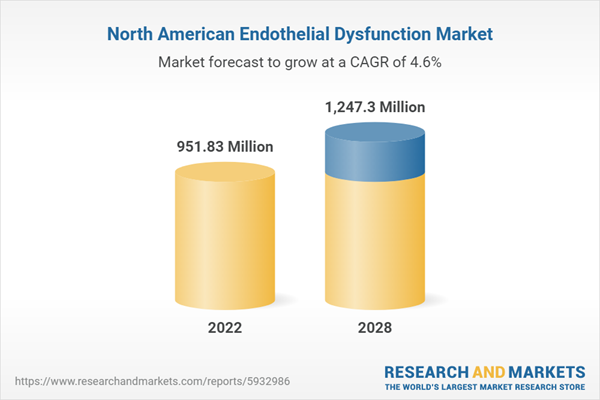

The North American endothelial dysfunction market is analyzed on the basis of three major countries: the US, Canada, and Mexico. The market expansion in the region can be attributed to an increase in the incidence of cardiac diseases and rising investments in cardiology informatics. The US holds the largest size of the endothelial dysfunction market in North America owing to factors such as the increasing burden of CAD, established healthcare infrastructure, and R&D activities undertaken to develop advanced endothelial dysfunction drugs and devices.North America Endothelial Dysfunction Market Revenue and Forecast to 2028 (US$ Million)

North America Endothelial Dysfunction Market Segmentation

The North America endothelial dysfunction market is segmented into cause, test type, end user, and country.Based on cause, the North America endothelial dysfunction market is segmented into hypertension, hypercholesterolaemia, obesity, diabetes, behcet's disease, and others. The hypertension segment registered the largest North America endothelial dysfunction market share in 2022.

Based on test type, the North America endothelial dysfunction market is segmented into invasive test and non-invasive test. The invasive test segment held a larger North America endothelial dysfunction market share in 2022. The non-invasive test segment is further subsegmented into flow mediated dilatory, peripheral arterial tonometry (PAT), venous occlusion pletismography, circulating markers, and others.

Based on end user, the North America endothelial dysfunction market has been categorized into hospitals, diagnostic centers, clinics, and others. The hospitals segment held the largest North America endothelial dysfunction market share in 2022.

Based on country, the North America endothelial dysfunction market is segmented into the US, Canada, and Mexico. The US dominated the North America endothelial dysfunction market in 2022.

ZOLL Medical Corp, Lawrence Berkeley National Laboratory, Endothelix Inc, Perimed AB, SMART Medical Ltd, Everist Health Inc, and Medizinische Messtechnik GmbH are some of the leading companies operating in the endothelial dysfunction market in the region.

Table of Contents

Executive Summary

At 4.6% CAGR, the North America Endothelial Dysfunction Market is Speculated to be Worth US$ 1,247.30 million by 2028.According to this research, the North America endothelial dysfunction market was valued at US$ 951.83 million in 2022 and is expected to reach US$ 1,247.30 million by 2028, registering a CAGR of 4.6% from 2022 to 2028. Increasing incidences of cardiovascular diseases and rising incidences of high cholesterol, diabetes and obesity are the critical factors attributed to the North America endothelial dysfunction market expansion.

Endothelial dysfunction is a strong prognostic factor for cardiovascular events and mortality in the population. Assessment of endothelial function can aid in selecting therapies and assessing their response. While invasive angiography remains the gold standard for measuring coronary endothelial function, several noninvasive imaging techniques have evolved to study both coronary and peripheral endothelial function. Available endothelial testing methods are helpful for mechanistically understanding diseases and risk stratification and prognoses, such as high-resolution B-mode ultrasound and Doppler, computed tomography angiography, cardiovascular magnetic resonance (CMR), magnetic resonance imaging (MRI), and positron emission tomography (PET). Noninvasive methods for assessing endothelial function are mainly used in scientific research since there is a significant risk of complications due to the specificity of endovascular interventions. One of the noninvasive methods to assess endothelial function is to measure fluorescence. Flow-mediated skin fluorescence (FMSF) is based on the fluorescence measurement of the reduced nicotinamide adenine dinucleotide (NADH) emitted by skin cells in response to UV light excitation. The test consists of three phases: recording the fluorescence's background intensity, occlusion phase, and reaction registration.

On the contrary, disadvantages associated with the techniques for screening of endothelial dysfunction hurdles the growth of North America endothelial dysfunction market.

Based on cause, the North America endothelial dysfunction market is segmented into hypertension, hypercholesterolaemia, obesity, diabetes, behcet's disease, and others. The hypertension segment held 33.1% share of North America endothelial dysfunction market in 2022, amassing US$ 315.17 million. It is projected to garner US$ 424.42 million by 2028 to expand at 5.1% CAGR during 2022-2028.

Based on test type, the North America endothelial dysfunction market is segmented into invasive test and non-invasive test. The invasive test segment held 73.9% share of North America endothelial dysfunction market in 2022, amassing US$ 703.86 million. It is projected to garner US$ 908.51 million by 2028 to expand at 4.4% CAGR during 2022-2028. The non-invasive test segment is further subsegmented into flow mediated dilatory, peripheral arterial tonometry (PAT), venous occlusion pletismography, circulating markers, and others.

Based on end user, the North America endothelial dysfunction market has been categorized into hospitals, diagnostic centers, clinics, and others. The hospitals segment held 51.8% share of North America endothelial dysfunction market in 2022, amassing US$ 493.93 million. It is projected to garner US$ 659.34 million by 2028 to expand at 5.0% CAGR during 2022-2028.

Based on country, the North America endothelial dysfunction market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US captured 80.5% share of North America endothelial dysfunction market in 2022. It was assessed at US$ 766.34 million in 2022 and is likely to hit US$ 1,011.96 million by 2028, exhibiting a CAGR of 4.7% during 2022-2028.

Key players operating in the North America endothelial dysfunction are ZOLL Medical Corp, Lawrence Berkeley National Laboratory, Endothelix Inc, Perimed AB, SMART Medical Ltd, Everist Health Inc, and Medizinische Messtechnik GmbH, among others.

In April 2023, Perimed has signed an agreement with Lovell Government Services. Lovell’s customers are Federal, State, and Local Governments such as the Department of Veteran Affairs (VA), Defense Logistics Agency, and Department of Defense in the United States. With this agreement, Perimed gains an additional sales channel as Lovell will notify the company of any government contract opportunities within its field of business and bid on Perimed’s behalf. In April 2021, Berkeley Lab has developed flow-mediated dilation device to monitor both endothelial function and endothelium-independent vasodilation.

Companies Mentioned

- Endothelix Inc

- Everist Health Inc

- Lawrence Berkeley National Laboratory

- Medizinische Messtechnik GmbH

- Perimed AB

- SMART Medical Ltd

- ZOLL Medical Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | December 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value in 2022 | 951.83 Million |

| Forecasted Market Value by 2028 | 1247.3 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 7 |